false

0001853044

0001853044

2024-04-08

2024-04-08

0001853044

aert:ClassOrdinarySharesParValue0.0001PerShareMember

2024-04-08

2024-04-08

0001853044

aert:RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2024-04-08

2024-04-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 8, 2024

Aeries Technology, Inc.

(Exact

name of registrant as specified in its charter)

| Cayman Islands |

|

001-40920 |

|

98-1587626 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS Employer

Identification Number) |

60 Paya Lebar Road, #08-13

Paya Lebar Square

Singapore |

|

409051 |

| (Address of principal

executive offices) |

|

(Zip Code) |

(919)

228-6404

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

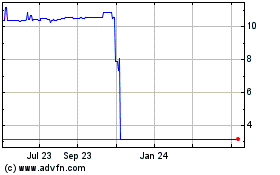

| Class A ordinary shares,

par value $0.0001 per share |

|

AERT |

|

Nasdaq Capital Market |

| Redeemable warrants, each

whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

AERTW |

|

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry Into A Material Definitive Agreement.

On

April 8, 2024, Aeries Technology, Inc. (the “Company”) entered into a Share Subscription Agreement (the “Agreement”)

with an institutional accredited investor named in the Agreement (the “Investor”). Pursuant to the Agreement, the Company

agreed to sell an aggregate of 2,261,778 newly issued Class A ordinary shares of the Company, $0.0001 par value per share (the “Shares”)

at a purchase price of $2.21 per share (the “Private Placement”); provided, that to the extent that the Investor determines,

in its sole discretion, that the Investor (together with the Investor’s affiliates, and any person acting as a group together with

the Investor or any of the Investor’s affiliates) would beneficially own in excess of the Beneficial Ownership Limitation (as defined

below), then, at the election of the Investor, the Investor may require the Company to delay issuance and delivery of a portion of the

Shares until later dates upon the Investor’s written notification and subject to the Beneficial Ownership Limitation the Investor

has elected. The “Beneficial Ownership Limitation” shall be 4.99% (or, at the election of the Investor at the closing, 9.99%)

of the number of Class A ordinary shares outstanding immediately after giving effect to the issuance of the Shares.

The

Agreement contains customary representations, warranties and covenants of the parties, and the closing was subject to customary closing

conditions. The Company intends to use the net proceeds of approximately $4.75 million from the Private Placement, following a deduction

of a 5% commission paid to a placement agent, for general corporate and working capital purposes.

The

foregoing description of the Agreement is a summary and is qualified in its entirety by reference to the form of the Agreement filed

as Exhibit 10.1, to this Current Report on Form 8-K and incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

To

the extent required by Item 3.02 of Form 8-K, the information contained in Item 1.01 of this Current Report on Form 8-K is incorporated

by reference herein.

The

issuance of the Shares to the Investor pursuant to the Agreement has been conducted in reliance on an exemption from registration provided

by Section 4(a)(2) of the Securities Act of 1933, as amended, on the basis that the Investor is an accredited investor and the Company

did not engage in any general solicitation in connection with such offer and sale.

Item

7.01 Regulation FD Disclosure.

On

April 12, 2024, the Company issued a press release regarding the Private Placement. A copy of the press release is furnished herewith

as Exhibit 99.1 and incorporated by reference in this Item 7.01.

The

information disclosed under this Item 7.01, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed “filed” with the Securities and Exchange Commission

nor incorporated by reference into any filing made under the Securities Act of 1933, as amended, except as expressly set forth by specific

reference in such filing.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date: April 12, 2024 |

AERIES

TECHNOLOGY, INC.

A

Cayman Islands exempted company |

| |

|

| |

By: |

/s/ Sudhir

Appukuttan Panikassery |

| |

Name: |

Sudhir Appukuttan Panikassery |

| |

Title: |

Chief Executive Officer and Director |

Exhibit 10.1

SHARE SUBSCRIPTION

AGREEMENT

BY AND BETWEEN

OYSTER BAY FUND LIMITED

AND

AERIES TECHNOLOGY, INC.

