SurgePays, Inc. (Nasdaq: SURG) (“SurgePays” or the “Company”), a

technology and telecommunications company focused on the

underbanked and underserved, today announced its financial results

for the third quarter ended September 30, 2022.

Third Quarter 2022 Operational and

Financial Highlights

- Revenue of $36.2 million in the

third quarter, an increase of 149% compared to the third quarter of

2021

- Gross profit of $1.9 million in the

third quarter, an increase of 1% compared to the third quarter of

2021

- Net loss of $(1.5 million) in the

third quarter compared to a net loss of $(1.7 million) in the year

ago period

- Surpasses Year end Goal of 200,000

subscribers

- Appoints Jeremy Gies, President of

SurgePays Fintech to drive increases in the number of stores using

SurgePays software and revenue per store

- Integrate ACP into SurgePays

Fintech Platform to enable in store enrollments

CEO Commentary and Outlook

Chairman and CEO Brian Cox commented on third

quarter results, “The third quarter for SurgePays was about

disciplined growth while maintaining a velocity resulting in a 2.5X

revenue increase and surpassing our 2022 year-end goal of 200,000

mobile broadband (wireless) subscribers. We continued our growth

curve without dilutive capital raises through planning and

discipline. In a turbulent economy, our team is successfully

forging ahead focused on defined targets of subscribers, stores on

our network, and revenue.

“Once we hit 150,000 mobile broadband

subscribers, we analyzed our efficiency in purchasing wireless

equipment, margins, and retention. This evaluation has led to

margin expansion in both our equipment and service provision. We

have also implemented new protocols to enhance customer

retention.”

“By adding ACP enrollments to our SurgePays

platform for convenience stores, we can accelerate our growth goals

due to being the only company we are aware of offering ACP at the

community stores where the underbanked most frequently shop. These

stores accept SNAP(EBT), a qualifying program. At the register, the

clerk can quickly submit customer data needed for our compliance

specialists to activate the customer. By adding this offering to

our suite of prepaid products for the store owner, we should see

rapid growth in our total store count.

Mr. Cox concluded: “I have been very open about

not measuring our company by quarters, but the trajectory to hit

subscriber and revenue goals while improving the Cap Table. We are

executing with real-time results in the middle of a land grab. I

believe we have barely scratched the surface and will continue to

refine our sales and operating practices to maximize the rapid

scaling of our sales and revenue.”

Conference Call and Webcast

InformationSurgePays will host a conference call today to

review its results and discuss its performance at 5:00 p.m. ET /

2:00 p.m. PT. Participants may join the conference call by dialing

1-877-270-2148 (United States) or 1-412-902-6510 (International). A

telephonic replay of the call will also be available shortly after

the completion of the call, until 11:59 pm ET on November 28, 2022,

by dialing 1-877-344-7529 (United States) or 1-412-317-0088

(International) and entering the replay pin number: 1557657.

A live webcast will be available on SurgePays,

Inc Investor Relations site under the Upcoming Event section at

http://ir.surgepays.com and will be archived online upon completion

of the conference call.

About SurgePays, Inc.

SurgePays, Inc. is a technology and

telecommunications company focused on the underbanked and

underserved communities. SurgePhone Wireless provide mobile

broadband to low-income consumers nationwide. SurgePays blockchain

fintech platform utilizes a suite of financial and prepaid products

to convert corner stores and bodegas into tech-hubs for underbanked

neighborhoods. Please visit SurgePays.com for more information.

About Non-GAAP Financial

Measures

The Company believes that EBITDA (earnings

before interest, taxes, depreciation and amortization) is useful to

investors because it is commonly used to evaluate companies on the

basis of operating performance and leverage.

EBITDA is not intended to represent cash flows

for the periods presented, nor have they been presented as an

alternative to operating income or as an indicator of operating

performance and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”). In accordance with SEC Regulation G, the non-GAAP

measurements in this press release have been reconciled to the

nearest GAAP measurement, which can be viewed under the heading

“Reconciliation of Net Income (loss) from Operations to EBITDA” in

the financial tables included in this press release.

Cautionary Note Regarding Forward-Looking

Statements

This press release includes express or implied

statements that are not historical facts and are considered

forward-looking within the meaning of Section 27A of the Securities

Act and Section 21E of the Securities Exchange Act. Forward-looking

statements involve substantial risks and uncertainties.

