QuickLinks

-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

Tender Offer Statement Under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

Aastrom Biosciences, Inc.

(Name of Subject Company (Issuer) and Filing Person (Offeror))

Warrants to Purchase Common Stock

(Title of Class of Securities)

(CUSIP

Numbers of Class of Securities)

Tim M. Mayleben

Chief Executive Officer

24 Frank Lloyd Wright Drive, P.O. Box 376,

Ann Arbor, Michigan

(800) 556-0311

(Name, address and telephone number of person authorized to receive notices and

communications on behalf of filing person)

Copy to:

Mitchell S. Bloom

Danielle M. Lauzon

Goodwin Procter LLP

Exchange Place

Boston, Massachusetts 02109

Telephone: (617) 570-1000

Facsimile: (617) 523-1231

CALCULATION OF FILING FEE

|

|

|

|

|

Transaction Valuation*

|

|

Amount of Filing Fee**

|

|

$2,543,334.06

|

|

$291.47

|

-

*

-

The

transaction valuation is estimated solely for the purposes of calculating the filing fee pursuant to Rule 0-11 under the Securities

Exchange Act of 1934, as amended ("Rule 0-11"). The transaction valuation estimate assumes the exchange of all of the warrants of Aastrom Biosciences, Inc. issued in

connection with its December 2010 public offering, and is based on the book value of the warrants as of June 27, 2012.

-

**

-

The

amount of the filing fee is calculated in accordance with Rule 0-11 by multiplying the estimated Transaction Valuation by

one-fiftieth of one percent of the estimated value of the transaction.

-

o

-

Check

box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the

filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

Amount Previously Paid: Not applicable.

|

|

Filing Party: Not applicable.

|

|

Form or Registration No.: Not applicable.

|

|

Date Filed: Not applicable.

|

-

o

-

Check

box if the filing relates solely to preliminary communications made before the commencement of a tender

offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

-

o

-

third

party tender offer subject to Rule 14d-1.

-

ý

-

issuer

tender offer subject to Rule 13e-4.

-

o

-

going-private

transaction subject to Rule 13e-3.

-

o

-

amendment

to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer.

o

INTRODUCTION

This issuer tender offer Statement on Schedule TO (this "Schedule TO") is being filed by Aastrom Biosciences, Inc., a

Michigan corporation ("Aastrom" or the "Company"), pursuant to Rule 13(e)-4 of the Securities Exchange Act of 1934, as amended, in connection with its offer to exchange (the

"Exchange Offer") any warrant (as amended, the "Warrants") to purchase shares of common stock, no par value per share, of the Company issued in connection with the Company's December 2010 public

offering, that is tendered and accepted, for shares of the Company's common stock. Aastrom is seeking to exchange any and all outstanding Warrants in the Exchange Offer.

This

is a one-time offer and only valid during the period the Exchange Offer remains open. Each Warrant is currently exercisable for one (1) share of common stock, at

an exercise price of $3.22. If you elect to exchange your Warrant, you will be entitled to receive one (1) share of common stock for every two (2) Warrants tendered.

The

Exchange Offer will commence on June 28, 2012 and will expire at 5:00 p.m., New York City time, on July 27, 2012 (the "Expiration Time"), unless extended or

earlier terminated by the Company.

The

Exchange Offer is made upon the terms and subject to the conditions to the conditions set forth in the Company's offer to exchange, dated June 28, 2012 (the "Exchange Offer

Statement"), and in the related Exchange Offer materials which are filed as Exhibits (a)(1), (a)(2), (a)(3), (a)(4), (a)(5) and (d)(1) to this Schedule TO (which the Exchange Offer and

related Exchange Offer materials, as amended or supplemented from time to time, collectively constitute the "Offer Materials").

This

Schedule TO is being filed in satisfaction of the reporting requirements of Rules 13e-4(b)(1) and (c)(2) promulgated under the Securities Exchange Act of

1934, as amended.

Information

set forth in the Offering Memorandum is incorporated by reference in response to Items 1 through 13 of this Schedule TO, except those items as to which

information is specifically provided herein.

Item 1.

Summary Term Sheet.

The information set forth under the captions entitled "Summary Term Sheet" and "Summary—Exchange Offer" in the Exchange

Offer, attached hereto as Exhibit (a)(1), is incorporated herein by reference.