SHARE SUBSCRIPTION AGREEMENT

THIS SHARE SUBSCRIPTION AGREEMENT is made on this April 08, 2024 (hereinafter referred to as “this Agreement”)

BY AND BETWEEN

Oyster Bay Fund Limited, a Bermudan fund, with its registered office at Victoria Place, 31 Victoria Street, Hamilton HM11 Bermuda, through its authorised signatory (hereinafter referred to as “the Investor”, which expression shall, unless contrary or repugnant to the context or meaning thereof, be deemed to mean and include its successors in business and permitted assigns);

AND

Aeries Technology Inc., a Cayman Company, having its registered office at P.O. Box 309, Ugland House, South Church Street, George Town, Grand Cayman KY1-1104, through its authorized signatory (hereinafter referred to as “the Company”, which expression shall, unless contrary or repugnant to the context or meaning thereof, be deemed to mean and include its successors in business and permitted assigns).

WHEREAS:

|

A. |

The Investor is a fund incorporated in Bermuda to act as a pooling vehicle for investors and its primary objective is to invest in listed and unlisted equity related emerging market securities. |

|

B. |

The Company is engaged in the business of professional services and consulting. |

|

C. |

The Investor proposes to invest the Subscription Amount (as defined below) into the Company, and in return for payment of the Subscription Amount, the Company proposes to issue to the Investor the Investor Equity Shares (as defined below) on the terms and conditions herein contained. |

|

D. |

The parties hereto wish to record their understanding and agreements on the respective rights and obligations regarding such investment. |

NOW, THEREFORE, in consideration of the promises hereinafter set forth, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

|

1. |

PURPOSE, DEFINITIONS AND INTERPRETATION: |

|

1.1 |

The purpose of the Investor’s investment in the Company is to assist in the growth of the Company. |

|

1.2 |

In this Agreement, the following words and expressions (including in the recitals hereof and schedules attached hereto) have the following meanings: |

|

(a) |

“Affiliate(s)” means any company or other person that is directly or indirectly Controlling or under common Control with or Controlled by a party hereto; provided, however, that with respect to the Company, “Affiliates” means any person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with a person as such terms are used in and construed under Rule 405 under the Securities Act; |

|

(b) |

“Articles of Association” or “AoA” means the articles of association of the Company from time to time; |

|

(c) |

“Assets” shall mean immovable property of the Company; |

|

(d) |

“Beneficial Ownership Limitation” has the meaning given to such term in Clause 2.1; |

|

(e) |

“Board” means the Board of Directors of the Company as constituted from time to time; |

|

(f) |

“Business” means professional services and consulting; |

|

(g) |

“Business Day(s)” means any day other than Saturdays, Sundays and days on which commercial banks are closed for business in The Cayman Islands and Bermuda; |

|

(h) |

“Closing” means the completion of all of the activities required to be undertaken by the parties hereto pursuant to Clause 4; |

|

(i) |

“Closing Date” means the Business Day notified in writing by the Investor, following the date on which the last of the Conditions Precedent are performed or waived and all covenants listed as Conditions Precedent in Clause 3 are met or waived by the parties hereto; |

|

(j) |

“Company’s knowledge” has the meaning given to such term in Clause 7.2; |

|

(k) |

“Conditions Precedent” shall have the meaning ascribed to such term in Clause 3.1; |

|

(l) |

“Constitutional Documents” in relation to the Company means its MoA and AoA; |

|

(m) |

“Control” and related expressions when used with respect to any company or other body corporate means the beneficial ownership, directly or indirectly, of more than 50% of the voting securities of such body corporate, or the ability to control the composition or the decisions of the board of directors, or the possession of the power to direct or cause the direction of the management and policies of such company or other body corporate; |

