SmileDirectClub, Inc. (Nasdaq: SDC), the next generation oral care

company with the first medtech platform for teeth straightening,

today announced its financial results for the fourth quarter and

year ended December 31, 2022.

For the full year 2022, our disciplined cost management allowed

us to deliver a $58 million improvement in Net Loss and comparable

Adjusted EBITDA even though we saw a decline in full year revenue,

and despite a $17 million increase in Net Cash used in operating

activities, we were able to deliver a $38 million improvement in

free cash flow over 2021. The leverage that we have built in our

operating model reflects a much more efficient organization that is

better positioned to achieve profitability and execute at a high

level on our mission to democratize access to a smile each and

every person loves by making it affordable and convenient for

everyone.

Fourth Quarter

2022 Financial Highlights

- Total revenue of $87 million, a

19.0% decrease from the third quarter of 2022 and a decrease of

31.5% over the prior year period.

- Net loss of $(69) million,

consistent with the third quarter of 2022 and an improvement of $26

million over the prior year period.

- Adjusted EBITDA of $(47) million,

an $18 million decrease over the third quarter of 2022, and an

improvement of $14 million over the prior year period.

- Diluted EPS of $(0.18), consistent

with the third quarter of 2022, and an improvement of $0.07 over

the prior year period.

- Net cash used in operating activities was $(51) million, an

increase of $27 million over the third quarter of 2022 and an

increase of $8 million over the prior year period.

- Free Cash Flow defined as net cash used in operating activities

less net cash used in investing activities of $(63) million, a

decrease of $28 million from the third quarter of 2022 and an

improvement of $16 million over the prior year period.

2022 Financial Highlights

- Total revenue of $471 million, a

26.2% decrease from the prior year.

- Net loss of $(278) million, an

improvement of $58 million over the prior year.

- Adjusted EBITDA of $(135) million,

a $1 million decrease from the prior year.

- Diluted EPS of $(0.71), an

improvement of $0.16 over the prior year.

- Net cash used in operating activities was $(158) million, an

increase of $17 million over the prior year.

- Free Cash Flow of $(210) million, an improvement of $38 million

over the prior year.

Key Operating Metrics and Strategic

Highlights

- Fourth quarter unique aligner shipments of 41,462, a 20.8%

sequential decrease over 52,367 shipments in the third quarter of

2022.

- Fourth quarter average aligner gross sales price (“ASP”) of

$1,960, a 3% improvement compared to $1,902 for the third quarter

of 2022.

“Our team delivered financial results that were

on track with our updated outlook provided on our third quarter

call and our preliminary outlook provided in our realignment press

release issued in late January,” said David Katzman, Chief

Executive Officer and Chairman of SmileDirectClub. “Our core

business continued to perform within our guidance range, while our

team continued to make progress on our key growth initiatives with

the successful Australian launch of our innovative SmileMaker

mobile scanning app for 3D treatment planning, with plans to

release in the U.S by the end of the second quarter this year. We

also recently launched our second growth initiative through our

hybrid in-person and remote premium aligner product,

SmileDirectClub CarePlus, available now in four key U.S. pilot

markets. Additionally, we took actions in January to realign our

cost structure based on our 2023 sales outlook driven by economic

challenges impacting our core customer base, while also tracking on

our path to profitability and positive cash flow run rates by the

end of the year. We’re excited to fully bring our oral care

innovations to the market this year and continue to execute on our

mission to democratize access to a smile each and every person

loves.”

Business Outlook

SmileDirectClub’s mission is to democratize

access to a smile each and every person loves by making it

affordable and convenient for everyone. The aspirational vision of

the Company’s organization is to become the “world’s leading oral

health brand by helping more people realize the life changing

potential of a confident smile.” SmileDirectClub’s vision and

mission are much greater than manufacturing and marketing clear

aligners. Every decision and investment the Company has made is to

support and expand this mission and enable its long-term growth

potential. For SmileDirectClub to realize the Company’s vision

through its mission, the Company must expand its reach within and

beyond the Company’s existing core customer base. Expanding reach

comes through continuously bringing transformative innovation to

the market across an entire portfolio of both consumer facing and

non-consumer facing innovations, including the Company’s SmileMaker

mobile scanning app for 3D treatment planning, hybrid aligner

offering CarePlus, the SmileDirectClub Partner Network, aligner

product innovations, and oral care solutions, including our

industry leading whitening and flosser products. SmileDirectClub

possesses the unique assets and innovation to disrupt the

incumbents, the agility to adjust to the needs of our customers,

and a sustainable brand that is top of mind with

consumers.

