Registration No. 333-

As filed with the Securities and Exchange Commission on August 1, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

UNIVEST FINANCIAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

Pennsylvania

|

23-1886144

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

Incorporation or Organization)

|

|

14 North Main Street

Souderton, Pennsylvania 18964

(Address of Principal Executive Offices)

Univest Financial Corporation 2023 Equity Incentive Plan

(Full Title of the Plan)

Copies to:

|

Jeffrey M. Schweitzer

|

Scott A. Brown, Esq.

|

|

President and Chief Executive Officer

|

Thomas P. Hutton, Esq.

|

|

Univest Financial Corporation

|

Luse Gorman, PC

|

|

14 North Main Street

|

5335 Wisconsin Ave., N.W., Suite 780

|

|

Souderton, Pennsylvania 18964

|

Washington, DC 20015-2035

|

|

(215) 721-2400

|

(202) 274-2000

|

|

(Name, Address and Telephone

|

|

|

Number of Agent for Service)

|

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large

accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended:

|

Large accelerated filer ☐

|

Accelerated filer ⌧

|

|

Non-accelerated filer ☐

|

Smaller reporting company ☐

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to

Section 7(a)(2)(B) of the Securities Act. ☐

PART I. INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

Items 1 and 2. Plan

Information; and Registrant Information and Employee Plan Annual Information

The documents containing the information specified in Part I of Form S-8 have been or will be sent or given to participants in the Univest Financial Corporation 2023 Equity

Incentive Plan (the “Plan”) as specified by Rule 428(b)(1) promulgated by the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”).

Such documents are not being filed with the Commission but constitute (along with the documents incorporated by reference into this Registration Statement pursuant to Item 3 of

Part II hereof) a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II. INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of

Documents by Reference

The following documents previously filed by Univest Financial Corporation (the “Company”) with the Commission under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), are incorporated herein by reference (other than any such documents or portions thereof that are furnished under Item 2.02 or Item 7.01 of Form 8-K, unless otherwise indicated therein, including any exhibits included with such Items):

(a)

The Company’s Annual Report on Form 10-K for the year ended

December 31, 2022, filed with the Commission on

February 24, 2023 (File No. 000-07617) pursuant to Section 13(a) of the Exchange Act

(including information specifically incorporated by reference therein from the Company’s definitive proxy statement on Schedule 14A, filed on

March

17, 2023);

(b)

The Company’s Quarterly Reports on Form 10-Q for the

quarters ended March 31, 2023 and June 30, 2023, filed with the Commission on

May 2, 2023 and

August 1, 2023 (File No. for all 000-07617);

(d)

The description of the Company’s common stock contained in

the Registration Statement on Form 8-A filed with the Commission on

October 21, 2011 to register the Company's

common stock under the Exchange Act (File No. 000-07617), including any subsequent amendments or reports filed for the purpose of updating such description.

All documents subsequently filed by the Company with the Commission pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act, after the date hereof, and prior to the

filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed incorporated by reference into this Registration Statement and to be a

part thereof from the date of the filing of such documents.

Any statement contained in the documents incorporated, or deemed to be incorporated, by reference herein or therein shall be deemed to be modified or superseded for purposes of

this Registration Statement and the prospectus to the extent that a statement contained herein or therein or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein or therein modifies or

supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement and the prospectus.

All information appearing in this Registration Statement and the prospectus is qualified in its entirety by the detailed information, including financial statements, appearing in

the documents incorporated herein or therein by reference.

Item 4. Description of Securities

Not applicable.

Item 5. Interests of Named Experts and Counsel

None.

Item 6. Indemnification of Directors and Officers

Articles III and IV of the Bylaws of Univest Financial Corporation (the “Corporation”) set forth the circumstances under which directors, officers, employees and agents of the Corporation may be

insured or indemnified against liability which they may occur in their capacity as such:

ARTICLE III – Directors

SECTION 15. Limitation of

Directors' Liability: A Director or Alternate Director of the Corporation shall not be personally liable, as such, for monetary damages for any action taken, or any failure to take any action unless the Director or Alternate Director has

breached or failed to perform his duties of his office as provided under Section 14 of this Article, and the breach or failure to perform constitutes self-dealing, willful misconduct or recklessness. This provision shall not apply to the

responsibility or liability of a Director or Alternate Director pursuant to any criminal statute or for the liability of a Director or Alternate Director for the payment of taxes pursuant to local, state, or federal law, nor shall this provision

apply to any actions filed prior to the date of the adoption of this provision, nor to any breach of performance of duty or any failure of performance of duty by a Director or Alternate Director prior to the date of adoption of this provision. If

the Pennsylvania Consolidated Statutes are hereafter amended to authorize the further elimination or limitation of the liability of directors, then the liability of a Director or Alternate Director, in addition to the limitation on personal

liability provided herein, shall be limited to the fullest extent permitted by the amended Pennsylvania Consolidated Statutes. Any repeal or modification of this section shall be prospective only, and shall not adversely affect any limitation on

the personal liability of a Director or Alternate Director existing at the time of such repeal or modification.

ARTICLE IV – Indemnification

SECTION 1. Indemnification:

The Corporation shall indemnify, to the fullest extent and manner authorized or permitted by the laws of the Commonwealth of Pennsylvania, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent

that such amendment permits the Corporation to provide broader indemnification rights than said law permitted the Corporation to provide prior to such amendment), any person who is or was or shall be a Director, Alternate Director, Officer,

employee or agent of the Corporation, or who is, was, or shall be serving at the request of the Corporation as a Director, Alternate Director, officer, employee or agent of another Corporation, partnership, joint venture, trust, charitable,

religious or educational organization or other enterprise, and the respective heirs, executors, administrators and assigns of each of the foregoing, against all reasonable expenses and liabilities (including, without limitation, attorneys' fees,

court costs, fines, ERISA excise taxes or penalties and amounts paid in satisfaction of judgments or in reasonable settlement), actually and reasonably incurred by, or imposed upon him in connection with, or resulting from the defense of any civil

or criminal action, suit or proceeding whether civil, criminal, administrative or investigative (or any appeal therein), including without limitation an action, suit or proceeding by or in the right of the Corporation, in which they, or any of

them, are made parties or a party or are otherwise involved by reason of being or having been a Director, Alternate Director, officer, employee or agent of the Corporation or of such other Corporation, whether or not he is or continues to be a

