UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number 001-41385

Visionary Education

Technology Holdings Group Inc.

(Translation of registrant’s name into English)

105 Moatfield Dr. Unit 1003

Toronto, Ontario, Canada M3B 0A2

905-739-0593

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

| |

VISIONARY EDUCATION TECHNOLOGY

HOLDINGS GROUP INC. |

| |

|

| |

|

|

| Date: November 6, 2023 |

By: |

/s/ Fan Zhou |

| |

|

Fan Zhou |

| |

|

Chief Executive Officer |

Exhibit 99.1

Visionary Education Technology Holdings Group

Inc.

105 Moatfield Dr. Unit 1003

Toronto, Ontario, Canada M3B 0A2

To the Shareholders of Visionary Education Technology Holdings Group

Inc.:

You are cordially invited

to attend the 2023 Annual Shareholders Meeting of Visionary Education Technology Holdings Group Inc. (the “Company”) on Monday,

December 11, 2023 (the “Annual Shareholders Meeting”), at the offices of the Company, located at 105 Moatfield Dr. Unit 1003,

Toronto, Ontario, Canada M3B 0A222F, at 10:00 a.m., local time. A Notice of the 2023 Annual Shareholders Meeting, a Proxy Card and a Proxy

Statement containing information about the matters to be voted upon at the Annual Shareholders Meeting are enclosed.

All registered holders of

our common shares (“Common Shares” or “Shares”) as of the close of business on October 16, 2023 (the “Record

Date”), will be entitled to vote at the Annual Shareholders Meeting on the basis of one vote for each Common Share held.

Our activities for the fiscal

year ended March 31, 2023, are included in our annual report on Form 20-F filed with the Securities and Exchange Commission (“SEC”)

on August 15, 2023 (the “Annual Report”). Upon written request to the Secretary of the Company, the Company will provide,

without charge, to each person solicited, a copy of the Annual Report, including the financial statements and report of independent registered

public accounting firm filed therewith. The Annual Report and other reports that we file with the SEC are also available to the public

from the SEC's website at http://www.sec.gov.

Whether or not you plan to

attend the Annual Shareholders Meeting, the Company requests that you please exercise your voting rights by completing and returning your

Proxy Card promptly in the enclosed self-addressed stamped envelope. If you are a registered holder of Common Shares, by attending the

Annual Shareholders Meeting and voting in person, your Proxy Card will not be used.

We are providing the accompanying

Proxy Statement and accompanying Proxy Card to our shareholders in connection with the solicitation of proxies to be voted at the Annual

Shareholders Meeting and at any adjournments of such meeting. Whether or not you plan to attend the Annual Shareholders Meeting, we urge

you to read the Proxy Statement and sign, date and return the Proxy Card.

On behalf of our Board of Directors, I thank you

for your support.

Sincerely,

/s/ Fan Zhou

Fan Zhou

Chief Executive Officer

Visionary Education Technology Holdings Group

Inc.

105 Moatfield Dr. Unit 1003

Toronto, Ontario, Canada M3B 0A2

NOTICE OF THE 2023 ANNUAL SHAREHOLDERS MEETING

OF VISIONARY EDUCATION TECHNOLOGY HOLDINGS GROUP

INC.

To Be Held on December 11, 2023

Dear Shareholder:

NOTICE IS HEREBY GIVEN that

the Annual Shareholders Meeting (2023) of Visionary Education Technology Holdings Group Inc. (“Visionary” or the “Company”),

will be held on December 11, 2023, at 10:00 a.m., local time, at the offices of the Company, located at 105 Moatfield Dr. Unit 1003, Toronto,

Ontario, Canada M3B 0A222F.

At the 2023 Annual Shareholders

Meeting, our shareholders will be asked to consider and vote upon:

Proposal No. 1. To fix the

number of directors and elect the directors of the Company for the ensuing year;

Proposal No. 2. To

consider and approve by special resolution the reverse stock split or consolidation of the Company’s Common Shares on the

basis of fifteen (15) pre-consolidation Common Shares for one (1) post-consolidation Common Share, or such other consolidation ratio

as may be approved by the Directors on or prior to the Annual Shareholders Meeting, which aims to increase the market price of

individual shares and reduce the total number of outstanding shares. We refer to Proposal No. 2 as the “Share Consolidation

Proposal;

Proposal No. 3. To consider

and approve by special resolution the name change of the Company from “Visionary Education Technology Holdings Group Inc.”

to “Visionary Holdings Inc.” We refer to Proposal No. 3 as the “Name Change Proposal”; and

Proposal No. 4. To consider

and approve the appointment of MNP LLP as the independent registered public accounting firm for the fiscal year ending March 31, 2023.

We refer to Proposal No. 4 as the “Ratification of Auditors Proposal.”

Only holders of record of

our Common Shares at the close of business on October 16, 2023 are entitled to notice of the 2023 Annual Shareholders Meeting and to vote

at the meeting and any adjournments of the meeting. A complete list of our shareholders of record entitled to vote at the 2023 Annual

Shareholders Meeting will be available for ten (10) days before the meeting at our principal executive offices for inspection by shareholders

during common business hours for any purpose germane to the meeting.

Each of these Proposals is

more fully described in the accompanying Proxy Statement. We ask that you vote or date, sign and return the enclosed Proxy Card in the

self-addressed stamped envelope. If you are a registered holder of Common Shares, you may revoke your Proxy Card and vote in person if

you later decide to attend in person.

Sincerely,

/s/ Fan Zhou

Fan Zhou

Chief Executive Officer

November 6, 2023

Visionary Education Technology Holdings Group

Inc.

105 Moatfield Dr. Unit 1003

Toronto, Ontario, Canada M3B 0A2

PROXY STATEMENT

November 6, 2023

GENERAL INFORMATION

This Proxy Statement and the

accompanying Proxy Card are being mailed to shareholders of Visionary Education Technology Holdings Group Inc. (the “Company”)

in connection with the solicitation of proxies by the Board of Directors (the “Board”) of the Company for the 2023 Annual

Shareholders Meeting of the Company (the “Annual Shareholders Meeting”). The Company’s Annual Report on Form 20-F, for

the fiscal year ended March 31, 2023, which is not part of this Proxy Statement, was filed separately with the Securities and Exchange

Commission on August 15, 2023.