The Company has been issued 47 patents and

counting for its innovations in orthodontic treatment planning,

aligner manufacturing, smile scanning technologies, its proprietary

telehealth platform and a variety of other areas. There are many

more patents pending in the pipeline in both the U.S. and abroad on

various technologies relating to data capture, 3D image capture,

intraoral scanning, monitoring, manufacturing, and consumer

products. In addition, the Company has enabled treatment for over

1.9 million customers, built the only end-to-end vertically

integrated platform for the consumer at scale, created a Dental

Partner Network with over 1,000 global practices that are live or

pending training, delivered oral care products available at over

16,300 retail stores worldwide, and remains the strongest

teledentistry brand with continued high brand awareness. Demand for

medical professionals to join SmileDirectClub’s Partner Network has

been strong with over 125 new partners added in the fourth quarter

and a robust pipeline of additional practice interest even before

the launch of the CarePlus offering.

When consumers are considering straightening

their teeth, they typically do one or all of the following: search

online to understand their options; ask a dentist; ask a friend or

family member which option they should choose. Based on the

Company’s research, consumers have noted its product and customer

experience is nearly identical to Invisalign, less expensive, and

more convenient. Compared to other teledentistry platforms,

research showed that significantly fewer customers would recommend

those brands to their friends and family compared with

SmileDirectClub customer recommendations. A first quarter 2022

consumer brand survey separately noted that SmileDirectClub’s

unaided and aided brand awareness continues to increase from and

surpass its teledentistry competitors and close in on the brand

awareness recognition of category originator Invisalign.

Additionally, the Company’s pioneering telehealth platform was

recently recognized by MedTech Breakthrough, winning the “Best

Telehealth Platform” award in 2022.

In addition to these investments to create the

next generation of oral care and influence consumer decision

making, the Company will continue to make strategic investments in

penetrating new demographics to drive controlled growth, while also

executing against its profitability goals. Lastly, favorable

industry dynamics continue to increase with broader acceptance of

telehealth, and specifically teledentistry, minimal penetration

against the total addressable market, a number of recent regulatory

wins that helped remove barriers to access to care, and clear

aligners gaining share in the overall industry.

Full Year 2023 Guidance

Challenges to consumer spending and sustained

high inflation continue to impact our overall expected demand in

2023. For the year ending December 31, 2023, the

Company expects total revenue for the core business to be in the

range of $400 million to $450 million, which does not include any

anticipated revenue upside from the United States rollout of the

SmileMaker Platform or launch of its CarePlus program.

The full year 2023 costs and capital outlook for

the core business include (see Company’s supplemental earnings

presentation for more insights regarding these assumptions):

- Gross margin range (as a percentage of total revenues) of 72.0%

to 75.0%

- Adjusted EBITDA range of ($35 million) to ($5 million), with

positive Adjusted EBITDA by Q3 2023

- CapEx range of $35 million to $45 million

- One-time costs range of $12 million to $15 million

Revenue and Adjusted EBITDA guidance represents

core business only and excludes any contributions from the 2023

SmileMaker Platform rollout or launch of the CarePlus program. As

these initiatives are introduced to the market at scale, the

Company will provide more details and additional full-year

expectations in the future.

In addition to the guidance for our core business, the Company

has provided some insights regarding the potential contributions

from 2023 growth initiatives, including SmileMaker Platform and

CarePlus. Collectively, the growth initiatives have the potential

of delivering $125 million in incremental revenue and $80 million

in Adjusted EBITDA to the Company’s core business guidance. These

estimates are based on the early results from the SmileMaker

Platform pilot launch in Australia at the end of November 2022 with

plans for a U.S. rollout by the end of the second quarter 2023, and

a continued rollout of CarePlus to all Partner Network locations

over the balance of 2023. The Company will provide updates

throughout the year as these initiatives are introduced to the

market at scale.