Item 2.

Subject Company Information.

(a) The

name of the subject company is Aastrom Biosciences, Inc., and the address of its principal executive offices is 24 Frank Lloyd Wright Drive,

P.O. Box 376, Ann Arbor, Michigan 48106. The Company's telephone number is (800) 556-0311.

(b) The

subject class of securities is the Company's Warrants to purchase shares of the Company's common stock with an exercise price of $3.22 and an expiration date of

December 15, 2015. As of June 28, 2012, the Company had 2,333,334 Warrants outstanding and the aggregate number of shares issuable upon exercise of the Warrants was 2,333,334 shares of

the Company's common stock. The information set forth in the Exchange Offer under the caption entitled "The Exchange Offer—Eligibility" is incorporated herein by reference.

(c) The

Warrants are not listed on any national securities exchange. To the Company's knowledge, there is no established trading market for the Warrants.

1

Item 3.

Identity and Background of Filing Person.

(a) The

principal executive offices of the filing person, Aastrom Biosciences, Inc., are located at is 24 Frank Lloyd Wright Drive, P.O. Box 376, Ann

Arbor, Michigan 48106 and the Company's telephone number at that address is (800) 556-0311.

As

required by General Instruction C to Schedule TO, the following persons are the directors and executive officers of the Company as of the date of this

Schedule TO. The address for each of the following persons is the same as that of the filing person.

|

|

|

|

|

Name

|

|

Office

|

|

Nelson M. Sims

|

|

Lead Director

|

|

Ronald M. Cresswell

|

|

Director

|

|

Alan L. Rubino

|

|

Director

|

|

Harold C. Urschel, Jr.

|

|

Director

|

|

Robert L. Zerbe

|

|

Director

|

|

Tim M. Mayleben

|

|

President, Chief Executive Officer and Director

|

|

Brian D. Gibson

|

|

Vice President of Finance, Chief Accounting Officer and Treasurer

|

|

Ronnda L. Bartel

|

|

Chief Scientific Officer

|

|

Sharon M. Watling

|

|

Vice President Clinical Development

|

Item 4.

Terms of the Transaction.

(a) The

information set forth in the Exchange Offer under the captions entitled "Summary Term Sheet," "Summary," "Summary—Exchange Offer," "The Exchange

Offer—Purpose of the Exchange Offer", "The Exchange Offer—Eligibility", "The Exchange Offer—Exchange of Warrants", "The Exchange Offer—Procedures for

Tendering Warrants", "The Exchange Offer—Withdrawal Rights", "The Exchange Offer—Exchange Agent", "The Exchange Offer—Acceptance of Warrants; Issuance of Common

Stock", "The Exchange Offer—Extension of Offer; Termination; Amendment", "The Exchange Offer—Source and Amount of Consideration; Description of Warrants" and "Certain Tax

Consequences of the Offer" is incorporated herein by reference.

(b) To

the Company's knowledge, no Warrants are owned by any officer, director or affiliate of the Company.

Item 5.

Past Contacts, Transactions, Negotiations and Arrangements.

(e) The

information set forth under the caption entitled "The Exchange Offer—Warrant Exchange Agreements" in the Exchange Offer is incorporated herein by

reference.

Item 6.

Purposes of the Transaction and Plans or Proposals.

(a) The

information set forth in the Exchange Offer under the captions entitled "The Exchange Offer—Purpose of the Exchange Offer" is incorporated herein by

reference.

(b) All

Warrants tendered pursuant to the Exchange Offer will be cancelled.

(c) Not

applicable.

Item 7.

Source and Amount of Funds or Other Consideration.

(a) Not

applicable. No cash will be used for the exchange of the Warrants.

(b) Not

applicable. There are no alternative financing arrangements for the mandatory redemption of the Warrants.

(d) Not

applicable.

2

Item 8.

Interest in Securities of the Subject Company.

(a) To

the Company's knowledge, none of the Company's directors, executive officers or controlling persons, or any of their affiliates, beneficially own any Warrants or will

be tendering any Warrants pursuant to the Exchange Offer.

(b) The

information set forth in the Exchange Offer in the section entitled "Warrant Exchange Agreements" is incorporated herein by reference. See "Identity and Background

of Filing Person" herein.