Voting By Registered Holders of Common Shares

When your Proxy Card is returned

properly executed, the Common Shares it represents will be voted in accordance with your specifications. You have three choices as to

your vote on each of the items described in this Proxy Statement that are to be voted upon at the Annual Shareholders Meeting. You may

vote “for” or “against” each item or “abstain” from voting by marking the appropriate box.

If you sign and return your

Proxy Card but do not specify any choices, you will thereby confer discretionary authority for your Common Shares to be voted as recommended

by the Board. The Proxy Card also confers discretionary authority on the individuals named therein to vote on any variations to the proposed

resolutions.

Whether or not you plan to

attend the Annual Shareholders Meeting, you can be assured that your Common Shares are voted by completing, signing, dating and returning

the enclosed Proxy Card to the attention of the Company’s Chief Financial Officer at 105 Moatfield Dr. Unit 1003, Toronto, Ontario,

Canada M3B 0A222F, not less than forty-eight (48) hours before the time appointed for the Annual Shareholders Meeting. You may revoke

your Proxy Card at any time before it is exercised by giving written notice thereof to the Secretary of the Company, by submitting a subsequently

dated Proxy Card, by attending the Annual Shareholders Meeting and withdrawing the Proxy Card, or by voting in person at the Annual Shareholders

Meeting.

Each holder of the Common

Shares in the capital of the Company in issue, and recorded in the Register of Members of the Company at the close of business on October

16, 2023, is entitled to one vote on a show of hands and, on a poll, to one vote for each Common Share so held at the Annual Shareholders

Meeting. All such Common Shares entitled to vote at the Annual Shareholders Meeting are referred to herein as “Record Shares.”

The presence in person or by proxy of the holders of a majority of the Record Shares will constitute a quorum for the transaction of business

at the Annual Shareholders Meeting. Resolutions put to the vote at the Annual Shareholders Meeting will be decided by a show of hands

unless a poll is, before or on the declaration of the result of the show of hands, demanded by the Chairman of the Annual Shareholders

Meeting or any holder of Record Shares present in person or by proxy. Every holder of a Record Share present in person or by proxy is

entitled to one vote on a show of hands and, on a poll, to one vote for each Record Share held.

If two or more persons are

jointly registered as holders of a Common Share then in voting, the vote of the senior who tenders a vote, whether in person or by proxy,

shall be accepted to the exclusion of the votes of other holders of the Common Share and, for this purpose seniority, shall be determined

by the order in which the names stand on the register of the Shareholders.

Broker Non-Votes and Abstentions

Under the rules of various

national and regional securities exchanges, your broker, bank or other nominee cannot vote your shares with respect to non-discretionary

matters unless you provide instructions on how to vote in accordance with the information and procedures provided to you by your broker,

bank or other nominee. The proposals, except for the Ratification of Auditors Proposal, will be considered non-discretionary and therefore

your broker, bank or other nominee cannot vote your shares without your instruction. If you do not provide instructions with your proxy,

your bank, broker or other nominee may deliver a Proxy Card expressly indicating that it is NOT voting your shares; this indication that

a broker, bank or other nominee is not voting your shares is referred to as a “broker non-vote.” The Ratification of Auditors

Proposal will be considered discretionary and therefore your broker, bank or other nominee may vote your shares without your instruction.

With respect to the meeting,

abstentions and broker non-votes will be considered present for the purposes of establishing a quorum but will have no effect on any of

the Proposals.

Certain Filings With SEC

Our activities for the fiscal

year ended March 31, 2023, are included in our annual report on Form 20-F, filed with the Securities and Exchange Commission (“SEC”)

on August 15, 2023 (the “Annual Report”). Upon written request to the Secretary of the Company, the Company will provide,

without charge, to each person solicited, a copy of the Annual Report, including the financial statements and report of independent registered

public accounting firm filed therewith. The Annual Report and other reports that we file with the SEC are also available to the public

from the SEC’s website at http://www.sec.gov.

Upon request, we will, without

charge, send you copies of our Annual Report that we have filed with the SEC. You may request copies of the Annual Report by addressing

your request to Secretary, Visionary Education Technology Holdings Group Inc., 105 Moatfield Dr. Unit 1003, Toronto, Ontario, Canada M3B

0A222F.

Security Ownership of Certain Beneficial Owners

and Management

The following table sets

forth certain information regarding the beneficial ownership of our Common Shares as of October 16, 2023 by (a) each shareholder who is

known to us to own beneficially 5% or more of our outstanding ordinary shares; (b) all directors; (c) our executive officers and (d) all

executive officers and directors as a group. Except as otherwise indicated, all shares are owned directly and the percentage shown is

based on 51,660,883 Common Shares issued and outstanding. Beneficial ownership is determined in accordance with the rules of the SEC and

includes voting or investment power with respect to, or the power to receive the economic benefit of ownership of, the securities. In

computing the number of shares beneficially owned by a person and the percentage ownership of that person, we have included shares that

the person has the right to acquire within sixty (60) days, including through the exercise of any option or other right or the conversion

of any other security. However, these shares are not included in the computation of the percentage ownership of any other person.

