SLR Investment Corp. (NASDAQ: SLRC) (the “Company”, “SLRC”,

“we”, “us”, or “our”) today reported net investment income (“NII”)

of $24.3 million, or $0.45 per share, for the second quarter

of 2024. On August 7, 2024, the Board declared a quarterly

distribution of $0.41 per share payable on September 27, 2024, to

holders of record as of September 13, 2024.

As of June 30, 2024, net asset value (“NAV”) was

$18.20 per share, compared to $18.19 per share as of March 31,

2024.

“NII per share in the second quarter reached the

highest level in 5 years, reflecting our deliberate approach to

rebuild the Company’s investment portfolio after a period of

conservatism during the pandemic. Importantly, SLRC’s portfolio

growth over the last couple of years has been driven by

originations in both sponsor finance and specialty finance

investments, enabling us to take advantage of our complementary

niches within the private credit market that are not as competitive

as the sponsor market,” said Michael Gross, Co-CEO. “Our

multi-strategy approach provides greater earnings stability across

cycles due to the relative consistency of the returns in our

specialty finance strategies.”

“Our portfolio continues to perform well, which

is evidenced by another quarter of NAV stability, a decline in

non-accrual investments, a low level of watch list investments, and

minimal payment-in-kind income,” said Bruce Spohler,

Co-CEO. “We believe the recent stability in the NAV reflects

our multi-strategy portfolio, which was substantially constructed

in 2023 and 2024 and underwritten to withstand higher interest

rates and a softening economy.”

FINANCIAL HIGHLIGHTS FOR QUARTER ENDED

JUNE 30, 2024: Investment portfolio fair value: $2.1

billionNet assets: $993.0 million or $18.20 per shareLeverage:

1.16x net debt-to-equity

Operating Results for the Quarter Ended

June 30, 2024:Net investment income: $24.3 million or

$0.45 per shareNet realized and unrealized losses: $1.1 million or

$0.02 per shareNet increase in net assets from operations: $23.2

million or $0.43 per share

COMPREHENSIVE

PORTFOLIO(1) HIGHLIGHTS AND

ACTIVITY(2) FOR QUARTER ENDED

JUNE 30, 2024:Portfolio fair value: $3.1 billionNumber of

unique issuers: approximately 800Investments made during the

quarter: $355.8 millionInvestments prepaid and sold during the

quarter: $292.7 million

(1) The Comprehensive Investment Portfolio for

the quarter ended June 30, 2024 is comprised of SLRC’s investment

portfolio and SLR Credit Solutions’ (“SLR-CS”) full portfolio, SLR

Equipment Finance’s (“SLR-EF”) full portfolio, Kingsbridge

Holdings, LLC’s (“KBH”) full portfolio, SLR Business Credit’s

(“SLR-BC”) full portfolio, SLR Healthcare ABL’s (“SLR-HC ABL”) full

portfolio owned by the Company (collectively, the Company’s

“Commercial Finance Portfolio Companies”), and the senior secured

loans held by the SLR Senior Lending Program LLC (“SSLP”)

attributable to the Company, and excludes the Company’s fair value

of the equity interests in SSLP and the Commercial Finance

Portfolio Companies and also excludes SLRC’s loans to KBH and

SLR-EF.(2) Comprehensive Portfolio Activity for the quarter ended

June 30, 2024, includes investment activity of the Commercial

Finance Portfolio Companies and SSLP attributable to the

Company.

Comprehensive Investment

Portfolio

Portfolio Activity

During the three months ended June 30, 2024,

SLRC had Comprehensive Portfolio originations of $355.8 million and

repayments of $292.7 million across the Company’s four investment

strategies:

|

|

|

|

|

|

|

|

Asset Class |

SponsorFinance(1) |

Asset-basedLending(2) |

EquipmentFinance(3) |

Life Science Finance |

TotalComprehensive InvestmentPortfolio

Activity |

|

Originations |

$44.5 |

$130.4 |

$177.9 |

$3.0 |

$355.8 |

|

Repayments /Amortization |

$33.2 |

$100.4 |

$159.1 |

$0.0 |

$292.7 |

|

Net PortfolioActivity |

$11.3 |

$30.0 |

$18.8 |

$3.0 |

$63.1 |

(1) Sponsor Finance refers to cash flow loans to

sponsor-owned companies including cash flow loans held in SSLP

attributable to the Company.(2) Includes SLR-CS, SLR-BC and SLR-HC

ABL’s full portfolios, as well as asset-based loans on the

Company’s balance sheet.(3) Includes SLR-EF’s full portfolio and

equipment financings on the Company’s balance sheet and Kingsbridge

Holdings’ (KBH) full portfolio.

