As filed with the Securities and Exchange Commission

on December 23, 2024

Registration No. 333 -

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form F-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

WEARABLE DEVICES LTD.

(Exact name of registrant as specified in its

charter)

| State of Israel |

|

3873 |

|

Not Applicable |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

| 5 Ha-Tnufa St. |

|

Mudra Wearable, Inc. |

| Yokne’am Illit, 2066736 Israel |

|

24A Trolley Square #2203 |

| Tel: +972.4.6185670 |

|

Wilmington, DE 19806 |

| (Address, including zip code, and telephone number, |

|

(Name, address, including zip code, and telephone |

including area code, of registrant’s principal

executive offices) |

|

number, including area code, of agent for service) |

Copies to:

|

Oded Har-Even, Esq.

Howard Berkenblit, Esq.

Eric Victorson, Esq.

Sullivan & Worcester LLP

1251 Avenue of the Americas

New York, NY 10020

Tel: 212.660.3000 |

|

Reut Alfiah, Adv.

Gal Cohen, Adv.

Sullivan & Worcester

Tel-Aviv (Har-Even & Co.)

HaArba’a Towers

28 HaArba’a St.

North Tower, 35th Floor

Tel-Aviv, Israel 6473925

T +972.74.758.0480 |

|

Leslie Marlow, Esq.

Patrick Egan, Esq.

Melissa Murawsky, Esq.

Blank Rome LLP

1271 Avenue of the Americas

New York, New York 10020

Tel: (212) 885-5000 |

Approximate date of commencement of proposed

sale to the public: As soon as practicable after the effective date hereof.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following

box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards † provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☒

| † |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The information in

this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the

Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer

to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

DECEMBER 23, 2024 |

Up to Ordinary

Shares

Warrants to purchase

up to Ordinary Shares

Up to Ordinary

Shares underlying such Warrants

Pre-Funded Warrants

to purchase up to Ordinary Shares

Up to Ordinary

Shares underlying such Pre-Funded Warrants

Wearable Devices Ltd.

We are offering on a “best

efforts” basis up to ordinary shares, no par value per share, or the Ordinary Shares, together with

accompanying warrants to purchase up to Ordinary Shares, or the Warrants, together with the Ordinary

Shares, based on an assumed combined public offering price of $

per Ordinary Share and accompanying Warrant (the last reported sale price of our Ordinary Shares on The Nasdaq Capital Market, or Nasdaq,

on , ). The actual offering price per Ordinary

Share and accompanying Warrant will be negotiated between us and the investors, in consultation

with the placement agent based on, among other things, the trading price of our Ordinary Shares prior to the offering and may be at a

discount to the current market price. Therefore, the assumed public offering price used throughout this prospectus may not be indicative

of the final offering price.

The

assumed public offering price for each Ordinary Share and accompanying Warrant is $ (the last reported

sale price of our Ordinary Shares on the Nasdaq on , ).

Each Warrant will have an exercise price per share of $ , will be immediately exercisable beginning on the original issuance date, or

the Issuance Date, and will expire on the five-year anniversary of the Issuance Date. See “Description of Securities We Are

Offering” for more information related to the Warrants.

We are also offering those

purchasers whose purchase of Ordinary Shares in this offering would otherwise result in the purchaser, together with its affiliates and

certain related parties, beneficially owning more than 4.99% (or, at the election of such purchaser, 9.99%) of our outstanding Ordinary

Shares immediately following the consummation of this offering, Pre-Funded warrants, or Pre-Funded Warrants, in lieu of Ordinary Shares.

Each Pre-Funded Warrant will be immediately exercisable for one Ordinary Share and may be exercised at any time until all of the Pre-Funded

Warrants are exercised in full. The purchase price of each Pre-Funded Warrant will equal the price per share at which the Ordinary Shares

are being sold to the public in this offering, minus $0.0001, and the exercise price of each Pre-Funded Warrant will be $0.0001 per share.

For each Pre-Funded Warrant we sell, the number of Ordinary Shares we are offering will be decreased on a one-for-one basis. This offering

also relates to the Ordinary Shares issuable upon exercise of the Warrants and any Pre-Funded Warrants sold in this offering.

The Ordinary Shares, Warrants,

and Pre-Funded Warrants are collectively referred to herein as the “Securities.”

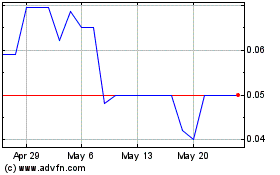

Our Ordinary Shares and certain

previously issued warrants, or the IPO Warrants, are listed on Nasdaq under the symbols “WLDS” and “WLDSW,” respectively.

On December 20, 2024, the last reported sale price of our Ordinary Shares and IPO Warrants on Nasdaq was $1.87 per share and $0.29 per

IPO Warrant, respectively.

The Ordinary Shares

and accompanying Warrants will be issued separately and will be immediately separable upon issuance but can only be purchased together

in this offering.

There is no established public

trading market for the Warrants and the Pre-Funded Warrants, and we do not expect a market to develop. In addition, we do not intend to

apply for the listing of the Warrants and Pre-Funded Warrants on any national securities exchange or other nationally recognized trading

system. Without an active trading market, the liquidity of the Warrants and the Pre-Funded Warrants will be limited.

We are an emerging growth

company, as defined in the Jumpstart Our Business Startups Act of 2012 and a “foreign private issuer”, as defined in Rule

405 under the U.S. Securities Act of 1933, as amended, or the Securities Act, and are eligible for reduced public company reporting requirements.

Unless otherwise noted and

other than in our historical financial statements and the notes thereto incorporated by reference herein, the share and per share information

in this prospectus supplement reflects the 1-for-20 reverse share split reverse share split, or the Reverse Share Split, of the outstanding

Ordinary Shares of the Company. The Reverse Share Split became effective on October 10, 2024.

Investing in our Securities

involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus for a discussion

of information that should be considered in connection with an investment in our Securities, as well as the risks described under the

heading “Item 3 Key Information – D. Risk Factors” in our Annual Report on Form 20-F for the year ended December 31,

2023, or the 2023 Annual Report, which we filed with the Securities and Exchange Commission on March 15, 2024, and in other documents

incorporated by reference into this prospectus.

Neither the Securities

and Exchange Commission, or the SEC, nor any state or other foreign securities commission has approved nor disapproved these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have engaged A.G.P./Alliance

Global Partners, or A.G.P., or the placement agent, as our placement agent, to use its best efforts to solicit offers to purchase our

Securities in this offering. The placement agent has no obligation to purchase any securities from us or to arrange for the purchase or

sale of any specific number or dollar amount of the securities. Because there is no minimum offering amount required as a condition to

closing in this offering the actual public offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable

and may be substantially less than the total maximum offering amounts set forth in this prospectus. We have agreed to pay the placement

agent the placement agent fees set forth in the table below. See “Plan of Distribution” in this prospectus for more

information.

The securities will be offered

at a fixed price and are expected to be issued in a single closing. The offering will terminate on February 28, 2025, unless the offering

is completed sooner or unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date.