Unless otherwise indicated,

the address of each beneficial owner listed in the table below is 200 Town Centre Boulevard, Markham Ontario.

| | |

Shares Beneficially Owned | |

| Name of Beneficial Owner | |

Number | | |

Percent | |

| Officers and Directors: | |

| | | |

| | |

| Dr. Simon Tang | |

| | | |

| – | |

| Honorable Peter A.S. Milliken | |

| – | | |

| – | |

| Michael Viotto | |

| – | | |

| – | |

| William Chai | |

| – | | |

| – | |

| Fan Zhou (1) | |

| 22,750,000 | | |

| 44.0% | |

| Katy Liu | |

| – | | |

| – | |

| All directors and executive officers as a group (six persons) | |

| 22,750,000 | | |

| 44.0% | |

| | |

| | | |

| | |

| 5% Stockholders: | |

| | | |

| | |

| 3888 Investment Group Limited(1) | |

| 22,750,000 | | |

| 44.0% | |

| Monolith IT Solutions Inc. (2) | |

| 3,885,000 | | |

| 7.5% | |

| 5% Stockholders as a group (three persons): | |

| 26,635,000 | | |

| 51.6% | |

(1) Fan

Zhou is the sole owner of 3888 Investment Group Limited, which is the record owner of 22,750,000 Common Shares. Consequently,

Ms. Zhou may be deemed the beneficial owner of Common Shares held by 3888 Investment Group Limited.

(2) Ying

Wang and Yamin Han each beneficially own 50% of Monolith IT Solutions, Inc., which is the record owner of 3,885,000 Common Shares, and

may be deemed to beneficially own such Common Shares held directly by Monolith IT Solutions Inc.

Board of Directors

The Board is responsible for

establishing broad corporate policies and for overseeing the overall performance of the Company. The Board reviews significant developments

affecting the Company and acts on other matters requiring its approval.

Number and Terms of Directors.

The Company has five (5) directors and each director is to serve until his or her successor is elected and qualified or until his or her

death, resignation or removal.

Arrangements. We are

not aware of any arrangement among shareholders regarding the nomination or approval of directors or senior management.

Involvement

in Certain Legal Proceedings. During the past ten years, none of the Company’s directors have been the subject of the following

events:

| |

1. |

a petition under the Federal bankruptcy laws or any state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing; |

| |

|

|

| |

2. |

convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| |

|

|

| |

3. |

the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities: |

| |

i) |

acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity; |

| |

|

|

| |

ii) |

engaging in any type of business practice; or |

| |

|

|

| |

iii) |

engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws; |

| |

4. |

the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph 3.i in the preceding paragraph or to be associated with persons engaged in any such activity; |

| |

|

|

| |

5. |

was found by a court of competent jurisdiction in a civil action or by the SEC to have violated any Federal or State securities law, and the judgment in such civil action or finding by the SEC has not been subsequently reversed, suspended, or vacated; |

| |

|

|

| |

6. |

was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; |

| |

|

|

| |

7. |

was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of: |

| |

i) |

any Federal or State securities or commodities law or regulation; or |

| |

|

|

| |

ii) |

any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or |

| |

|

|

| |

iii) |

any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| |

8. |

was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Director

Independence. The Company has directors who qualify as “independent” according to the rules of the Nasdaq Stock Market,

LLC. The Company’s Board has determined that the following directors are “independent” as such directors do not

have a direct or indirect material relationship with the Company: Dr. Simon Tang, William Chai, Honorable Peter A.S. Milliken and Michael

Viotto.

A

material relationship is a relationship which could, in the view of the Company’s Board of Directors, be reasonably expected to

interfere with the exercise of a director’s independent judgment.

Board

Committees. The Company has established three (3) committees under the Board of Directors: an Audit Committee, a Compensation Committee

and a Nominating Committee. Each committee is governed by a charter approved by the Board of Directors. In addition, the Company has an

informal Strategic Advisory Board that will assist the board in setting strategies, achieving goals and analyzing opportunities.

Audit Committee.

The Company has appointed to its Audit Committee three (3) directors that satisfy the “independence” requirements

of Rule 5605(a)(2) of the Listing Rules of the Nasdaq Stock Market and meet the independence standards under Rule 10A-3 under

the Exchange Act. One of the Company’s directors on the Audit Committee is an “audit committee financial expert”

within the meaning of the SEC rules and possesses financial sophistication within the meaning of the Listing Rules of the Nasdaq Stock

Market. The Audit Committee oversees the Company’s accounting and financial reporting processes and the audits of the financial

statements of the Company. The Audit Committee is responsible for, among other things:

| |

• |

selecting the Company’s independent registered public accounting firm and pre-approving all auditing and non-auditing services permitted to be performed by the Company’s independent registered public accounting firm; |

| |

• |

reviewing with the Company’s independent registered public accounting firm any audit problems or difficulties and management’s response and approving all proposed related-party transactions, as defined in Item 404 of Regulation S-K; |

| |

• |

discussing the annual audited financial statements with management and the Company’s independent registered public accounting firm; |

| |

• |

annually reviewing and reassessing the adequacy of the Company’s Audit Committee charter; |

| |

• |

meeting separately and periodically with management and the Company’s independent registered public accounting firm; |

| |

• |

reporting regularly to the full board of directors; |

| |

• |

reviewing the adequacy and effectiveness of the Company’s accounting and internal control policies and procedures and any steps taken to monitor and control major financial risk exposure; and |

| |

• |

such other matters that are specifically delegated to our Audit Committee by the Board of Directors from time to time. |

Compensation Committee.

The Company has appointed to our Compensation Committee three (3) directors that will satisfy the “independence” requirements

of Rule 5605(a)(2) of the Listing Rules of the Nasdaq Stock Market and meet the independence standards under Rule 10A-3

under the Exchange Act. The Company’s Compensation Committee assists the board in reviewing and approving the compensation

structure, including all forms of compensation, relating to our directors and executive officers. No officer may be present at any committee

meeting during which such officer’s compensation is deliberated upon. The Compensation Committee is responsible for, among other

things:

| |

• |

reviewing and approving to the Board of Directors with respect to the total compensation package for the Company’s most senior executive officers; |

| |

• |

approving and overseeing the total compensation package for the Company’s executives other than the most senior executive officers; |

| |

• |

reviewing and recommending to the Board of Directors with respect to the compensation of the Company’s directors; |

| |

• |

reviewing periodically and approving any long-term incentive compensation or equity plans; |

| |

• |

selecting compensation consultants, legal counsel or other advisors after taking into consideration all factors relevant to that person’s independence from management; and |

| |

• |

programs or similar arrangements, annual bonuses, employee pension and welfare benefit plans. |

Nominating Committee.