Comprehensive Investment Portfolio

Composition

The Comprehensive Investment Portfolio is

diversified across approximately 800 unique issuers, operating in

over 110 industries, and resulting in an average exposure of $3.8

million or 0.1% per issuer. As of June 30, 2024, 99.2% of the

Company’s Comprehensive Investment Portfolio was invested in senior

secured loans of which 97.7% is held in first lien senior secured

loans. Second lien ABL exposure is 1.2% and second lien cash flow

exposure is 0.3% of the Comprehensive Investment Portfolio at June

30, 2024.

SLRC’s Comprehensive Investment Portfolio

composition by asset class as of June 30, 2024 was as follows:

|

Comprehensive InvestmentPortfolio Composition(at

fair value) |

Amount |

WeightedAverage AssetYield(5) |

|

($mm) |

% |

|

Senior Secured Investments Cash Flow Loans

(Sponsor Finance)(1) |

$759.0 |

24.3% |

11.7% |

|

Asset-Based Loans(2) |

$961.4 |

30.8% |

15.2% |

|

Equipment Financings(3) |

$1,034.1 |

33.1% |

8.1% |

| Life

Science Loans |

$345.5 |

11.0% |

13.0% |

|

Total Senior Secured Investments |

$3,100.0 |

99.2% |

11.7% |

|

Equity and Equity-like Securities |

$24.8 |

0.8% |

|

|

Total Comprehensive InvestmentPortfolio |

$3,124.8 |

100.0% |

|

|

Floating Rate Investments(4) |

$2,058.1 |

66.3% |

|

|

First Lien Senior Secured Loans |

$3,054.0 |

97.7% |

|

|

Second Lien Senior SecuredAsset-Based Loans |

$38.2 |

1.2% |

|

|

Second Lien Senior Secured Cash Flow Loans |

$7.8 |

0.3% |

|

(1) Includes cash flow loans held in the SSLP

attributable to the Company and excludes the Company’s equity

investment in SSLP.(2) Includes SLR-CS, SLR-BC, and SLR-HC ABL’s

full portfolios, as well as asset-based loans on the Company’s

balance sheet, and excludes the Company’s equity investments in

each of SLR-CS, SLR-BC, and SLR-HC ABL.(3) Includes SLR-EF’s full

portfolio and equipment financings on the Company’s balance sheet

and Kingsbridge Holdings’ (KBH) full portfolio. Excludes the

Company’s equity and debt investments in each of SLR-EF and KBH.(4)

Floating rate investments are calculated as a percent of the

Company’s income-producing Comprehensive Investment Portfolio. The

majority of fixed rate loans are associated with SLR-EF and leases

held by KBH. Additionally, SLR-EF and KBH seek to match-fund their

fixed rate assets with fixed rate liabilities.(5) The weighted

average asset yield for income producing cash flow, asset-based and

life science loans on balance sheet is based on a yield to maturity

calculation. The yield calculation of Life Science loans excludes

the impact of success fees and/or warrants. The weighted average

yield for on-balance sheet equipment financings is calculated based

on the expected average life of the investments. The weighted

average asset yield for SLR-CS asset-based loans is an Internal

Rate of Return calculated using actual cash flows received and the

expected terminal value. The weighted average asset yield for

SLR-BC and SLR-HC ABL represents total interest and fee income for

the three month period ended on June 30, 2024 against the average

portfolio over the same fiscal period, annualized. The weighted

average asset yield for SLR-EF represents total interest and fee

income for the three month period ended on June 30, 2024 compared

to the portfolio as of June 30, 2024, annualized. The weighted

average yield for the KBH equipment leasing portfolio represents

the expected return on equity during 2024.

SLR INVESTMENT CORP.

PORTFOLIO

Asset Quality

As of June 30, 2024, 99.6% of SLRC’s portfolio

was performing on a fair value basis and 99.4% on a cost basis,

with one investment recognized as non-accrual.