|

(n) |

“Director(s)” shall mean the director(s) for the time being of the Company; |

|

(o) |

“Effective Date” means the date first set forth above; |

|

(p) |

“Encumbrance” means any right, title or interest existing by way of pledge, non-disposal undertaking, right of first offer or first refusal, lien, mortgage or charge other than those set out in the Constitutional Documents or under the Securities Act, the Exchange Act or any rules or regulations issued by the SEC. Unless the context otherwise requires, “Encumbrance” includes transfer, assignment and any other disposal of any right title or interest; |

|

(q) |

“Equity Shares” means the Company’s Class A ordinary shares, US$0.0001 par value per share; |

|

(r) |

“Exchange Act” means the United States Exchange Act of 1934, as amended; |

|

(s) |

“Financial Quarter” means each three calendar-month period starting on the 1st of January, the 1st of April, the 1st of July and the 1st of October of each calendar year, except as otherwise approved by the Board; |

|

(t) |

“Financial Statements” has the meaning given to such term in Clause 3.1.1; |

|

(u) |

“Financial Year” means the period beginning on April 1st every calendar year and ending on March 31st of the subsequent calendar year. The expression “Financial Year “ followed by a year means the Financial Year beginning 1 April of the preceding calendar year and ending 31 March of that year. By way of illustration, “Financial Year 2023” means the Financial Year beginning 1 April 2022 and ending 31 March 2023; |

|

(v) |

“Governmental Authority” shall mean any federal, state, local or foreign government, or political subdivision thereof, any regulatory or administrative authority, any agency or instrumentality of any such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority (to the extent that the rules, regulations or orders of such organization or authority have the force of Law), or any arbitrator, court or tribunal of competent jurisdiction; |

|

(w) |

“Investor Equity Shares” or “IESs” means the aggregate number of Equity Shares purchased by the Investor hereunder which shall be equal to (rounded down to the nearest whole Equity Share) (x) US$5,000,000 divided by (y) the Purchase Price per Share; |

|

(x) |

“Law(s)” means any statute, law, regulation, ordinance, rule, judgment, notification, rule of common law, order, decree, bye-law, government approval, directive, guideline, requirement or other governmental restriction, or any similar form of decision of, or determination by, or any interpretation or policy issued by any Governmental Authority; |

|

(y) |

“Memorandum of Association” or “MoA” means the memorandum of association of the Company; |

|

(z) |

“Ordinary Course of Business” means any action by the Company that is: |

|

(i) |

taken in the course of the day-to-day operation of the Company; and |

|

(ii) |

within the scope of the Business; |

|

(aa) |

“Price Per Share” means 5% discount to the average NASDAQ official closing Price of the Equity Shares as reflected on www.nasdaq.com for the five (5) trading days immediately preceding the Effective Date; |

|

(bb) |

“SEC” means the United States Securities and Exchange Commission; |

| (cc) | “Securities Act” means the United States

Securities Act of 1933, as amended; |

| (dd) | “Subscription Amount” means the aggregate sum of approximately

US$5,000,000, determined using the following formula (x) the number of Investor Equity Shares multiplied by (y) the Price Per

Share. |

|

1.3 |

Except where the context requires otherwise, this Agreement will be interpreted as follows: |

|

(a) |

headings are for convenience only and shall not affect the construction or interpretation of any provision of this Agreement; |

|

(b) |

where a word or phrase is defined, other parts of speech and grammatical forms and the cognate variations of that word or phrase shall have corresponding meanings; |

|

(c) |

words importing the singular shall include plural and vice versa; |

|

(d) |

reference to Recitals, Clauses, Schedules and Annexures are to recitals, clauses, schedules and Annexures of this Agreement; |

|

(e) |

all words (whether gender-specific or gender neutral) shall be deemed to include each of the masculine, feminine and neuter genders; |

|

(f) |

any reference in this Agreement to a statutory provision includes that provision and any regulation made in pursuance thereof, as from time to time modified or re-enacted, whether before or after the date of this Agreement; |

