Visteon Corporation Commences Tender Offer For Up To $250 Million Of Its 7.95% Notes Due 2005

02 March 2004 - 2:12AM

PR Newswire (US)

Visteon Corporation Commences Tender Offer For Up To $250 Million

Of Its 7.95% Notes Due 2005 DEARBORN, Mich., March 1

/PRNewswire-FirstCall/ -- Visteon Corporation today announced that

it has commenced a cash tender offer for up to $250,000,000

aggregate principal amount of its 7.95% Notes due 2005. The tender

offer will expire at 5:00 p.m., New York City time, on Friday,

April 2, 2004, unless extended or earlier terminated. (Logo:

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO ) Under the

terms of the offer, the Company is offering to purchase a portion

of the outstanding Notes at a purchase price based on the yield to

maturity of a specified U.S. Treasury reference security plus a

fixed spread, in addition to paying accrued and unpaid interest for

the period up to but excluding the settlement date of the offer.

Holders who tender on or prior to 5:00 p.m., New York City time, on

March 12, 2004 will receive the total consideration, which includes

an early tender premium. If the aggregate principal amount of Notes

validly tendered and not properly withdrawn exceeds $250,000,000,

Visteon will accept Notes for purchase on a pro rata basis based on

the principal amount of Notes tendered. Payment for tendered Notes

will be made in same day funds on the second business day after the

expiration of the offer, or as soon as practicable thereafter. The

tender offer is conditioned upon the satisfaction of certain

conditions, including the consummation by Visteon before the

expiration of the tender offer of an offering of registered debt

securities on terms and conditions satisfactory to the company,

with net proceeds at least sufficient to purchase the maximum

number of Notes that may be tendered and accepted by Visteon

pursuant to the terms of the tender offer. If any of the conditions

are not satisfied, Visteon is not obligated to accept for payment,

purchase or pay for, and may delay the acceptance for payment of,

any tendered Notes, and may even terminate the tender offer.Full

details of the terms and conditions of the tender offer are

included in the company's Offer to Purchase dated March 1, 2004.

Citigroup Global Markets Inc. and J.P. Morgan Securities Inc. will

act as Dealer Managers for the tender offer. Requests for documents

may be directed to Global Bondholder Services Corporation, the

Information Agent, at 212-430-3774 or 866-470-4200. This press

release is neither an offer to purchase nor a solicitation of an

offer to sell the Notes or any other security. The offer is made

only by an Offer to Purchase dated March 1, 2004. Persons with

questions regarding the offer should contact the Dealer Managers:

(i) Citigroup Global Markets Inc., toll-free at 800-558-3745, or

(ii) J.P. Morgan Securities Inc., toll- free at 866-834-4666.

Statements in this press release regarding the offering of

registered debt securities shall not constitute an offer to sell or

a solicitation of an offer to buy such securities. Visteon

Corporation is a leading full-service supplier that delivers

consumer-driven technology solutions to automotive manufacturers

worldwide and through multiple channels within the global

automotive aftermarket. Visteon has approximately 72,000 employees

and a global delivery system of more than180 technical,

manufacturing, sales and service facilities located in 25

countries. This press release contains forward-looking statements

made pursuant to the Private Securities Litigation Reform Act of

1995. Words such as "anticipate," "estimate," "expect," and

"projects" signify forward-looking statements. Forward-looking

statements are not guarantees of future results and conditions but

rather are subject to various risks and uncertainties. Some of

these risks and uncertainties are identified in our periodic

filings with the Securities and Exchange Commission. Should any

risks or uncertainties develop into actual events, these

developments could have material adverse effects on Visteon's

business, financial condition, and results of operations. We assume

no obligation to update these forward- looking statements.

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO DATASOURCE:

Visteon Corporation CONTACT: Media Inquiries: Kimberly A. Welch,

+1-313-755-3537, , Jim Fisher, +1-313-755-0635, , or Investor

Inquiries: Derek Fiebig, +1-313-755-3699, , all of Visteon

Corporation Web site: http://www.visteon.com/

Copyright

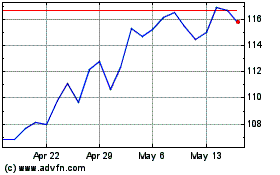

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

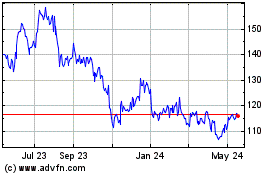

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024