Conference Call Information

|

SmileDirectClub Fourth

Quarter and Year End 2022 Conference Call

Details |

| |

|

| Date: |

March 1, 2023 |

| Time: |

8:00 a.m. Eastern Time (7:00

a.m. Central Time) |

|

Dial-In: |

1-877-407-9208 (domestic) or

1-201-493-6784 (international) |

|

Webcast: |

Visit “Events and

Presentations” section of the company’s IR page

at http://investors.smiledirectclub.com |

A replay of the call may be accessed the same

day from 11 a.m. Eastern Time on Wednesday, March 1, 2023 until

11:59 p.m. Eastern Time on Wednesday, March 8, 2023 by dialing

1-844-512-2921 (domestic) or 1-412-317-6671 (international) and

entering the replay PIN: 13735275. A copy of the fourth quarter and

year end 2022 results supplemental earnings presentation and an

archived version of the call, when completed, will also be

available on the Investor Relations section of SmileDirectClub’s

website at investors.smiledirectclub.com.

Forward-Looking Statements

This earnings release contains forward-looking

statements. All statements other than statements of historical

facts may be forward-looking statements. Forward-looking statements

generally relate to future events and include, without limitation,

projections, forecasts and estimates about possible or assumed

future results of our business, financial condition, liquidity,

results of operations, plans, and objectives. Some of these

statements may include words such as “expects,” “anticipates,”

“believes,” “estimates,” “targets,” “plans,” “potential,”

“intends,” “projects,” and “indicates.”

Although they reflect our current, good faith

expectations, these forward-looking statements are not a guarantee

of future performance, and involve a number of risks,

uncertainties, estimates, and assumptions, which are difficult to

predict. Some of the factors that may cause actual outcomes and

results to differ materially from those expressed in, or implied

by, the forward-looking statements include, but are not necessarily

limited to: the current noncompliance with the minimum bid

requirement pursuant to the Nasdaq Listing Rules; the duration and

magnitude of the COVID-19 pandemic and related containment

measures; our management of growth; the execution of our business

strategies, implementation of new initiatives, and improved

efficiency; our sales and marketing efforts; our manufacturing

capacity, performance, and cost; our ability to obtain future

regulatory approvals; our financial estimates and needs for

additional financing; consumer acceptance of and competition for

our clear aligners; our relationships with retail partners and

insurance carriers; our R&D, commercialization, and other

activities and expenditures; the methodologies, models,

assumptions, and estimates we use to prepare our financial

statements, make business decisions, and manage risks; laws and

regulations governing remote healthcare and the practice of

dentistry; our relationships with vendors; the security of our

operating systems and infrastructure; our risk management

framework; our cash and capital needs; our intellectual property

position; our exposure to claims and legal proceedings; and other

factors described in our filings with the Securities and Exchange

Commission, including but not limited to our Annual Report on Form

10-K for the year ended December 31, 2022.

About SmileDirectClub

SmileDirectClub, Inc. (Nasdaq: SDC)

(“SmileDirectClub”) is an oral care company and creator of the

first medtech platform for teeth straightening. Through its

cutting-edge telehealth technology and vertically integrated model,

SmileDirectClub is revolutionizing the oral care industry.

SmileDirectClub’s mission is to democratize access to a smile each

and every person loves by making it affordable and convenient for

everyone. SmileDirectClub is headquartered in Nashville, Tennessee,

USA. For more information, please visit

SmileDirectClub.com.

