false000145296500014529652023-11-132023-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 13, 2023

Minerva Surgical, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-40919 |

|

26-3422906 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

4255 Burton Dr., Santa Clara, CA 95054

(Address of Principal Executive Offices) (Zip Code)

(855) 646-7874

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.001 par value |

|

UTRS |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02. |

Results of Operations and Financial Condition. |

On November 13, 2023, Minerva Surgical, Inc. (the “Company”) issued a press release announcing the results of the Company’s operations for the quarter ended September 30, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

MINERVA SURGICAL, INC. |

|

|

By: |

|

/s/ Joel R. Jung |

Name: |

|

Joel R. Jung |

Title: |

|

Chief Financial Officer |

Date: November 13, 2023.

Minerva Surgical Reports Third Quarter 2023 Financial Results

Santa Clara, Calif. – November 13, 2023 (GLOBE NEWSWIRE) – Minerva Surgical, Inc. (Nasdaq: UTRS) (Minerva Surgical or the Company), a women's health company focused on solutions to meet the distinct uterine healthcare needs of women, today reported third quarter financial results for the period ended September 30, 2023.

Third Quarter Highlights:

•Reported revenue of $12.0 million in the third quarter of 2023, compared with revenue of $12.6 million in the third quarter of 2022

•Increased Symphion product revenue by 19% compared to the third quarter of 2022

“As we head into the fourth quarter of 2023, I am very pleased with the progress we have made to date in expanding the reach of our Symphion product line,” said Todd Usen, Minerva Surgical’s Chief Executive Officer. “As we look ahead, I remain confident in our ability to drive long-term growth, and continue to deliver best in class products to our surgeons and their patients.”

Third Quarter and Year-to-Date 2023 Financial Results

Revenue was $12.0 million for the third quarter of 2023, compared to $12.6 million in the third quarter of 2022 and $13.4 million in the second quarter of 2023. Despite total revenue declining 5% compared to the third quarter of 2022, Symphion product revenues continued to experience strong growth, increasing 19% compared to same period in 2023. Through the first three quarters of 2023, Symphion product revenues have increased 15% compared to the same period in 2022. While revenue for Minerva ES experienced a decline during the third quarter of 2023 compared to the same period of 2022, on a year-to-date basis, revenue for Minerva ES increased 3%.

Gross margin was 52.0% for the third quarter of 2023, decreasing from 54.1% in the same period of 2022. This reduction in gross margin compared to the third quarter of 2022 was due in part to direct cost increases on certain products from our contract manufacturers as well as a product mix shift from Genesys HTA to Symphion, which currently has a lower gross margin. While total overhead and other indirect costs of goods sold decreased in the third quarter of 2023 compared to the same period of 2022, these expenses were spread over a smaller revenue base, contributing to the decrease in the gross margin. Year-to-date 2023 gross margin of 54.5% is in line with the gross margin of 54.4% in the prior year comparable period.

Operating expenses were $12.3 million for the third quarter of 2023, compared to $17.3 million in the same period of 2022. The decrease in expense was partly attributable to a $1.1 million decrease in non-cash stock-based compensation expenses and a $1.1 million decrease in amortization charges. Absent these changes in non-cash expenses, operating expenses decreased $2.8 million compared to the third quarter of 2022. This decrease was primarily attributable to realignment of the commercial organization that was completed during the second quarter of 2023, which substantially reduced operating expenses, as well as a significant decrease in legal related expenses.

Net loss in the third quarter of 2023 was $7.2 million, compared to a net loss of $11.3 million for the same period in 2022.

Adjusted EBITDA for the third quarter of 2023 was negative $3.8 million, compared to negative $5.8 million for the same period in 2022. Despite the decrease in revenue and gross margin, the Company was able to improve Adjusted EBITDA for the third quarter of 2023 compared to the same period in 2022, due to the significant reduction in operating expenses.

Use of Non-GAAP Financial Measures

Adjusted EBITDA and Adjusted EBITDA Margin

To provide investors with additional information regarding the Company’s financial results, it has provided EBITDA and adjusted EBITDA. The Company calculates EBITDA, a non-GAAP financial measure, as net income/(loss) excluding depreciation and amortization, interest income and expense and income tax expense. The Company calculates adjusted EBITDA, a non-GAAP financial measure by further excluding non-cash items for stock-based compensation expenses and

1

change in fair value of contingent consideration liability. EBITDA margin represents EBITDA as a percentage of revenue. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of revenue. EBITDA and Adjusted EBITDA should be viewed as measures of operating performance that are supplements to, and not substitutes for, operating income (loss), net income (loss) and other U.S. GAAP measures of income and loss.

The Company has included adjusted EBITDA in this earnings release because it is a key measure used by the Company’s management and board of directors to evaluate and compare the Company’s financial and operational performance over multiple periods, identifying trends affecting the Company’s business, formulating business plans and making strategic decisions. In particular, the exclusion of certain expenses in calculating adjusted EBITDA facilitates operating performance comparability across reporting periods by removing the effect of non-cash expenses and certain non-recurring variable charges. In addition, the Company believes that providing each of EBITDA and Adjusted EBITDA, together with a reconciliation of net loss to each such measure, helps investors make comparisons between Minerva Surgical and other companies that may have different capital structures, different tax rates, and/or different forms of employee compensation.