We expect to enter into a securities purchase agreement relating to the offering with those investors that choose to enter into such an

agreement on the day that the registration statement of which this prospectus forms a part is declared effective and that the closing

of the offering will end one trading day after we first enter into a securities purchase agreement relating to the offering. The offering

will settle delivery versus payment, or DVP, receipt versus payment, or RVP, (on the closing date we will issue the Ordinary Shares and

accompanying Warrants directly to the account(s) at the placement agent identified by each purchaser; upon receipt of such shares, the

placement agent shall promptly electronically deliver such shares to the applicable purchaser, and payment therefor shall be made by the

placement agent (or its clearing firm) by wire transfer to us).

We and the placement agent

have not made any arrangements to place investor funds in an escrow account or trust account since the placement agent will not receive

investor funds in connection with the sale of the new securities offered hereunder. As stated above, because this is a best efforts offering,

the placement agent does not have an obligation to purchase any securities and, as a result, there is a possibility that we may not be

able to sell the securities. There is no minimum offering requirement as a condition of closing of this offering. Because there is no

minimum offering amount required as a condition to closing this offering, we may sell fewer than all of the securities offered hereby,

which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the

event that we do not sell an amount of securities sufficient to pursue our business goals described in this prospectus. In addition, because

there is no escrow account and no minimum offering amount, investors could be in a position where they have invested in our company, but

we are unable to fulfill all of our contemplated objectives due to a lack of interest in this offering. Further, any proceeds from the

sale of Securities offered by us will be available for immediate use, despite uncertainty about whether we would be able to use such funds

to effectively implement our business plan. See the section entitled “Risk Factors – Risks Related to this Offering and

the Ownership of the Ordinary Shares and Pre-Funded Warrants” for more information.

| |

|

Per

Ordinary

Share and

Accompanying

Warrant |

|

|

Per Pre-

Funded

Warrant and

Accompanying

Warrant |

|

|

Total |

|

| Public offering price |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Placement agent fees(1) |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| Proceeds to us (before expenses)(2) |

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

| (1) |

Represents a cash fee equal to 7% of the aggregate purchase price paid by investors in this offering provided, This does not include a management fee equal to 1.00% of the gross proceeds of the offering, to which the placement agent is entitled. We have also agreed to reimburse the placement agent for certain of their offering-related expenses and pay the placement agent a non-accountable expense allowance. See “Plan of Distribution” beginning on page 23 of this prospectus for a description of the compensation to be received by the placement agent. |

| (2) |

Does not give any effect to any exercise of the Warrants and/or Pre-Funded Warrants being issued in this offering. |

Delivery of the securities

to the purchasers being offered pursuant to this prospectus is expected to be made on or about

, 2025, subject to customary closing conditions.

Sole Placement Agent

A.G.P.

The date of this prospectus is ,

2025

TABLE OF CONTENTS

You should rely only on

the information contained in this prospectus. We have not, and the placement agent has not, authorized anyone to provide you with any

information other than that contained in this prospectus. We take no responsibility for and can provide no assurance as to the reliability

of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our Securities.

The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus

or any sale of our Securities. Our business, financial condition, results of operations and prospects may have changed since that date.

We are not, and the placement agent are not, making an offer of these securities in any jurisdiction where the offer is not permitted.

For investors outside of the

United States: Neither we nor the placement agent have done anything that would permit this offering or possession or distribution of

this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform

yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In this prospectus, “we,”

“us,” “our,” the “Company” and “Wearable Devices” refer to Wearable Devices Ltd. “Mudra”

is a registered trademark of Wearable Devices Ltd.

All historical quantities

of Ordinary Shares and per share data presented herein give retroactive effect to our 1-for-20 reverse share split effected prior to the

start of trading on Nasdaq on October 10, 2024. Further, on September 26, 2024, the par value of our Ordinary Shares was changed from

NIS 0.01 par value per share to no par value per share.

Certain figures

included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not

be an arithmetic aggregation of the figures that precede them.

All trademarks

or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and

trade names in this prospectus and the documents incorporated herein by reference are referred to without the ® and ™ symbols,

but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under

applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply

a relationship with, or endorsement or sponsorship of us by, any other companies.

Our reporting currency

and functional currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references in this prospectus

to “NIS” are to New Israeli Shekels, and references to “dollars” or “$” mean U.S. dollars.

This prospectus and the documents

incorporated herein by reference include statistical, market and industry data and forecasts which we obtained from publicly available

information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry

publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do

not guarantee the accuracy or completeness of the information.

We report in accordance with

generally accepted accounting principles in the United States, or U.S. GAAP.

PROSPECTUS

SUMMARY

This summary highlights

information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing

in our Securities. Before you decide to invest in our Securities, you should read the entire prospectus carefully, including the “Risk

Factors” section and the financial statements and related notes thereto and the other information incorporated by reference herein.

Our Company

We are a growth company developing

a non-invasive neural input interface in the form of a wearable wristband for controlling digital devices using subtle finger gestures

and hand movements. Since our technology was introduced to the market in 2014, we have been working with both B2B and B2C customers as

part of our push-pull strategy. We are now in the transition phase from research and development to commercialization of our technology

into B2B products. At the same time, starting in December 2023, we have commenced shipment of the “Mudra Band”, our first

B2C consumer product, and aftermarket accessory band for Apple Watch that enables gesture control across Apple ecosystem devices such

as iPhone, Mac computer, Apple TV, and iPad, inter alia. In September 2024, we launched the Mudra Link, a universal gesture control wearable

wristband. The Mudra Link is open for pre-orders and is expected to ship in the first quarter of 2025.

Our company’s vision

is to create a world in which the user’s hand becomes a universal input device for touchlessly interacting with technology. We believe

that our technology is setting the standard input interface for the Metaverse. We intend to transform interaction and control of digital

devices to be as natural and intuitive as real-life experiences. We imagine a future in which humans can share skills, thoughts, emotions,

and movements with each other and with computers, using wearable interfaces and devices. We believe that neural-based interfaces will

become as ubiquitous to interact with wearable computing and digital devices in the near future as the touchscreen is a universal input

method for smartphones.

Combining our own proprietary

sensors and AI algorithms into a stylish wristband, our Mudra platform enables users to control digital devices through subtle finger

movements and hand gestures, without physical touch or contact. These digital devices include consumer electronics, smart watches, smartphones,

augmented reality, or AR, glasses, virtual reality, or VR, headsets, televisions, personal computers and laptop computers, drones, robots,

etc.

Mudra Development Kit, originally

named Mudra Inspire, our B2B development kit product, started selling to B2B customers in 2018 as the first point of business engagement

and contributed to our early-stage revenues. Our early-stage revenues are composed of sales of our Mudra Inspire and from pilot transactions

with several B2B customers. Towards the end of 2023, we commenced the shipments of the “Mudra Band”, our first B2C consumer

product and since the fourth quarter of 2023 we have shipped over one thousand Mudra Bands. In September 2024, we launched the Mudra Link,

a universal gesture control wearable wristband. The Mudra Link is open for pre-orders and is expected to ship in the first quarter of

2025. In 2023 and 2022, we had revenues of $82 thousand and $45 thousand, respectively, and comprehensive and net loss of $7.8 million

and $6.5 million, respectively. For the six months ended June 30, 2024 and June 30, 2023, we had revenues of $394 thousand and $12 thousand,

respectively, and comprehensive and net loss of $4.2 million and $3.9 million, respectively.