Forward-looking statements generally relate to future events or our

future financial or operating performance and may contain

projections of our future results of operations or of our financial

information or state other forward-looking information. In some

cases, you can identify forward-looking statements by the following

words: “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing,” or the negative of

these terms or other comparable terminology, although not all

forward-looking statements contain these words.

Although we believe that the expectations

reflected in these forward-looking statements such as regarding our

market potential along with the statements under the heading

Business Outlook are reasonable, these statements relate to future

events or our future operational or financial performance and

involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by these forward-looking

statements. Furthermore, actual results may differ materially from

those described in the forward-looking statements and will be

affected by a variety of risks and factors that are beyond our

control, including, without limitation, statements about our future

financial performance, including our revenue, cash flows, costs of

revenue and operating expenses; our anticipated growth; our

predictions about our industry; the impact of the COVID-19 pandemic

on our business and our ability to attract, retain and cross-sell

to clients. The forward-looking statements contained in this

release are also subject to other risks and uncertainties,

including those more fully described in our filings with the

Securities and Exchange Commission (“SEC”), including in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2021.

The forward-looking statements in this press release speak only as

of the date on which the statements are made. We undertake no

obligation to update, and expressly disclaim the obligation to

update, any forward-looking statements made in this press release

to reflect events or circumstances after the date of this press

release or to reflect new information or the occurrence of

unanticipated events, except as required by law.

Investor RelationsBrian M.

Prenoveau, CFAMZ Group – MZ North AmericaSURG@mzgroup.us561 489

5315

|

SurgePays, Inc. and Subsidiaries |

|

Consolidated Statements of Operations |

| |

| |

|

For the Three MonthsEnded September 30, |

|

|

For the Nine MonthsEnded September 30, |

|

| |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

36,171,345 |

|

|

$ |

14,538,353 |

|

|

$ |

85,317,860 |

|

|

$ |

36,905,373 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

|

34,250,541 |

|

|

|

12,634,871 |

|

|

|

78,572,421 |

|

|

|

32,544,619 |

|

| General and administrative

expenses |

|

|

2,885,744 |

|

|

|

2,909,954 |

|

|

|

9,656,518 |

|

|

|

10,262,479 |

|

| Total costs and

expenses |

|

|

37,136,285 |

|

|

|

15,544,825 |

|

|

|

88,228,939 |

|

|

|

42,807,098 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

(964,940 |

) |

|

|

(1,006,472 |

) |

|

|

(2,911,079 |

) |

|

|

(5,901,725 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(633,593 |

) |

|

|

(1,236,778 |

) |

|

|

(1,370,236 |

) |

|

|

(4,637,236 |

) |

| Derivative expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,775,057 |

) |

| Change in fair value of

derivative liabilities |

|

|

- |

|

|

|

(202,784 |

) |

|

|

- |

|

|

|

746,896 |

|

| Gain (loss) on investment in

Centercom - former related party |

|

|

(52,435 |

) |

|

|

21,072 |

|

|

|

(42,099 |

) |

|

|

(3,556 |

) |

| Gain on settlement of

liabilities |

|

|

- |

|

|

|

136,487 |

|

|

|

- |

|

|

|

979,469 |

|

| Gain on deconsolidation of

True Wireless |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,895,871 |

|

| Amortization of debt

discount |

|

|

(57,933 |

) |

|

|

630,580 |

|

|

|

(95,001 |

) |

|

|

2,008,036 |

|

| Gain on forgiveness of PPP

loan - government |

|

|

- |

|

|

|

- |

|

|

|

524,143 |

|

|

|

- |

|

| Total other income

(expense) - net |

|

|

(743,961 |

) |

|

|

(651,423 |

) |

|

|

(983,193 |

) |

|

|

(785,577 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss including

non-controlling interest |

|

|

(1,708,901 |

) |

|

|

(1,657,895 |

) |

|

|

(3,894,272 |

) |

|

|

(6,687,302 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-controlling

interest |

|

|

(216,163 |

) |

|

|

- |

|

|

|

(192,811 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss available to

common stockholders |

|

$ |

(1,492,738 |

) |

|

$ |

(1,657,895 |

) |

|

$ |

(3,701,461 |

) |

|

$ |

(6,687,302 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share - basic

and diluted |

|

$ |

(0.12 |

) |

|

$ |

(0.51 |

) |

|

$ |

(0.30 |

) |

|

$ |

(2.21 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of shares - basic and diluted |