The Company has appointed to our Nominating Committee three (3) directors that satisfy the “independence” requirements

of Rule 5605(a)(2) of the Listing Rules of the Nasdaq Stock Market and meet the independence standards under Rule 10A-3 under

the Exchange Act. The Nominating Committee is responsible for overseeing the selection of persons to be nominated to serve on the

Board of Directors. The Nominating Committee considers persons identified by its members, management, shareholders, investment bankers

and others.

Presentation of Financial Statements

At the Annual Shareholders Meeting, the consolidated comparative financial

statements of the Company for the fiscal year ended March 31, 2023 and the auditors' report on such statements will be placed before the

shareholders. No formal action is required or proposed to be taken at the Meeting with respect to the financial statements.

PROPOSAL NO. 1.

ELECTION OF DIRECTORS

The Board currently consists

of five (5) directors. At the Annual Shareholders Meeting, all five (5) directors will be nominated by management for election as directors

for the ensuing year. A brief summary of the persons nominated by management for election as directors and their principal occupation,

business affiliations and other information are as follows.

Fan Zhou, Chief

Executive Officer, Chairman of the Board of Directors, Principal Shareholder, Director, and Executive Director. Fan Zhou is the

Company’s Chief Executive Officer, founder and majority shareholder. Ms. Zhou was the Chief Executive Officer from April 1, 2020

to October 31, 2020. Ms. Zhou served as a Director from August 20, 2013 and as Executive Director from March 24, 2021 until December 15,

2021. On June 27, 2022, she was re-appointed as Executive Director and re-elected as a Director. On December 14, 2022, Ms. Zhou was re-appointed

as Chief Executive Officer, and was appointed as Chairman of our Board of Directors on June 6, 2023. Ms. Zhou has over 20 years of experience

in international vocational education in Canada and China. In 2000, she became the Director of China marketing at US Xintra International

Computer Institute (“Xintra”) in Toronto, Canada. Between 2001 and 2004, she served as the Director of the China Branch of

Xintra in Guangzhou, China, and later the Chair of Guangzhou Xintra Computer Ltd. and the Principal of Guangzhou Xintra Computer Training

School. From 2005 to 2019, she was the Director for the International Financial Management Association, South China Chapter and the Chair

and Chief Executive Officer of China Youth Lang Dun Education Culture and Technology in Toronto, Canada, From 2015 to 2019, she served

as the Marketing Director for the Toronto E-School, now a subsidiary of our Company, to promote and market the program in China, and served

as the Director of the International Commercial Art Designer Association (“ICAD”) in Toronto, Canada, where she managed the

program for ICAD certification. She is the Executive Chairman of the Canada-China Economic and Trade Development Policy Committee, the

Chairman of the Board of Directors for the North American Chinese Culture and Education Exchange Promotion Association, and, since March

2020, the Chairman of the Board of Directors for the Canadian Youth Education Mutual Aid Association. Ms. Zhou is pursuing her doctorate

(PhD Candidate) degree from Jinan University in China.

Dr. Simon Tang,

Vice-Chairman. Dr. Tang has served as a vice-chairman of the Company’s Board of Directors since June 21, 2021. Dr. Tang

has served as the Managing Director of WinWin Law PLLC in Houston, Texas, since 1994, and was a shareholder of Allied Law Firm and Allied

Management Consulting Group, which he founded in 1999 has offices in Hong Kong and Shenzhen, China. Dr. Tang specializes in trans-border

corporate transactions. Dr. Tang is member of the State Bar of Texas. He earned his Bachelor of Arts from the University of Utah, a Master’s

in Global Geopolitics from Brigham Young University, a Ph.D. in Economics and History from the University of California, and a Juris Doctor

from the University of Minnesota School of Law. We believe that Dr. Tang’s experience as a lawyer, and, specifically, his familiarity

with United States and Canadian laws and education policy makes him well qualified to serve on our Board of Directors.

Honorable Peter

A.S. Milliken, Director. Honorable Peter A.S. Milliken has served as an independent director since March 24, 2021 and has served on

the Board of Directors of our subsidiary Farvision Education Group, Inc. since November 20, 2020. Mr. Milliken is a Canadian lawyer and

politician. His political career began in 1988 as a member of the House of Commons and ended with his retirement in 2011, after serving

as Speaker of the House of Commons for ten years. Mr. Milliken earned his Bachelor of Arts in Political Science and Economics from Queen’s

University in Kingston, Ontario, a Bachelor of Arts and Master of Arts in Jurisprudence from the University of Oxford in England, and

a Bachelor of Laws from Dalhousie University in Halifax, Nova Scotia. We believe that Mr. Milliken’s service as a government public

official makes him well qualified to serve on our Board of Directors.

William Chai, Director.

On November 22, 2022, the Board elected Mr. William Chai as a member of the Board, and as a member and Chairman of the Audit Committee,

a member of the Nominating and Corporate Governance Committee, and a member of the Compensation Committee of the Board. Mr. Chai has over

35 years’ experience in business investment, venture capital investment, fund management, and fundraising. For the past five years,

Mr. Chai has served as one of the founding partners of Global Call to Acton Against Poverty, a nonprofit organization and global network,

which works with the United Nations and World Health Organization to support people in their struggles for justice and against poverty

and inequality. Mr. Chai is also a senior advisor at Global Innovation Centre, a global think tank. He is a director at Alpha Ring International

Ltd., a company headquartered in California that provides software, industrial engineering, and green energy optics. Mr. Chai earned his

Bachelor of Science in Electrical Engineering from National Cheng Kung University in Taiwan, a Master of Science in Systems Engineering

from Arizona State University, a EMBA degree in Business Administration from National Chengchi University in Taiwan, and an honorary doctorate

degree in Management from the International Academy of Public Welfare Corporation.

