Current Report Filing (8-k)

19 October 2022 - 8:16AM

Edgar (US Regulatory)

0001514183

false

0001514183

2022-10-12

2022-10-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 12, 2022

Silo Pharma, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41512 |

|

27-3046338 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

560 Sylvan Ave, Suite 3160

Englewood Cliffs, NJ |

|

07632 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (718) 400-9031

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Rule 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

SILO |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

As previously disclosed, on

October 27, 2021, Silo Pharma, Inc. (the “Company”) entered into a sponsored research agreement with Columbia University (the

“Columbia Agreement”) pursuant to which the Company was granted an option to license certain assets currently under development,

including Alzheimer’s disease. On October 13, 2022, the Company entered into an amendment to the Columbia Agreement (the “Columbia

Amendment”), pursuant to which the parties agreed to extend the payment schedule.

The foregoing description

of the Columbia Amendment does not purport to be complete and is subject to, and qualified in its entirety by reference to the full text

of the Columbia Amendment, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 5.02. Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 12, 2022, the Company entered into an employment agreement

with Eric Weisblum (the “Weisblum Employment Agreement”) pursuant to which Mr. Weisblum’s (i) base salary will be $350,000

per year, (ii) Mr. Weisblum will be paid a one-time signing bonus of $100,000, and (iii) Mr. Weisblum shall be entitled to receive an

annual bonus of up to $350,000, subject to the sole discretion of the Compensation Committee of the Board of Directors of the Company

(the “Compensation Committee”), and upon the achievement of additional criteria established by the Compensation Committee

from time to time (the “Annual Bonus”). In addition, pursuant to the Weisblum Employment Agreement, upon termination of Mr.

Weisblum’s employment for death or Total Disability (as defined in the Weisblum Employment Agreement), in addition to any accrued

but unpaid compensation and vacation pay through the date of his termination and any other benefits accrued to him under any Benefit Plans

(as defined in the Weisblum Employment Agreement) outstanding at such time and the reimbursement of documented, unreimbursed expenses

incurred prior to such termination date (collectively, the “Weisblum Payments”), Mr. Weisblum shall also be entitled to the

following severance benefits: (i) 24 months of his then base salary; (ii) if Mr. Weisblum elects continuation coverage for group health

coverage pursuant to COBRA Rights (as defined in the Weisblum Employment Agreement), then for a period of 24 months following Mr. Weisblum’s

termination he will be obligated to pay only the portion of the full COBRA Rights cost of the coverage equal to an active employee’s

share of premiums (if any) for coverage for the respective plan year; and (iii) payment on a pro-rated basis of any Annual Bonus or other

payments earned in connection with any bonus plan to which Mr. Weisblum was a participant as of the date of his termination (together

with the Weisblum Payments, the “Weisblum Severance”). Furthermore, pursuant to the Weisblum Employment Agreement, upon Mr.

Weisblum’s termination (i) at his option (A) upon 90 days prior written notice to the Company or (B) for Good Reason (as defined

in the Weisblum Employment Agreement), (ii) termination by the Company without Cause (as defined in the Weisblum Employment Agreement)

or (iii) termination of Mr. Weisblum’s employment within 40 days of the consummation of a Change in Control Transaction (as defined

in the Weisblum Employment Agreement), Mr. Weisblum shall receive the Weisblum Severance; provided, however, Mr. Weisblum shall be entitled

to a pro-rated Annual Bonus of at least $200,000. In addition, any equity grants issued to Mr. Weisblum shall immediately vest upon termination

of Mr. Weisblum’s employment by him for Good Reason or by the Company at its option upon 90 days prior written notice to Mr. Weisblum,

without Cause.

On October 12, 2022, the Company entered into an amendment (the “Ryweck

Amendment”) to the employment agreement by and between the Company and Daniel Ryweck dated September 27, 2022, pursuant to which

Mr. Ryweck’s base salary will increase to $60,000 per year.

The foregoing descriptions

of the Weisblum Employment Agreement and the Ryweck Amendment do not purport to be complete and are subject to, and qualified in their

entirety by reference to the full text of the Weisblum Employment Agreement and the Ryweck Amendment, copies of which are attached hereto

as Exhibits 10.2 and 10.3 respectively, and are incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

The Company has prepared

presentation materials (the “Presentation Materials”) that management intends to use from time to time on and after October

12, 2022, in presentations about the Company’s operations and performance. The Presentation Materials are furnished as Exhibit 99.1

to this Current Report on Form 8-K.

The information contained

in the Presentation Materials is summary information that should be considered within the context of the Company’s filings with

the Securities and Exchange Commission and other public announcements that the Company may make by press release or otherwise from time

to time. The Presentation Materials speak as of the date of this Current Report on Form 8-K. While the Company may elect to update

the Presentation Materials in the future or reflect events and circumstances occurring or existing after the date of this Current Report

on Form 8-K, the Company specifically disclaims any obligation to do so.

The information in this Item

7.01 and Exhibit 99.1 of this Current Report on Form 8-K is furnished and shall not be deemed to be “filed” for

the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section. The information in this Item 7.01 and Exhibit 99.1 of this Current Report on Form 8-K shall

not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before

or after the date of this Current Report, regardless of any general incorporation language in any such filing.

Item 8.01 Other Events

On October 18, 2022, the Company

issued a press release announcing the extension of its agreement with Columbia University (“Columbia”) pursuant to which,

Columbia granted the Company the option to license certain assets currently under development, including Alzheimer’s disease and

Stress Induced Anxiety. A copy of this press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K and incorporated

by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| # | Pursuant to Item 601(b)(10) of Regulation S-K, certain confidential

portions of this exhibit were omitted by means of marking such portions with an asterisk because the identified confidential portions

(i) are not material and (ii) would be competitively harmful if publicly disclosed. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

SILO PHARMA, INC. |

| |

|

|

| Date: October 18, 2022 |

By: |

/s/ Eric Weisblum |

| |

|

Eric Weisblum |

| |

|

Chief Executive Officer |

-3-

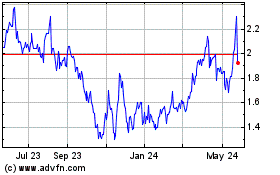

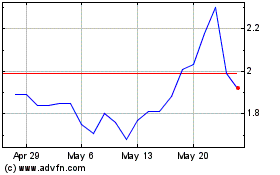

Silo Pharma (NASDAQ:SILO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Silo Pharma (NASDAQ:SILO)

Historical Stock Chart

From Jul 2023 to Jul 2024