180 Degree Capital Corp. Notes Average Discount of Net Asset Value per Share to Stock Price for Fifth Month of Initial Measurement Period of Its Discount Management Program

03 June 2024 - 11:00PM

180 Degree Capital Corp. (“180 Degree Capital”) (NASDAQ: TURN),

noted today that the average discount between its estimated daily

net asset value per share (“NAV”) and its daily closing stock price

during May 2024 and year-to-date through the end of May 2024, were

approximately 18% and 20%, respectively.1 This discount was

approximately 19% on May 31, 2024.

As previously disclosed in a press release on

November 13, 2023, 180 Degree Capital’s Board of Directors has set

two measurement periods of 1) January 1, 2024 to December 31, 2024,

and 2) January 1, 2025 to June 30, 2025, in which it will evaluate

the average discount between TURN’s estimated daily NAV and its

closing stock price pursuant to a Discount Management Program.

Should TURN’s common stock trade at an average daily discount to

NAV of more than 12% during either of these measurement periods,

180 Degree Capital’s Board will consider all available options at

the end of each measurement period including, but not limited to, a

significant expansion of 180 Degree Capital’s current stock buyback

program of up to $5 million, cash distributions reflecting a return

of capital to shareholders, or a tender offer.

“May 2024 was an overall improvement from April

2024 for both microcapitalization stocks and 180 Degree Capital’s

holdings,” said Kevin M. Rendino, Chief Executive Officer of 180

Degree Capital. “This improvement was coupled with heightened

volatility, particularly for many of our portfolio holdings that

are relatively thinly traded. For example, Synchronoss

Technologies, Inc. (SNCR) reported a positive Q1 2024 that beat all

analyst estimates across the board. Here are the daily percent

changes in SNCR’s stock price over the three weeks post its

earnings report on May 9, 2024: +31.0%, +1.8%, -13.0%, +6.41%,

+2.6%, +16.23%, +5.0%, -7.1%, +8.0%, -0.9%, 0%, -5.9%, -5.2%,

-5.6%, +0.5%. Aside from the +31.0% on the day following its Q1

2024 report, there was no news from SNCR that could be attributed

as the cause for stock price movements of greater than 5% during 10

of the 15 trading days listed above. We are experiencing similar

levels of volatility with many of our other core holdings. It is

frustrating to watch the values of these holdings fluctuate wildly,

particularly to the downside, in the face of positive performance

in business results. We remain laser focused on our core investment

philosophy and approach of building value for shareholders over

investment cycles through our focus on microcapitalization stocks

enhanced by constructive activism.”

“We are investors, not traders,” continued

Daniel B. Wolfe, President of 180 Degree Capital. “We seek to

generate returns of greater than 100% over a one-to-three year

holding period. We know this volatility of our holdings in a given

month, quarter or even year does not often accurately reflect the

health or business prospects of many of our portfolio companies. We

believe there are material catalysts ahead in 2024 and beyond for

our portfolio companies that could be the basis for material value

appreciation and growth in 180 Degree Capital’s NAV in future

quarters and years.”

About 180 Degree Capital

Corp.

180 Degree Capital Corp. is a publicly traded

registered closed-end fund focused on investing in and providing

value-added assistance through constructive activism to what we

believe are substantially undervalued small, publicly traded

companies that have potential for significant turnarounds. Our goal

is that the result of our constructive activism leads to a reversal

in direction for the share price of these investee companies, i.e.,

a 180-degree turn. Detailed information about 180 and its holdings

can be found on its website at www.180degreecapital.com.

Press Contact:Daniel B. WolfeRobert E. Bigelow180 Degree Capital

Corp.973-746-4500ir@180degreecapital.com

Mo ShafrothRF BinderMorrison.shafroth@rfbinder.com

Forward-Looking Statements

This press release may contain statements of a

forward-looking nature relating to future events. These

forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These

statements reflect the Company's current beliefs, and a number of

important factors could cause actual results to differ materially

from those expressed in this press release. Please see the

Company's securities filings filed with the Securities and Exchange

Commission for a more detailed discussion of the risks and

uncertainties associated with the Company's business and other

significant factors that could affect the Company's actual results.

Except as otherwise required by Federal securities laws, the

Company undertakes no obligation to update or revise these

forward-looking statements to reflect new events or uncertainties.

The reference and link to the website www.180degreecapital.com has

been provided as a convenience, and the information contained on

such website is not incorporated by reference into this press

release. 180 is not responsible for the contents of third-party

websites.

1. Daily estimated NAVs used for the discount

calculation outside of quarter-end dates are determined as

prescribed in 180’s Valuation Procedures for Level 3 assets.

Non-investment-related assets and liabilities used to determine

estimated daily NAV are those reported as of the end of the prior

quarter.

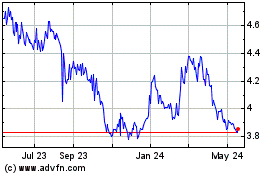

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Nov 2024 to Dec 2024

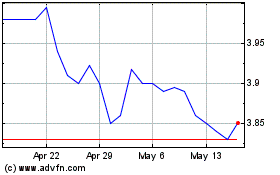

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Dec 2023 to Dec 2024