Michael Viotto,

Director. On June 14, 2023, the Board elected Mr. Michael Viotto as a member of the Board. Mr. Viotto serves as Financial Consultant

to Prime King Investment Limited (Hong Kong) as of January 1, 2023, to Present. Duties include research, product development, business

strategy and advisory services. Mr. Viotto was appointed as an independent director to the board of directors for Golden Heaven Group

Holdings LTD. (NASDAQ: GDHG) on July 28, 2022, to Present. He serves as Chairman to the Compensation Committee and Member to Nominating

and Audit Committees. Mr. Viotto served as a and the Company Chief Financial Officer to Fuse Group Holding Inc. (OTCMKTS FUST) from August

16, 2017, to November 30, 2022. Mr. Viotto was appointed as an independent director to the board of directors for Sentage Holdings Inc.

(NASDAQ: SNTG) on July 09, 2021, to Present. He serves as Chairman to the Compensation Committee and Member to Nominating and Audit Committees.

Mr. Viotto has served as an independent director, Chairman of Compensation Committee and a member of Audit Committee and Corporate Governance

and Nominating Committee of the Board of Directors to China Eco-Materials Group Co. Limited from January 20, 2020, to May 3, 2022. Mr.

Viotto has served as an Independent Director and Chairman of the Compensation Committee of the Board of Dunxin Financial Holding LTD.

(NYSE AMERICAN: DXF) from December 2017 to April 2021. Mr. Viotto served as Non-Executive Independent Director, Chairman of the Nomination

and Remuneration Committee and Member of the Audit Committee of Future World Financial Holdings, Inc. (Hong Kong Stock Exchange: 0572)

from September 2016 to January 2017. Mr. Viotto serves as President of MJV Consulting from October 2014 to Present. From May 2013 to January

2017, Mr. Viotto served as a member of the Board of Directors to Nova Lifestyle, Inc. (NASDAQ: NVFY) and as Chairman of its Nominating

and Corporate Governance Committee, and as a member of the Compensation and Audit Committees. From May 2009 to September 2014, Mr. Viotto

was the President of MJV Financial Inc. and was appointed as exclusive agent for Coface North America, an internationally recognized leader

in the Trade Finance Industry. Mr. Viotto received his Bachelor of Science Degree in Business Administration from California Polytechnic

University in Pomona, California in 1985. Mr. Viotto is selected to serve as a qualified member to the Board due to his extensive experience

in the finance industry, including business development, risk assessment and management.

The above nominees have consented

to being named in this Proxy Statement and to serve on the Board, if appointed. In the event that the nominee is not be available, the

persons named in the Proxy Card will vote for the other nominees and may vote for a substitute for the unavailable nominee.

Vote Required for Approval

At the Meeting it is proposed

that a special resolution be approved to fix the number of directors of the Company at a number to be determined by resolution of the

directors of the Company from time to time (the “Director Number Resolution”). For the Director Number Resolution to

be approved, at least two-thirds majority of the Common Shares voted on the Director Number Resolution must be cast FOR the Director Number

Resolution.

The Board has already by resolution

fixed the number of directors of the Company at five (5).

Upon approval of the Director

Number Resolution, shareholders will be asked to vote for or withhold from voting, the proposed director nominees set forth above.

THE BOARD RECOMMENDS THAT YOU VOTE FOR THE

DIRECTOR NUMBER RESOLUTION AND THE APPOINTMENT OF NOMINEES IDENTIFIED ABOVE AS DIRECTORS TO SERVE UNTIL THEIR SUCCESSORS ARE APPOINTED

AND DULY QUALIFIED, OR UNTIL SUCH DIRECTOR’S EARLIER RESIGNATION OR REMOVAL. UNLESS DIRECTED TO THE CONTRARY, THE COMMON SHARES

REPRESENTED BY VALID PROXIES WILL BE VOTED FOR THE DIRECTOR NUMBER RESOLUTION AND THE APPOINTMENT OF SAID NOMINEES.

PROPOSAL NO. 2

AUTHORIZE THE BOARD OF DIRECTORS TO EFFECT A

SHARE CONSOLIDATION

Purpose and Background of the Share Consolidation

To consider and approve a

proposal, to consolidate the Company’s shares on the basis of fifteen (15) pre-consolidation Common Shares for one (1) post-consolidation

Common Share, or such other consolidation ratio as may be approved by the Directors on or prior to the Meeting, which aims to increase

the market price of individual shares and reduce the total number of outstanding shares (the “Share Consolidation”)

.

On October 31, 2023, the Board

approved by written resolution the proposal authorizing the Share Consolidation because the Board believes that effecting the Share

Consolidation could, in some circumstances, be an effective means of maintaining, or if necessary, regaining, compliance with the minimum

trading price requirement for continued listing of our Common Shares on The Nasdaq Capital Market.

On June 14, 2023, the Company

received a letter from The Nasdaq Stock Market regarding the Company’s failure to comply with Nasdaq Continued Listing Rule (“Rules”)

5550(a)(2) (the “Price Rule”), which requires listed securities to maintain a minimum bid price of $1.00 per share. A failure

to comply with Rule 5550(a)(2) exists when listed securities fail to maintain a closing bid price of at least $1.00 per share for 30 consecutive

business days.

Under Rule 5810(c)(3)(A),

the Company was provided a compliance period of 180 calendar days, until December 11, 2023, to regain compliance. If at any time during

this 180-day period the closing bid price of the Company’s securities is at least $1.00 for a minimum of ten consecutive business

days, the Company’s compliance will be regained.

To regain compliance, the

bid price of the Company’s Common Shares must close at or above $1.00 per share for a minimum of ten consecutive business days at

any time during the second 180-day compliance period. The Company has been monitoring the closing bid price of its Common Shares and now

considers effecting the Share Consolidation.

