Form 8-K - Current report

02 September 2023 - 6:30AM

Edgar (US Regulatory)

false000003614600000361462023-08-302023-08-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

August 30, 2023

Date of Report (Date of earliest event reported)

TRUSTMARK CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Mississippi |

|

000-03683 |

|

64-0471500 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

248 East Capitol Street, Jackson, Mississippi |

|

39201 |

(Address of principal executive offices) |

|

(Zip Code) |

|

|

|

Registrant’s telephone number, including area code: |

|

(601) 208-5111 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered Pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, no par value |

TRMK |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On August 30, 2023, Trustmark National Bank (“Trustmark”) agreed to a settlement in principle (the “Settlement”) relating to litigation and claims involving Arthur Lamar Adams, Madison Timber Properties, LLC, and other related entities (collectively “Adams/Madison Timber”). The Settlement would resolve the lawsuit filed on December 30, 2019, by Alysson Mills, the court-appointed Receiver for Adams/Madison Timber (the “Receiver”), in the United States District Court for the Southern District of Mississippi, as well as asserted and unasserted claims of investors who allegedly incurred losses due to their investments with Adams/Madison Timber. Trustmark Corporation, the parent company of Trustmark, has provided disclosure relating to these matters in its periodic reports on Forms 10-K and 10-Q throughout the pendency of these actions.

The parties to the Settlement are, on the one hand, Alysson Mills, in her capacity as Receiver; and, on the other hand, Trustmark. The Receiver sought to recover from the defendants, for the benefit of the receivership estate and investors who were allegedly defrauded by Adams/Madison Timber, damages as well as related costs allegedly attributable to actions of the defendants that allegedly facilitated or enabled illegal and fraudulent activities engaged in by Adams and Madison Timber.

The Settlement was negotiated via mediation conducted by the United States Magistrate Judge. Pursuant to the Settlement the lawsuit captioned Alysson Mills, in her Capacity as the Court-Appointed Receiver for Arthur Lamar Adams and Madison Timber Properties, LLC v. Trustmark National Bank, et al., Civ. Act. No. 3:19-cv-941-CWR-BWR, pending in the United States District Court for the Southern District of Mississippi (“the Lawsuit”) will be dismissed with prejudice, and the Receiver will fully release all claims against Trustmark and any of its employees, agents and representatives. The Settlement includes the parties’ agreement to seek the Court’s entry of bar orders prohibiting any continued or future claims by anyone against Trustmark and its related parties relating to Adams/Madison Timber, whether asserted to date or not. The bar orders therefore would prohibit all litigation relating to Adams/Madison Timber described in Trustmark Corporation’s SEC periodic reports. Final Court approval of a bar order is a condition of the Settlement.

The Settlement is also subject to the execution and delivery of a definitive Settlement Agreement reflecting the terms of the Settlement, notice to Adams/Madison Timber investors, and final, non-appealable approval by the Court and entry of a judgment dismissing the Lawsuit against Trustmark. The timing of any final decision by the Court is subject to the discretion of the Court and any appeal. If the Settlement, including the bar order described above, is approved by the Court and is not subject to further appeal, Trustmark will make a one-time cash payment of $6.5 million to the Receiver.

While Trustmark believes that the Settlement is consistent with the terms of settlements in similar cases that have been approved and were not successfully appealed, it is possible that the Court may decide not to approve the Settlement Agreement or that the Court of Appeals could reject the Settlement Agreement on an appeal, either of which could render the Settlement a nullity.

Trustmark makes no admission of liability or wrongdoing in connection with Adams/Madison Timber, and the Settlement Agreement will so provide. As has been the case throughout the pendency of the Lawsuit, Trustmark expressly denies any liability or wrongdoing with respect to any matter alleged regarding the Ponzi scheme operated by Adams/Madison Timber. Trustmark’s relationship with Adams/Madison Timber consisted of ordinary banking services provided to business deposit customers, in addition to loans to entities in which Adams held interests made on customary commercial terms.

While federal law prohibits Trustmark from disclosing the full extent of its actions, Trustmark believes that its proactive communications with law enforcement agencies regarding its concerns with the activities of Adams/Madison Timber, and its cooperation with such authorities, resulted in the discovery and termination of Adams/Madison Timber's criminality. All of the Ponzi scheme promissory notes that were unpaid when the Ponzi scheme collapsed were issued by Adams/Madison Timber after Trustmark had closed its Adams/Madison Timber accounts.

Trustmark and Trustmark Corporation have determined that it is in the best interest of Trustmark, Trustmark Corporation and the shareholders of Trustmark Corporation to enter into the Settlement, to eliminate the risks and costs of continuing litigation.

As a result of the entry into the Settlement, Trustmark Corporation has recognized a $6.5 million litigation settlement expense included in non-interest expense related to the Adams/Madison Timber litigation during the third quarter of 2023. Trustmark Corporation expects that the Settlement will be tax deductible.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TRUSTMARK CORPORATION

|

|

|

BY: |

|

/s/ Thomas C. Owens |

|

|

Thomas C. Owens |

|

|

Treasurer and Principal Financial Officer |

|

|

|

DATE: |

|

September 1, 2023 |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

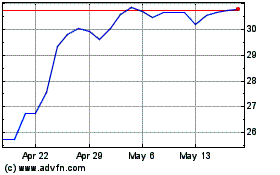

Trustmark (NASDAQ:TRMK)

Historical Stock Chart

From Apr 2024 to May 2024

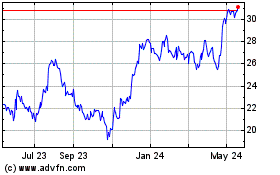

Trustmark (NASDAQ:TRMK)

Historical Stock Chart

From May 2023 to May 2024