Bull of the Day: Visteon (VC) - Bull of the Day

26 July 2013 - 6:49PM

Zacks

Thanks to its outstanding

quarterly results, earnings estimates have been on the uptrend and

the company has maintained its Zacks rank #1 (Strong Buy) since

March this year.

About

the Company

Visteon

Corporation (VC) is a leading global automotive supplier

of climate, electronics and interiors products for vehicle

manufacturers. It serves original equipment vehicle manufacturers

with its technical, manufacturing, sales and service facilities

located in 29 countries.

The

company has been transforming from a US centric company with only

one major customer to a predominantly Asia-based, multi-customer

global enterprise.

Excellent

First Quarter Results

The

company reported its first quarter results on May 9, 2013. Adjusted

earnings came in at $2.02 per share, significantly ahead of the

Zacks consensus estimate of $1.15 per share.

Results

benefitted from increased vehicle production and new business

in Asia and North America, partially offset by lower

production volumes in Europe.

Hyundai-Kia accounted

for approximately 33% of the sales, while Ford accounted

for another 28%. On a regional basis, Asia accounted

for 46% of total sales, while Europe and

Americas represented 30% and 24% respectively.

Visteon updated

its full-year guidance for adjusted earnings, to a range

of $4.04 to $5.52 per share. The company has repurchased

2.2 million shares ($125 million) year-to-date, representing 4% of

its outstanding shares.

Improved

Industry Outlook

Per

Zacks Auto Industry Outlook, while a strong pent-up demand due to

aging vehicles on the U.S. roads along with falling unemployment

rate have been the key factors in driving the auto sales in the

U.S., Asia promises high growth for the industry.

Asian

countries, especially China and India, are expected to account for

40% of growth in the auto industry over the next five to seven

years due to their rapidly growing economies. With its strong

presence in Asia, VC will definitely benefit from the surging

demand for automobiles in that region.

Estimates

Revisions

As a result of strong

results and updated guidance, analysts have increased their

earnings estimates for VC. Zacks consensus estimate for the current

quarter now stands at $1.05 per share up from $0.97 per share, 30

days ago. The estimate for the current year is also up to $4.80 per

share from $4.74 per share earlier. The company has delivered

positive earnings surprise in three out of last four quarters, with

an average surprise of 22%. Visteon will announce its second

quarter results on August 8, 2013.

The Bottom Line

VC is a Zacks Rank#1

(Strong Buy) stock. It also has a Zacks recommendation of

Outperform”. Further Zacks Industry Rank of 60 out of 265

also indicates chance of outperformance in the near- to mid-

term.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7

Best Stocks for the Next 30 Days. Click

to get this free report >>

VISTEON CORP (VC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

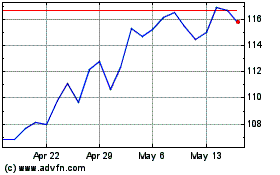

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

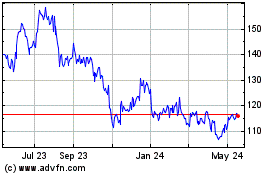

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024