The Company emphasizes risk control and credit

performance. On a quarterly basis, or more frequently if deemed

necessary, the Company formally rates each portfolio investment on

a scale of one to four, with one representing the least amount of

risk.

As of June 30, 2024, the composition of our

Investment Portfolio, on a risk ratings basis, was as follows:

|

Internal Investment Rating |

Investments at Fair Value ($mm) |

% of Total Portfolio |

|

1 |

$656.0 |

30.7% |

|

2 |

$1,464.4 |

68.5% |

|

3 |

$8.4 |

0.4% |

|

4 |

$7.8 |

0.4% |

Investment Income Contribution by Asset

Class

|

Investment Income Contribution by Asset

Class(1)($mm) |

|

For the QuarterEnded: |

SponsorFinance |

Asset-basedLending |

EquipmentFinance |

Life ScienceFinance |

Total |

|

6/30/2024 |

$22.5 |

$14.6 |

$9.4 |

$12.5 |

$59.0 |

|

% Contribution |

38.2% |

24.7% |

15.9% |

21.2% |

100.0% |

(1) Investment Income Contribution by Asset

Class includes: interest income/fees from Sponsor Finance (cash

flow) loans on balance sheet and distributions from SSLP;

income/fees from asset-based loans on balance sheet and

distributions from SLR-CS, SLR-BC, SLR-HC ABL; income/fees from

equipment financings and distributions from SLR-EF and

distributions from KBH; and income/fees from life science loans on

balance sheet.

SLR Senior Lending Program LLC

(SSLP)

As of June 30, 2024, the Company and its 50%

partner, Sunstone Senior Credit L.P., had contributed combined

equity capital of $95.8 million of a total equity commitment of

$100 million to SSLP. At quarter end, SSLP had total commitments of

$236.4 million at par and total funded portfolio investments of

$220.8 million at fair value, consisting of floating rate senior

secured loans to 39 different borrowers and an average investment

of $5.7 million per borrower. This compares to funded portfolio

investments of $216.9 million at fair value across 39 different

borrowers at March 31, 2024. During the quarter ended June 30,

2024, SSLP invested $11.4 million in 7 portfolio companies and had

$7.7 million of investments repaid. The fair value of the portfolio

increased by 1.8% over the prior quarter.

In Q2 2024, the Company earned income of $1.9

million from its investment in the SSLP, representing an annualized

yield of 15.8% on the cost basis of the Company’s investment,

compared to income of $1.6 million in Q1 2024.

SLR Investment Corp.’s Results of

Operations for the Quarter Ended June 30, 2024 compared to the

Quarter Ended June 30, 2023

Investment Income

SLRC’s gross investment income totaled $59.0

million and $56.3 million, respectively, for the three months ended

June 30, 2024 and 2023. The year-over-year increase of 4.7% in

gross investment income was primarily due to a combination of an

increase in other income, the ramp of the SSLP, and an increase in

index rates.

Expenses

SLRC’s net expenses totaled $34.7 million and

$33.7 million, respectively, for the three months ended June 30,

2024 and 2023. The year-over-year increase in expenses of 3.0% was

primarily due to an increase in other general and administrative

expenses as well as an increase in management fees.

SLRC’s investment adviser agreed to waive

incentive fees resulting from income earned due to the accretion of

the purchase price discount allocated to investments acquired in

the Company’s merger with SLR Senior Investment Corp., which closed

on April 1, 2022. For the three months ended June 30, 2024 and

2023, $44 thousand and $125 thousand, respectively, of

performance-based incentive fees were waived, amounting to a

cumulative fee waiver of $2.1 million or $0.04 per share.

Net Investment Income

SLRC’s net investment income totaled $24.3

million and $22.7 million, or $0.45 and $0.42 per average share,

respectively, for the fiscal quarters ended June 30, 2024 and

2023.

Net Realized and Unrealized

Loss

Net realized and unrealized losses for the

fiscal quarters ended June 30, 2024 and 2023 totaled $1.1 million

and $3.7 million, respectively.

Net Increase in Net Assets Resulting

from Operations

For the three months ended June 30, 2024 and

2023, the Company had a net increase in net assets resulting from

operations of $23.2 million and $19.0 million, respectively. For

the same periods, earnings per average share were $0.43 and $0.35,

respectively.