Director, Alternate Director, officer, employee or agent at the time such expenses or liabilities are paid or incurred. Notwithstanding the foregoing, the Corporation need not indemnify such Director, Alternate Director, Officer, employee or agent

with respect to any matter as to which he shall be finally adjudged in such action, suit or proceeding to have been liable for willful misconduct or recklessness in the performance of his duties as such Director, Alternate Director, officer,

employee or Agent. In the case of a criminal action, suit or proceeding, a conviction (whether based on a plea of guilty or nolo contenders or its equivalent, or after trial) shall not of itself be deemed an adjudication that such Director,

alternate Director, officer, employee or agent or former Director, Alternate Director, officer, employee or agent is liable for willful misconduct or recklessness in the performance of his duties as such Director, Alternate Director, officer,

employee or agent. With respect to payment of amounts in settlement or compromise, the Corporation shall be obliged to indemnify hereunder only if the Board of Directors shall adopt a resolution determining that such settlement or compromise is

reasonable, and approving the same.

|

A.

|

The indemnification provided hereunder shall be in addition to and not exclusive of any other right to which those seeking indemnification may be entitled under any agreement, vote of Shareholders, or

disinterested Directors, other By-Law, or otherwise, both as to actions in their official capacity and as to actions in another capacity while holding such office; and shall continue as to a person who has ceased to be a Director, Alternate

Director, or officer, and shall inure to the benefit of their heirs, executors, and administrators of such person.

|

|

B.

|

The Corporation may purchase and maintain insurance on behalf of any person who is or was a Director, Alternate Director, officer, employee or agent, is now or was serving at the request of the Corporation as a

Director, Alternate Director, officer, employee or agent of a subsidiary of the Corporation, another company, partnership, joint venture, trust, charitable, religious, or educational organization, or other enterprise, against any liability

asserted against him and incurred by him in any such capacity or arising out of his status as such, whether or not the Corporation would have the power to indemnify him against such liability under the provisions above mentioned.

|

SECTION 2. Expenses.

Expenses incurred by a Director, Alternate Director, officer, employee or agent in defending a civil or criminal action, suit or proceeding, may be paid by the Corporation in advance of the final disposition of such action, suit or proceeding upon

receipt of any undertaking by or on behalf of such person to repay such amount if it shall ultimately be determined that he is not entitled to be indemnified by the Corporation.

Item 7. Exemption From Registration Claimed.

Not applicable.

Item 8. List of Exhibits.

|

Regulation S-K

Exhibit Number

|

|

Document

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

The undersigned registrant hereby undertakes:

1. To file, during any period in which offers or sales are

being made, a post-effective amendment to the Registration Statement:

(i) to include any prospectus required by Section 10(a)(3) of

the Securities Act;

(ii) to reflect in the prospectus any facts or events arising

after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement.

Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum

offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) (section 230.424(b)) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fees” table in the effective registration statement;

(iii) to include any material information with respect to the

plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement;

provided, however, that paragraphs 1(i) and 1(ii) above do not apply if the information required to be included in a post-effective amendment by these paragraphs is contained in reports filed with

or furnished to the Commission by the Company pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

2. That, for the purpose of determining any liability under the

Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof;

3. To remove from registration by means of a post-effective

amendment any of the securities being registered which remain unsold at the termination of the offering;

4. That, for purposes of determining any liability under the

Securities Act, each filing of the registrant's annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Exchange Act) that

is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof; and

5. Insofar as indemnification for liabilities arising under the

Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission such indemnification is against

public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer

or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the

opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be

governed by the final adjudication of such issue.

SIGNATURES

The Registrant. Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement on Form S-8 to be signed on its behalf by the undersigned, thereunto duly authorized, in the Borough of Souderton, Commonwealth of

Pennsylvania, on August 1, 2023.

| |

|

UNIVEST FINANCIAL CORPORATION

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Jeffrey M. Schweitzer

|

| |

|

Jeffrey M. Schweitzer

|

| |

|

President and Chief Executive Officer

|

| |

|

(Duly Authorized Representative)

|

We, the undersigned directors and officers of Univest Financial Corporation (the “Company”) hereby severally constitute and appoint Jeffrey M. Schweitzer, as our true and lawful

attorney and agent, to do any and all things in our names in the capacities indicated below which said Jeffrey M. Schweitzer may deem necessary or advisable to enable the Company to comply with the Securities Act of 1933, as amended (the “Securities

Act”), and any rules, regulations and requirements of the Securities and Exchange Commission, in connection with the registration of shares of common stock to be granted and shares of common stock to be issued upon the exercise of stock options to be

granted under the Univest Financial Corporation 2023 Equity Incentive Plan, including specifically, but not limited to, power and authority to sign for us in our names in the capacities indicated below the registration statement and any and all

amendments (including post-effective amendments) thereto; and we hereby approve, ratify and confirm all that said Jeffrey M. Schweitzer shall do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and on the date indicated.

|

Signatures

|

|

Title

|

|

Date

|

| |

|

|

|

|

/s/ William S. Aichele

|

|

Chairman and Director

|

|

August 1, 2023

|

|

William S. Aichele

|

|

|

|

|

| |

|

|

|

|

|

/s/ Jeffrey M. Schweitzer

|

|

President, Chief Executive Officer

and Director

|

|

August 1, 2023

|

|

Jeffrey M. Schweitzer

|

|

(Principal Executive Officer)

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

/s/ Brian J. Richardson

|

|

Chief Financial Officer

(Principal Financial and Accounting Officer)

|

|

August 1, 2023

|

|

Brian J. Richardson

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Joseph P. Beebe

|

|

Director

|

|

August 1, 2023

|

|

Joseph P. Beebe

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Todd S. Benning

|

|

Director

|

|

August 1, 2023

|

|

Todd S. Benning

|

|

|

|

|

| |

|

|

|

|

|

Signatures

|

|

Title

|

|

Date

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Martin P. Connor

|

|

Director

|

|

August 1, 2023

|

|

Martin P. Connor

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Suzanne Keenan

|

|

Director

|

|

August 1, 2023

|

|

Suzanne Keenan

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Natalye Paquin

|

|

Director

|

|

August 1, 2023

|

|

Natalye Paquin

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Thomas M. Petro

|

|

Director

|

|

August 1, 2023

|

|

Thomas M. Petro

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Michael L. Turner

|

|

Director

|

|

August 1, 2023

|

|

Michael L. Turner

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Robert C. Wonderling

|

|

Director

|

|

August 1, 2023

|

|

Robert C. Wonderling

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

/s/ Charles H. Zimmerman III

|

|

Director

|

|

August 1, 2023

|

|

Charles H. Zimmerman III

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

EXHIBIT 5

LUSE GORMAN, PC

ATTORNEYS AT LAW

5335 WISCONSIN AVENUE, N.W., SUITE 780

WASHINGTON, D.C. 20015

TELEPHONE (202) 274-2000

FACSIMILE (202) 362-2902

www.luselaw.com

August 1, 2023

Board of Directors

Univest Financial Corporation

14 North Main Street

Souderton, Pennsylvania 18964

|

Re: |

Univest Financial Corporation - Registration Statement on Form S-8

|

Ladies and Gentlemen:

You have requested the opinion of this firm as to certain matters in connection with the registration of 1,200,000 shares of common

stock, $5.00 par value per share (the “Shares”), of Univest Financial Corporation (the “Company”) to be issued pursuant to the Univest Financial Corporation 2023 Equity Incentive Plan (the “Equity Plan”).

