Visteon Corporation Prices Tender Offer For $250 Million Of 7.95 Percent Notes Due 2005

01 April 2004 - 10:29AM

PR Newswire (US)

Visteon Corporation Prices Tender Offer For $250 Million Of 7.95

Percent Notes Due 2005 DEARBORN, Mich., March 31

/PRNewswire-FirstCall/ -- Visteon Corporation today announced that

it has priced its tender offer for up to $250 million of its 7.95

percent notes due 2005. Upon consummation of the tender offer,

Visteon will pay $1,072.73 for each $1,000 principal amount of

notes purchased in the tender offer, plus accrued but unpaid

interest up to, but not including, the settlement date. The

purchase price was determined by reference to a fixed spread of 100

basis points over the bid side yield (as quoted on Bloomberg Screen

PX4 at 2:00 p.m. New York City time, today) of the 2.00 percent

U.S. Treasury Note due August 31, 2005, calculated to the maturity

date of the notes. (Logo:

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO ) The

purchase price includes an early tender premium of $15.00 per

$1,000 principal amount of notes that is payable only to holders

who validly tendered their notes before 5:00 p.m., New York City

time, on March 12, 2004, and did not withdraw their tender. Holders

who validly tender their notes after 5:00 p.m. New York City time,

on March 12, 2004, but before the expiration of the offer, and do

not withdraw their tender, will be paid the purchase price less the

early tender fee of $15.00 per $1,000 principal amount of notes.

Holders not eligible to receive the early tender premium may

withdraw their tender at any time before 5:00 p.m., New York City

time, on Friday, April 2, 2004, unless the tender offer is

extended. Visteon will accept notes for purchase on a pro rata

basis based on the principal amount of notes tendered. Payment for

properly tendered notes will be made in same day funds not later

than the second business day after the expiration date of the

offer, or as soon thereafter as practicable. Specific details of

the offer are fully described in the Offer to Purchase, dated March

1, 2004 (the "Offer to Purchase") and the related Letter of

Transmittal. Copies of these documents can be obtained by

contacting Global Bondholder Services Corporation, the Information

Agent for the offer, toll-free at (866) 470-4200 or (212) 430-3774

(for banks and brokers). Questions regarding the offer may be

directed to (i) Citigroup Global Markets Inc., toll-free at (800)

558-3745, or (ii) J.P. Morgan Securities Inc., toll- free at (866)

834-4666, the Dealer Managers for the offer. Visteon's obligation

to accept for purchase and topay for the notes validly tendered is

subject to conditions set forth in the Offer to Purchase and the

related Letter of Transmittal. This press release does not

constitute an offer to buy any securities nor a solicitation of an

offer to sell any securities. This offer is being made only

pursuant to the Offer to Purchase and the related Letter of

Transmittal and only to such persons and only in such jurisdictions

as permitted by applicable law. Visteon Corporation is a leading

full-service supplier that delivers consumer-driven technology

solutions to automotive manufacturers worldwide and through

multiple channels within the global automotive aftermarket. Visteon

has approximately 72,000 employees and a global delivery system of

more than 200 technical, manufacturing, sales and service

facilities located in 25 countries. This press release contains

forward-looking statements made pursuant to the Private Securities

Litigation Reform Act of 1995. Words such as "anticipate,"

"estimate," "expect," and "projects" signify forward-looking

statements. Forward-looking statements are not guarantees of future

results and conditions but rather are subject to various risks and

uncertainties. These risks and uncertainties include, but are not

limitedto, a risk that a sale of our notes might not be completed

and other risks, relevant factors and uncertainties identified in

our periodic filings with the Securities and Exchange Commission.

Should any risks or uncertainties develop into actual events, these

developments could have material adverse effects on Visteon's

business, financial condition, and results of operations. We assume

no obligation to update these forward-looking statements.

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO DATASOURCE:

Visteon Corporation CONTACT: Media Inquiries: Kimberly A. Welch,

+1-313-755-3537, , Jim Fisher, +1-313-755-0635, , or Investor

Inquiries: Derek Fiebig, +1-313-755-3699, , all of Visteon

Corporation Web site: http://www.visteon.com/

Copyright

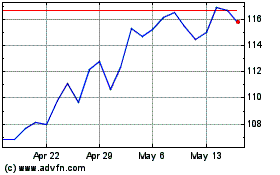

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

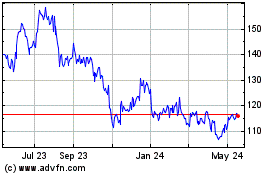

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024