If the Share Consolidation

successfully increases the per share price of our Common Shares, the Board believes this Share Consolidation will enable us to maintain

The Nasdaq Capital Market listing of our Common Shares.

The Share Consolidation is

conditional upon the board of directors of the Company determining, confirming and approving that the Share Consolidation is an effective

means of maintaining, or if necessary, regaining, compliance with the minimum trading price requirement for continued listing of our Common

Shares on The Nasdaq Capital Market.

The conditionality of Proposal

No. 2 and the Share Consolidation will expire on June 8, 2024, 2023, and Proposal No. 2 and the Share Consolidation shall not be effective

after this date if the board of directors of the Company has not determined, confirmed and approved that the Share Consolidation is an

effective means of maintaining, or if necessary, regaining, compliance with the minimum trading price requirement for continued listing

of our Common Shares on The Nasdaq Capital Market.

If we fail to regain compliance

by December 11, 2023, and are unable to obtain an additional 180 calendar days to regain compliance with the $1.00 per share minimum required

for continued listing on The Nasdaq Capital Market pursuant to Price Rule, our Common Shares will be subject to delisting by the Nasdaq

Stock Market. In the event that our Common Shares are delisted by the Nasdaq Stock Market, our Common Shares would likely trade on the

over-the-counter market. If our stocks were to trade on the over-the-counter market, selling our Common Shares could be more difficult

because smaller quantities of stocks would likely be bought and sold, and transactions could be delayed. In addition, in the event our

Common Shares are delisted, broker-dealers have certain regulatory burdens imposed upon them, which may discourage broker-dealers from

effecting transactions in our Common Shares, further limiting the liquidity of our Common Shares. These factors could result in lower

prices and larger spreads in the bid and ask prices for Common Shares. Such potential delisting from Nasdaq and continued or further declines

in our share price could also greatly impair our ability to raise additional necessary capital through equity or debt financing, including

short-term debt financing provided by foreign lenders.

In light of the factors mentioned

above, our Board approved this proposal as a potential means of maintaining the price of our Common Shares above $1.00 per share in compliance

with Price Rule.

Potential Affected Investor Interest

In approving this proposal,

the Board considered that the Company’s Common Shares may not appeal to brokerage firms that are reluctant to recommend lower priced

securities to their clients. Investors may also be dissuaded from purchasing lower priced stocks because the brokerage commissions, as

a percentage of the total transaction, tend to be higher for such stocks. Moreover, the analysts at many brokerage firms do not monitor

the trading activity or otherwise provide coverage of lower priced stocks.

By approving this proposal,

shareholders will approve the Board to effect a Share Consolidation which it deems in the best interests of the Company and its shareholders.

Principal Effects of the Share Consolidation

If implemented, the Share

Consolidation will be effected simultaneously for all issued and outstanding shares of Common Shares. The Share Consolidation will affect

all of our shareholders uniformly and will not affect any shareholder’s percentage ownership interests in the Company, except to

the extent that the Share Consolidation would otherwise result in any of our shareholders owning a fractional share (in which case the

fractional amount will be rounded up to the next whole share). After the Share Consolidation, the shares of our Common Shares will have

the same voting rights and rights to dividends and distributions and will be identical in all other respects to our Common Shares now

authorized. Common Shares issued pursuant to the Share Consolidation will remain fully paid and non-assessable. The Share Consolidation

will not affect the Company continuing to be subject to the periodic reporting requirements of the Exchange Act. The Share Consolidation

is not intended to be, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 under the Exchange

Act.

The Share Consolidation may

result in some shareholders owning “odd-lots” of less than 100 shares of our Common Shares. Brokerage commissions and other

costs of transactions in odd-lots are generally higher than the costs of transactions in “round-lots” of even multiples of

100 shares.

Following the effectiveness

of such Share Consolidation approved by the shareholders and implementation by the Board, current shareholders will hold fewer shares

of Common Shares, but the rights and ownership percentages will remain the same.

IF THIS PROPOSAL IS NOT APPROVED,

WE MAY BE UNABLE TO MAINTAIN THE LISTING OF OUR COMMON SHARES ON THE NASDAQ STOCK MARKET, WHICH COULD ADVERSELY AFFECT THE LIQUIDITY AND

MARKETABILITY OF OUR COMMON SHARES.

Fractional Shares

No fractional shares will

be issued in connection with the Share Consolidation. Instead, we will issue one full share of the Common Shares after Share Consolidation

to any shareholder who would have been entitled to receive a fractional share as a result of the Share Consolidation. Each common shareholder

will hold the same percentage of the outstanding Common Shares immediately following the Share Consolidation as that shareholder did immediately

prior to the Share Consolidation, except for minor adjustments due to the additional net share fractions that will need to be issued as

a result of the treatment of fractional shares.

Risks Associated with the Share Consolidation

There are risks associated

with the Share Consolidation. Shareholders should note that the effect of the Share Consolidation, if any, upon the market price for our

Common Shares cannot be accurately predicted. In particular, we cannot assure you that prices for shares of our Common Shares after the

Share Consolidation will be the number of times equals exactly to the ratio multiplied by the prices for shares of our Common Shares

immediately prior to the Share Consolidation. Furthermore, even if the market price of our Common Shares does rise following the Share

Consolidation, we cannot assure you that the market price of our Common Shares immediately after the proposed Share Consolidation will

be maintained for any period of time. Even if an increased per-share price can be maintained, the Share Consolidation may not achieve

the desired results that have been outlined above. Moreover, because some investors may view the Share Consolidation negatively, we cannot

assure you that the Share Consolidation will not adversely impact the market price of our Common Shares.

The market price of our Common

Shares will also be based on our performance and other factors, some of which are unrelated to the Share Consolidation or the number of

shares outstanding. If the Share Consolidation is effected and the market price of our Common Shares declines, the percentage declines

as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of a Share

Consolidation. The total market capitalization of our Common Shares after implementation of the Share Consolidation, when and if implemented,

may also be lower than the total market capitalization before the Share Consolidation. Furthermore, the liquidity of our Common Shares

could be adversely affected by the reduced number of shares that would be outstanding after the Share Consolidation.