In rendering the opinion expressed herein, we have reviewed the Articles of Incorporation and Bylaws of the Company, the Equity Plan,

the Company’s Registration Statement on Form S-8 (the “Form S-8”), as well as resolutions of the board of directors of the Company and applicable statutes and regulations governing the Company. We have assumed the authenticity, accuracy and

completeness of all documents in connection with the opinion expressed herein. We have also assumed the legal capacity and genuineness of the signatures of persons signing all documents in connection with which the opinions expressed herein are

rendered. This opinion is limited to matters of Maryland corporate law.

Based on the foregoing, we are of the following opinion:

Following the effectiveness of the Form S-8, the Shares of the Company, when issued in accordance with the terms and conditions of the

Equity Plan, will be legally issued, fully paid and non-assessable.

This opinion has been prepared solely for the use of the Company in connection with the preparation and filing of the Form S-8, and

shall not be used for any other purpose or relied upon by any other person without the prior express written consent of this firm. We hereby consent to the use of this opinion in the Form S-8. By giving such consent, we do not hereby admit that we

are in the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended.

| |

Very truly yours,

|

| |

|

| |

|

| |

/s/ Luse Gorman, PC

|

| |

LUSE GORMAN, PC

|

EXHIBIT 10.2

FORM OF

RESTRICTED STOCK UNIT AWARD AGREEMENT

Granted by

UNIVEST FINANCIAL CORPORATION

under the

UNIVEST FINANCIAL CORPORATION 2023 EQUITY INCENTIVE PLAN

This restricted stock unit agreement (“Restricted Stock Unit Award” or “Agreement”) is and will be subject in every respect to the provisions of the Univest Financial Corporation 2023 Equity Incentive Plan (the “Plan”), which are incorporated

herein by reference and made a part hereof, subject to the provisions of this Agreement. A copy of the Plan and related prospectus have been provided or made available to each person granted a Restricted Stock Unit Award under the Plan. The holder

of this Restricted Stock Unit Award (the “Participant”) hereby accepts this Restricted Stock Unit Award, subject to all the terms and provisions of the Plan and this Agreement and agrees

that all decisions under and interpretations of the Plan and this Agreement by the Board of Directors of Univest Financial Corporation (the “Company”) or the Compensation Committee of the

Board of Directors of the Company (the “Committee”) will be final, binding and conclusive upon the Participant and the Participant’s heirs, legal representatives, successors and permitted

assigns. Except where the context otherwise requires, the term “Company” includes the parent and all present and future subsidiaries of the Company as described in Sections 424(e) and 424(f) of the Internal Revenue Code of 1986, as amended from time

to time (the “Code”). Capitalized terms used herein but not defined will have the same meaning as in the Plan.

|

1.

|

Name of Participant:______________________________________________________

|

|

2.

|

Date of Grant: _________, 20___.

|

|

3.

|

Total number of shares of Company common stock, $5.00 par value per share, that may be acquired pursuant to this

Award:_____________

(subject to adjustment pursuant to Section 8 hereof).

|

|

4.

|

Vesting Schedule. Except as otherwise provided in this Agreement, this Restricted Stock Award first becomes earned and will be settled

in Stock in accordance with the following vesting schedule:

|

As set forth in Section 9 of this Agreement, vesting will automatically accelerate pursuant to Sections 2.5, 2.7 and 4.1 of the Plan in the event of death, Disability or Involuntary

Termination of Service at or following a Change in Control.

| 5. |

Settlement of Restricted Stock Unit Award. On or as soon as practicable after the vesting of any Restricted Stock Units, the Company shall promptly deliver to the

Participant either

|

electronically through book-entry at the Corporation’s transfer agent or physically one or more certificates representing whole shares of Common Stock (one share of common stock for

each Restricted Stock Unit); provided, however, the Company shall not be liable to the Participant, the Participant’s personal representative or the Participant’s successor(s)-in-interest for damages relating to

any delays in issuing the certificates, any loss of the certificates or any mistakes or errors in the issuance of the certificate or in the certificates themselves.

|

6.1 |

The Participant will not have the right to vote the shares of Stock underlying this Award until this the units become vested and are settled in Stock.

|

|

6.2 |

Dividend Equivalent Rights attributable to Restricted Stock Units will be credited to a Participant’s account and shall be distributed in cash upon settlement of the Restricted Stock Units. Dividend Equivalent

Rights will not earn interest and if the Restricted Stock Unit is forfeited for any reason, the Participant will have no right to the Dividend Equivalent Rights. Upon settlement of the vested Restricted Stock Units in shares of Stock, the

Participant will obtain full dividend, voting and other rights as a shareholder of the Company. Any beneficiary, heir or legatee of the Participant shall receive the rights herein granted with respect to any vested Restricted Stock Units,

subject to the terms and conditions of this Agreement and the Plan. Any transferee of such rights shares shall agree in writing to be bound by the terms and conditions of this Agreement.

|

| 7. |

Delivery of Shares. Delivery of shares of Stock under this Restricted Stock Unit Award will comply with all applicable laws (including the requirements of the Securities

Act of 1933, as amended), and the applicable requirements of any securities exchange or similar entity.

|

| 8. |

Adjustment Provisions. The number of unvested shares of Stock subject to this Restricted Stock Unit Award, will be adjusted upon the occurrence of the events specified in,

and in accordance with the provisions of, Section 3.4 of the Plan.

|

| 9. |

Effect of Termination of Service on Restricted Stock Unit Award.

|

Upon the Participant’s Termination of Service, this units subject to this Restricted Stock Unit Award will vest as follows:

|

9.1 |

Death. In the event of the Participant’s Termination of Service by reason of death, any unvested units will immediately vest.

|

|

9.2 |

Disability. In the event of the Participant’s Termination of Service by reason of Disability, any unvested units will immediately vest.

|

|

9.3 |

Change in Control. In the event of the Participant’s Involuntary Termination of Service at or following a Change in Control (at least six months following the Date of Grant

to any Director), any unvested units will immediately vest.

|

|

9.4 |

Retirement. [In the case of a non-employee Director, in the event of the Participant’s Termination of Service by reason of Retirement, then that portion of the Award

(calculated on a pro-rata basis based upon the period between the date of this Agreement and the date of Retirement, divided by the original vesting period provided in this Agreement will become vested and settled in shares of Stock. For

purposes of this Agreement, Retirement shall mean the date of the latter to occur of (i) the first day of the month following the Participant’s seventy-second birthday or (ii) the date that the Participant actually retires as a Director.] [In

the case of an Employee, any unvested units will expire and be forfeited as of the date of the Termination of Service on account of the Participant’s Retirement.]