Over 100 companies have purchased

our Mudra Inspire development kit, 30 of which are multinational technology companies. These companies are exploring various input and

control use-cases for their products, ranging over multiple countries and industry sectors, including consumer electronics manufacturers,

consumer electronics brands, electronic components manufacturers, IT services and software development companies, industrial companies,

and utility providers. Our objective with these companies is to commercialize the Mudra technology by licensing it for integration in

the hardware and software of these companies’ products and services. We estimate that there will be a three-to-five-year period

from the time we are first introduced to a customer to signing a licensing agreement. As of December 23, 2024, we have not signed a license

agreement with any of these companies.

In addition to consumer electronics,

we have recently expanded our brand to include neurotech and brain-computer interface sensors, with additional verticals that include

Industry 4.0 – a new phase in the Industrial Revolution that focuses on interconnectivity, automation, machine learning, and real-time

data, digital health, sport analytics, and more.

The core of our platform is

Mudra, which means “gesture” in Sanskrit. Mudra, our surface nerve conductance, or SNC, technology and wristband tracks neural

signals on the user’s wrist skin surface, which our algorithms decipher to predict as gestures made by finger and hand movements.

The interface binds each gesture with a specific digital function, allowing users to input commands without physical touch or contact.

Mudra gestures are natural to perform, and gestures can be tailored per a user’s intent, desired function, and the controlled digital

device. Mudra can detect multiple gesture types, including hand movements, finger movements, and fingertip pressure gradations. In addition

to the control use-case, our Mudra technology and SNC sensor can be utilized in multiple monitoring use-cases where we can monitor neural

and hand movements for digital health purposes, sport analytics performance, and Industry 4.0 solutions.

Corporate Information

We

are an Israeli corporation based in Yokne’am Illit, Israel and were incorporated in Israel in 2014 under the name Wearable Devices

Ltd. Our principal executive offices are located at 5 Ha-Tnufa St., Yokne’am Illit, Israel 2066736. Our telephone number in Israel

is +972.4.6185670. Our website address is www.wearabledevices.co.il. The information

contained on, or that can be accessed through, our website is not part of this prospectus. We have included our website address in this

prospectus solely as an inactive textual reference.

THE

OFFERING

Ordinary Shares currently issued

and

outstanding |

2,829,854 Ordinary Shares |

| |

|

| Ordinary Shares offered by us |

Up to Ordinary

Shares |

| |

|

| Warrants offered by us |

Purchasers of the Ordinary

Shares and Pre-Funded Warrants in this offering will also receive Warrants to purchase % of the

number of the Ordinary Shares and Pre-Funded Warrants purchased by such investor in this offering, or up to Warrants.

We will receive gross proceeds from the Warrants solely to the extent such Warrants are exercised for cash. The Warrants will be

exercisable beginning on the Issuance Date. The Warrants will expire on the five-year anniversary of the Issuance Date and have an

exercise price of $ per Ordinary Share. |

| |

|

| Pre-Funded Warrants offered by us |

We are also offering

to certain purchasers whose purchase of Ordinary Shares in this offering would otherwise result in the purchaser, together with its

affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of each purchaser, 9.99%) of our

outstanding Ordinary Shares immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser

so chooses, Pre-Funded Warrants in lieu of Ordinary Shares that would otherwise result in such purchaser’s beneficial ownership

exceeding 4.99% (or, at the election of each purchaser, 9.99%) of our outstanding Ordinary Shares. The purchase price of each Pre-Funded

Warrant is $ (which is equal to the assumed public offering price per ordinary share to be sold in this offering

minus $0.0001, the exercise price per ordinary share of each Pre-Funded Warrant). The Pre-Funded Warrants are immediately exercisable

(subject to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in

full. For each Pre-Funded Warrant we sell (without regard to any limitation on exercise set forth therein), the number of Ordinary

Shares we are offering will be decreased on a one-for-one basis. We are also registering the Ordinary Shares issuable from time to

time upon the exercise of the Pre-Funded Warrants and Warrants offered hereby.

The Ordinary Shares or the Pre-Funded Warrants,

and accompanying Warrants are immediately separable and will be issued separately in this offering, but must initially be purchased

together in this offering. For more information regarding the Warrants and Pre-Funded Warrants, you should carefully read the section

titled “Description of the Securities We are Offering” in this prospectus. |

| |

|

Ordinary Shares to be outstanding after

this offering

(1) |

Ordinary

Shares (assuming we sell only Ordinary Shares and accompanying Warrants and no Pre-Funded Warrants and none of the Warrants sold

in this offering are exercised). |

| |

|

| Offering Price |

The assumed offering price

is $ per share (or $ per Pre-Funded Warrant), based on our last reported sales

price on Nasdaq of our Ordinary Shares on . |

| Use of proceeds |

We

expect to receive approximately $ million

in net proceeds from the sale of the Ordinary Shares and Pre-Funded Warrants offered by us in this offering, after deducting

the estimated placement agent’s discounts and commissions and offering expenses payable by us, based on our last reported

sales price on Nasdaq of our Ordinary Shares on . We will receive nominal proceeds, if any, upon exercise of

the Pre-Funded Warrants.

However, this is

a best efforts offering with no minimum number of securities or amount of proceeds as a condition to closing, and we may not sell

all or any of these securities offered pursuant to this prospectus; as a result, we may receive significantly less in net proceeds.

We intend to use

the net proceeds from this offering for working capital and general corporate purposes.

Regardless of the

amount of proceeds received in this offering, the use of proceeds is expected to remain the same. The amounts and schedule of our

actual expenditures will depend on multiple factors. As a result, our management will have broad discretion in the application of

the net proceeds of this offering. |

| Best efforts offering |

We have agreed

to offer and sell the Securities offered hereby to the purchasers through the placement agent. The placement agent is not required

to buy or sell any specific number or dollar amount of the Securities offered hereby, but it will use its reasonable best efforts

to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page 23

of this prospectus. |

| |

|

| Risk factors |

You should read the “Risk

Factors” section beginning on page 5 of this prospectus and in the documents incorporated by reference in this

prospectus for a discussion of factors to consider before deciding to purchase our Securities. |

| |

|

| Nasdaq symbol |

“WLDS” for

the Ordinary Shares and “WLDSW” for the IPO Warrants. We do not intend to apply for listing of the Pre-Funded Warrants

or Warrants on any securities exchange or recognized trading system. Without an active trading market, the

liquidity of the Pre-Funded Warrants or Warrants will be limited. |

| (1) |

The number of Ordinary Shares outstanding immediately after this offering is based on 2,829,854 Ordinary Shares outstanding as of December 23, 2024 and excludes, as of such date: |

| |

● |

95,960 Ordinary Shares issuable upon the exercise of outstanding options allocated or granted to directors, employees and consultants under the 2015 Share Option Plan, or the 2015 Plan, at a weighted average exercise price of $14.04 per share, of which 72,328 were vested as of December 23, 2024; |