Liquidity and Capital

Resources

Unsecured Debt

At June 30, 2024, 41% of the Company’s funded

debt was comprised of fixed rate unsecured notes. We expect to

opportunistically access the investment-grade debt market.

Credit Facilities and Available Capital

As of June 30, 2024, the Company had $588.9

million drawn on the $860 million of commitments that the Company

has under its revolving credit facilities, $100 million of term

loans, and $470 million of unsecured notes. Also as of June 30,

2024, including anticipated available borrowing capacity at the

SSLP and our specialty finance portfolio companies, subject to

borrowing base limits, SLRC, SSLP and our specialty finance

portfolio companies had over $750 million of available capital in

the aggregate.

Leverage

As of June 30, 2024, the Company’s net

debt-to-equity ratio was 1.16x, within the Company’s target range

of 0.9x to 1.25x.

Unfunded Commitments

As of June 30, 2024, excluding commitments to

SLR-CS, SLR-HC ABL and SSLP, over which the Company has discretion

to fund, the Company had unfunded commitments of approximately

$136.1 million.

Subsequent Events

Distributions

On August 7, 2024, the Board declared a

quarterly distribution of $0.41 per share payable on September 27,

2024 to holders of record as of September 13, 2024.

Conference Call and Webcast Information

The Company will host an earnings conference

call and audio webcast at 10:00 a.m. (Eastern Time) on Thursday,

August 8, 2024. All interested parties may participate in the

conference call by dialing (800) 267-6316 approximately 5-10

minutes prior to the call, international callers should dial (203)

518-9783. Participants should reference SLR Investment Corp. and

Conference ID: SLRC2Q24. A telephone replay will be available until

August 22, 2024 and can be accessed by dialing (800) 839-2418.

International callers should dial (402) 220-7210. This conference

call will also be broadcast live over the Internet and can be

accessed by all interested parties from the Event Calendar within

the “Investors” tab of SLR Investment Corp.’s website,

https://slrinvestmentcorp.com/Investors/Event-Calendar. Please

register online prior to the start of the call. For those who are

not able to listen to the broadcast live, a replay of the webcast

will be available soon after the call.

Financial Statements and Tables

|

SLR INVESTMENT CORP.CONSOLIDATED STATEMENTS OF ASSETS AND

LIABILITIES(in thousands, except share amounts) |

|

|

|

|

| |

June 30, 2024 |

|

December 31, 2023 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Investments at fair

value: |

|

|

|

|

|

|

|

|

|

Companies less than 5% owned (cost: $1,232,964 and $1,260,205,

respectively)………………………………. |

$ |

1,247,747 |

|

|

$ |

1,271,442 |

|

|

|

Companies 5% to 25% owned (cost: $61,055 and $60,064,

respectively)…..……….……………………………… |

|

45,242 |

|

|

|

44,250 |

|

|

|

Companies more than 25% owned (cost: $875,473 and $870,128,

respectively)……….……………………….. |

|

843,561 |

|

|

|

839,074 |

|

|

|

Cash…………………………………………………………………………………………….……………………………………………………………………… |

|

11,031 |

|

|

|

11,864 |

|

|

| Cash equivalents (cost:

$274,126 and $332,290,

respectively)……………………………….……........................................ |

|

274,126 |

|

|

|

332,290 |

|

|

| Dividends

receivable…………………………………………………………………………………………………………………………………………… |

|

12,114 |

|

|

|

11,768 |

|

|

| Interest

receivable…………………………………………………………………………….……………………………………………………………….. |

|

11,759 |

|

|

|

11,034 |

|

|

| Receivable for investments

sold……………………………………………………………….………………………………………………………… |

|

1,755 |

|

|

|

1,538 |

|

|

| Prepaid expenses and other

assets…………………………………………………………………………………………………………………….. |

|

943 |

|

|

|

608 |

|

|

|

Total

assets………………………………………………………………………………………………………………………………………… |

$ |

2,448,278 |

|

|

$ |

2,523,868 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

| Debt ($1,158,850 and

$1,183,250 face amounts, respectively, reported net of unamortized

debt issuance costs of $4,497 and $5,473,

respectively).………………………………………………………………………………………………….. |

$ |

1,154,353 |

|

|

$ |

1,177,777 |

|

|

| Payable for investments and

cash equivalents purchased……………...……………………………………………………………….…. |

|

274,126 |

|

|

|

332,290 |

|

|

| Management fee payable

…………..…………………………………………………………………………………………………………………….. |

|

7,874 |

|

|

|

8,027 |

|

|

| Performance-based incentive

fee payable …………..……………………………………………………………………………………………. |

|

6,024 |

|

|

|

5,864 |

|

|

| Interest payable

………….…………………………………………………………………………………………………………………………………….. |

|

6,752 |

|

|

|

7,535 |

|

|

| Administrative services

payable ………….……………………………..……………………………………………………………………………… |

|

3,111 |

|

|

|

1,969 |

|

|

| Other liabilities and accrued

expenses……………………………………………………………………………………………………………….. |

|

3,035 |

|

|

|

3,767 |

|

|

|

Total

liabilities…………………………………………………………….…………………………………………………………..……….… |

$ |

1,455,275 |

|

|

$ |

1,537,229 |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Assets |

|

|

|

|

|

|

|

|

| Common stock, par value $0.01

per share, 200,000,000 and 200,000,000 common shares authorized,

respectively, and 54,554,634 and 54,554,634 shares issued and

outstanding, respectively………………… |

$ |

546 |

|

|

$ |

546 |

|

|

| Paid-in capital in excess of

par …………….………………………...…………………………………………………………………………………. |

|

1,117,930 |

|

|

|

1,117,930 |

|

|

| Accumulated distributable net

loss ……………….…………………………………………………………………………………………………… |

|

(125,473 |

) |

|

|

(131,837 |

) |

|

|

Total net

assets……………………………………………………………..…………………………………………………………………… |

$ |

993,003 |

|

|

$ |

986,639 |

|

|

| Net Asset Value Per

Share…..…………………………………………………………………………………………………………………………….. |

$ |

18.20 |

|

|

$ |

18.09 |

|

|

| |

|

|

SLR INVESTMENT CORP. CONSOLIDATED

STATEMENTS OF OPERATIONS(in thousands, except

share amounts) |

|

| |

|

|

|

Three months ended |

|

|

|

June 30, 2024 |

|

June 30, 2023 |

|

|

INVESTMENT INCOME: |

|

|

|

|

|

|

|

|

|

Interest: |

|

|

|

|

|

|

|

|

|

Companies less than 5% owned

........................................................................................................ |

$ |

40,015 |

|

|

$ |

41,267 |

|

|

|

Companies 5% to 25%

owned............................................................................................................ |

|

856 |

|

|

|

265 |

|

|

|

Companies more than 25% owned

.................................................................................................... |

|

3,306 |

|

|

|

2,814 |

|

|

|

Dividends: |

|

|

|

|

|

|

|

|

|

Companies more than 25% owned

.................................................................................................... |

|

12,482 |

|

|

|

11,177 |

|

|

| Other

income: |

|

|

|

|

|

|

|

|

|

Companies less than 5% owned

........................................................................................................ |

|

2,184 |

|

|

|

757 |

|

|

|

Companies more than 25% owned

.................................................................................................... |

|

135 |

|

|

|

57 |

|

|

|

Total investment

income.................................................................................................... |

$ |

58,978 |

|

|

$ |

56,337 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES: |

|

|

|

|

|

|

|

|

|

Management fees

……………................................................................................................................................ |

$ |

7,875 |

|

|

$ |

7,878 |

|

|

|

Performance-based incentive fees

…………......................................................................................................... |

|

6,068 |

|

|

|

5,638 |

|

|

|

Interest and other credit facility expenses

…………….......................................................................................... |

|

18,179 |

|

|

|

17,842 |

|

|

|

Administrative services expense

…………….......................................................................................................... |

|

1,376 |

|

|

|

1,480 |

|

|

| Other

general and administrative expenses

...................................................................................................... |

|

1,206 |

|

|

|

948 |

|

|

|

Total

expenses.................................................................................................................... |

|

34,704 |

|

|

|

33,786 |

|

|

|

Performance-based incentive fees waived

…………….......................................................................................... |

|

(44 |

) |

|

|

(125 |

) |

|

|

Net expenses

..................................................................................................................... |

|

34,660 |

|

|

|

33,661 |

|

|

|

Net investment income

............................................................................................. |