|

|

9.5 |

Termination for Cause. In the event of the Participant’s Termination of Service for Cause, any unvested units will expire and be

forfeited as of the date of the Termination of Service.

|

|

9.6 |

Other Termination. In the event of the Participant’s Termination of Service for any reason other than due to death, Disability,

Retirement, or an Involuntary Termination of Service at or following a Change in Control, any unvested units will expire and be forfeited as of the date of the Termination of Service.

|

10. Miscellaneous.

|

10.1 |

This Restricted Stock Unit Award will not confer upon the Participant any rights as a stockholder of the Company with respect to the shares underlying the Award prior to the date on which the individual fulfills

all conditions for receipt of such rights.

|

|

10.2 |

Except as otherwise provided for in the Plan, this Agreement may not be amended or otherwise modified unless evidenced in writing and signed by the Company and the Participant.

|

|

10.3 |

This Restricted Stock Unit Award is not transferable except as provided for in the Plan.

|

|

10.4 |

This Restricted Stock Unit Award will be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania.

|

|

10.5 |

Nothing in this Agreement will interfere with or limit in any way the right of the Company or any Affiliate to terminate the employment or service of the Participant at any time, nor confer upon the Participant any

right to continue in the employ or service of the Company or any Affiliate.

|

|

10.6 |

This Restricted Stock Unit Award is subject to forfeiture in accordance with the provisions of Section 7.16 of the Plan or as otherwise adopted by the Company.

|

|

10.7 |

This Restricted Stock Unit Award is subject to any required federal, state and local tax withholding, which may be effected in the manner or manners permitted by the Company.

|

|

10.8 |

In the event of a conflict between the terms of this Agreement and the Plan, the terms of the Plan will control.

|

|

10.9 |

This Restricted Stock Unit Award is subject to all laws, regulations and orders of any governmental authority which may be applicable thereto and, notwithstanding any of the provisions hereof, the Company will not

be obligated to issue any shares of Stock hereunder if the issuance of such shares would constitute a violation of any such law, regulation or order or any provision.

|

|

10.10 |

The Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding the Participant’s participation in the Plan, or the Participant’s acquisition or sale of the

underlying shares. The Participant is hereby advised to consult with his or her own personal tax, legal and financial advisors regarding the Participant’s participation in the Plan before taking any action related to the Plan.

|

|

10.11 |

This Award Agreement shall be binding upon any successor of the Company, in accordance with the terms of this Agreement and the Plan.

|

[Signature page follows]

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed in its name and on its behalf as of the date of grant of this Restricted Stock Unit Award set forth above.

UNIVEST FINANCIAL CORPORATION

____________________________________

Name:_______________________________

Title:

________________________________

PARTICIPANT’S ACCEPTANCE

The undersigned hereby accepts the foregoing Restricted Stock Unit Award and agrees to the terms and conditions hereof, including the terms and provisions of the

Univest Financial Corporation 2023 Equity Incentive Plan. The undersigned hereby acknowledges receipt of a copy of the Company’s Univest Financial Corporation 2023 Equity Incentive Plan and related prospectus.

PARTICIPANT

____________________________________

Name:_______________________________

5

EXHIBIT 10.3

FORM OF

PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD AGREEMENT

Granted by

UNIVEST FINANCIAL CORPORATION

under the

UNIVEST FINANCIAL CORPORATION 2023 EQUITY INCENTIVE PLAN

This performance-based restricted stock unit agreement (“Restricted Stock Unit Award” or “Agreement”) is and will be subject in every respect to the provisions of the Univest Financial Corporation 2023 Equity Incentive Plan (the “Plan”), which are

incorporated herein by reference and made a part hereof, subject to the provisions of this Agreement. A copy of the Plan and related prospectus have been provided or made available to each person granted a Restricted Stock Unit Award under the

Plan. The holder of this Restricted Stock Unit Award (the “Participant”) hereby accepts this Restricted Stock Unit Award, subject to all the terms and provisions of the Plan and this

Agreement and agrees that all decisions under and interpretations of the Plan and this Agreement by the Board of Directors of Univest Financial Corporation (the “Company”) or the

Compensation Committee of the Board of Directors of the Company (the “Committee”) will be final, binding and conclusive upon the Participant and the Participant’s heirs, legal

representatives, successors and permitted assigns. Except where the context otherwise requires, the term “Company” includes the parent and all present and future subsidiaries of the Company as described in Sections 424(e) and 424(f) of the Internal

Revenue Code of 1986, as amended from time to time (the “Code”). Capitalized terms used herein but not defined will have the same meaning as in the Plan.

|

1.

|

Name of Participant:______________________________________________________

|

|

2.

|

Date of Grant: _________, 20___.

|

|

3.

|

Total number of shares of Company common stock, $5.00 par value per share, that may be acquired pursuant to this Award:____________

(subject to adjustment pursuant to Section 8 hereof).

|

|

4.

|

Vesting Schedule. Except as otherwise provided in this Agreement, this Restricted Stock Award first becomes earned and will be settled

in Stock in accordance with the following vesting schedule:

|

As set forth in Section 9 of this Agreement, vesting will automatically accelerate pursuant to Sections 2.5, 2.7 and 4.1 of the Plan in the event of death, Disability or Involuntary

Termination of Service at or following a Change in Control.

| 5. |

Settlement of Restricted Stock Unit Award. On or as soon as practicable after the vesting of any Restricted Stock Units, the Company shall promptly deliver to the

Participant either electronically through book-entry at the Corporation’s transfer agent or physically one or more certificates representing whole shares of Common Stock (one share of common stock for each Restricted Stock Unit); provided, however, the Company shall not be liable to the Participant, the Participant’s personal representative or the Participant’s successor(s)-in-interest for damages relating to any delays in issuing

the certificates, any loss of the certificates or any mistakes or errors in the issuance of the certificate or in the certificates themselves.

|

|

6.1 |

The Participant will not have the right to vote the shares of Stock underlying this Award until this the units become vested and are settled in Stock.

|

|

6.2 |

Dividend Equivalent Rights attributable to Restricted Stock Units will be credited to a Participant’s account and shall be distributed in cash upon settlement of the Restricted Stock Units. Dividend Equivalent

Rights will not earn interest and if the Restricted Stock Unit is forfeited for any reason, the Participant will have no right to the Dividend Equivalent Rights. Upon settlement of the vested Restricted Stock Units in shares of Stock, the

Participant will obtain full dividend, voting and other rights as a shareholder of the Company. Any beneficiary, heir or legatee of the Participant shall receive the rights herein granted with respect to any vested Restricted Stock Units,

subject to the terms and conditions of this Agreement and the Plan. Any transferee of such rights shares shall agree in writing to be bound by the terms and conditions of this Agreement.

|

| 7. |

Delivery of Shares. Delivery of shares of Stock under this Restricted Stock Unit Award will comply with all applicable laws (including the requirements of the Securities

Act of 1933, as amended), and the applicable requirements of any securities exchange or similar entity.

|

| 8. |

Adjustment Provisions. The number of unvested shares of Stock subject to this Restricted Stock Unit Award, will be adjusted upon the occurrence of the events specified in,

and in accordance with the provisions of, Section 3.4 of the Plan.

|

| 9. |

Effect of Termination of Service on Restricted Stock Unit Award.