| |

|

|

| |

● |

1,110 Ordinary Shares issuable upon the exercise of warrants issued to a consultant, at an exercise price of $45 per share, which are all vested as of December 23, 2024, and an additional 1,182 Ordinary Shares issuable upon the exercise of warrants issued to an advisor, at an exercise price of $84.6 per share; |

| |

● |

44,832 Ordinary Shares reserved for future issuance under the 2015 Plan; |

| |

● |

393,043 Ordinary Shares issuable upon the exercise of 393,043 IPO Warrants, at an exercise price of $40.00 per share and warrants to purchase up to 9,375 Ordinary Shares, issued to the underwriter in the IPO at an exercise price of $106.2 per share, or the Underwriter’s Warrants; |

| |

|

|

| |

● |

11 Ordinary Shares reserved for issuance under the Standby Equity Purchase Agreement, dated June 6, 2024, between the Company and YA II PN, LTD., or the SEPA; |

| |

|

|

| |

● |

250,000 Ordinary Shares reserved for future issuance under the 2024 Employee Stock Purchase Plan, or the ESPP; |

| |

|

|

| |

● |

565,970 Ordinary Shares reserved for future issuance

under our 2024 Global Equity Incentive Plan, or the 2024 Plan;

|

| |

|

|

| |

● |

822,000 Ordinary Shares issuable upon the exercise of warrants issued at an exercise price of $2.50 per share pursuant to a November 2024 private placement; |

| |

|

|

| |

● |

312,000 Ordinary Shares issuable upon the exercise of pre-funded

warrants sold in the registered direct offering which closed on November 27, 2024; and. |

| |

|

|

| |

● |

Ordinary Shares issuable upon the exercise of warrants issued at an exercise price of $ per share under this offering. |

RISK

FACTORS

An investment in our Securities

involves a high degree of risk. You should carefully consider the risks and uncertainties described below and those described under the

section captioned “Risk Factors” contained in our 2023 Annual Report and all other information contained or incorporated by

reference into this prospectus and the documents incorporated by reference into this prospectus before making an investment in our Securities.

Our business, financial condition or results of operations could be materially and adversely affected if any of these risks occurs and,

as a result, the market price of our Securities could decline and you could lose all or part of your investment. This prospectus also

contains forward-looking statements that involve risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements.”

Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain

factors.

Risks Related to this Offering and the Ownership

of the Ordinary Shares and Pre-Funded Warrants

The market price of

our Ordinary Shares may be highly volatile and fluctuate substantially, which could result in substantial losses for purchasers of our

Ordinary Shares and Pre-Funded Warrants in this offering.

Our Ordinary Shares currently

trade on The Nasdaq Capital Market. There is limited public float, and trading volume historically has been low and sporadic. As a result,

the market price for our Ordinary Shares may not necessarily be a reliable indicator of our fair market value. The price at which our

Ordinary Shares trades may fluctuate as a result of a number of factors, including the number of shares available for sale in the market,

quarterly variations in our operating results, actual or anticipated announcements of new releases by us or competitors, the gain or loss

of sources of revenues, changes in the estimates of our operating performance, market conditions in our industry and the economy as a

whole.

Future issuances or

sales, or the potential for future issuances or sales, of our Ordinary Shares may cause the trading price of our Ordinary Shares to decline

and could impair our ability to raise capital through subsequent equity offerings.

We have issued a significant

number of Ordinary Shares and we may do so in the future. Shares to be issued in future equity offerings could cause the market price

of our Ordinary Shares to decline and could have an adverse effect on our earnings per share if and when we become profitable. In addition,

future sales of our Ordinary Shares or other securities in the public markets, or the perception that these sales may occur, could cause

the market price of our Ordinary Shares to decline, and could materially impair our ability to raise capital through the sale of additional

securities.

The market price of our Ordinary

Shares could decline due to sales, or the announcements of proposed sales, of a large number of Ordinary Shares in the market, including

sales of Ordinary Shares by our large shareholders, or the perception that these sales could occur. These sales or the perception that

these sales could occur could also depress the market price of our Ordinary Shares and impair our ability to raise capital through the

sale of additional equity securities or make it more difficult or impossible for us to sell equity securities in the future at a time

and price that we deem appropriate. We cannot predict the effect that future sales of Ordinary Shares or other equity-related securities

would have on the market price of our Ordinary Shares.

Our amended and restated articles

of association authorize our board of directors to, among other things, issue additional Ordinary Shares or securities convertible or

exchangeable into Ordinary Shares, without shareholder approval. We may issue such additional Ordinary Shares or convertible securities

to raise additional capital. The issuance of any additional Ordinary Shares or convertible securities could be substantially dilutive

to our shareholders. Moreover, to the extent that we issue restricted share units, stock appreciation rights, options or warrants to purchase

our Ordinary Shares in the future and those stock appreciation rights, options or warrants are exercised, or as the restricted share units

settle, our shareholders may experience further dilution. Holders of our Ordinary Shares have no preemptive rights that entitle such holders

to purchase their pro rata share of any offering of shares or equivalent securities and, therefore, such sales or offerings could result

in increased dilution to our shareholders.

Management will have

broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad

discretion in the allocation of the net proceeds and could use them for purposes other than those contemplated at the time of this offering

and as described in the section titled “Use of Proceeds.” Our management could spend the proceeds in ways that

you do not agree with or that do not improve our results of operations or enhance the value of our Ordinary Shares.

If you purchase Ordinary

Shares, Warrants, and/or Pre-Funded Warrants in this offering, you will incur immediate and substantial dilution in the book value of

your investment.

You

will suffer immediate and substantial dilution in the net tangible book value of the Ordinary Shares if you purchase shares in this offering.

Based on an assumed public offering price of $ per share, after giving effect to this offering, purchasers

of Ordinary Shares in this offering will experience immediate dilution in net tangible book value of $ per

share. In addition, after giving effect to this offering, investors purchasing Ordinary Shares in this offering will contribute %

of the total amount invested by shareholders since inception but will only own % of the Ordinary Shares

outstanding. In addition, the Ordinary Shares issuable upon the exercise of the Warrants and Pre-Funded Warrants to be issued pursuant

to the offering will further dilute the ownership interest of shareholders not participating in this offering and holders of warrants

who have not exercised their warrants, and the holders of pre-funded warrants who have not exercised their pre-funded warrants. To the

extent outstanding options and warrants are exercised, you will incur further dilution See “Dilution” for a more detailed

description of the dilution to new investors in the offering.

Nasdaq may delist our

Ordinary Shares from its exchange which could limit your ability to make transactions in our Securities and subject us to additional trading

restrictions.