Investor Relations:Michael

BrykVice President, Finance

Jonathan FleetwoodDirector, Investor

Relationsinvestorrelations@smiledirectclub.com

Media Relations:Kim

AtkinsonSenior Vice President, Global

Communicationspress@smiledirectclub.com

| |

|

SmileDirectClub, Inc.Consolidated

Balance Sheets(in thousands, except share

and per share amounts)(unaudited) |

| |

| |

Years Ended |

|

|

December 31, |

December 31, |

|

2022 |

2021 |

| ASSETS |

|

|

|

Cash |

$ |

93,120 |

|

$ |

224,860 |

|

| Accounts receivable, net |

|

143,082 |

|

|

184,558 |

|

| Inventories |

|

44,387 |

|

|

40,803 |

|

| Prepaid and other current

assets |

|

16,830 |

|

|

17,519 |

|

|

Total current assets |

|

297,419 |

|

|

467,740 |

|

| Restricted cash |

|

25,278 |

|

|

— |

|

| Accounts receivable, net,

non-current |

|

45,168 |

|

|

59,210 |

|

| Property, plant and equipment,

net |

|

190,087 |

|

|

227,201 |

|

| Operating lease right-of-use

assets |

|

21,141 |

|

|

24,927 |

|

| Other assets |

|

17,970 |

|

|

15,480 |

|

|

Total assets |

$ |

597,063 |

|

$ |

794,558 |

|

| LIABILITIES AND EQUITY

(DEFICIT) |

|

|

| Accounts payable |

$ |

30,513 |

|

$ |

19,922 |

|

| Accrued liabilities |

|

65,937 |

|

|

122,066 |

|

| Deferred revenue |

|

13,646 |

|

|

20,258 |

|

| Current portion of long-term

debt |

|

— |

|

|

10,997 |

|

| Other current liabilities |

|

6,704 |

|

|

4,997 |

|

|

Total current liabilities |

|

116,800 |

|

|

178,240 |

|

| Long-term debt, net of current

portion |

|

849,379 |

|

|

729,973 |

|

| Operating lease liabilities,

net of current portion |

|

16,082 |

|

|

20,352 |

|

| Other long-term

liabilities |

|

— |

|

|

347 |

|

|

Total liabilities |

|

982,261 |

|

|

928,912 |

|

| Commitment and

contingencies |

|

|

| Equity

(Deficit) |

|

|

| Class A common stock, par

value $0.0001 and 124,785,562 shares issued and outstanding at

December 31, 2022 and 119,280,781 shares issued and

outstanding at December 31, 2021 |

|

12 |

|

|

12 |

|

| Class B common stock, par

value $0.0001 and 268,823,501 shares issued and outstanding at

December 31, 2022 and 269,243,501 shares issued and

outstanding at December 31, 2021 |

|

27 |

|

|

27 |

|

| Additional

paid-in-capital |

|

475,034 |

|

|

448,867 |

|

| Accumulated other

comprehensive income |

|

430 |

|

|

293 |

|

| Accumulated deficit |

|

(381,725 |

) |

|

(295,321 |

) |

| Noncontrolling interest |

|

(496,596 |

) |

|

(305,852 |

) |

| Warrants |

|

17,620 |

|

|

17,620 |

|

|

Total equity (deficit) |

|

(385,198 |

) |

|

(134,354 |

) |

|

Total liabilities and equity (deficit) |

$ |

597,063 |

|

$ |

794,558 |

|

| |

|

SmileDirectClub, Inc.Consolidated

Statements of Operations(in thousands,

except share and per share

amounts)(unaudited) |

| |

| |

Three Months Ended December 31, |

Years Ended December 31, |

|

2022 |

2021 |

2022 |

2021 |

|

Revenue, net |

$ |

79,127 |

|

$ |

116,507 |

|

$ |

436,965 |

|

$ |

594,692 |

|

| Financing revenue |

|

7,404 |

|

|

9,779 |

|

|

33,778 |

|

|

42,919 |

|

|

Total revenues |

|

86,531 |

|

|

126,286 |

|

|

470,743 |

|

|

637,611 |

|

| Cost of revenues |

|

33,754 |

|

|

44,364 |

|

|

142,890 |

|

|

177,597 |

|

| Gross profit |

|

52,777 |

|

|

81,922 |

|

|

327,853 |

|

|

460,014 |

|

| Marketing and selling

expenses |

|

64,117 |

|

|

99,209 |

|

|

290,231 |

|

|

388,450 |

|

| General and administrative

expenses |

|

60,158 |

|

|

73,791 |

|

|

278,778 |

|

|

325,569 |

|

| Lease abandonment and