Upon the Participant’s Termination of Service, this units subject to this Restricted Stock Unit Award will vest as follows

|

|

9.1 |

Death. In the event of the Participant’s Termination of Service by reason of death, unvested units will immediately vest pro-rata, by multiplying (i) the number of Awards

that would be obtained based on achievement at target (or if actual achievement of the performance measures is greater than the target level, at the actual achievement level) as of the date of death, by (ii) a fraction, the numerator of which

is the number of whole months the Participant was in Service during the performance period and the denominator of which is the number of months in the performance period.

|

|

9.2 |

Disability. In the event of the Participant’s Termination of Service by reason of Disability, any unvested units will immediately vest pro-rata, by multiplying (i) the

number of Awards that would be obtained based on achievement at target (or if actual achievement of the performance measures is greater than the target level, at the actual achievement level) as of the date of death, by (ii) a fraction, the

numerator of which is the number of whole months the Participant was in Service during the performance period and the denominator of which is the number of months in the performance period.

|

|

9.3 |

Change in Control. In the event of the Participant’s Involuntary Termination of Service at or following a Change in Control, any unvested units will immediately vest based

on the greater of the target level of performance or actual performance measured as of the most recent completed fiscal quarter.

|

|

9.4 |

Retirement. [In the case of a non-employee Director, in the event of the Participant’s Termination of Service by reason of Retirement, then that portion of the Award

(calculated on a pro-rata basis based upon the period between the date of this Agreement and the date of Retirement, divided by the original vesting period provided in this Agreement) multiplied by the actual performance achievement rate will

vest on the original vest date and will be settled shares of Stock. For purposes of this Agreement, “Retirement” shall mean the date of the latter to occur of (i) the first day of the month following the Participant’s seventy-second birthday

or (ii) the date that the Participant actually retires as a Director.] [In the case of an Employee, any unvested units will expire and be forfeited as of the date of the Termination of Service on account of the Participant’s Retirement.]

|

|

9.5 |

Termination for Cause. In the event of the Participant’s Termination of Service for Cause, any unvested units will expire and be

forfeited as of the date of the Termination of Service.

|

|

9.6 |

Other Termination. In the event of the Participant’s Termination of Service for any reason other than due to death, Disability,

Retirement, or an Involuntary Termination of Service at or following a Change in Control, any unvested units will expire and be forfeited as of the date of the Termination of Service.

|

10. Miscellaneous.

|

10.1 |

This Restricted Stock Unit Award will not confer upon the Participant any rights as a stockholder of the Company with respect to the shares underlying the Award prior to the date on which the individual fulfills

all conditions for receipt of such rights.

|

|

10.2 |

Except as otherwise provided for in the Plan, this Agreement may not be amended or otherwise modified unless evidenced in writing and signed by the Company and the Participant.

|

|

10.3 |

This Restricted Stock Unit Award is not transferable except as provided for in the Plan.

|

|

10.4 |

This Restricted Stock Unit Award will be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania.

|

|

10.5 |

Nothing in this Agreement will interfere with or limit in any way the right of the Company or any Affiliate to terminate the employment or service of the Participant at any time, nor confer upon the Participant any

right to continue in the employ or service of the Company or any Affiliate.

|

|

10.6 |

This Restricted Stock Unit Award is subject to forfeiture in accordance with the provisions of Section 7.16 of the Plan or as otherwise adopted by the Company.

|

|

10.7 |

This Restricted Stock Unit Award is subject to any required federal, state and local tax withholding, which may be effected in the manner or manners permitted by the Company.

|

|

10.8 |

In the event of a conflict between the terms of this Agreement and the Plan, the terms of the Plan will control.

|

|

10.9 |

This Restricted Stock Unit Award is subject to all laws, regulations and orders of any governmental authority which may be applicable thereto and, notwithstanding any of the provisions hereof, the Company will not

be obligated to issue any shares of Stock hereunder if the issuance of such shares would constitute a violation of any such law, regulation or order or any provision.

|

|

10.10 |

The Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding the Participant’s participation in the Plan, or the Participant’s acquisition or sale of the

underlying shares. The Participant is hereby advised to consult with his or her own personal tax, legal and financial advisors regarding the Participant’s participation in the Plan before taking any action related to the Plan.

|

|

10.11 |

This Award Agreement shall be binding upon any successor of the Company, in accordance with the terms of this Agreement and the Plan.

|

[Signature page follows]

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed in its name and on its behalf as of the date of grant of this Performance-Based Restricted Stock Unit Award

set forth above.

UNIVEST FINANCIAL CORPORATION

____________________________________

Name:_______________________________

Title:

________________________________

PARTICIPANT’S ACCEPTANCE

The undersigned hereby accepts the foregoing Performance-Based Restricted Stock Unit Award and agrees to the terms and conditions hereof, including the terms and

provisions of the Univest Financial Corporation 2023 Equity Incentive Plan. The undersigned hereby acknowledges receipt of a copy of the Company’s Univest Financial Corporation 2023 Equity Incentive Plan and related prospectus.

PARTICIPANT

____________________________________

Name:_______________________________

5

EXHIBIT 10.4

FORM OF

INCENTIVE STOCK OPTION AWARD AGREEMENT

Granted by

UNIVEST FINANCIAL CORPORATION

under the

UNIVEST FINANCIAL CORPORATION 2023 EQUITY INCENTIVE PLAN

This stock option agreement (“Option” or “Agreement”) is and

will be subject in every respect to the provisions of the Univest Financial Corporation 2023 Equity Incentive Plan (the “Plan”), which are incorporated herein by reference and made a part

hereof, subject to the provisions of this Agreement. A copy of the Plan and related prospectus have been provided to each person granted a stock option under the Plan. The holder of this Option (the “Participant”) hereby accepts this Option, subject to all the terms and provisions of the Plan and this Agreement, and agrees that all decisions under and interpretations of the Plan and this Agreement by the Board of Directors of

Univest Financial Corporation (the “Company”) or the Compensation Committee of the Board of Directors of the Company (the “Committee”)

will be final, binding and conclusive upon the Participant and the Participant’s heirs, legal representatives, successors and permitted assigns. Except where the context otherwise requires, the term “Company” includes the parent and all present and

future subsidiaries of the Company as described in Sections 424(e) and 424(f) of the Internal Revenue Code of 1986, as amended from time to time (the “Code”). Capitalized terms used herein

but not defined will have the same meaning as in the Plan.