We are required to meet the

continued listing requirements of Nasdaq, including those regarding minimum share price. In particular, we are required to maintain a

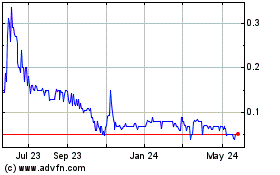

minimum bid price for our listed Ordinary Shares of $1.00 per share. On November 24, 2022, we received a written notification from Nasdaq,

which stated that because the closing bid price of our Ordinary Shares for 30 consecutive business days was below the minimum $1.00 per

share bid price requirement for continued listing on Nasdaq, we were not in compliance with Nasdaq Listing Rule 5550(a)(2). Pursuant to

Nasdaq Listing Rule 5810(c)(3)(A), the applicable grace period to regain compliance was 180 days, or until May 22, 2023. On May 23, 2023,

we announced that we received a letter from the Nasdaq pursuant to which Nasdaq granted us an extension until November 20, 2023, to regain

compliance with the minimum bid price requirement. On June 12, 2023, we announced that Nasdaq confirmed that we regained compliance with

Nasdaq Listing Rule 5550(a)(2) concerning the minimum bid price of our Ordinary Shares.

On October 24, 2023, we received

another written notification from Nasdaq, which stated that because the closing bid price of our Ordinary Shares for 30 consecutive business

days was below the minimum $1.00 per share bid price requirement for continued listing on Nasdaq, we were not in compliance with Nasdaq

Listing Rule 5550(a)(2). Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), we had a grace period of 180 days to regain compliance until April

22, 2024. On April 24, 2024, we announced that we received a letter from the Nasdaq Stock Market LLC pursuant to which Nasdaq granted

us an extension until October 21, 2024, to regain compliance with the minimum bid price requirement.

On October 7, 2024, we effectuated

a 1-for-20 reverse share split in order to regain compliance with Nasdaq Listing Rule 5550(a)(2). As a result, we were informed by Nasdaq

on October 28, 2024 that we had regained compliance.

A future decline in the closing

price of our Ordinary Shares on Nasdaq or other factors that cause us not to meet any Nasdaq continued listing requirements could result

in suspension or delisting procedures in respect of our Ordinary Shares. The commencement of suspension or delisting procedures by an

exchange remains, at all times, at the discretion of such exchange and would be publicly announced by the exchange. If a suspension or

delisting were to occur, there would be significantly less liquidity in the suspended or delisted securities. In addition, our ability

to raise additional necessary capital through equity or debt financing would be greatly impaired. Furthermore, with respect to any suspended

or delisted Ordinary Shares, we would expect decreases in institutional and other investor demand, analyst coverage, market making activity

and information available concerning trading prices and volume, and fewer broker-dealers would be willing to execute trades with respect

to such Ordinary Shares. A suspension or delisting would likely decrease the attractiveness of our Ordinary Shares to investors and cause

the trading volume of our Ordinary Shares to decline, which could result in a further decline in the market price of our Ordinary Shares.

Finally, if the volatility

in the broader capital markets increases, that could have an adverse effect on the market price of our Ordinary Shares, regardless of

our operating performance.

There is no public

market for the Warrants or Pre-Funded Warrants being offered in this offering.

There

is no established public trading market for the Warrants or Pre-Funded Warrants being offered in this offering and we do not expect a

market to develop. In addition, we do not intend to apply to list the Warrants or Pre-Funded Warrants on any national securities exchange

or other nationally recognized trading system, including Nasdaq. Without an active market, the liquidity of the Warrants or Pre-Funded

Warrants will be limited.

The Warrants and Pre-Funded

Warrants are speculative in nature.

The

Warrants and Pre-Funded Warrants offered hereby do not confer any rights of Ordinary Share ownership on their holders, such as voting

rights, but rather merely represent the right to acquire Ordinary Shares at a fixed price. Specifically, commencing on the date of issuance,

holders of the Warrants and Pre-Funded Warrants may exercise their right to acquire the Ordinary Shares upon the payment of an exercise

price of $ per share in the case of Warrants and an exercise price of $0.0001 per share in the case of Pre-Funded

Warrants. Moreover, following this offering, the market value of the Warrants and Pre-Funded Warrants is uncertain and there can be no

assurance that the market value of the Warrants or Pre-Funded Warrants will equal or exceed their imputed public offering prices. Furthermore,

each Warrant will expire five years from the Issuance Date. Each Pre-Funded Warrant will not expire until it has been exercised in full.

Holders

of our Warrants and Pre-Funded Warrants will have no rights as

a shareholder until they acquire our Ordinary Shares.

Until

holders of our Warrants and Pre-Funded Warrants acquire Ordinary Shares upon exercise of such warrants, the holders will have no rights

with respect to the Ordinary Shares issuable upon exercise of such Warrants and Pre-Funded Warrants. Upon exercise of the Warrants and

Pre-Funded Warrants, holders will be entitled to exercise the rights of shareholder only as to matters for which the record date occurs

after the exercise date.

If

we do not maintain a current and effective prospectus relating to the Ordinary Shares issuable upon exercise of the Warrants and Pre-Funded

Warrants, public holders will only be able to exercise such Warrants and Pre-Funded Warrants on a “cashless basis.”

If

we do not maintain a current and effective prospectus relating to the Ordinary Shares issuable upon exercise of the Warrants and Pre-Funded

Warrants at the time that holders wish to exercise such Warrants and Pre-Funded Warrants, they will only be able to exercise them on a

“cashless basis,” and under no circumstances would we be required to make any cash payments to the holders or net cash settle

such Warrants and Pre-Funded Warrants. As a result, the number of Ordinary Shares that holders will receive upon exercise of the Warrants

and Pre-Funded Warrants will be fewer than it would have been had such holders exercised their Warrants and Pre-Funded Warrants for cash.

We will do our best efforts to maintain a current and effective prospectus relating to the Ordinary Shares issuable upon exercise of such

Warrants and Pre-Funded Warrants until the expiration of such Warrants and Pre-Funded Warrants. However, we cannot assure you that we

will be able to do so. If we are unable to do so, the potential “upside” of the holder’s investment in our company may

be reduced.

The “best efforts”

structure of this offering may have an adverse effect on our business plan.

The placement agent is offering

the Securities in this offering on a best efforts basis. The placement agent is not required to purchase any securities, but will use

its best efforts to sell the securities offered. As a “best efforts” offering, there can be no assurance that the offering

contemplated hereby will ultimately be consummated or will result in any proceeds being made available to us or if consummated the amount

of proceeds to be received. The success of this offering will impact our ability to use the proceeds to execute our business plan. An

adverse effect on the business may result from raising less than anticipated, and from the fact that there is no minimum raise.

Significant holders

or beneficial holders of Ordinary Shares may not be permitted to exercise the Warrants or Pre-Funded Warrants that they hold.

A holder (together with its

affiliates and other attribution parties) may not exercise any portion of a Warrant or Pre-Funded Warrant to the extent that immediately

prior to or after giving effect to such exercise the holder would own more than 4.99% (or, at the election of the such holder, 9.99%)

of our outstanding Ordinary Shares immediately after exercise, which percentage may be changed at the holder’s election to a higher or

lower percentage not in excess of 9.99% upon 61 days’ notice to us subject to the terms of the Pre-Funded Warrants. As a result,

you may not be able to exercise your Warrants or Pre-Funded Warrants for Ordinary Shares at a time when it would be financially beneficial

for you to do so. In such a circumstance, you could seek to sell your Warrants or Pre-Funded Warrants to realize value, but you may be

unable to do so in the absence of an established trading market and due to applicable transfer restrictions.

