Current Report Filing (8-k)

22 July 2022 - 11:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 20, 2022

SK Growth Opportunities Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Cayman Islands |

|

001-41432 |

|

98-1643582 |

| (State or other jurisdiction

of incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

|

|

| 228 Park Avenue S #96693

New York, New York |

|

10003 |

| (Address of principal executive offices) |

|

(Zip Code) |

(917) 599-1622

Registrant’s telephone number, including area code

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one Class A Ordinary Share, $0.0001 par value, and one-half of one redeemable warrant |

|

SKGRU |

|

The Nasdaq Stock Market LLC |

| Class A Ordinary Shares included as part of the units |

|

SKGR |

|

The Nasdaq Stock Market LLC |

| Redeemable Warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

SKGRW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As previously disclosed, on June 28, 2022, SK Growth Opportunities Corporation (the

“Company”) consummated its initial public offering (“IPO”) of 20,000,000 units (the “Units”). Each Unit consists of one Class A ordinary share of the Company, par value $0.0001 per share (the

“Class A Ordinary Shares”), and one-half of one redeemable warrant of the Company (the “Public Warrants”), each whole Public Warrant entitling the

holder thereof to purchase one Class A Ordinary Share at an exercise price of $11.50 per share, subject to adjustment. The Units were sold at a price of $10.00 per unit, generating gross proceeds to the Company of $200,000,000. Upon

consummation of the IPO, the aggregate net proceeds of $205,000,000, or $10.25 per Class A Ordinary Share, were placed into the trust account established at the time of the Company’s IPO for the benefit of the Company’s public

shareholders and the underwriter with Continental Stock Transfer & Trust Company acting as trustee (the Trust Account”). In connection with the IPO, the underwriters were granted

a 45-day option from the date of the prospectus (the “Over-Allotment Option”) to purchase up to 3,000,000 additional Units at the public offering price to

cover over-allotments (the “Over-Allotment Units”), if any.

Item 2.03. Creation of a Direct

Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement or a Registrant.

In connection with the Over-Allotment Exercise (as defined below), the Company issued a promissory note (the “Note”), dated

July 20, 2022, to Auxo Capital Managers LLC (the “Sponsor”). The Note has a principal balance of $240,000 and bears no interest. The Note will mature upon the consummation of the Company’s initial business combination. The

proceeds of the Note were used to fund the Trust Account in connection with the exercise of the Over-Allotment Exercise, as discussed below.

The above description of the Note is qualified in its entirety by reference to the full text of the applicable agreement, which is

incorporated by reference herein and filed herewith as Exhibit 10.1.

Item 3.02. Unregistered Sales of Equity Securities.

The disclosure set forth below in Item 8.01 of this Current Report on Form 8-K regarding the Private

Placement Warrants (as defined below) is incorporated by reference herein.

Item 8.01. Other Events.

On July 18, 2022, the underwriters provided notice of the partial exercise of the Over-Allotment Option to purchase an additional 960,000

Over-Allotment Units (the “Over-Allotment Exercise”). On July 20, 2022, the Over-Allotment Units were sold at an offering price of $10.00 per Over-Allotment Unit, generating aggregate additional gross

proceeds of $9,600,000 to the Company. Substantially concurrently with the closing of the Over-Allotment Exercise, the Company completed the private placement of 192,000 warrants (the “Private Placement Warrants”) to the Sponsor at

a purchase price of $1.00 per Private Placement Warrant, generating gross proceeds to the Company of $192,000 (the “Private Placement”). The terms of the Private Placement Warrants are consistent with the private placement warrants

issued in connection with the IPO.

The aggregate net proceeds of $9,840,000, or $10.25 per Class A Ordinary share, from the

Over-Allotment Exercise, the Overfunding Loan and the Private Placement were placed into the Trust Account for the benefit of the Company’s public shareholders and the underwriter.

2

Item 9.01. Financial Statements and Exhibits.

(d)

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated: July 22, 2022

|

|

|

|

|

| SK GROWTH OPPORTUNITIES CORPORATION |

|

|

| By: |

|

/s/ Derek Jensen |

|

|

|

|

Name: Derek Jensen |

|

|

|

|

Title: Chief Financial Officer |

4

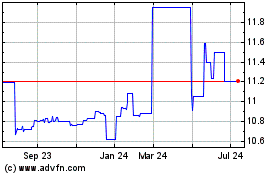

SK Growth Opportunities (NASDAQ:SKGRU)

Historical Stock Chart

From Jan 2025 to Feb 2025

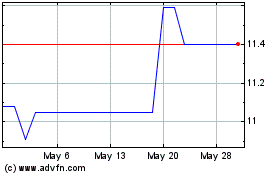

SK Growth Opportunities (NASDAQ:SKGRU)

Historical Stock Chart

From Feb 2024 to Feb 2025