Visteon Announces Preliminary Second Quarter 2005 Financial Information

08 August 2005 - 10:00PM

PR Newswire (US)

Second Quarter Highlights * Non-Ford sales of $1.8 billion; new

business wins continue in core areas * Refinancing of credit

facilities completed * Ford MOU signed; progress continues toward

definitive agreements VAN BUREN TOWNSHIP, Mich., Aug. 8

/PRNewswire-FirstCall/ -- Visteon Corporation (NYSE:VC), today

announced preliminary second quarter 2005 sales of $5.0 billion and

a net loss of $1.2 billion or $9.49 per share. These preliminary

results include previously announced non-cash fixed asset

impairment charges of $1.1 billion, or $9.01 per share. (Logo:

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO ) The

preliminary financial information presented is unaudited and

remains subject to change because, as announced on May 10, 2005,

the company's Audit Committee is conducting an independent review

of the accounting for certain transactions originating in the

company's North American purchasing activities. On August 1, 2005,

Visteon provided an update on preliminary conclusions reached to

date with respect to the transactions that have been the primary

focus of the independent review. However, Visteon is not yet able

to determine whether further adjustments may be required to the

preliminary financial results presented, or in any other period,

resulting from completion of the independent review, the company's

or its independent registered public accounting firm's review

processes or any subsequent events. Non-Ford sales for the second

quarter 2005 grew by $401 million, or 29 percent, compared with the

second quarter 2004, to an all-time high of $1.8 billion and

represented 36 percent of total sales. Ford sales decreased more

than 7 percent to $3.2 billion, primarily reflecting lower

production levels in North America and Europe. Currency favorably

impacted total sales by $120 million. Through the first half of the

year Visteon has won more net new business with non-Ford customers

than it did in the first half of 2004. These wins are balanced

across several customers; 90 percent are in the core areas of

electronics, interiors and climate and more than 80 percent are

outside of North America. "Our customer diversification continues

as non-Ford sales were 36 percent of total sales in the second

quarter and we continue to win new business with these customers in

our key growth products," said Mike Johnston, Visteon chairman and

chief executive officer. "We also took a major step toward

addressing a number of structural challenges in the company's North

American manufacturing operations by signing the memorandum of

understanding with Ford. The Ford transaction will allow us to

focus our efforts and resources to support our global customers in

the core areas of electronics, interiors and climate and to take

the required actions to improve our financial performance." As

announced on August 1, 2005, second quarter 2005 preliminary

financial results include a non-cash charge of $1.1 billion for

fixed assets in both North America and Europe. In North America,

non-cash charges of nearly $900 million were recorded as the

company reduced, to estimated fair value, the carrying value of

fixed assets related to the 24 facilities that will be transferred

to Ford. Visteon also recorded a non-cash charge of about $250

million to reduce the carrying value of certain non-core fixed

assets, primarily in Europe, related to drive line and engine air

fuel systems. Compared with results from the same period a year

ago, second quarter 2005 results were adversely impacted by lower

Ford production volumes, price reductions and increased reserves

for Tier 1 customer bankruptcies. Second quarter results were

positively impacted by the benefits of the Ford Funding Agreement

agreed to in March 2005 as well as other net cost efficiencies. The

Ford Funding Agreement reduced the wage reimbursement to Ford for

Visteon- assigned Ford / UAW hourly employees. Visteon ended the

second quarter 2005 with $823 million of cash and $1,921 million in

debt, resulting in net debt of $1.1 billion, $128 million lower

than it was on March 31, 2005. This reduction was a result of

improved operating cash flow primarily reflecting the benefit of

reduced payment terms provided by the Ford Funding Agreement as

well as reduced capital spending. Refinancing of Credit Facilities

During the quarter, Visteon also obtained a new $300 million

secured short-term credit facility, and revised the terms of its

existing $775 million, five-year facility and the $250 million

delayed draw term loan. On August 1, 2005, Visteon drew down $450

million on its revised bank facilities to fund the repayment of its

maturing $250 million 7.95 percent notes and to provide additional

required liquidity due to working capital needs associated with

summer shut down at its primary customers. Visteon expects to repay

a portion of the amount drawn on the bank facilities when it

receives the $250 million short-term loan from Ford upon reaching

definitive agreements with Ford relating to the Ford MOU.