impairment of long-lived assets |

|

(140 |

) |

|

103 |

|

|

1,289 |

|

|

1,481 |

|

| Restructuring and other

related costs |

|

1,799 |

|

|

2,039 |

|

|

19,668 |

|

|

3,798 |

|

|

Loss from operations |

|

(73,157 |

) |

|

(93,220 |

) |

|

(262,113 |

) |

|

(259,284 |

) |

| Interest expense |

|

6,591 |

|

|

1,877 |

|

|

17,961 |

|

|

23,154 |

|

| Loss on extinguishment of

debt |

|

— |

|

|

— |

|

|

— |

|

|

47,631 |

|

| Other expense (income) |

|

(10,143 |

) |

|

576 |

|

|

(1,579 |

) |

|

4,313 |

|

|

Net loss before provision for income tax expense (benefit) |

|

(69,605 |

) |

|

(95,673 |

) |

|

(278,495 |

) |

|

(334,382 |

) |

| Provision for income tax

expense (benefit) |

|

(174 |

) |

|

(308 |

) |

|

(642 |

) |

|

1,268 |

|

|

Net loss |

|

(69,431 |

) |

|

(95,365 |

) |

|

(277,853 |

) |

|

(335,650 |

) |

| Net loss attributable to

noncontrolling interest |

|

(47,587 |

) |

|

(66,104 |

) |

|

(191,449 |

) |

|

(233,208 |

) |

|

Net loss attributable to SmileDirectClub, Inc. |

$ |

(21,844 |

) |

$ |

(29,261 |

) |

$ |

(86,404 |

) |

$ |

(102,442 |

) |

| |

|

|

|

|

| Earnings (loss) per

share of Class A common stock: |

|

|

|

|

| Basic |

$ |

(0.18 |

) |

$ |

(0.25 |

) |

$ |

(0.71 |

) |

$ |

(0.87 |

) |

| Diluted |

$ |

(0.18 |

) |

$ |

(0.25 |

) |

$ |

(0.71 |

) |

$ |

(0.87 |

) |

| |

|

|

|

|

| Weighted average

shares outstanding: |

|

|

|

|

| Basic |

|

123,028,115 |

|

|

119,188,971 |

|

|

121,312,580 |

|

|

118,360,801 |

|

| Diluted |

|

391,851,616 |

|

|

388,432,472 |

|

|

390,210,985 |

|

|

387,775,890 |

|

| |

|

SmileDirectClub, Inc.Consolidated

Statements of Cash Flows(in

thousands)(unaudited) |

| |

| |

Years Ended December 31, |

|

2022 |

2021 |

| Operating

Activities |

|

|

|

Net loss |

$ |

(277,853 |

) |

$ |

(335,650 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

Depreciation and amortization |

|

74,395 |

|

|

70,113 |

|

|

Deferred loan cost amortization |

|

5,897 |

|

|

5,148 |

|

|

Equity-based compensation |

|

26,608 |

|

|

44,628 |

|

|

Loss on extinguishment of debt |

|

— |

|

|

47,631 |

|

|

Paid in kind interest expense |

|

1,292 |

|

|

3,324 |

|

|

Asset impairment and related charges |

|

2,902 |

|

|

1,481 |

|

|

Other non-cash operating activities |

|

3,786 |

|

|

372 |

|

| Changes in operating assets

and liabilities: |

|

|

|

Accounts receivable |

|

55,518 |

|

|

49,560 |

|

|

Inventories |

|

(4,227 |

) |

|

(11,775 |

) |

|

Prepaid and other current assets |

|

689 |

|

|

(8,733 |

) |

|

Accounts payable |

|

14,242 |

|

|

(11,296 |

) |

|

Accrued liabilities |

|

(54,811 |

) |

|

10,039 |

|

|

Deferred revenue |

|

(6,612 |

) |

|

(6,361 |

) |

|

Net cash used in operating activities |

|

(158,174 |

) |

|

(141,519 |

) |

| Investing

Activities |

|

|

| Purchases of property,

equipment, and intangible assets |

|

(51,996 |

) |

|

(106,567 |

) |

|

Net cash used in investing activities |

|

(51,996 |

) |

|

(106,567 |

) |

| Financing

Activities |

|

|

| Repurchase of Class A shares

to cover employee tax withholdings |

|

(2,599 |

) |

|

(10,028 |

) |

| Proceeds from sale of Class A

common stock under public offerings |

|

1,916 |

|

|

— |

|

| Proceeds from stock purchase

plan |

|

622 |

|

|

1,031 |

|

| Repayment of 2020 HPS Credit

Facility |

|

— |

|

|

(396,497 |

) |

| Payment of extinguishment

costs |

|

— |

|

|

(37,701 |

) |

| Borrowings of long-term

debt |

|

114,920 |

|

|

747,500 |

|

| Payments of issuance

