Visteon to Control Halla Climate - Analyst Blog

12 July 2012 - 11:00PM

Zacks

Visteon Corp. (VC) has announced a tender

offer to purchase the remaining 30% of Halla Climate Control Corp.

The company, which already has a 70% stake in Halla, will have a

complete climate control portfolio following the acquisition,

which, in turn will greatly enhance its shareholders’ value.

Visteon’s Korean subsidiary Visteon Korea Holdings Corp. has

made an offer of KRW 913 billion ($805 million) for buying of the

remaining 32 million shares of Halla. The offer is subject to

shareholders tendering a minimum of 26.7 million shares for at

least 95% ownership of Visteon.

The acquisition will improve Visteon’s business in the climate

control segment with an efficient operating structure. Long-term

plans of the company to have a global presence in the climate

control of automotive will also have a favourable impact. In

addition, Halla’s capability of developing advanced powertrain

cooling technologies will back Visteon’s ongoing research and

development initiatives in the U.S. and Germany.

Visteon also expects that the deal will boost its earnings by 25

cents per share excluding operational and tax synergies. The

company anticipates roughly $20 million in synergies in the first

full year of integration.

Visteon has further plans to expand its foothold in Korea with

the establishment of the world’s largest compressor production

unit. The expansion in the country will also lead to development of

advanced technologies for radiators, condensers, evaporators and

heater cores.

After acquiring a majority ownership of Halla from Ford

Motor Co. (F) in 1999, Visteon has been lending support to

Halla to become a competitive global supplier with a sound

reputation in Korea. However, the deal faces certain challenges

from National Pension Service which holds about 10% of Halla’s

share. Hyundai Motor Co., the biggest customer of Halla is

also not very satisfied with the acquisition.

Visteon is one of the leading global automotive suppliers

engaged in designing, engineering and manufacturing innovative

climate, electronic, interior and lighting products for vehicle

manufacturers. Currently, it retains a Zacks #3 Rank, which

translates into a short-term (1 to 3 months) “Hold” rating.%

FORD MOTOR CO (F): Free Stock Analysis Report

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

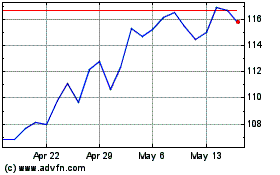

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

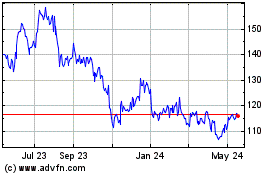

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024