Each of EBITDA and Adjusted EBITDA is used by the Company’s management team as an additional measure of Company performance for purposes of business decision-making, including managing expenditures, and evaluating potential acquisitions. Period-to-period comparisons of EBITDA and Adjusted EBITDA help the Company’s management identify additional trends in our financial results that may not be shown solely by period-to-period comparisons of net income or income from continuing operations. Each of EBITDA and Adjusted EBITDA has inherent limitations because of the excluded items, and may not be directly comparable to similarly titled metrics used by other companies.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on management’s current assumptions and expectations of future events and trends, which affect or may affect the Company’s business, strategy, operations or financial performance, and actual results may differ materially from those expressed or implied in such statements due to numerous risks and uncertainties. Forward-looking statements may include information regarding trends and expectations for the Company’s products and technology, demand for the Company’s products, the Company’s expected financial performance, expenses, and position in the market and outlook for fiscal year 2023. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Factors that could cause actual results to differ materially from those contemplated in this press release can be found in the Risk Factors section of the Company’s quarterly report on Form 10-Q for the quarter ended September 30, 2023, as filed with the U.S. Securities and Exchange Commission (SEC) on November 13, 2023, and available at www.SEC.gov.Because forward-looking statements are inherently subject to risks and uncertainties, you should not rely on these forward-looking statements as predictions of future events. All statements other than statements of historical fact are forward-looking statements. Except to the extent required by law, the Company undertakes no obligation to update or review any estimate, projection, or forward-looking statement. Actual results may differ from those set forth in this press release due to the risks and uncertainties inherent in the Company’s business.

About Minerva Surgical, Inc.

Minerva Surgical is a commercial-stage medical technology company focused on developing, manufacturing, and commercializing minimally invasive solutions to meet the distinct uterine healthcare needs of women. The Company has established a broad product line of commercially available, minimally invasive alternatives to hysterectomy, which are designed to address the most common causes of Abnormal Uterine Bleeding (AUB) in most uterine anatomies. The Minerva Surgical solutions can be used in a variety of medical treatment settings and aim to address the drawbacks associated with alternative treatment methods and to preserve the uterus by avoiding unnecessary hysterectomies.

Contact:

Media/Press: media@minervasurgical.com

Investors: investor.relations@minervasurgical.com

www.minervasurgical.com

www.AUBandMe.com

2

Minerva Surgical, Inc.

Condensed Statements of Operations

(in thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

Revenues |

|

$ |

|

11,965 |

|

|

$ |

|

12,588 |

|

|

$ |

|

37,889 |

|

|

$ |

|

36,490 |

Cost of goods sold |

|

|

|

5,747 |

|

|

|

|

5,775 |

|

|

|

|

17,254 |

|

|

|

|

16,619 |

Gross profit |

|

|

|

6,218 |

|

|

|

|

6,813 |

|

|

|

|

20,635 |

|

|

|

|

19,871 |

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

|

6,711 |

|

|

|

|

9,723 |

|

|

|

|

26,274 |

|

|

|

|

28,887 |

General and administrative |

|

|

|

4,190 |

|

|

|

|

6,142 |

|

|

|

|

13,770 |

|

|

|

|

12,706 |

Research and development |

|

|

|

1,413 |

|

|

|

|

1,456 |

|

|

|

|

4,655 |

|

|

|

|

3,985 |

Total operating expenses |

|

|

|

12,314 |

|

|

|

|

17,321 |

|

|

|

|

44,699 |

|

|

|

|

45,578 |

Loss from operations |

|

|

|

(6,096 |

) |

|

|

|

(10,508 |

) |

|

|

|

(24,064 |

) |

|

|

|

(25,707) |

Interest income |

|

|

|

92 |

|

|

|

|

42 |

|

|

|

|

277 |

|

|

|

|

70 |

Interest expense |

|

|

|

(1,172 |

) |

|

|

|

(861 |

) |

|

|

|

(3,369 |

) |

|

|

|

(2,196) |

Other expense, net |

|

|

|

(2 |

) |

|

|

|

(2 |

) |

|

|

|

(7 |

) |

|

|

|

(34) |

Net loss before income taxes |

|

|

|

(7,178 |

) |

|

|

|

(11,329 |

) |

|

|

|

(27,163 |

) |

|

|

|

(27,867) |

Income tax expense |

|

|

|

(3 |

) |

|

|

|

— |

|

|

|

|

(42 |

) |

|

|

|

— |

Net loss |

|

$ |

|

(7,181 |

) |

|

$ |

|

(11,329 |

) |

|

$ |

|

(27,205 |

) |

|

$ |

|

(27,867) |

Net loss per share attributable to common stockholders, basic and diluted |

|

$ |

|

(0.81) |

|

|

$ |

|

(7.92) |

|

|

$ |

|

(3.49) |

|

|

$ |

|

(19.48) |

Weighted-average common shares used in computing net loss per share, basic and diluted |

|

|

|

8,872,998 |

|

|

|

|

1,430,056 |

|

|

|

|

7,805,772 |

|

|

|

|

1,430,272 |

3

Minerva Surgical, Inc.