|

(g) |

“include” and “including” will be read without limitation; |

|

(h) |

the term “person” includes any individual, firm, corporation, partnership, company, trust, association, joint venture, government (or agency or political subdivision thereof) or other entity of any kind, whether or not having separate legal personality. A reference to any person in this Agreement shall, where the context permits, include such person’s executors, administrators, legal representatives and successors and permitted assigns. |

|

(i) |

a reference to any document (including this Agreement) is to that document as amended, restated, consolidated, supplemented, novated or replaced from time to time; |

|

(j) |

a reference to a statute or statutory provision includes, to the extent applicable at any relevant time: |

|

(i) |

that statute or statutory provision as from time to time consolidated, modified, re-enacted or replaced by any other statute or statutory provision; and |

|

(ii) |

any subordinate legislation or regulation made under the relevant statute or statutory provision; |

|

(k) |

references to writing include any mode of reproducing words in a legible and non-transitory form. |

|

2.1 |

Subject to the terms and conditions of this Agreement, the Company agrees to sell to the Investor, and the Investor agrees to purchase, the Investor Equity Shares; provided, however, that to the extent that the Investor determines, in its sole discretion, that the Investor (together with the Investor’s Affiliates, and any person acting as a group together with the Investor or any of the Investor’s Affiliates) would beneficially own in excess of the Beneficial Ownership Limitation, then, at the election of the Investor, the Investor may require the Company to delay issuance and delivery of a portion of the Investor Equity Shares until later dates as notified by the Investor in writing. The “Beneficial Ownership Limitation” shall be 4.99% (or, at the election of the Investor at the Closing, 9.99%) of the number of Equity Shares outstanding immediately after giving effect to the issuance of the Investor Equity Shares on the Closing Date. |

|

3.1 |

The issue of Investor Equity Shares shall take place, subject to the fulfillment or waiver of each of the following conditions (“Conditions Precedent”); provided, however, that the Investor shall be deemed to have been provided with and received any documents to the extent they have been filed with the SEC and are publicly available: |

|

3.1.1 |

Audited Financial Statements: The Company shall provide the Investor with audited financial statements for the fiscal years ended 2021, 2022 and 2023 and unaudited financial statements for the most recent year-to-date period for which information is available (the “Financial Statements”); |

|

3.1.2 |

The Company taking all necessary corporate actions and obtaining all approvals as per applicable Law and its Constitutional Documents, including, but not limited to, any approvals from Governmental Authorities required under applicable Law for the consummation of the transaction contemplated in this Agreement; |

|

3.1.3 |

Delivery by the Company to the Investor of a certificate in substantially the form set out in Schedule I signed by an authorized representative on behalf of the Company to the effect that: |

|

3.1.4.1 |

the Company is not in material breach of any Material Contract (as defined below) and to the Company’s knowledge, no other party to a Material Contract is in breach of the same; and |

|

3.1.4.2 |

all representations and warranties in Clause 7 and Schedule III are true, accurate and correct in all respects on and as of the relevant date, and the Company has materially performed each of its respective obligations which are required to be performed by it prior to Closing. |

|

3.2 |

The Company shall, immediately upon the satisfaction of all the Conditions Precedent, no later than 30 days from the date of this Agreement, provide a written notice to the Investor of such satisfaction (“CP Fulfillment Certificate”), enclosing copies of all such documentary evidence supporting the statements in the CP Fulfillment Certificate, confirming that the Conditions Precedent have been satisfied or, to the extent that they have not been satisfied, requesting Investor to, subject to applicable Law, waive or extend the time for fulfillment of such unsatisfied condition(s). Within 2 (two) days of receipt of the CP Fulfillment Certificate (signed by the representative of the Company), the Investor shall, if satisfied that the applicable Conditions Precedent have been fulfilled, confirm the respective satisfaction or waiver, as applicable, of the Conditions Precedent in writing by acknowledging and signing a copy of the CP Fulfillment Certificate and delivering it to the Company (“CP Satisfaction Certificate”). |