|

1.

|

Name of Participant:__________________________________

|

| 2. |

Date of Grant: ________________, 20___

|

|

3.

|

Total number of shares of Company common stock, $5.00 par value per share, that may be acquired pursuant to this Option:___________

(subject to adjustment pursuant to Section 9 hereof).

|

|

•

|

This Award is intended to be an Incentive Stock Option. The Option will be an Incentive Stock Option to the maximum extent permitted under Code Section 422(d), which means that up to $100,000

of Options that vest in any one calendar year will be Incentive Stock Options (based on the exercise price of the Option).

|

|

•

|

Please note that for purposes of determining the maximum number of Options that can vest in any one calendar year as Incentive Stock Options, the Options granted to you pursuant to this

Agreement that vest in a calendar year will be aggregated with any earlier Option grant you received that vest in the same calendar year. If you vest in the maximum number of Incentive Stock Options in which you are permitted to vest for a

calendar year under a prior Option Award, Options that you receive under this Agreement that vest in the same calendar year may be considered Non-Qualified Stock Options.

|

| 4. |

Exercise price per share:______________________

|

|

(subject to adjustment pursuant to Section 9 below)

| 5. |

Expiration Date of Option: _________, 20 . Notwithstanding anything in this Agreement to the contrary, no part of this Option may be exercised at any time on

or after the expiration date.

|

| 6. |

Vesting Schedule. Except as otherwise provided in this Agreement, the Option(s) granted hereunder will vest (i.e., become

exercisable) in accordance with the following schedule:

|

Vesting Date Number of Shares Exercisable

As set forth in Section 10 of this Agreement, vesting will automatically accelerate pursuant to Sections 2.5, 2.7 and 4.1 of the Plan in the event of death, Disability or

Involuntary Termination of Service at or following a Change in Control.

| 7. |

Exercise Procedure and Delivery of Notice of Exercise of Option. This Option may be exercised in whole or in part by the Participant’s delivery to the Company of written

notice (the “Notice of Exercise of Option” attached hereto as Exhibit A or as otherwise acceptable to the Company) setting forth the number of shares with respect to which

this Option is to be exercised, together with payment by cash or other means acceptable to the Committee, in accordance with the Plan.

|

| 8. |

Delivery of Shares. Delivery of shares of Stock upon the exercise of this Option will comply with all applicable laws (including the requirements of the Securities Act of

1933, as amended) and the applicable requirements of any securities exchange or similar entity.

|

| 9. |

Adjustment Provisions. This Option, including the number of shares subject to the Option and the exercise price, will be adjusted upon the occurrence of the events

specified in, and in accordance with the provisions of Section 3.4 of the Plan.

|

| 10. |

Accelerated Vesting and Exercisability Period

The vesting of this Option will accelerate as set forth in the following provisions under the Plan:

|

|

10.1 |

Death. In the event of the Participant’s Termination of Service by reason of death, any unvested portion of this Option will vest and any unexercised portion of the Option

may thereafter be exercised by the Participant’s legal representative or beneficiaries for the lesser of: (i) a period of one (1) year from the Participant’s date of death, or (ii) the remaining unexpired term of the Option.

|

|

10.2 |

Disability. In the event of the Participant’s Termination of Service by reason of the Participant’s Disability, any unvested portion of this Option will vest and any

|

|

|

unexercised portion of the Option may thereafter be exercised by the Participant or the Participant’s legal representative for the lesser of: (i) a period of one (1) year following the Termination of Service due

to Disability, or (ii) the remaining unexpired term of the Option.

|

|

10.3 |

Change in Control. In the event of the Participant’s Involuntary Termination of Service at or following a Change in Control, any unvested portion of the Option will vest and

any unexercised portion of the Option may be exercised by the Participant or the Participant’s legal representative for a period of one (1) year following the Participant’s Involuntary Termination of Service.

|

|

10.4 |

Retirement. In the event of the Participant’s Termination of Service by reason of the Participant’s Retirement, vested Options may be exercised for a period of one (1) year

from the date of Termination of Service. Options that have not vested will expire and be forfeited on the date of Termination of Service by reason of Retirement.

|

|

10.5 |

Termination for Cause. In the event of the Participant’s Termination of Service for Cause, all Options subject to this Agreement

that have not been exercised will immediately expire and be forfeited.

|

|

10.6 |

Other Termination. In the event of the Participant’s Termination from Service for any reason other than due to death, Disability,

Retirement, Involuntary Termination at or following a Change in Control, or for Cause, this Option may thereafter be exercised, only to the extent it was exercisable at the time of the termination and only for a period of one (1) year

following the termination.

|

| 11. |

Incentive Stock Option Treatment. The Incentive Stock Options granted hereunder are subject to the requirements of Code Section 421. No Option will be eligible for

treatment as an Incentive Stock Option in the event the Option is exercised more than three (3) months following Termination of Service (except in the case of Termination of Service due to Disability). In order to obtain Incentive Stock

Option treatment for Options exercised by heirs or devisees of the Participant, the Participant’s death must have occurred while the Participant was employed or within three (3) months of the Participant’s Termination of Service.

|

|

12.1 |

No Option will confer upon the Participant any rights as a stockholder of the Company prior to the date on which the individual fulfills all conditions for receipt of such rights.

|

|

12.2 |

Except as otherwise provided for in the Plan, this Agreement may not be amended or otherwise modified unless evidenced in writing and signed by the Company and the Participant.

|

|

12.3 |

Except as otherwise provided by the Committee, Incentive Stock Options under the Plan are not transferable except (i) as designated by the Participant by will or by the laws of descent and distribution; (ii) to a

trust established by the Participant; or (iii)

|

between spouses incident to a divorce or pursuant to a domestic relations order, provided, however, that in the case of a transfer described under (iii), the

Option will not qualify as an Incentive Stock Option as of the day of the transfer.

|

12.4 |

Under current tax laws, an Option that is exercised as an Incentive Stock Option is not subject to ordinary income taxes so long as it is held for the requisite holding period, which is two (2) years from the grant

date of the Option and more than one (1) year from the date of exercise.

|

|

12.5 |

This Agreement will be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania.

|

|

12.6 |

Nothing in this Agreement will interfere with or limit in any way the right of the Company or any Affiliate to terminate the employment or service of the Participant at any time, nor confer upon the Participant any

right to continue in the employ or service of the Company or any Affiliate.

|

|

12.7 |

This Option is subject to forfeiture in accordance with the provisions of Section 7.16 of the Plan or as otherwise adopted by the Company.

|

|

12.8 |

This Option is subject to any required federal, state and local tax withholding, which may be effected in the manner or manners permitted by the Company.

|

|

12.9 |

The Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding the Participant’s participation in the Plan, or the Participant’s acquisition or sale of the

underlying shares. The Participant is hereby advised to consult with his or her own personal tax, legal and financial advisors regarding the Participant’s participation in the Plan before taking any action related to the Plan.

|

|

12.10 |

This Option is subject to all laws, regulations and orders of any governmental authority which may be applicable thereto and, notwithstanding any of the provisions hereof, the Company will not be obligated to issue

any shares of stock hereunder if the issuance of such shares would constitute a violation of any such law, regulation or order or any provision thereof.

|

|

12.11 |

This Award Agreement shall be binding upon any successor of the Company, in accordance with the terms of this Agreement and the Plan.

|

[Signature Page to Follow]

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed in its name and on its behalf as of the date of grant of this Option set forth above.