|

|

12,443,052 |

|

|

|

3,264,274 |

|

|

|

12,259,907 |

|

|

|

3,024,487 |

|

|

SurgePays, Inc. and Subsidiaries |

|

Consolidated Balance Sheets |

| |

| |

|

September 30,2022 |

|

|

December 31,2021 |

|

| |

|

(Unaudited) |

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

Assets |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

7,892,050 |

|

|

$ |

6,283,496 |

|

| Accounts receivable - net |

|

|

9,467,422 |

|

|

|

3,249,889 |

|

| Inventory |

|

|

9,492,385 |

|

|

|

4,359,296 |

|

| Prepaids |

|

|

131,853 |

|

|

|

- |

|

| Total Current

Assets |

|

|

26,983,710 |

|

|

|

13,892,681 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment

- net |

|

|

747,056 |

|

|

|

200,448 |

|

| |

|

|

|

|

|

|

|

|

| Other

Assets |

|

|

|

|

|

|

|

|

| Note receivable |

|

|

176,851 |

|

|

|

176,851 |

|

| Intangibles - net |

|

|

2,943,353 |

|

|

|

3,433,484 |

|

| Goodwill |

|

|

1,666,782 |

|

|

|

866,782 |

|

| Investment in Centercom -

former related party |

|

|

401,190 |

|

|

|

443,288 |

|

| Operating lease - right of use

asset - net |

|

|

441,921 |

|

|

|

486,668 |

|

| Total Other

Assets |

|

|

5,630,097 |

|

|

|

5,407,073 |

|

| |

|

|

|

|

|

|

|

|

| Total

Assets |

|

$ |

33,360,863 |

|

|

$ |

19,500,202 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable and accrued

expenses |

|

$ |

13,672,082 |

|

|

$ |

6,602,577 |

|

| Accounts payable and accrued

expenses - related party |

|

|

3,558,258 |

|

|

|

1,389,798 |

|

| Deferred revenue |

|

|

1,896,510 |

|

|

|

276,250 |

|

| Operating lease liability |

|

|

38,606 |

|

|

|

49,352 |

|

| Loans payable - related

parties |

|

|

1,086,413 |

|

|

|

1,553,799 |

|

| Notes payable - SBA

government |

|

|

- |

|

|

|

126,418 |

|

| Notes payable - net |

|

|

6,679,597 |

|

|

|

- |

|

| Total Current

Liabilities |

|

|

26,931,466 |

|

|

|

9,998,194 |

|

| |

|

|

|

|

|

|

|

|

| Long Term

Liabilities |

|

|

|

|

|

|

|

|

| Loans payable - related

parties |

|

|

4,974,403 |

|

|

|

4,507,017 |

|

| Notes payable - SBA

government |

|

|

582,226 |

|

|

|

1,004,767 |

|

| Operating lease liability |

|

|

409,672 |

|

|

|

438,903 |

|

| Total Long-Term

Liabilities |

|

|

5,966,301 |

|

|

|

5,950,687 |

|

| |

|

|

|

|

|

|

|

|

| Total

Liabilities |

|

|

32,897,767 |

|

|

|

15,948,881 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

Contingencies (Note 8) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

|

|

|

|

| Series A, Convertible

Preferred stock, $0.001 par value, 100,000,000 shares authorized,

13,000,000 and 13,000,000 shares issued and outstanding,

respectively |

|

|

260 |

|

|

|

260 |

|

| Series C, Convertible

Preferred stock, $0.001 par value, 1,000,000 shares authorized, 0

and 0 shares issued and outstanding, respectively |

|

|

- |

|

|

|

- |

|

| Common stock, $0.001 par

value, 500,000,000 shares authorized 12,348,834 and 12,063,834

shares issued and outstanding, respectively |

|

|

12,496 |

|

|

|

12,064 |

|

| Additional paid-in

capital |

|

|

39,467,956 |

|

|

|

38,662,340 |

|

| Accumulated deficit |

|

|

(38,801,452 |

) |

|

|

(35,123,343 |

) |

| Stockholders’ equity |

|

|

679,260 |

|

|

|

3,551,321 |

|

|

Non-controlling interest |

|

|

(216,164 |

) |

|

|

- |

|

| Total Stockholders’

