Form 424B3 - Prospectus [Rule 424(b)(3)]

08 July 2023 - 6:36AM

Edgar (US Regulatory)

Filed

Pursuant to Rule 424(b)(3)

Registration No. 333-266056

PROSPECTUS SUPPLEMENT DATED

JULY 7, 2023

TO PROSPECTUS DATED MAY

9, 2023

VERTEX ENERGY, INC.

This

Prospectus Supplement, dated July 7, 2023, supplements that certain Prospectus filed with the Securities and Exchange Commission (the

“SEC”) and dated May 9, 2023 (the “Prospectus”) pursuant to Registration Statement No. 333-266056

and should be read in conjunction with the Prospectus. Certain capitalized terms used herein are defined in the Prospectus.

SELLING STOCKHOLDERS

The following

updates the table, to account for a transfer of shares listed in such table that Vertex Energy, Inc. (the “Company”),

is aware of since the date of the Prospectus. Effective on July 1, 2023, in a transaction exempt from the registration requirements

of the Securities Act of 1933, as amended (the “Securities Act”), Highbridge Tactical Credit Master Fund, L.P. (“Highbridge

Master”), transferred (a) Initial Warrants to purchase an aggregate of 100,465 shares of common stock of the Company, and (b)

Additional Warrants to purchase 9,135 shares of common stock of the Company, which it held, in an in-kind transfer to Highbridge Tactical

Credit Institutional Fund, Ltd. (“Highbridge Institutional”). The table under the section entitled “Selling

Stockholders” of the Prospectus, therefore, is amended by: (i) reducing the number of shares underlying warrants Initial Warrants

and Additional Warrants held by Highbridge Master; and (ii) including Highbridge Institutional as a selling stockholder.

| |

|

Number of Shares of

Common Stock Beneficially

Owned Prior to this

Offering (1)(2) |

|

Number of

Shares of

Common

Stock

Being

Offered |

|

Beneficial Ownership of

Common Stock After this

Offering (2) |

|

| Name of Selling Stockholders |

|

Number |

|

Percentage |

|

|

Number |

|

Percentage |

|

| Highbridge Tactical Credit Master Fund, L.P. |

(d) |

430,300 |

|

* |

|

430,300 |

(6) |

— |

|

— |

|

| Highbridge Tactical Credit Institutional Fund, Ltd. |

(f) |

109,600 |

|

* |

|

109,600 |

(11) |

— |

|

— |

|

* Less than 1%.

(1) “Beneficial ownership” means that a person, directly

or indirectly, has or shares voting or investment power with respect to a security or has the right to acquire such power within 60 days.

The number of shares beneficially owned is as of July 1, 2023, and the percentage is based upon 93,236,563 shares of our common stock

outstanding as of July 1, 2023.

(2) Assumes for purposes of the “Beneficial Ownership of Common

Stock After this Offering” that (i) all of the shares of common stock to be registered by the registration statement of which

this prospectus is a part are sold in this offering and (ii) the selling stockholders do not acquire additional shares of our common

stock after the date of this prospectus and prior to completion of this offering. The registration of this offering of shares does

not necessarily mean that the selling stockholders will sell all or any portion of the shares covered by this prospectus.

(6) Includes 394,435 Initial Warrants and 35,865 Additional Warrants.

(11) Includes 100,465 Initial Warrants and 9,135 Additional Warrants.

(d) Highbridge Capital Management, LLC is the trading manager of Highbridge

Tactical Credit Master Fund, L.P. Highbridge Tactical Credit Master Fund, L.P. disclaims beneficial ownership over these securities. The

address of Highbridge Capital Management, LLC is 277 Park Avenue, 23rd Floor, New York, NY 10172, and the address of Highbridge Tactical

Credit Master Fund, L.P. is c/o Maples Corporate Services Limited #309 Ugland House, South Church Street, George Town, Grand Cayman KY1-1104,

Cayman Islands.

(f) Highbridge Capital Management, LLC is the trading manager of Highbridge

Tactical Credit Institutional Fund, Ltd. Highbridge Tactical Credit Institutional Fund, Ltd. disclaims beneficial ownership over these

securities. The address of Highbridge Capital Management, LLC is 277 Park Avenue, 23rd Floor, New York, NY 10172, and the address of Highbridge

Tactical Credit Master Fund, L.P. is c/o Maples Corporate Services Limited #309 Ugland House, South Church Street, George Town, Grand

Cayman KY1-1104, Cayman Islands.

In addition,

the selling stockholders listed in the Prospectus may have sold or transferred, in transactions exempt from the registration requirements

of the Securities Act some or all of their shares of common stock since the date on which the information in the Prospectus is presented.

Information about the selling stockholders may change over time. To the extent required, any changed information will be set forth in

prospectus supplements.

Please

insert this Prospectus Supplement into your Prospectus and retain both this Prospectus Supplement and the Prospectus for future reference.

If you would like to receive a copy of the Prospectus, as supplemented, please write to Vertex Energy, Inc. at 1331 Gemini Street, Suite

250, Houston, Texas 77058.

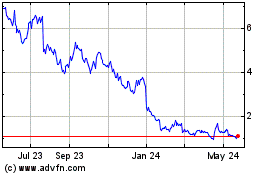

Vertex Energy (NASDAQ:VTNR)

Historical Stock Chart

From Apr 2024 to May 2024

Vertex Energy (NASDAQ:VTNR)

Historical Stock Chart

From May 2023 to May 2024