While we believe that the

Share Consolidation will be sufficient to maintain our listing on The Nasdaq Stock Market, it is possible that, even if the Share Consolidation

results in a closing price for our Common Shares that exceeds $1.00 per share, we may not be able to continue to satisfy other criteria

for continued listing of our Common Shares on The Nasdaq Stock Market. Although we believe that we will continue satisfying all of the

other continued listing criteria, we cannot assure you that this will be the case.

Shareholders will be asked at the Meeting to consider

and, if deemed advisable, to pass, with or without variation, the following special resolution (the "Share Consolidation Resolution"):

"BE IT RESOLVED AS A SPECIAL RESOLUTION THAT:

| 1. | Subject to acceptance by Nasdaq and the requisite approval of the shareholders of the Company, the Company

is hereby authorized to consolidate (the “Consolidation”) the issued and outstanding Common Shares of the Company on

the basis of fifteen (15) pre-Consolidation Common Shares for one (1) post-Consolidation Common Share of the Company or such other

ratio as the Company may require, provided that no shareholder of the Company (including any beneficial shareholder) shall be entitled

to receive a fraction of a post-Consolidation common share and any shareholder who would have been entitled to receive a fractional share

post-Consolidation will receive a full share; |

| 2. | notwithstanding that this special resolution has been passed by the shareholders of the Company, the Board

of Directors of the Company are hereby authorized and empowered without further notice to, or approval of, the shareholders to: |

| a. | modify,

vary or amend such terms and conditions in respect of the Consolidation as may be required by the regulatory authorities having jurisdiction

or as the Board of Directors may in its sole discretion deem in the best interests of the Company; or |

| b. | determine

not to proceed with the Consolidation at any time prior to the filing of the articles of amendment giving effect to the Consolidation. |

| 3. | the Board of Directors of the Company may, at its sole discretion, revoke this resolution before it is

acted upon without further approval or authorization of the shareholders of the Company; |

| 4. | the Effective Date of the Consolidation shall be the date shown in the certificate of amendment issued

under the Business Corporations Act (Ontario) or such other date indicated in the articles of amendment; and |

| 5. | any officer or director of the Company is hereby authorized and directed for on behalf of the Company

to execute and deliver all such documents and to do all such other acts and things as he may determine to be necessary or advisable to

give effect to this special resolution including, without limitation, to determine the timing for delivery and effect the delivery of

articles of amendment in the prescribed form to the registrar appointed under the Business Corporations Act (Ontario), the execution

of any such document or the doing of any such other act or thing being conclusive evidence of such determination. |

Vote Required to Approve Proposal No. 2

For the Share Consolidation Resolution to be approved,

at least 2/3 majority of the Common Shares voted on the Share Consolidation Resolution must be cast FOR the Share Consolidation Resolution.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS

VOTE IN FAVOUR OF THE NAME CHANGE RESOLUTION. UNLESS THE SHAREHOLDER HAS SPECIFICALLY INSTRUCTED IN THE FORM OF PROXY THAT THE COMMON

SHARES REPRESENTED BY SUCH PROXY ARE TO BE VOTED OTHERWISE, THE PERSONS NAMED IN THE ACCOMPANYING PROXY WILL VOTE FOR THE APPROVAL OF

THE NAME CHANGE RESOLUTION.

WE RECOMMEND A VOTE “FOR” THE PROPOSAL

TO AUTHORIZE THE BOARD OF DIRECTORS TO EFFECT THE SHARE CONSOLIDATION

PROPOSAL NO. 3

name

change proposal

Name Change

To consider and approve a

proposal, as a special resolution, the change of our name from “Visionary Education Technology Holdings Group Inc.” to “Visionary

Holdings Inc.”

The Company has notified Nasdaq of the proposed

change of name. The Board may determine not to implement the name change at any time after the Meeting and after receipt of necessary

regulatory approvals, but prior to the issuance of a certificate of amendment, without further action on the part of the Shareholders.

Following the name change, share certificates of "Visionary Education Technology Holdings Group Inc." will remain valid and

Shareholders will not be required to surrender and exchange their share certificates for share certificates with the new name of the Company.

The name change will not, by itself, affect any of the rights of Shareholders.

Shareholders will be asked at the Meeting to consider

and, if deemed advisable, to pass, with or without variation, the following special resolution (the "Name Change Resolution"):

"BE IT RESOLVED AS A SPECIAL RESOLUTION THAT:

| 1. | The Company is authorized to file articles of amendment pursuant to the Business Corporations Act (Ontario)

(the "OBCA") to change its name from " Visionary Education Technology Holdings Group Inc." to " Visionary

Holdings Inc.", or such other name that the board of directors of the Company (the "Board") deems appropriate and

as may be approved by the regulatory authorities (including Ontario Securities Commission), if the Board considers it to be in

the best interests of the Company to implement such a name change; |

| 2. | any director or officer of the Company be and is hereby authorized and directed to execute and deliver,

or cause to be delivered, articles of amendment pursuant to the OBCA, and to do and perform all such acts and things, sign such documents

and take all such other steps as, in the opinion of such director or officer, may be considered necessary or desirable to carry out the

purpose and intent of this resolution; |

| 3. | notwithstanding that this resolution has been duly passed by the shareholders of the Company, the Board

is hereby authorized and empowered, if it decides not to proceed with the Name Change Resolution, to revoke this resolution in whole or

in part at any time prior to it being given effect without further notice to, or approval of, the shareholders of the Company; and |

| 4. | any director or officer of the Company be and the same is hereby authorized and directed for and in the

name of and on behalf of the Company to execute or cause to be executed, whether under corporate seal of the Company or otherwise, and

to deliver or cause to be delivered all such documents, and to do or cause to be done all such acts and things, as in the opinion of such

director or officer may be necessary or desirable in order to carry out the terms of this resolution, such determination to be conclusively

evidenced by the execution and delivery of such documents or the doing of any such act or thing.” |

Vote Required to Approve Proposal No. 3

For the Name Change Resolution to be approved,

at least 2/3 majority of the Common Shares voted on the Name Change Resolution must be cast FOR the Name Change Resolution.