Item 9.

Person/Assets, Retained, Employed, Compensated or Used.

(a) We

have not retained any person for the purpose of soliciting eligible holders of Warrants to tender their Warrants pursuant to the Exchange Offer.

Item 10.

Financial Statements.

(a) The

consolidated balance sheets of the Company as of December 31, 2010 and 2011 and the related consolidated statements of operations, shareholders' equity

(deficit) and comprehensive loss, and cash flows for the years ended December 31, 2010 and 2011 are incorporated by reference in the Exchange Offer under the caption entitled "Available

Information/Incorporation by Reference" which is incorporated herein by reference. The condensed consolidated balance sheet of the Company at March 31, 2012 in the Quarterly Reports for the

quarter ended March 31, 2012 and the related condensed consolidated statements of operations, and cash flows for the quarter ended March 31, 2012 are incorporated by reference in the

Exchange Offer under the caption entitled "Available Information/Incorporation by Reference" which is incorporated herein by reference.

(b) The

information set forth in the Exchange Offer under the caption "Pro Forma Financial Information" and "Capitalization" is incorporated herein by reference.

Item 11.

Additional Information.

(a) The

information set forth under the caption entitled "The Exchange Offer—Warrant Exchange Agreements" in the Exchange Offer is incorporated herein by

reference.

(b) The

information set forth in the Exchange Offer and the accompanying Letter of Transmittal is incorporated herein by reference.

Item 12.

Exhibits

.

|

|

|

|

|

|

|

|

|

(a)

|

|

(1)

|

|

Exchange Offer, dated June 28, 2012.

|

|

(a)

|

|

(2)

|

|

Form of Letter of Transmittal and Instructions.

|

|

(a)

|

|

(3)

|

|

Form of Notice of Withdrawal.

|

|

(a)

|

|

(4)

|

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

|

(a)

|

|

(5)

|

|

Press Release, dated June 27, 2012, filed as Exhibit 99.1 to the Company's Report on Form 8-K, filed on June 27, 2012, incorporated herein by reference.

|

|

(d)

|

|

(1)

|

|

Form of Warrant Exchange Agreement, dated June 27, 2012, filed as Exhibit 10.1 to the Company's Report on Form 8-K, filed on June 27, 2012, incorporated herein by reference.

|

Item 13.

Information Required by Schedule 13E-3.

(a) Not

applicable.

3

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

correct and complete.

|

|

|

|

|

|

|

|

|

|

|

Aastrom Biosciences, Inc.

|

Date: June 28, 2012

|

|

By:

|

|

/s/ TIM M. MAYLEBEN

|

|

|

|

|

|

Name:

|

|

Tim M. Mayleben

|

|

|

|

|

|

Title:

|

|

Chief Executive Officer and President

|

4

INDEX TO EXHIBITS

|

|

|

|

|

|

|

(a)

|

|

(1)

|

|

Exchange Offer, dated June 28, 2012.

|

(a)

|

|

(2)

|

|

Form of Letter of Transmittal and Instructions.

|

(a)

|

|

(3)

|

|

Form of Notice of Withdrawal.

|

(a)

|

|

(4)

|

|

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.

|

(a)

|

|

(5)

|

|

Press Release, dated June 27, 2012, filed as Exhibit 99.1 to the Company's Report on Form 8-K, filed on June 27, 2012, incorporated herein by reference.

|

(d)

|

|

(1)

|

|

Form of Warrant Exchange Agreement, dated June 27, 2012, filed as Exhibit 10.1 to the Company's Report on Form 8-K, filed on June 27, 2012, incorporated herein by reference.

|

5

QuickLinks

CALCULATION OF FILING FEE

INTRODUCTION

SIGNATURES

INDEX TO EXHIBITS

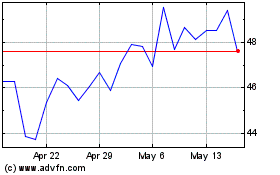

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Jun 2024 to Jul 2024

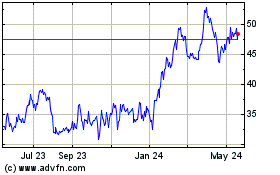

Vericel (NASDAQ:VCEL)

Historical Stock Chart

From Jul 2023 to Jul 2024