|

3.3 |

In case the Company fails to complete the Conditions Precedent within the period of 30 days from the Effective Date and the Investor has not waived such incomplete Conditions Precedent, the Investor shall have the right at its sole option to (a) extend the time for such Conditions Precedent to be fulfilled, (b) waive the relevant Conditions Precedent or (c) terminate this Agreement with immediate effect upon written notice to the Company. |

|

4.1 |

Pursuant to fulfilment of the Conditions Precedent to the satisfaction of the Investor as specified above, on the Closing Date (which shall be not be later than 15 (fifteen) days from the date of receipt of the CP Satisfaction Certificate), the following actions shall be transacted in the order indicated below and will be deemed to have been performed simultaneously: |

|

4.1.1 |

The Investor shall wire transfer the Subscription Amount in immediately available funds to the bank account of the Company specified in Schedule II; |

|

4.1.2 |

Upon receipt of the amounts by way of wire transfer as per Clause 4.1.1, the Board shall within a period of 15 days, pass necessary resolutions regarding the following: |

|

4.1.2.1 |

Authorizing the issue and allotment of the Investor Equity Shares to the Investor; |

|

4.1.2.2 |

Recording necessary entries in the Company’s register of members, as applicable; |

|

4.1.2.3 |

Authorizing officers of the Company to make requisite filings with Governmental Authorities as required under applicable Law. |

|

4.2 |

All proceedings to be taken and all documents to be executed and delivered by the parties hereto at the Closing under this Agreement shall be deemed to have been taken and executed simultaneously at the Closing and no proceedings shall be deemed to be taken nor any documents executed or delivered at the Closing until all have been so taken, executed and delivered. In such case, each party hereto shall have the rights and remedies as it may have at Law or in equity or otherwise, including the right to seek specific performance, rescission, restitution or other injunctive relief, none of which rights or remedies shall be affected or diminished thereby. |

|

4.3 |

The Company shall issue in book entry form, registered in the name of the Investor, such number of Investor Equity Shares as elected by the Investor pursuant to Clause 2.1, to the address of the Investor indicated below (or as otherwise set forth in such Investor’s delivery instructions). If the Investor elects to receive only a portion of the Investor Equity Shares, the remaining Investor Equity Shares will be issued to the Investor in one or more installments upon written notice to the Company, provided at least two (2) Business Days in advance of the delivery date of each installment, subject to the Beneficial Ownership Limitation the Investor has elected. As promptly as practicable after the issuance of any Investor Equity Shares, the Company shall deliver to the Investor evidence from the Company’s transfer agent of the issuance of such Investor Equity Shares to the Investor. |

|

5.1 |

Pursuant to the issuance of the Investor Equity Shares to the Investor, the Company undertakes that it shall fulfil the following conditions subsequent (“Conditions Subsequent”) to the reasonable satisfaction of the Investor, within 10 (ten) days from the Closing Date, unless any other timeline has been agreed by the parties hereto in writing: |

|

5.1.1 |

The Company shall deliver to the Investor certified true copies of an extract of the register of members of the Company, evidencing the Investor as the holder of the Investor Equity Shares in accordance with this Agreement. |

|

7. |

REPRESENTATIONS AND WARRANTIES |

|

7.1 |

The Company represents and warrants to the Investor on the Effective Date that each of the statements in this Clause 7 and Schedule III is true, accurate and correct as of the Effective Date and acknowledges that the Investor is entering into this Agreement in reliance upon such representations and warranties in this Clause 7 and Schedule III; provided, however that all of such representations and warranties are in all cases qualified by any and all filings made by the Company with the SEC and that are publicly available (collectively, the “SEC Filings”), and with respect to the foregoing, the Investor shall be deemed to have knowledge of the contents of the SEC Filings, and shall be deemed to have been provided with and received any documents that are SEC Filings. |

|

7.2 |

Where any representation and warranty contained in this Agreement is expressly qualified by reference to knowledge of the Company, such knowledge is the knowledge of the Chief Executive Officer or Chief Financial Officer of the Company, after reasonable inquiry under the circumstances (the “Company’s knowledge”). |