costs |

|

(5,426 |

) |

|

(21,179 |

) |

| Purchase of capped call

transactions |

|

— |

|

|

(69,518 |

) |

| Final payment of Align

arbitration |

|

— |

|

|

(43,400 |

) |

| Principal payments on

long-term debt |

|

— |

|

|

(4,609 |

) |

| Payments of finance

leases |

|

(6,447 |

) |

|

(11,055 |

) |

| Other |

|

462 |

|

|

1,173 |

|

|

Net cash provided by financing activities |

|

103,448 |

|

|

155,717 |

|

|

Effect of exchange rates change on cash flow activities |

|

260 |

|

|

505 |

|

| Decrease in cash and

restricted cash |

|

(106,462 |

) |

|

(91,864 |

) |

| Cash and restricted cash at

beginning of period |

|

224,860 |

|

|

316,724 |

|

|

Cash and restricted cash at end of period |

$ |

118,398 |

|

$ |

224,860 |

|

| |

|

|

|

|

|

|

Use of Non-GAAP Financial

Measures

This earnings release contains certain non-GAAP

financial measures, including adjusted EBITDA (“Adjusted EBITDA”)

and Free Cash Flow. We provide a reconciliation of these non-GAAP

financial measures to the most directly comparable GAAP financial

measures below and in our Current Report on Form 8-K announcing our

quarterly earnings results, which can be found on the SEC’s website

at www.sec.gov and our website at investors.smiledirectclub.com. We

do not provide a reconciliation of forward-looking Adjusted EBITDA

to the most directly comparable GAAP financial measure (net loss),

as the reconciliation to the corresponding GAAP measure is not

available due to the variability, complexity and limited visibility

of the non-cash items that are excluded from forward-looking

Adjusted EBITDA.

We utilize certain non-GAAP financial measures,

including Free Cash Flow and Adjusted EBITDA, to evaluate our

actual operating performance and for the planning and forecasting

of future periods.

We define Free Cash Flow as net cash used in

operating activities less net cash used in investing

activities.

We define Adjusted EBITDA as net loss, plus

depreciation and amortization, interest expense, income tax expense

(benefit), equity-based compensation, loss on extinguishment of

debt, impairment of long-lived assets, abandonment and other

related charges and certain other non-operating expenses, such as

one-time store closure costs associated with our real estate

repositioning strategy, severance, retention and other labor costs,

certain one-time legal settlement costs, and unrealized foreign

currency adjustments. We use Adjusted EBITDA when evaluating our

performance when we believe that certain items are not indicative

of operating performance. Adjusted EBITDA provides useful

supplemental information to management regarding our operating

performance, and we believe it will provide the same to

members/stockholders.

We believe that Adjusted EBITDA will provide

useful information to members/stockholders about our performance,

financial condition, and results of operations for the following

reasons: (i) Adjusted EBITDA is among the measures used by our

management team to evaluate our operating performance and make

day-to-day operating decisions and (ii) Adjusted EBITDA is

frequently used by securities analysts, investors, lenders, and

other interested parties as a common performance measure to compare

results or estimate valuations across companies in our

industry.

Adjusted EBITDA does not have a definition under

GAAP, and our definition of Adjusted EBITDA may not be the same as,

or comparable to, similarly titled measures used by other

companies. Adjusted EBITDA should not be considered in isolation

from, or as a substitute for, financial information prepared in

accordance with GAAP.