Memorandum of Understanding with Ford On May 25, 2005, Visteon and

Ford announced that they had entered into a memorandum of

understanding to transfer 24 North American facilities to a

Ford-managed entity. The parties have made significant progress

toward signing definitive agreements, including resolving most of

the significant transactional issues and receiving U.S. anti-trust

and union approvals. Both parties remain committed to the goal of

closing the transaction by the end of the third quarter. Visteon

and Ford have been working diligently to define how Visteon will

support the Ford-managed entity after closing of the transaction.

Although agreements are not completely formalized, Visteon

anticipates a significant portion of its salaried workforce in

North America will support the Ford- managed entity. These

employees will continue to support the transferred business as

required and the Ford-managed entity will reimburse Visteon for the

cost of these employees. Conference Call Scheduled at 9:00 a.m. EDT

Today At 9 a.m. (EDT) today, a conference call is scheduled to

discuss the results in further detail, as well as other related

matters. Dial-in numbers: U.S.: 888-452-7086; International:

706-643-3752 (Call in approximately 10 minutes prior to the start

of the conference.) Those interested in hearing a replay of the

conference in the United States should call 800-642-1687;

international callers should dial 706-645- 9291. The pass code to

access the replay is 6927704 (domestic and international). The

replay will be available for one week. Visteon will provide a

broadcast of the quarterly meeting for the general public via a

live audio webcast. The conference call, along with the financial

results release, presentation material and other supplemental

information, can be accessed through Visteon's Web site at

http://www.visteon.com/earnings . Visteon Corporation is a leading

full-service supplier that delivers consumer-driven technology

solutions to automotive manufacturers worldwide and through

multiple channels within the global automotive aftermarket. Visteon

has approximately 70,000 employees and a global delivery system of

more than 200 technical, manufacturing, sales and service

facilities located in 24 countries. This press release contains

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward- looking

statements are not guarantees of future results and conditions but

rather are subject to various factors, risks and uncertainties that

could cause our actual results to differ materially from those

expressed in these forward-looking statements, including the

automotive vehicle production volumes and schedules of our

customers, and in particular Ford's North American vehicle

production volumes; our ability to enter into definitive agreements

that reflect the terms of the memorandum of understanding with Ford

and close the transactions that are contemplated in the memorandum

of understanding; implementing structural changes that result from

the closing of the transactions contemplated by the memorandum of

understanding in order to achieve a competitive and sustained

business; our ability to satisfy our future capital and liquidity

requirements and comply with the terms of our credit agreements;

the results of the investigation being conducted by Visteon's Audit

Committee and the company's inability to make timely filings with

the SEC; the financial distress of our suppliers; our successful

execution of internal performance plans and other cost-reduction

and productivity efforts; charges resulting from restructurings,

employee reductions, acquisitions or dispositions; our ability to

offset or recover significant material surcharges; the effect of

pension and other post- employment benefit obligations; as well as

those factors identified in our filings with the SEC (including our

Annual Report on Form 10-K for the year- ended December 31, 2004).

We assume no obligation to update these forward- looking

statements. VISTEON CORPORATION AND SUBSIDIARIES SECOND QUARTER

2005 FINANCIAL INFORMATION SUMMARY (preliminary and unaudited) (in

millions, except per share amounts) Sales Ford and affiliates

$3,223 Other customers 1,780 Total sales $5,003 Costs of sales

$5,891 Selling, administrative and other expenses $274 Operating

loss $(1,162) Loss before income taxes and minority interests

$(1,185) Net loss $(1,193) Net loss per share Basic and diluted

$(9.49) Average shares outstanding Basic and diluted 125.7 Special

charges (included in costs of sales) $(1,132) Special charges

above, after-tax $(1,132) Special charges per share, based on

average diluted shares outstanding above $(9.01) Other Selected

Information Depreciation and amortization Depreciation $154

Amortization 26 Total depreciation and amortization $180 Net

interest expense $31 Income tax benefit $(2) Capital expenditures

(including $2 million related to capital leases) $152 Cash and

borrowing Cash $823 Borrowing 1,921

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO DATASOURCE:

Visteon Corporation CONTACT: Media Inquiries: Jim Fisher,

+1-734-710-5557, , or Investor Inquiries: Derek Fiebig,

+1-734-710-5800, , both of Visteon Corporation Web site:

http://www.visteon.com/

Copyright

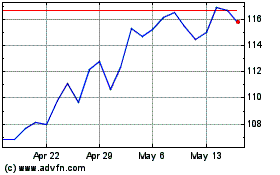

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

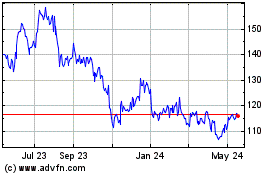

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024