We may not receive any

additional funds upon the exercise of the Pre-Funded Warrants.

Each Pre-Funded Warrant may

be exercised by way of a cashless exercise, meaning that the holder may not pay a cash purchase price upon exercise, but instead would

receive upon such exercise the net number of Ordinary Shares determined according to the formula set forth in the Pre-Funded Warrant.

Accordingly, we may not receive any additional funds upon the exercise of the Pre-Funded Warrants.

Purchasers who purchase

our securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase

without the benefit of a securities purchase agreement.

In addition to rights and

remedies available to all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities

purchase agreement will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach of contract

provides those investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement, including:

a covenant to not enter into any equity financings for a certain number of days from closing of the offering, subject to certain exceptions.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents

incorporated by reference in this prospectus and contain, and our officers and representatives may from time to time make, “forward-looking

statements,” which include information relating to future events, future financial performance, financial projections, strategies,

expectations, competitive environment and regulation. Words such as “may,” “should,” “could,” “would,”

“predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,”

“intends,” “plans,” “believes,” “estimates,” “goal,” “seek,” “project,”

“strategy,” “likely,” and similar expressions, as well as statements in future tense, identify forward-looking

statements. Forward-looking statements are neither historical facts, nor should they be read as a guarantee of future performance or results

and may not be accurate indications of when such performance or results will be achieved. Forward-looking statements are based on information

we have when those statements are made or management’s good faith belief as of that time with respect to future events, and are

subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested

by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| |

● |

our financial statements for the six months ended June 30, 2024, contained an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern, which could prevent us from obtaining new financing on reasonable terms or at all; |

| |

● |

SNC becoming the industry standard input method for wearable computing and consumer electronics; |

| |

● |

our ability to maintain and expand our existing customer base; |

| |

● |

our ability to maintain and expand compatibility of our devices with a broad range of mobile devices and operating systems; |

| |

● |

timing of the shipment to early-booking orders of our Mudra Band; |

| |

● |

our ability to maintain our business models; |

| |

● |

our ability to correctly predict the market growth; |

| |

● |

our ability to remediate material weaknesses in our internal control over financial reporting; |

| |

● |

our ability to retain our founders; |

| |

● |

our ability to maintain, protect, and enhance our intellectual property; |

| |

● |

our ability to raise capital through the issuance of additional securities; |

| |

● |

the impact of competition and new technologies; |

| |

● |

general market, political and economic conditions in the countries in which we operate; |

| |

● |

projected capital expenditures and liquidity; |

| |

● |

changes in our strategy; and |

These statements are only

current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s

actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking

statements. We discuss many of these risks in this prospectus in greater detail under the heading “Risk Factors” and elsewhere

in this prospectus and the documents incorporated by reference herein. You should not rely upon forward-looking statements as predictions

of future events.

Although we believe that the

expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance,

or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as

a result of new information, future events or otherwise, after the date of this prospectus.

Moreover, new risks regularly

emerge and it is not possible for our management to predict or articulate all risks we face, nor can we assess the impact of all risks

on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any

forward-looking statements. The Private Securities Litigation Reform Act of 1995 and Section 27A of the Securities Act do not protect

any forward-looking statements that we make in connection with this offering. All forward-looking statements included in this prospectus

and the documents incorporated by reference herein and therein are based on information available to us as of the date of this prospectus

or the date of the applicable document incorporated by reference. Except to the extent required by applicable laws or rules, we undertake

no obligation to publicly update or revise any forward-looking statement, whether written or oral, that may be made from time to time,

whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable

to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout

this prospectus and the documents incorporated by reference in this prospectus. We qualify all of our forward-looking statements by these

cautionary statements.

IN ADDITION TO THE ABOVE RISKS,

BUSINESSES ARE OFTEN SUBJECT TO RISKS NOT FORESEEN OR FULLY APPRECIATED BY OUR MANAGEMENT. IN REVIEWING THIS PROSPECTUS AND THE DOCUMENTS

INCORPORATED BY REFERENCE HEREIN AND THEREIN, POTENTIAL INVESTORS SHOULD KEEP IN MIND THAT THERE MAY BE OTHER POSSIBLE RISKS THAT COULD

BE IMPORTANT.

USE

OF PROCEEDS

We

expect to receive approximately $ million in net proceeds from the sale of the

Securities offered by us in this offering, based upon an assumed public offering price of $

per Ordinary Share and accompanying Warrant, which is the last reported sales price on Nasdaq of our Ordinary Shares on ,

, and after deducting placement agent fees and commissions and estimated offering expenses payable by us,

and excluding the proceeds, if any, from the exercise of the Warrants and assuming no sale of any Pre-Funded Warrants.

We

currently expect to use the net proceeds from this offering for working capital and general corporate purposes.

Changing

circumstances may cause us to consume capital significantly faster than we currently anticipate. The amounts and timing of our actual

expenditures will depend upon numerous factors, including the progress of our global marketing and sales efforts, the development

of our products and the overall economic environment. Therefore, our management will retain broad discretion over the use of the proceeds

from this offering. We may ultimately use the proceeds for different purposes than what we currently intend. Pending any ultimate use

of any portion of the proceeds from this offering, if the anticipated proceeds will not be sufficient to fund all the proposed purposes,

our management will determine the order of priority for using the proceeds, as well as the amount and sources of other funds needed.

The

amounts and timing of our actual expenditures will depend upon numerous factors, including the timing, scope, progress and results of

our research and development efforts, timing and progress of our clinical trials, regulatory and competitive environment and other factors

that management believes are appropriate.

Pending

our use of the net proceeds from this offering, we may invest the net proceeds in a variety of capital preservation investments, including

short-term, investment grade, interest bearing instruments and U.S. government securities.

Because

this is a “best efforts” offering and there is no minimum offering amount required as a condition to the closing of this offering,

the actual offering amount, the placement agent fees and net proceeds to us are not presently determinable and may be substantially less

than the maximum amounts set forth on the cover page of this prospectus. As a result, we may receive significantly less in net proceeds.

Based on the assumed offering price set forth above, we estimate that our net proceeds from the sale of 75%, 50%, and 25% of the securities

offered in this offering would be approximately $ , $ and $

, respectively, after deducting the estimated placement agent fees and estimated offering expenses payable by us, and excluding the proceeds,

if any, from the exercise of the Warrants and assuming no sale of any Pre-Funded Warrants.

DIVIDEND

POLICY

We

have never declared or paid any cash dividends on our Ordinary Shares and do not anticipate paying any cash dividends in the foreseeable

future. Payment of cash dividends, if any, in the future will be at the discretion of our board of directors and will depend on then-existing

conditions, including our financial condition, operating results, contractual restrictions, capital requirements, business prospects and

other factors our board of directors may deem relevant. Under the Israeli Companies Law, 5759-1999, or the Companies Law, the repurchase

of shares is treated as a dividend distribution.

