Flight to Safety: Is it a bad tell for stocks? - Real Time Insight

06 May 2014 - 3:45AM

Zacks

The relative performance chart below, which I

constructed on the fantastic and free StockCharts.com, describes

the market landscape of the past month in several interesting

ways.

I will break it down after you take a look, but note that the blue

bar next to AAPL is the ETF TLT, a proxy for the US Treasury long

bond, and "Cyclicals" is the Consumer Discretionary ETF,

XLY. And I only picked AAPL as the only single

stock because I think it is representative of where big money can

hide and ride out a storm.

What stands out are defensive sectors like Utilities and Consumer

Staples leading, with the laggard Energy finally catching some

money flow into summer and geopolitical worries. Obviously the

growth areas lag, represented by small caps, the Nasdaq, and

Financials.

I included the NYSE because it was one of the better looking charts

just like the S&P 500 and the Dow. But that is just part of the

same theme of the flight to safety in big caps.

About ten days ago, I said this market would show its hand in the

next "3-7 sessions" about whether it could bust out to new highs,

with the big caps dragging the growth indexes along for the

ride.

I thought we got an all-clear sign after the market didn't fall

following an awful GDP print and another FOMC taper notch. Instead

what we got was more muted action after a great jobs number and

revisions that took the "worst winter ever" to an NFP average of

214k jobs vs last year's 194k.

And if there's any doubt about how long the flight to safety by

money managers has been going on, here's the 3 month view of the

same chart. Except for bonds playing catch-up a lot recently, these

trends have been in force for some time.

This is where money goes when institutions are in "distribution"

mode and getting out of growth stocks. It's not a pretty picture

and seems to argue for more corrective action before their risk

appetite returns.

And while it is typical of what happens at the end of the "best six

months" (Nov-April), I thought we would see a shift back to

"risk-on" investing this week during another good enough earnings

season.

I actually thought it could be "Buy in May" this year. But these

persistant signs are troubling, especially when there was little

spark for them to reverse after that jobs number.

What say you? Is the writing on the wall above likely to reverse as

money managers find bargains in growth, or is the path of least

resistance still lower until the bargains get

better?

APPLE INC (AAPL): Free Stock Analysis Report

ISHARS-R 2000 (IWM): ETF Research Reports

ISHARS-20+YTB (TLT): ETF Research Reports

SPDR-UTIL SELS (XLU): ETF Research Reports

EXXON MOBIL CRP (XOM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

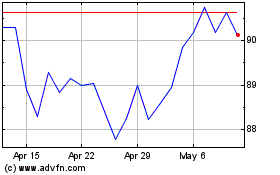

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Feb 2025 to Mar 2025

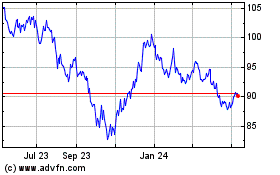

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about iShares 20 plus Year Treasury Bond (NASDAQ): 0 recent articles

More News Articles