Condensed Balance Sheets

(in thousands, except share and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

|

December 31, 2022 |

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

11,125 |

|

$ |

6,942 |

Restricted cash, current |

|

|

80 |

|

|

604 |

Accounts receivable, net |

|

|

7,569 |

|

|

7,244 |

Inventory |

|

|

18,183 |

|

|

16,850 |

Prepaid expenses and other current assets |

|

|

3,045 |

|

|

4,479 |

Total current assets |

|

|

40,002 |

|

|

36,119 |

Restricted cash, net of current portion |

|

|

265 |

|

|

265 |

Intangible assets, net |

|

|

22,326 |

|

|

26,778 |

Property and equipment, net |

|

|

5,427 |

|

|

5,042 |

Operating lease right-of-use asset |

|

|

3,996 |

|

|

270 |

Other non-current assets |

|

|

769 |

|

|

426 |

Total assets |

|

$ |

72,785 |

|

$ |

68,900 |

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

3,036 |

|

$ |

2,804 |

Accrued compensation |

|

|

3,577 |

|

|

3,701 |

Accrued liabilities |

|

|

2,366 |

|

|

5,524 |

Current portion of operating lease liability |

|

|

623 |

|

|

355 |

Current portion of long-term debt |

|

|

11,649 |

|

|

1,894 |

Total current liabilities |

|

|

21,251 |

|

|

14,278 |

Long-term debt |

|

|

27,885 |

|

|

37,441 |

Operating lease liability, net of current portion |

|

|

3,394 |

|

|

— |

Total liabilities |

|

|

52,530 |

|

|

51,719 |

Commitments and contingencies (Note 9) |

|

|

|

|

|

|

Stockholders` equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value, 15,000,000 and 5,000,000 shares authorized, and no shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively |

|

|

— |

|

|

— |

Common stock, $0.001 par value, 300,000,000 and 100,000,000 shares authorized, 8,878,582 shares and 1,490,761 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively. |

|

|

9 |

|

|

1 |

Additional paid-in capital |

|

|

330,953 |

|

|

300,837 |

Accumulated other comprehensive income |

|

|

11 |

|

|

11 |

Accumulated deficit |

|

|

(310,718) |

|

|

(283,668) |

Total stockholders’ equity |

|

|

20,255 |

|

|

17,181 |

Total liabilities and stockholders’ equity |

|

$ |

72,785 |

|

$ |

68,900 |

4

Non-GAAP Financial Measures

Adjusted EBITDA and Adjusted EBITDA Margin: The following table presents reconciliation of net loss to adjusted EBITDA for each of the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

(in thousands, except percentage figures) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

|

(7,181 |

) |

|

$ |

|

(11,329 |

) |

|

$ |

|

(27,205 |

) |

|

$ |

|

(27,867 |

) |

Depreciation and amortization |

|

|

1,446 |

|

|

|

|

2,692 |

|

|

|

|

5,943 |

|

|

|

|

8,053 |

|

Interest expense, net |

|

|

1,080 |

|

|

|

|

819 |

|

|

|

|

3,092 |

|

|

|

|

2,126 |

|

Income tax expense |

|

|

3 |

|

|

|

|

- |

|

|

|

|

42 |

|

|

|

|

- |

|

EBITDA |

|

|

(4,652 |

) |

|

|

|

(7,818 |

) |

|

|

|

(18,128 |

) |

|

|

|

(17,688 |

) |

EBITDA margin |

|

|

(38.9% |

) |

|

|

|

(62.1% |

) |

|

|

|

(47.8% |

) |

|

|

|

(48.5% |

) |

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

|

833 |

|

|

|

|

1,977 |

|

|

|

|

3,205 |

|

|

|

|

5,176 |

|

Change in fair value of contingent consideration liability |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

(4,094 |

) |

Adjusted EBITDA |

$ |

|

(3,819 |

) |

|

$ |

|

(5,841 |

) |

|

$ |

|

(14,923 |

) |

|

$ |

|

(16,606 |

) |

Adjusted EBITDA margin |

|

|

(31.9% |

) |

|

|

|

(46.4% |

) |

|

|

|

(39.4% |

) |

|

|

|

(45.5% |

) |

5

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

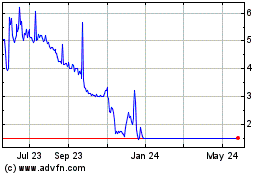

Minerva Surgical (NASDAQ:UTRS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Minerva Surgical (NASDAQ:UTRS)

Historical Stock Chart

From Jan 2024 to Jan 2025