|

7.3 |

The Company hereby represents that it is not bound to seek the consent of any third party prior to the issue of Investor Equity Shares to the Investor. |

|

8. |

BREACH OF REPRESENTATIONS AND WARRANTIES |

|

8.1 |

The Company shall indemnify, defend and hold harmless, the Investor from and against any and all losses suffered, incurred or paid, directly or indirectly as a result of, or arising out of, or relating to, or in connection with any of the following: |

|

(a) |

breach or inaccuracy of the representations and warranties in Clause 7 and Schedule III or covenants of the Company as provided in this Agreement; or |

|

(b) |

any tax liability which may devolve on the Investor in respect of, or relating to, any period prior to the Closing Date; |

Notwithstanding anything to the contrary in this Agreement, the indemnification obligations of the Company under this Clause 8 shall not exceed an aggregate amount equal to the Subscription Amount.

|

8.2 |

Notwithstanding anything to the contrary contained herein, in case of any losses incurred by the Investor resulting from or arising out of any breach of any representations and warranties in Clause 7 or Schedule III or covenants in the Agreement, the Investor shall have the right to exercise its right of indemnification against the Company pursuant to this Clause 8. |

|

8.3 |

In the event of occurrence of any loss, the Investor shall, within ten (10) days of occurrence of the loss, notify the Company in writing of such loss (including the basis, act or event on which it is based together with documents, if any, which enable the existence of the loss to be established) and the amount or an estimate of the amount claimed in respect of the loss (if such amount is known or such estimate can be determined) (“Indemnity Notice”). The Investor shall also provide any other information that is in its possession which the Company may reasonably request with respect to the Indemnity Notice. Upon the Company’s reasonable request the Investor shall also provide access to all information and documents pertaining to the Indemnity Notice. |

|

8.4 |

If a third party commences any legal action or suit or proceedings or investigations against the Investor that gives rise to an indemnification obligation under this Clause 8 (a “Third Party Claim”), then the Investor shall notify the Company in writing of such Third Party Claim in the manner set out in Clause 8.3 (a “Third Party Indemnity Notice”) and comply with any Company information requests as set forth in Clause 8.3. |

|

8.5 |

The failure of the Investor to notify the Company of a loss shall not relieve the Company of any indemnification responsibility under this Clause 8; provided however, that the Company shall not be liable to indemnify the Investor for any increase in the loss due to delay on the part of the Investor to notify the Company in writing within the time period mentioned in Clause 8.3. |

|

8.6 |

The Company shall undertake its indemnification obligations under this Clause 8 within thirty (30) Business Days of the receipt of a valid Indemnity Notice or a valid Third Party Indemnity Notice. |

|

8.7 |

If the Company disputes an Indemnity Notice or Third Party Indemnity Notice, as applicable, the Parties shall attempt to resolve their dispute amicably and, if no written agreement in that regard has been reached within sixty (60) days after receipt of such Indemnity Notice or the Third Party Indemnity Notice, as applicable, the dispute shall be settled as per Clause 20. |

|

8.8 |

The indemnification rights of the Investor shall not prejudice the Investor’s rights to seek equitable relief, including the right to seek specific performance. |

|

8.9 |

Other than with respect to the SEC Filings, the knowledge (actual, constructive or imputed) of the Investor or the conduct of any due diligence by the Investor in relation to the Company shall not in any manner affect or limit the Investor’s right to indemnification. |

|

17.1 |

This Agreement shall continue to be in force until terminated in accordance with its provisions. |

|

17.2 |

Notwithstanding anything contained in this Agreement, the Investor shall have the right to terminate the Agreement as specified in Clause 3.3. |

|

17.3 |

Without prejudice to any claim for any antecedent breach, a party hereto shall be entitled at its option, on the happening of any of the following events, to terminate this Agreement: |

|

(a) |

by delivering a written notice to the other party hereto if the such other party hereto becomes or is declared bankrupt or goes into voluntary or compulsory liquidation, except for the purpose of amalgamation or reconstruction, and this Agreement will terminate on the 10th Business Day following the delivery of such notice; or |