UNIVEST FINANCIAL CORPORATION

____________________________________

Name:_______________________________

Title:

________________________________

PARTICIPANT’S ACCEPTANCE

The undersigned hereby accepts the foregoing Option and agrees to the terms and conditions hereof, including the terms and provisions of the Univest Financial

Corporation 2023 Equity Incentive Plan. The undersigned hereby acknowledges receipt of a copy of the Univest Financial Corporation 2023 Equity Incentive Plan and related prospectus.

PARTICIPANT

____________________________________

Name:_______________________________

EXHIBIT A

NOTICE OF EXERCISE OF OPTION

I, ______________________________, hereby exercise the stock option (the “Option”) granted to me by Univest Financial Corporation (the “Company”) or its affiliate, subject to all the terms and provisions set forth in the Incentive Stock Option Agreement (the “Agreement”)

and the Univest Financial Corporation 2023 Equity Incentive Plan (the “Plan”) referred to therein, and notify you of my desire to purchase __________________ shares of common stock of the

Company (“Common Stock”) for a purchase price of $________ per share.

I elect to pay the exercise price by:

|

___ |

Cash or personal, certified or cashier’s check in the sum of $____________, in full/partial payment of the purchase price.

|

|

___ |

Stock of the Company with a fair market value of $____________ in full/partial payment of the purchase price.*

|

|

___ |

My check in the sum of $___________ and stock of the Company with a fair market value of $______, in full/partial payment of the purchase price.*

|

|

___ |

A net settlement of the Option, using a portion of the shares obtained on exercise in payment of the exercise price of the Option (and, if applicable, any minimum required tax withholding).

|

|

___ |

Selling ___________ shares from my Option shares through a broker in full/partial payment of the purchase price.

|

I understand that after this exercise, _____________ shares of Common Stock remain subject to the Option, subject to all terms and provisions set forth in the Agreement and the

Plan.

I hereby represent that it is my intention to acquire these shares for the following purpose:

___ investment

___ resale or distribution

Please note: if your intention is to resell (or distribute within the meaning of Section 2(11) of the Securities Act of 1933, as amended (the "Securities

Act"), the shares you acquire through this Option exercise, the Company or transfer agent may require an opinion of counsel that such resale or distribution would not violate the Securities Act prior to your exercise of such Option.

Date: _______________, 20___ _________________________________________

Participant’s signature

* If I elect to exercise by exchanging shares I already own, I will constructively return shares that I already own to purchase the new option shares. If my shares are in certificate form,

I must attach a separate statement indicating the certificate number of the shares I am treating as having exchanged. If the shares are held in “street name” by a registered broker, I must provide the Company with a notarized statement attesting to

the number of shares owned that will be treated as having been exchanged. I will keep the shares that I already own and treat them as if they are shares acquired by the option exercise. In addition, I will receive additional shares equal to the

difference between the shares I constructively exchange and the total new option shares that I acquire.

6

EXHIBIT 10.5

FORM OF

RESTRICTED STOCK AWARD AGREEMENT

Granted by

UNIVEST FINANCIAL CORPORATION

under the

UNIVEST FINANCIAL CORPORATION 2023 EQUITY INCENTIVE PLAN

This restricted stock agreement (“Restricted Stock Award” or “Agreement”)

is and will be subject in every respect to the provisions of the Univest Financial Corporation 2023 Equity Incentive Plan (the “Plan”), which are incorporated herein by reference and made a

part hereof, subject to the provisions of this Agreement. A copy of the Plan and related prospectus have been provided or made available to each person granted a Restricted Stock Award under the Plan. The holder of this Restricted Stock Award (the

“Participant”) hereby accepts this Restricted Stock Award, subject to all the terms and provisions of the Plan and this Agreement, and agrees that all decisions under and interpretations of

the Plan and this Agreement by the Board of Directors of Univest Financial Corporation (the “Company”) or the Compensation Committee of the Board of Directors of the Company (the “Committee”) will be final, binding and conclusive upon the Participant and the Participant’s heirs, legal representatives, successors and permitted assigns. Except where the context otherwise

requires, the term “Company” includes the parent and all present and future subsidiaries of the Company as described in Sections 424(e) and 424(f) of the Internal Revenue Code of 1986, as amended from time to time (the “Code”). Capitalized terms used herein but not defined will have the same meaning as in the Plan.

|

1.

|

Name of Participant:______________________________________________________

|

|

2.

|

Date of Grant: _________, 20___.

|

|

3.

|

Total number of shares of Company common stock, $5.00 par value per share, that may be acquired pursuant to this Award:_________

(subject to adjustment pursuant to Section 8 hereof).

|

|

4.

|

Vesting Schedule. Except as otherwise provided in this Agreement, this Restricted Stock Award first becomes earned in accordance with

the following vesting schedule:

|

As set forth in Section 9 of this Agreement, vesting will automatically accelerate pursuant to Sections 2.5, 2.7 and 4.1 of the Plan in the event of death, Disability or Involuntary

Termination of Service at or following a Change in Control.

| 5. |

Grant of Restricted Stock Award. The Restricted Stock Award will be in the form of issued and outstanding shares of Stock registered in the name of the Participant and held

by the Company, together, to the extend necessary, with a stock power executed by the

|

Participant in favor of the Company, pending the vesting or forfeiture of the Restricted Stock. Notwithstanding the foregoing, the Company may, in its sole discretion, issue

Restricted Stock in any other format (e.g., electronically) to facilitate the paperless transfer of the Awards.