THE BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS

VOTE IN FAVOUR OF THE NAME CHANGE RESOLUTION. UNLESS THE SHAREHOLDER HAS SPECIFICALLY INSTRUCTED IN THE FORM OF PROXY THAT THE COMMON

SHARES REPRESENTED BY SUCH PROXY ARE TO BE VOTED OTHERWISE, THE PERSONS NAMED IN THE ACCOMPANYING PROXY WILL VOTE FOR THE APPROVAL OF

THE NAME CHANGE RESOLUTION.

WE RECOMMEND A VOTE “FOR” THE PROPOSAL

TO APPROVE THE NAME CHANGE PROPOSAL

PROPOSAL NO. 4

APPROVAL AND RATIFICATION OF THE APPOINTMENT

OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To consider and approve a

proposal, that the appointment of MNP LLP as the independent registered public accounting firm for the fiscal year ending March 31, 2024,

be approved and ratified. We refer to Proposal No. 4 as the “Ratification of Auditors Proposal.”

The Audit Committee of the

Board has appointed MNP LLP as the independent registered public accounting firm of the Company for the fiscal year ending March 31, 2024,

subject to approval and ratification by the Shareholders.

If the Shareholders do not

approve and ratify the appointment of MNP LLP, the selection of another independent registered public accounting firm will be considered

by the Audit Committee and the Board.

Vote Required to Approve Proposal No. 4

Shareholders will be asked

to vote for, or withhold from voting, the approval and ratification of MNP LLP as our independent registered public accounting firm.

THE BOARD RECOMMENDS THAT YOU VOTE FOR THE

APPROVAL AND RATIFICATION OF THE APPOINTMENT OF MNP LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE FISCAL

YEAR ENDING MARCH 31, 2024. UNLESS DIRECTED TO THE CONTRARY, THE COMMON SHARES REPRESENTED BY VALID PROXIES WILL BE VOTED FOR THE APPROVAL

AND RATIFICATION OF THE APPOINTMENT OF MNP LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE FISCAL YEAR

ENDING MARCH 31, 2024.

GENERAL

At the date of this Proxy

Statement, the Board has no knowledge of any business which has been presented for consideration at the Annual Shareholders Meeting other

than that described above.

Present officers, directors

and other employees of the Company may solicit proxies by telephone, telecopy, telegram or mail, or by meetings with Shareholders or their

representatives. The Company will reimburse brokers, banks or other custodians, nominees and fiduciaries for their charges and expenses

in forwarding proxy materials to beneficial owners. All expenses of solicitation of proxies will be borne by the Company.

By Order of the Board of Directors,

/s/ Fan Zhou

Fan Zhou

Chief Executive Officer

Dated: November 6, 2023

Exhibit 99.2

Exhibit 99.3

GV to Hold Annual Shareholder Meeting on December

11, 2023

TORONTO, Nov. 6, 2023 /PRNewswire/ -- Visionary

Education Technology Holdings Group Inc. (the "Company") (NASDAQ: GV), a private education provider with technology of artificial

intelligence and life science on the cutting edge, today announced that it will hold an annual shareholder meeting of the Company (the

"Annual Meeting") at the offices of the Company, located at 105 Moatfield Dr. Unit 1003, Toronto, Ontario, Canada M3B 0A2, at

10:00 a.m., local time, for the purposes of considering and, if thought fit, passing each of the proposed resolutions (“Proposed

Resolutions”)as defined and set forth in the notice of the Annual Meeting. The board of directors of the Company fully supports

the Proposed Resolutions.

The Company has filed its annual report on Form

20-F, including its audited financial statements, for the fiscal year ended March 31, 2022, with the U.S. Securities and Exchange Commission

(the "SEC"). The Company's annual report on Form 20-F can be accessed on the Company's website at https://ir.visiongroupca.com

and on the SEC's website at http://www.sec.gov.

About Visionary Education Technology Holdings

Group Inc.

Visionary Education Technology Holdings Group

Inc., headquartered in Toronto, Canada, is a private education provider located in Canada, with subsidiaries in Canada and market partners

in China, that offers high-quality education resources to students around the globe. The Company aims to provide access to secondary,

college, undergraduate and graduate and vocational education to students in Canada through technological innovation so that more people

can learn, grow and succeed to their full potential. As a fully integrated provider of educational programs and services in Canada, the

Company has been serving and will continue to serve both Canadian and international students. For more information, visit the Company's

website at https://ir.visiongroupca.com/.

Forward-Looking Statements

All statements other than statements of historical

fact in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties

and are based on the Company's current expectations and projections about future events that the Company believes may affect its financial

condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words

or phrases such as "believes," "expects," "anticipates," "estimates," "intends," "would,"

"continue," "should," "may," or similar expressions. The Company undertakes no obligation to update or revise

publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except

as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable,

it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ

materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company's

registration statement and in its other filings with the SEC.

For more information, please contact:

Visionary Education Technology Holdings Group Inc.

Investor Relations Department

Email: ir@farvision.ca

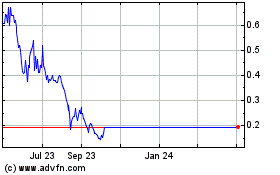

Visionary Education Tech... (NASDAQ:VEDU)

Historical Stock Chart

From Nov 2024 to Dec 2024

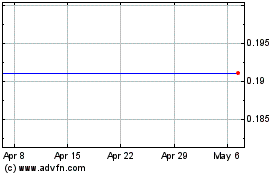

Visionary Education Tech... (NASDAQ:VEDU)

Historical Stock Chart

From Dec 2023 to Dec 2024