Equity |

|

|

463,096 |

|

|

|

3,551,321 |

|

| |

|

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

33,360,863 |

|

|

$ |

19,500,202 |

|

|

SurgePays, Inc. and Subsidiaries |

|

Consolidated Statements of Cash Flows |

| |

| |

|

For the Nine Months Ended September 30, |

| |

|

2022 |

|

|

2021 |

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

Operating activities |

|

|

|

|

|

|

|

| Net loss - including

non-controlling interest |

|

$ |

(3,894,272 |

) |

|

$ |

(6,687,302 |

| Adjustments to reconcile net

loss to net cash used in operations |

|

|

|

|

|

|

|

|

Provision for inventory obsolescence |

|

|

51,718 |

|

|

|

- |

|

Depreciation and amortization |

|

|

664,534 |

|

|

|

398,240 |

|

Amortization of right-of-use assets |

|

|

44,747 |

|

|

|

92,531 |

|

Amortization of debt discount/debt issue costs |

|

|

95,001 |

|

|

|

1,351,351 |

|

Recognition of share-based compensation |

|

|

27,882 |

|

|

|

45,099 |

|

Warrants issued for interest expense |

|

|

251,362 |

|

|

|

- |

|

Change in fair value of derivative liabilities |

|

|

- |

|

|

|

(949,680 |

|

Derivative expense |

|

|

- |

|

|

|

1,775,057 |

|

Gain on settlement of liabilities |

|

|

- |

|

|

|

(840,932 |

|

(Gain) loss on equity method investment - Centercom - former

related party |

|

|

42,098 |

|

|

|

24,628 |

|

Gain on forgiveness of PPP loan |

|

|

(524,143 |

) |

|

|

- |

|

Gain on deconsolidation of subsidiary (True Wireless) |

|

|

- |

|

|

|

(1,895,871 |

| Changes in operating assets

and liabilities |

|

|

|

|

|

|

|

|

(Increase) decrease in |

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(6,217,533 |

) |

|

|

(411,943 |

|

Lifeline revenue - due from USAC |

|

|

- |

|

|

|

105,532 |

|

Inventory |

|

|

(5,184,807 |

) |

|

|

(71,700 |

|

Prepaids |

|

|

(131,853 |

) |

|

|

(462 |

|

Increase (decrease) in |

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

|

7,075,480 |

|

|

|

1,824,604 |

|

Accounts payable and accrued expenses - related party |

|

|

2,168,460 |

|

|

|

(1,305,278 |

|

Deferred revenue |

|

|

1,620,260 |

|

|

|

122,600 |

|

Operating lease liability |

|

|

(39,977 |

) |

|

|

(89,616 |

| Net cash used in

operating activities |

|

|

(3,951,043 |

) |

|

|

(6,513,142 |

| |

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

|

|

| Purchase of property and

equipment |

|

|

(9,611 |

) |

|

|

(45,983 |

| Purchase of software |

|

|

(300,000 |

) |

|

|

- |

| Acquisition of Torch,

Inc. |

|

|

(800,000 |

) |

|

|

- |

| Cash disposed in

deconsolidation of subsidiary (True Wireless) |

|

|

- |

|

|

|

(325,316 |

| Net cash used in

investing activities |

|

|

(1,109,611 |

) |

|

|

(371,299 |

| |

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

|

|

| Proceeds from stock and

warrants issued for cash |

|

|

- |

|

|

|

1,510,000 |

| Proceeds from loans - related

party |

|

|

- |

|

|

|

2,123,000 |

| Repayments of loans - related

party |

|

|

- |

|

|

|

(63,000 |

| Proceeds from notes

payable |

|

|

6,700,000 |

|

|

|

- |

| Repayments on notes

payable |

|

|

- |

|

|

|

(250,000 |

| Proceeds from SBA notes |

|

|

- |

|

|

|

518,167 |

| Repayments on SBA notes |

|

|

(30,792 |

) |

|

|

- |

| Proceeds from convertible

notes |

|

|

- |

|

|

|

2,550,000 |

| Repayments on convertible

notes - net of overpayment |

|

|

- |

|

|

|

(1,260,792 |

| Net cash provided by

financing activities |

|

|

6,669,208 |

|

|

|

5,127,375 |

| |

|

|

|

|

|

|

|

| Net increase

(decrease) in cash |

|

|

1,608,554 |

|

|

|

(1,757,066 |

| |

|

|

|

|

|

|

|

| Cash - beginning of

period |

|

|

6,283,496 |

|

|

|

673,995 |

| |

|

|

|

|

|

|

|

| Cash - end of

period |

|

$ |

7,892,050 |

|

|

$ |

(1,083,071 |

| |

|

|

|

|

|

|

|

| Supplemental

disclosure of cash flow information |

|

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

195,950 |

|

|

$ |

- |

| Cash paid for income tax |

|

$ |

- |

|

|

$ |

- |

| |

|

|

|

|

|

|

|

| Supplemental

disclosure of non-cash investing and financing

activities |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Debt issue costs recorded in