The

Companies Law imposes further restrictions on our ability to declare and pay dividends. Under the Companies Law, we may declare and pay

dividends only if, upon the determination of our board of directors, there is no reasonable concern that the distribution will prevent

us from being able to meet the terms of our existing and foreseeable obligations as they become due. Under the Companies Law, the distribution

amount is further limited to the greater of retained earnings or earnings generated over the two most recent years legally available for

distribution according to our then last reviewed or audited financial statements, provided that the end of the period to which the financial

statements relate is not more than six months prior to the date of distribution. In the event that we do not meet such earnings criteria,

we may seek the approval of a court in order to distribute a dividend. The court may approve our request if it is convinced that there

is no reasonable concern that the payment of a dividend will prevent us from satisfying our existing and foreseeable obligations as they

become due.

Under

new exemptions, however, an Israeli company whose shares are listed outside Israel is permitted to execute distributions through repurchasing

its own shares, even if earnings criteria are not met, without the need for a court’s approval. This exemption is subject to certain

conditions, including, among others: (i) the distribution meets the solvency criteria; and (ii) there had not been any objection filed

by any of the Company’s creditors to the relevant court. If any creditor objects to such distribution, the Company will be required

to obtain the court’s approval for such distribution.

Payment

of dividends may be subject to Israeli withholding taxes. See “Item 10 – Taxation” in our 2023 Annual Report

for additional information, which is incorporated by reference herein.

CAPITALIZATION

The following table sets forth

our cash and cash equivalents and our capitalization as of June 30, 2024:

| |

● |

on an actual basis; |

| |

|

|

| |

● |

on a pro forma basis to give effect to: (i) the issuance of 1,203,699 Ordinary Shares under the SEPA for aggregate gross proceeds of $4.3 million; and (ii) the issuance in November 2024 of 252,000 Ordinary Shares and pre-funded warrants to purchase up to 570,000 Ordinary Shares, at the offering price of $2.25 per Ordinary Share in a registered direct offering and accompanying privately placed warrants and $2.499 per pre-funded warrant and accompanying privately placed warrants (and assuming no exercise of the pre-funded warrants or the warrants issued in such concurrent private placement), after deducting placement agent fees and estimated offering expenses, as if all such issuances had occurred as of June 30, 2024; and |

| |

● |

on a pro forma as adjusted basis to gives further effect to the sale in this offering of Ordinary Shares and accompanying Warrants at the assumed public offering price of $ per share, which was the last reported sales price on Nasdaq of our Ordinary Shares on , , after deducting estimated placement agent fees and expenses and estimated offering expenses payable by us, and assuming no exercise of Warrants, as if the sale of the Ordinary Shares and accompanying Warrants had occurred on June 30, 2024. |

You should read this table

in conjunction with our Unaudited Interim Financial Statements as of June 30, 2024 and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations for the Six Months Ended June 30, 2024” attached as Exhibits 99.1 and 99.2, respectively,

to our Report of Foreign Private Issuer on Form 6-K, or a Form 6-K, filed on September 23, 2024 and incorporated by reference herein.

| | |

As of June 30, 2024 | |

| U.S. dollars in thousands | |

Actual* | | |

Pro Forma* | | |

As

Adjusted* | |

| Cash | |

$ | 3,103 | | |

| 8,990 | | |

$ | | |

| Long term debt | |

| 144 | | |

| 144 | | |

| | |

| Shareholders’ equity: | |

| | | |

| | | |

| | |

| Share capital | |

| 58 | | |

| 58 | | |

| | |

| Additional paid in capital | |

| 27,070 | | |

| 32,957 | | |

| | |

| Accumulated losses | |

| (25,433 | ) | |

| (25,433 | ) | |

| | |

| Total shareholders’ equity | |

$ | 1,695 | | |

$ | 7,582 | | |

$ | | |

| | |

| | | |

| | | |

| | |

| Total capitalization | |

$ | 1,839 | | |

$ | 7,726 | | |

$ | | |

Except as otherwise indicated

above, the number of Ordinary Shares to be outstanding immediately after this offering is based on 1,044,371 Ordinary Shares outstanding

as of June 30, 2024 and excludes:

| |

● |

87,209 Ordinary Shares issuable upon the exercise of outstanding options allocated or granted to directors, employees and consultants under the 2015 Plan, at a weighted average exercise price of $14.61 per share, of which 60,009 were vested as of June 30, 2024; |

| |

|

|

| |

● |

1,110 Ordinary Shares issuable upon the exercise of warrants issued to a consultant, at an exercise price of $45 per share, which are all vested as of June 30, 2024, and an additional 1,182 Ordinary Shares issuable upon the exercise of warrants issued to an advisor, at an exercise price of $84.6 per share; |

| |

● |

53,582 Ordinary Shares

reserved for future issuance under the 2015 Plan; |

| |

● |

1,203,710 Ordinary Shares reserved for issuance under

the SEPA, as of June 30, 2024; |

| |

|

|

| |

● |

393,043 Ordinary Shares

issuable upon the exercise of 393,043 IPO Warrants issued in our IPO at an exercise price of $40.00 per share and warrants to

purchase up to 9,375 Underwriter’s Warrants at an exercise price of $106.2 per share; |

| |

|

|

| |

● |

565,970 Ordinary Shares reserved for future issuance under the 2024 Plan; |

| |

|

|

| |

● |

822,000 Ordinary Shares issuable upon the exercise of warrants issued at an exercise price of $2.50 per share pursuant to a November 2024 private placement; |

| |

● |

570,000 Ordinary Shares issuable upon exercise

of the pre-funded warrants and 252,000 Ordinary Shares issued and sold in a November 2024 registered direct offering; and

|

| |

● |

Ordinary Shares issuable upon the exercise of warrants issued at an exercise price of $ per share under this offering. |

DILUTION

If you invest in our Ordinary

Shares, your interest will be diluted immediately to the extent of the difference between the public offering price per Ordinary Share

and accompanying Warrant, you will pay in this offering and the pro forma net tangible book value per Ordinary Share after this offering.

As of June 30, 2024, we had a net tangible book value of $1.7 million, corresponding to a net tangible book value of $1.62 per Ordinary

Share. Net tangible book value per Ordinary Share represents the amount of our total tangible assets less our total liabilities, divided

by 1,044,371, the total number of Ordinary Shares issued and outstanding on June 30, 2024.

After giving effect to the

sale of the Ordinary Shares and accompanying Warrants offered by us in this offering (and assuming no sale of any Pre-Funded Warrants

in this offering), and after deducting the estimated placement agent fees and offering expenses payable by us, our pro forma net

tangible book value estimated at June 30, 2024 would have been approximately $ million, representing

$ per Ordinary Share. At the assumed public offering price for this offering of $ per

Ordinary Share, which is the last reported sales price on Nasdaq of our Ordinary Shares on , 2024,

set forth on the cover page of this prospectus, this represents an immediate increase in historical net tangible book value of $ per

Ordinary Share to existing shareholders and an immediate dilution in net tangible book value of $ per

Ordinary Share to purchasers of Ordinary Shares in this offering. Dilution for this purpose represents the difference between the price

per Ordinary Share paid by these purchasers and pro forma net tangible book value per Ordinary Share immediately after the completion

of this offering.