A reconciliation of Free Cash Flow and Adjusted

EBITDA to Net Cash used in operating activities and net loss,

respectively, the most directly comparable GAAP financial measures,

is set forth below.

| |

|

SmileDirectClub, Inc.Reconciliation of

Free Cash Flow(in thousands) |

| |

|

|

Three Months Ended |

Year Ended |

|

March 31, 2022 |

June 30, 2022 |

September 30, 2022 |

December 31, 2022 |

December 31, 2022 |

|

Net Cash used in operating activities |

$ |

(64,764 |

) |

$ |

(17,840 |

) |

$ |

(24,100 |

) |

$ |

(51,470 |

) |

|

(158,174 |

) |

| Net Cash used in investing

activities |

|

(11,618 |

) |

|

(17,754 |

) |

|

(10,796 |

) |

|

(11,828 |

) |

|

(51,996 |

) |

|

Free Cash Flow |

$ |

(76,382 |

) |

$ |

(35,594 |

) |

$ |

(34,896 |

) |

$ |

(63,298 |

) |

$ |

(210,170 |

) |

| |

Three Months Ended |

Year Ended |

|

March 31, 2021 |

June 30, 2021 |

September 30, 2021 |

December 31, 2021 |

December 31, 2021 |

|

Net Cash used in operating activities |

$ |

(28,338 |

) |

$ |

(31,013 |

) |

$ |

(38,716 |

) |

$ |

(43,452 |

) |

$ |

(141,519 |

) |

| Net Cash used in investing

activities |

|

(22,981 |

) |

|

(22,322 |

) |

|

(24,981 |

) |

|

(36,283 |

) |

|

(106,567 |

) |

|

Free Cash Flow |

$ |

(51,319 |

) |

$ |

(53,335 |

) |

$ |

(63,697 |

) |

$ |

(79,735 |

) |

$ |

(248,086 |

) |

| |

|

SmileDirectClub, Inc.Reconciliation of

Net Loss to Adjusted

EBITDA(in thousands) |

| |

| |

Three Months Ended December 31, |

Years Ended December 31, |

|

2022 |

2021 |

2022 |

2021 |

|

Net loss |

$ |

(69,431 |

) |

$ |

(95,365 |

) |

$ |

(277,853 |

) |

$ |

(335,650 |

) |

| Depreciation and

amortization |

|

16,786 |

|

|

18,458 |

|

|

74,395 |

|

|

70,113 |

|

| Total interest expense |

|

6,591 |

|

|

1,877 |

|

|

17,961 |

|

|

23,154 |

|

| Income tax expense

(benefit) |

|

(174 |

) |

|

(308 |

) |

|

(642 |

) |

|

1,268 |

|

| Lease abandonment and

impairment of long-lived assets |

|

(140 |

) |

|

103 |

|

|

1,289 |

|

|

1,481 |

|

| Restructuring and other

related costs |

|

1,799 |

|

|

2,039 |

|

|

19,668 |

|

|

3,798 |

|

| Loss on extinguishment of

debt |

|

— |

|

|

— |

|

|

— |

|

|

47,631 |

|

| Equity-based compensation |

|

5,049 |

|

|

6,969 |

|

|

26,608 |

|

|

44,628 |

|

| Other non-operating general

and administrative losses (gains) |

|

(7,817 |

) |

|

4,596 |

|

|

3,961 |

|

|

10,373 |

|

|

Adjusted EBITDA |

$ |

(47,337 |

) |

$ |

(61,631 |

) |

$ |

(134,613 |

) |

$ |

(133,204 |

) |

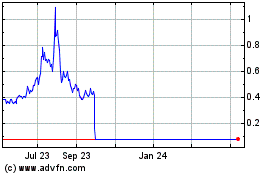

SmileDirectClub (NASDAQ:SDC)

Historical Stock Chart

From Nov 2024 to Dec 2024

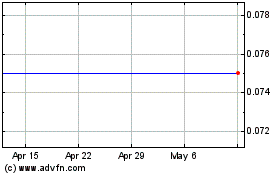

SmileDirectClub (NASDAQ:SDC)

Historical Stock Chart

From Dec 2023 to Dec 2024