connection with notes payable |

|

$ |

115,404 |

|

|

$ |

- |

| Stock issued to acquire

software |

|

$ |

411,400 |

|

|

$ |

- |

| Debt discount/issue costs

recorded in connection with debt/derivative liabilities |

|

$ |

- |

|

|

$ |

2,140,829 |

| Stock issued in settlement of

liabilities |

|

$ |

- |

|

|

$ |

1,755,150 |

| Conversion of debt into

equity |

|

$ |

- |

|

|

$ |

858,158 |

| Right-of-use asset obtained in

exchange for new operating lease liability |

|

$ |

- |

|

|

$ |

515,848 |

| Termination of ECS ROU

lease |

|

$ |

- |

|

|

$ |

228,752 |

| Stock issued in connection

with debt modification |

|

$ |

- |

|

|

$ |

108,931 |

| Stock issued under make-whole

arrangement |

|

$ |

- |

|

|

$ |

90,401 |

| Stock issued for acquisition

of membership interest in ECS |

|

$ |

- |

|

|

$ |

17,900 |

| Deconsolidation of subsidiary

(True Wireless) |

|

$ |

- |

|

|

$ |

2,434,552 |

|

Reconciliation of Net Income (loss) from Operations to

EBITDA |

| |

| |

|

Three months

ended |

|

Three months

ended |

| |

|

September

30, 2022 |

|

September

30, 2021 |

|

(unaudited) |

(unaudited) |

|

Revenue |

|

$ |

36,171,345 |

|

|

$ |

14,538,353 |

|

| Cost of

revenue (exclusive of depreciation and amortization) |

|

|

34,250,541 |

|

|

|

12,634,871 |

|

| General and

administrative expenses |

|

|

2,933,204 |

|

|

|

2,909,954 |

|

| Loss from

operations |

|

$ |

(1,012,400 |

) |

|

$ |

(1,006,472 |

) |

| Net loss to

common stockholders |

|

|

(1,540,198 |

) |

|

|

(1,657,895 |

) |

| Interest

expense |

|

|

633,593 |

|

|

|

1,236,778 |

|

| Depreciation

and Amortization |

|

|

140,318 |

|

|

|

17,756 |

|

| EBITDA |

|

$ |

(766,287 |

) |

|

|

(403,361 |

) |

| |

|

|

|

|

|

|

| |

|

Nine months

ended |

|

Nine months

ended |

| |

|

September

30, 2022 |

|

September

30, 2021 |

|

(unaudited) |

(unaudited) |

| Revenue |

|

$ |

85,317,860 |

|

|

$ |

36,905,373 |

|

| Cost of

revenue (exclusive of depreciation and amortization) |

|

|

78,572,421 |

|

|

|

32,544,619 |

|

| General and

administrative expenses |

|

|

9,655,529 |

|

|

|

10,262,479 |

|

| Loss from

operations |

|

$ |

(2,910,090 |

) |

|

$ |

(5,901,725 |

) |

| Net loss to

common stockholders |

|

|

(3,725,569 |

) |

|

|

(6,687,302 |

) |

| Interest

expense |

|

|

1,370,236 |

|

|

|

4,637,236 |

|

| Depreciation

and Amortization |

|

|

501,157 |

|

|

|

415,996 |

|

| EBITDA |

|

$ |

(1,854,176 |

) |

|

|

(1,634,070 |

) |

| |

|

|

|

|

|

|

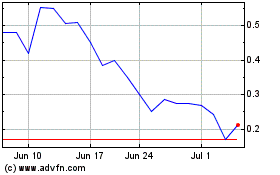

SurgePays (NASDAQ:SURGW)

Historical Stock Chart

From Jun 2024 to Jul 2024

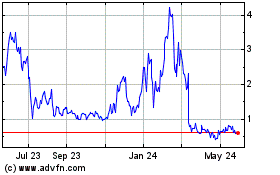

SurgePays (NASDAQ:SURGW)

Historical Stock Chart

From Jul 2023 to Jul 2024