If certificated, the certificates evidencing the Restricted Stock Award will bear a legend restricting the transferability of the Restricted Stock. The Restricted Stock awarded

to the Participant will not be sold, encumbered hypothecated or otherwise transferred except in accordance with the terms of the Plan and this Agreement.

|

6.1 |

The Participant will have the right to vote the shares of Restricted Stock awarded hereunder on matters which require stockholder vote.

|

|

6.2 |

No cash dividends shall be paid with respect to any Restricted Stock Awards unless and until the Participant vests in the underlying share(s) of Restricted Stock. Upon the vesting of Restricted Stock, any dividends

declared but not paid during the vesting period shall be paid within thirty (30) days following the vesting date. Any stock dividends declared on shares of Stock subject to the Restricted Stock Award shall be subject to the same restrictions

and will vest at the same time as the shares of Restricted Stock from which said dividends were derived. All unvested dividends shall be forfeited by the Participant to the extent the underlying Restricted Stock Awards are forfeited.

|

| 7. |

Delivery of Shares. Delivery of shares of Stock under this Restricted Stock Award will comply with all applicable laws (including the requirements of the Securities Act of

1933, as amended), and the applicable requirements of any securities exchange or similar entity.

|

| 8. |

Adjustment Provisions. The number of unvested shares of Stock subject to this Restricted Stock Award, will be adjusted upon the occurrence of the events specified in, and

in accordance with the provisions of, Section 3.4 of the Plan.

|

| 9. |

Effect of Termination of Service on Restricted Stock Award.

Upon the Participant’s Termination of Service, shares of Stock subject to this Restricted Stock Award will vest as follows:

|

|

9.1 |

Death. In the event of the Participant’s Termination of Service by reason of death, any unvested shares will immediately vest.

|

|

9.2 |

Disability. In the event of the Participant’s Termination of Service by reason of Disability, any unvested shares will immediately vest.

|

|

9.3 |

Change in Control. In the event of the Participant’s Involuntary Termination of Service at or following a Change in Control, any unvested shares will immediately vest.

|

|

9.4 |

Retirement. In the event of the Participant’s Termination of Service by reason of Retirement, any unvested shares of Restricted Stock subject to this Agreement will expire

and be forfeited as of the date of the Termination of Service. “Retirement” has the meaning set forth in Article 8 of the Plan.

|

|

9.5 |

Termination for Cause. In the event of the Participant’s Termination of Service for Cause, any unvested shares will expire and be

forfeited as of the date of the Termination of Service.

|

|

9.6 |

Other Termination. In the event of the Participant’s Termination of Service for any reason other than due to death, Disability,

Retirement, or an Involuntary Termination of Service at or following a Change in Control, any unvested shares will expire and be forfeited as of the date of the Termination of Service.

|

10. Miscellaneous.

|

10.1 |

This Restricted Stock Award will confer upon the Participant any rights as a stockholder of the Company with respect to the shares underlying the Award prior to the date on which the individual fulfills all

conditions for receipt of such rights.

|

|

10.2 |

Except as otherwise provided for in the Plan, this Agreement may not be amended or otherwise modified unless evidenced in writing and signed by the Company and the Participant.

|

|

10.3 |

This Restricted Stock Award is not transferable except as provided for in the Plan.

|

|

10.4 |

This Restricted Stock Award will be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania.

|

|

10.5 |

Nothing in this Agreement will interfere with or limit in any way the right of the Company or any Affiliate to terminate the employment or service of the Participant at any time, nor confer upon the Participant any

right to continue in the employ or service of the Company or any Affiliate.

|

|

10.6 |

This Restricted Stock Award is subject to forfeiture in accordance with the provisions of Section 7.16 of the Plan or as otherwise adopted by the Company.

|

|

10.7 |

This Restricted Stock Award is subject to any required federal, state and local tax withholding, which may be effected in the manner or manners permitted by the Company.

|

|

10.8 |

In the event of a conflict between the terms of this Agreement and the Plan, the terms of the Plan will control.

|

|

10.9 |

This Restricted Stock Award is subject to all laws, regulations and orders of any governmental authority which may be applicable thereto and, notwithstanding any of the provisions hereof, the Company will not be

obligated to issue any shares of Stock hereunder if the issuance of such shares would constitute a violation of any such law, regulation or order or any provision.

|

|

10.10 |

The Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding the Participant’s participation in the Plan, or the Participant’s acquisition or sale of the

underlying shares. The Participant is hereby advised to consult with his or her own personal tax, legal and financial advisors regarding the Participant’s participation in the Plan before taking any action related to the Plan.

|

|

10.11 |

This Award Agreement shall be binding upon any successor of the Company, in accordance with the terms of this Agreement and the Plan.

|

[Signature page follows]

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed in its name and on its behalf as of the date of grant of this

Restricted Stock Award set forth above.

UNIVEST FINANCIAL CORPORATION

____________________________________

Name:_______________________________

Title:________________________________

PARTICIPANT’S ACCEPTANCE

The undersigned hereby accepts the foregoing Restricted Stock Award and agrees to the terms and conditions hereof, including the terms and provisions of the

Univest Financial Corporation 2023 Equity Incentive Plan. The undersigned hereby acknowledges receipt of a copy of the Company’s Univest Financial Corporation 2023 Equity Incentive Plan and related prospectus.

PARTICIPANT

___________________________________

Name:

_______________________________

5

EXHIBIT 23.2

Consent of Independent Registered Public Accounting Firm

We consent to the use of our reports dated February 24, 2023, with respect to the consolidated financial statements of Univest Financial

Corporation, and the effectiveness of internal control over financial reporting, incorporated herein by reference.

Philadelphia, Pennsylvania

August 1, 2023

EXHIBIT 107

Calculation of Filing Fee Tables

Form S-8

Univest Financial Corporation

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount to be Registered(1)

|

Proposed Maximum Aggregate Offering Price Per Share(2)

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

Equity

|

Common stock, $5.00 par value per share

|

457(c) and 457(h)

|

1,200,000

|

$19.62

|

$23,544,000.00

|

0.00011020

|

$2,594.55

|

|

Total Offering Amounts

|

|

$23,544,000.00

|

|

$2,594.55

|

|

Total Fee Offsets

|

|

|

|

$0.00

|

|

Net Fee Due

|

|

|

|

$2,594.55

|

___________________________________________

|

(1)

|

Together with an indeterminate number of additional shares that may be necessary to adjust the number of shares reserved for issuance pursuant to

the Univest Financial Corporation 2023 Equity Incentive Plan as a result of a stock split, stock dividend or similar adjustment of the outstanding common stock of Univest Financial Corporation (the “Company”) pursuant to 17 C.F.R.

Section 230.416(a).

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee

in accordance with Rules 457(c) and (h) under the Securities Act, based on the average of the high and low prices of the Company’s common stock as

reported on the Nasdaq Stock Market on July 31, 2023.

|

Table 2: Fee Offset Claims and Sources

N/A

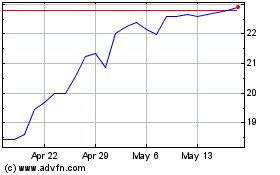

Univest Financial (NASDAQ:UVSP)

Historical Stock Chart

From Apr 2024 to May 2024

Univest Financial (NASDAQ:UVSP)

Historical Stock Chart

From May 2023 to May 2024