$ |

24,318 |

|

|

$ |

22,676 |

|

|

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND CASH

EQUIVALENTS: |

|

|

|

|

|

|

|

|

| Net

realized gain on investments and cash equivalents (companies less

than 5% owned) .............................. |

$ |

105 |

|

|

$ |

498 |

|

|

| Net

change in unrealized gain (loss) on investments and cash

equivalents: |

|

|

|

|

|

|

|

|

|

Companies less than 5% owned

........................................................................................................ |

|

63 |

|

|

|

5,181 |

|

|

|

Companies 5% to 25% owned

........................................................................................................... |

|

- |

|

|

|

(3,216 |

) |

|

|

Companies more than 25%

owned.................................................................................................... |

|

(1,258 |

) |

|

|

(6,144 |

) |

|

|

Net change in unrealized loss on investments and cash equivalents

................................... |

|

(1,195 |

) |

|

|

(4,179 |

) |

|

|

Net realized and unrealized loss on investments and cash

equivalents.................... |

|

(1,090 |

) |

|

|

(3,681 |

) |

|

| NET

INCREASE IN NET ASSETS RESULTING FROM

OPERATIONS…………………………………………………………………. |

|

|

|

|

|

|

|

|

|

$ |

23,228 |

|

|

$ |

18,995 |

|

|

|

EARNINGS PER SHARE

…………........................................................................................................................... |

$ |

0.43 |

|

|

$ |

0.35 |

|

|

| |

|

About SLR Investment Corp.

SLR Investment Corp. is a closed-end investment

company that has elected to be regulated as a business development

company under the Investment Company Act of 1940. A specialty

finance company with expertise in several niche markets, the

Company primarily invests in leveraged, U.S. upper middle market

companies in the form of cash flow, asset-based, and life sciences

senior secured loans.

Forward-Looking Statements

Some of the statements in this press release

constitute forward-looking statements because they relate to future

events, future performance or financial condition. The

forward-looking statements may include statements as to: the

expected stability of the Company’s earnings; the excess spread of

the Company’s investments; the Company’s ability to

opportunistically access the investment grade debt market; the

market environment and its impact on the business prospects of SLRC

and the prospects of SLRC’s portfolio companies; prospects for

additional portfolio growth of SLRC; and the quality of, and the

impact on the performance of SLRC from the investments that SLRC

has made and expects to make. In addition, words such as

“anticipate,” “believe,” “expect,” “seek,” “plan,” “should,”

“estimate,” “project” and “intend” indicate forward-looking

statements, although not all forward-looking statements include

these words. The forward-looking statements contained in this press

release involve risks and uncertainties. Certain factors could

cause actual results and conditions to differ materially from those

projected, including the uncertainties associated with: (i) changes

in the economy, financial markets and political environment,

including the impacts of inflation and changing interest rates;

(ii) risks associated with possible disruption in the operations of

SLRC or the economy generally due to terrorism, war or other

geopolitical conflicts, natural disasters, or pandemics; (iii)

future changes in laws or regulations (including the interpretation

of these laws and regulations by regulatory authorities); (iv)

conditions in SLRC’s operating areas, particularly with respect to

business development companies or regulated investment companies;

and (v) other considerations that may be disclosed from time to

time in SLRC’s publicly disseminated documents and filings. SLRC

has based the forward-looking statements included in this press

release on information available to it on the date of this press

release, and SLRC assumes no obligation to update any such

forward-looking statements. Although SLRC undertakes no obligation

to revise or update any forward-looking statements, whether as a

result of new information, future events or otherwise, you are

advised to consult any additional disclosures that it may make

directly to you or through reports that SLRC in the future may file

with the Securities and Exchange Commission, including annual

reports on Form 10-K, quarterly reports on Form 10-Q and current

reports on Form 8-K.

Contact

SLR Investment Corp.

Investor Relations

slrinvestorrelations@slrcp.com | (646) 308-8770

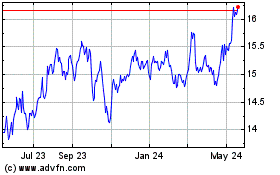

SLR Investment (NASDAQ:SLRC)

Historical Stock Chart

From Jul 2024 to Aug 2024

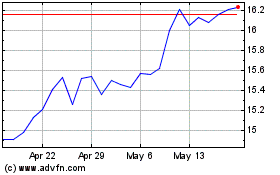

SLR Investment (NASDAQ:SLRC)

Historical Stock Chart

From Aug 2023 to Aug 2024