MORNING UPDATE: Man Securities Issues Alerts for AMGN, WDC, KRB, VC, and HLIT

24 April 2004 - 12:48AM

PR Newswire (US)

MORNING UPDATE: Man Securities Issues Alerts for AMGN, WDC, KRB,

VC, and HLIT CHICAGO, April 23 /PRNewswire/ -- Man Securities

issues the following Morning Update at 8:30 AM EDT with new

PriceWatch Alerts for key stocks. (Logo:

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO ) Before

the open... PriceWatch Alerts for AMGN, WDC, KRB, VC, and HLIT,

Market Overview, Today's Economic Calendar, and the Quote Of The

Day. QUOTE OF THE DAY "Overall corporate IT spending continued to

improve and we expect to see healthy demand through the end of our

fiscal year." -- John Connors, chief financial officer, Microsoft

Corp. New PriceWatch Alerts for AMGN, WDC, KRB, VC, and HLIT...

PRICEWATCH ALERTS - HIGH RETURN COVERED CALL OPTIONS ----------- --

Amgen Inc. (NASDAQ:AMGN) Last Price 57.14 - OCT 55.00 CALL OPTION@

$5.40 -> 6.3 % Return assigned* -- Western Digital Corp.

(NYSE:WDC) Last Price 8.98 - JUL 7.50 CALL OPTION@ $1.85 -> 5.2

% Return assigned* -- MBNA Corp. (NYSE:KRB) Last Price 25.96 - SEP

25.00 CALL OPTION@ $2.40 -> 6.1 % Return assigned* -- Visteon

Corp. (NYSE:VC) Last Price 11.45 - SEP 10.00 CALL OPTION@ $1.85

-> 4.2 % Return assigned* -- Harmonic Inc. (NASDAQ:HLIT) Last

Price 8.40 - MAY 7.50 CALL OPTION@ $1.20 -> 4.2 % Return

assigned* * To learn more about how to use these alerts and for our

FREE report, "The 18 Warning Signs That Tell You When To Dump A

Stock ", go to: http://www.investorsobserver.com/mu18 (Note: You

may need to copy the link above into your browser then press the

[ENTER] key) ** For the FREE report, "The Secrets of Smart Election

Year Investing - Insights, Stocks, And Strategies." go to:

http://www.investorsobserver.com/FREEelection NOTE: All stocks and

options shown are examples only. These are not recommendations to

buy or sell any security. MARKET OVERVIEW Overseas markets are much

improved over this same period compared to yesterday. Currently 14

of the 15 markets that we track are positive with a cumulative

average return on the collective standing a plus 0.723 percent.

Closing at its highs for the week, the Nikkei added 2.5 percent on

the week to accomplish a second weekly close above the 12,000 level

over the past three weeks. Growth in the United Kingdom appears to

have slowed a bit in the first quarter. The preliminary Gross

Domestic Product came in at plus 0.6 percent over the fourth

quarter and plus 3.0 percent over the first quarter of 2003.

Analysts were looking for plus 0.7 percent and plus 3.1 percent

respectively. The fourth quarter finalized figures showed a 0.9

percent rise over the prior quarter and a 2.7 percent

year-over-year rate of growth. Despite the Q1 apparent shortfall,

it was the best year-over-year performance since the third quarter

of 2000 and above the 2.5 percent trend of growth. The week should

end on a calm note as the earnings calendar dwindles to a

manageable handful and the 8:30 a.m. release of March Durable Goods

Orders represents the sum of today's economic data. The Durable

goods figure is expected to have slowed a bit to a plus 0.7 percent

from February's heated 2.5 percent rise. Be prepared for the

investing week ahead with Bernie Schaeffer's FREE Monday Morning

Outlook. For more details and to sign up, go to:

http://www.investorsobserver.com/freemo DYNAMIC MARKET

OPPORTUNITIES "The latest unemployment claims number isn't

terrible. But it suggests the job market is still weak, which means

an interest rate hike isn't imminent. Over the last month, the

10-year bond yield has gone from 3.7% to over 4.4%, effectively

pricing in a 0.5% hike. It looks like it's time to give some of

that back." That's according to Brit Ryle at the Taipan Group's

Money-Flow Matrix Trader service. Elsewhere, Xybernaut enjoyed a

healthy bounce to $1.49 on a $350,000 new order from Europe for its

wearable computer technology. Specifically, the order concerned

Xybernaut's Mobile Assistants, which will be used for airport

security and management. Since advising investors to buy Xybernaut,

William Colburn, chief trader at Value Edge, is up 51% on the

position. And amid talk that Sony, Texas Pacific Group and

Provident Equity Partners are set to bid $5 billion for MGM,

directors at the film/television company could vote as early as

next week on a special $8 dividend. That would be great news for

Ian Cooper's traders at the Extreme Volatility Speculator, who can

hope to add to their 10.3% gains over the last two weeks. The

editorial team has prepared a special FREE REPORT for you -

"America's 1,300 Fastest-Growing Companies." You can access it

immediately by following this link:

http://www.investorsobserver.com/agora1 TODAY'S ECONOMIC CALENDAR

8:30 a.m.: Fed Vice Chairman Ferguson speaks on global imbalance at

European Institute's financial affairs roundtable in Washington.

8:30 a.m.: March Durable Goods Orders (last plus 2.5 percent). 2:15

p.m.: Fed Gov Bernanke speaks on monetary policy at World Economy

Laboratory Conference in Washington. Man Financial Inc is one of

the world's major futures and options brokers and has been

recognized as a leading option order execution firm for individuals

and institutions. Member CBOE/NASD/SIPC (CRD#6731). For more

information and a free CD with educational tools to help you invest

smarter, see http://www.investorsobserver.com/mancd This Morning

Update was prepared with data and information provided by:

InvestorsObserver.com - Better Strategies for Making Money ->

For Investors With a Sense of Humor. Only $1 for your first month

plus seven free bonuses worth over $420, see:

http://www.investorsobserver.com/must 247profits.com: You'll get

exclusive financial commentary, access to a global network of

experts and undiscovered stock alerts. Register NOW for the FREE

247profits e-Dispatch. Go to:

http://www.investorsobserver.com/agora Schaeffer's Investment

Research - Sign up for your FREE e-weekly, Monday Morning Outlook,

Bernie Schaeffer's look ahead at the markets. Sign Up Now

http://www.investorsobserver.com/freemo PowerOptionsPlus - The Best

Way To Find, Compare, Analyze, and Make Money On Options

Investments. For a 14-Day FREE trial and 5 FREE bonuses go to:

http://www.poweroptionsplus.com/ All stocks and options shown are

examples only. These are not recommendations to buy or sell any

security and they do not represent in any way a positive or

negative outlook for any security. Potential returns do not take

into account your trade size, brokerage commissions or taxes which

will affect actual investment returns. Stocks and options involve

risk and are not suitable for all investors and investing in

options carries substantial risk. Prior to buying or selling

options, a person must receive a copy of Characteristics and Risks

of Standardized Options available from Sharon at 800-837-6212 or at

http://www.cboe.com/Resources/Intro.asp. Privacy policy available

upon request.

http://www.newscom.com/cgi-bin/prnh/20020214/MANSECLOGO

http://photoarchive.ap.org/ DATASOURCE: Man Securities CONTACT:

Michael Lavelle of Man Securities, +1-800-837-6212 Web site:

http://www.mansecurities.com/mu.html

Copyright

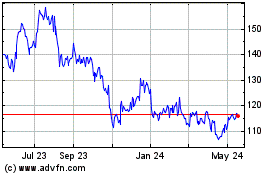

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

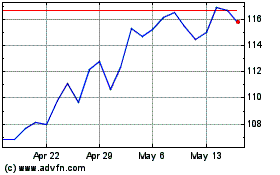

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024