The following table illustrates

this dilution on a per Ordinary Share basis to purchasers of Ordinary Shares in this offering:

| Assumed public offering price per Ordinary Share |

|

$ |

|

|

| Net tangible book value per Ordinary Share as of June 30, 2024 |

|

$ |

1.62 |

|

| Pro forma net tangible book value per Ordinary Share |

|

$ |

|

|

| Increase in pro forma net tangible book value per Ordinary Share attributable to new investors |

|

$ |

|

|

| Dilution per Ordinary Share to new investors |

|

$ |

|

|

| Percentage of dilution in net tangible book value per Ordinary Share for new investors |

|

$ |

|

% |

The dilution information set

forth in the table above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering

determined at pricing. A $ increase or decrease in the assumed offering price of $ per Ordinary Share

would increase or decrease our pro forma net tangible book value per Ordinary Share after this offering by $

and the dilution per Ordinary Share to new investors by $ , assuming the number of Ordinary Shares

and accompanying Warrants offered by us, as set forth on the cover page of this prospectus remains the same, after deducting the estimated

placement agent fees and expenses and estimated offering expenses payable by us, and assuming no exercise of Warrants. We may also increase

or decrease the number of Ordinary Shares and accompanying Warrants we are offering.

An increase or decrease

of 500,000 in the number of the Ordinary Shares and accompanying Warrants offered by us in this offering would increase or decrease our

as adjusted net tangible book value after this offering by approximately $ million and the as adjusted net

tangible book value per Ordinary Share after this offering by $ per Ordinary Share and would increase or

decrease the dilution per Ordinary Share to new investors by $ , assuming the assumed public offering price remains

the same, after deducting estimated placement agent fees and expenses and estimated offering expenses payable by us, and

assuming no exercise of Warrants.

The number of the Ordinary

Shares to be outstanding immediately after this offering as shown above assumes that all of the Ordinary Shares offered hereby and no

Pre-Funded Warrants offered hereby are sold and is based on 1,044,371 Ordinary Shares outstanding as of June 30, 2024. This

number excludes:

| |

● |

87,209 Ordinary Shares

issuable upon the exercise of outstanding options allocated or granted to directors, employees and consultants under the 2015 Share

Option Plan, or the 2015 Plan, at a weighted average exercise price of $14.61 per share, of which 60,009 were vested as of June 30,

2024; |

| |

|

|

| |

● |

1,110 Ordinary Shares

issuable upon the exercise of warrants issued to a consultant, at an exercise price of $45 per share, which are all vested as of

June 30, 2024, and an additional 1,182 Ordinary Shares issuable upon the exercise of warrants issued to an advisor, at an exercise

price of $84.6 per share; |

| |

● |

53,582 Ordinary Shares reserved for future issuance under the 2015 Plan; |

| |

● |

393,043 Ordinary Shares issuable upon the exercise of 393,043 IPO Warrants at an exercise price of $40.00 per share and warrants to purchase up to 9,375 Ordinary Shares at an exercise price of $106.2 per share; |

| |

|

|

| |

● |

1,203,710 Ordinary Shares reserved for issuance under the standby equity purchase agreement, or the SEPA; |

| |

|

|

| |

● |

565,970

Ordinary Shares reserved for future issuance under our the 2024 Plan; |

| |

|

|

| |

● |

822,000 Ordinary Shares issuable upon the exercise

of warrants issued at an exercise price of $2.50 per share under this offering;

|

| |

● |

570,000 pre-funded warrants sold in the registered

direct offering which closed on November 27, 2024; and

|

| |

|

|

| |

● |

Ordinary Shares issuable upon the exercise of warrants issued at an exercise price of $ per share under this offering. |

DESCRIPTION

OF SHARE CAPITAL

The following description

of the share capital of Wearable Devices Ltd., or the Company, and the provisions of our amended and restated articles of association and

Israeli law are summaries, do not purport to be complete and is qualified in its entirety by reference to our amended and

restated articles of association, Israeli law and any other documents referenced.

We

are offering (i) up to Ordinary

Shares; (ii) up to Warrants

to purchase up to Ordinary

Shares and (iii) up to Pre-Funded

Warrants to purchase up to Ordinary

Shares. For each Pre-Funded Warrant we sell, the number of Ordinary Shares we are offering will be decreased on a one-for-one basis. We

are also registering the Ordinary Shares issuable from time to time upon exercise of the Warrants and Pre-Funded Warrants offered hereby.

Type and class of securities

Ordinary Shares

As of December 23,

2024, our authorized share capital consists of 50,000,000 Ordinary Shares, no par value per share, of which 2,829,854 Ordinary Shares

were issued and outstanding as of such date.

All of our outstanding Ordinary

Shares have been validly issued, fully paid and non-assessable. Our Ordinary Shares are not redeemable and are not subject to any preemptive

right.

Our Ordinary Shares and the

IPO Warrants, have been listed on the Nasdaq Capital Market under the symbols “WLDS” and “WLDSW,” respectively,

since September 13, 2022.

Warrants and Options

As of December 23,

2024, we have issued and outstanding IPO Warrants to purchase an aggregate of 393,043 Ordinary Shares, with exercise price of $40.00 per

Ordinary Share. The warrants were issued as part of our IPO, and have been listed on the Nasdaq Capital Market under the symbol “WLDSW”

since September 13, 2022.

As of December 23,

2024, we have 95,960 Ordinary Shares issuable upon the exercise of outstanding options allocated or granted to certain employees, directors

and consultants, under our 2015 Share Option Plan. An additional 44,832 Ordinary Shares are reserved for future issuance under our 2015

Share Option Plan.

Under the ESPP, the board

of directors and our shareholders have authorized the issuance of up to 250,000 Ordinary Shares. Further, under the 2024 Plan, the board

of directors has initially authorized the issuance of up to 565,970 Ordinary Shares. The 2024 Plan includes an Annex, or the U.S. Addendum,

that governs the grants of awards to employees and other service providers who are citizens or resident aliens of the United States. The

U.S. Addendum permits the grant of incentive stock options, or ISOs, nonqualified stock options and RSUs. The U.S. Addendum includes a

total of 25,000 Ordinary Shares available for issuance underlying grants of ISOs. Under the ESPP, the board of directors and our shareholders

have authorized the issuance of up to 250,000 Ordinary Shares.

Articles of Association

Directors

Our board of directors shall

direct our policy and shall supervise the performance of our Chief Executive Officer and his actions. Our board of directors may exercise

all powers that are not required under the Israeli Companies Law 5759-1999, or the Companies Law, or under our amended and restated articles

of association to be exercised or taken by our shareholders.

Rights Attached to Ordinary Shares

Our Ordinary Shares shall

confer upon the holders thereof:

| |

● |

equal right to attend and to vote at all of our general meetings, whether regular or special, with each Ordinary Share entitling the holder thereof, which attend the meeting and participate at the voting, either in person or by a proxy or by a written ballot, to one vote; |

| |

● |

equal right to participate in distribution of dividends, if any, whether payable in cash or in bonus shares, in distribution of assets or in any other distribution, on a per share pro rata basis; and |

| |

● |

equal right to participate, upon our dissolution, in the distribution of our assets legally available for distribution, on a per share pro rata basis. |

Election of Directors

Pursuant to our amended and