|

(b) |

by delivering a written notice to the other party hereto if any distress or attachment is levied, or any receiver or administrator is appointed in respect of the business or a substantial part of the property or assets of such other party hereto, or if it takes any similar action in consequence of debt, and this Agreement will terminate on the 10th Business Day following the delivery of such notice; or |

|

(c) |

by delivering a written notice to the other party hereto if such other party hereto has committed a material breach of this Agreement and fails to remedy such material breach within thirty (30) days from the date of the written notice being received by it or such other period as may be mutually agreed to in writing by the parties hereto, with such termination effective at the end of such thirty (30) day period or other period mutually agreed to in writing by the parties, as applicable; or |

|

(d) |

by delivering a written notice to the other party hereto if such other party hereto makes an assignment for the benefit of creditors generally or fails to pay its debts generally as they become due; or |

|

(e) |

by delivering a written notice to the party hereto if there is a government expropriation, nationalisation or condemnation of all or a substantial part of the assets or capital stock of such other party hereto, and the Agreement will terminate on the 10th Business Day following receipt of such notice; or |

|

(f) |

by delivering a written notice to the other party hereto if any direction or order from any Governmental Authority or any change in applicable Law is made which prevents the implementation of this Agreement, and the Agreement will terminate on the 10th Business Day following receipt of such notice. |

|

17.3 |

This Agreement shall remain in full force and effect until such time as: |

|

(a) |

this Agreement shall terminate automatically if the Investor ceases to hold Investor Equity Shares below 1% (one percent) of the outstanding issued capital of the Company; |

|

(b) |

this Agreement is terminated in accordance with its provisions; or |

|

(c) |

the Company is dissolved or liquidated. |

|

18. |

CONSEQUENCES OF TERMINATION AND SURVIVAL |

|

18.1 |

The termination of this Agreement shall not relieve a party hereto of any obligation or liability accrued prior to the effective date of termination. |

|

18.2 |

Those provisions of this Agreement which by their very nature are incapable of being performed or enforced prior to expiration or termination of this Agreement, which suggest at least partial performance or enforcement following such expiration or termination, or which are otherwise necessary to interpret the respective rights and obligations of the parties hereto, shall survive termination of the Agreement for any reason. |

|

19.1 |

Any notice pursuant to this Agreement shall be in writing signed by (or by some person duly authorised by) the person giving it and may be served personally or sending it by prepaid registered air mail or internationally recognized courier addressed as follows (or to such other address as shall have been duly notified in accordance with this Clause 19.1): |

If to the Company:

Aeries Technology, Inc.

P.O. Box 309

Ugland House, South Church Street

George Town, Grand Cayman KY1-1104

Attention: Sudhir Appukuttan Panikassery, Chief Executive Officer

Telephone: 919-228-6404

Email: sudhir@aeriestechnology.com

with a copy (for informational purposes only) to:

Norton Rose Fulbright US LLP

1301 Avenue of the Americas

New York, NY 10019-6022

Attention: Rajiv Khanna

Telephone: 212-318-3168

Email: rajiv.khanna@nortonrosefulbright.com

If to the Investor:

Oyster Bay Fund Limited

c/o SpearFin ltd

Level 7, Tower B, 1 Exchange Square,

Ebene 72201, Mauritius

Attention: Mr. Subiraj Gujadhur

Telephone: ***

Email: oysterbay@oyster-bay.net

with a copy (for informational purposes only) to:

Harbour Financial Services Limited

Victoria Place, 31 Victoria Street

Hamilton HM11

Bermuda

Attention: Mr. Brian McDevitt

Telephone: 441-494-4000

Email: oysterbay@oyster-bay.net

|

19.2 |

All notices given in accordance with Clause 19.1 shall be deemed to have been served as follows: |

|

(a) |

if delivered by hand, at the time of delivery; |

|

(b) |

if by registered air mail at the expiration of twenty-one (21) days after the envelope containing the same was delivered into the custody of the postal authorities; and |

|

(c) |

if by courier at the expiration of the six (5) days after the envelope containing the same was delivered into the custody of the internationally recognized courier. |

|

20. |

GOVERNING LAW, DISPUTE RESOLUTION AND JURISDICTION: |

|

20.1 |

This Agreement shall be governed by, and construed in accordance with, the laws of Bermuda, without regard to the principles of conflicts with law of any other jurisdiction. |

|

20.2 |

Any and all claims, disputes, questions or controversies involving the parties hereto and arising out of or in connection with or relating to this Agreement, or the execution, interpretation, validity, performance, breach or termination hereof (including, without limitation, the provisions of this Clause 20 (collectively, “Disputes”) which cannot be finally resolved by the parties hereto within one (1) month of the arising of a Dispute by amicable negotiation and conciliation shall be finally resolved by arbitration under the rules of arbitration of the International Chamber of Commerce (the “Rules”) by a sole arbitrator appointed in accordance with the Rules. The place or seat of arbitration shall be, exclusively at Bermuda. All arbitration proceedings shall be conducted in the English language. |

|

20.3 |

The parties hereto agree to facilitate the arbitration by (i) cooperating in good faith to expedite (to the maximum extent practicable) the conduct of the arbitration, (ii) making available to one another and to the sole arbitrator for inspection and extraction all relevant documents, books, records, and personnel under their control or under the control of a person controlling or controlled by such party if determined by the sole arbitrator to be relevant to the Dispute, (iii) conducting arbitration hearings to the greater extent possible on successive Business Days and (iv) using their best efforts to observe the time periods established by the rules of the sole arbitrator for the submission of evidence and briefs. |

|

20.4 |

The costs and expenses of the arbitration, including, without limitation, the fees of the arbitration, including, without limitation, the fees of the sole arbitrator, shall be borne equally by each party to the Dispute, and each such party shall pay its own fees, disbursements and other charges of its counsel. |

|

20.5 |

Any award made by the sole arbitrator shall be final and binding on each of the parties that were parties to the dispute. |

|

21.1 |

Except as may be required by applicable Law or a Governmental Authority, the Investor shall not divulge to any person, or use or exploit for any purpose, the terms and conditions of this Agreement, any trade secrets or confidential information or any technical, operational, administrative, financial or business information relating to the Company. |

|

21.2 |

The restriction in Clause 21.1 above shall continue to apply after the termination of this Agreement, but shall cease to apply to information or knowledge which may properly come into the public domain through no fault of the Investor. |

|

22.1 |

This Agreement is binding upon and shall ensure for the benefit of the successors of the Parties hereto. The Investor agrees that the terms and conditions of this Agreement shall not be assigned by it to any party except with the prior written consent of the Company. |

|

23.1 |

No announcement or disclosure in respect of the making or terms of this Agreement shall be made or disclosed by the Investor without the prior written consent of the Company except to the extent disclosure is required by applicable Law or rule of a Governmental Authority which disclosure shall then only be made: |

|

(a) |

after prior consultation with the Company as to its terms; |

|

(b) |

strictly in accordance with the Company’s reasonable directions as to the terms of disclosure; and |

|

(c) |

only to the persons and in the manner required by applicable Law or a Governmental Authority or as otherwise agreed in writing by the parties hereto. |

|

23.2 |

The restrictions contained in this Clause 23 shall continue to apply after termination of this Agreement without limit in time. |

|

24 |

SEVERABILITY OF PROVISIONS |

|

24.1 |

The invalidity or unenforceability of any term, phrase, Clause, paragraph, restriction, covenant, agreement or other provisions hereof shall in no way affect the validity or enforcement of any other provision, or any part thereof. |

|

25. |

BINDING EFFECT AND INVALIDITY |

|

25.1 |

All terms and conditions of this Agreement shall be binding upon and inure to the benefit of and be enforceable by the legal representatives and permitted assigns of the parties hereto. |

|

25.2 |

The parties hereto agree that if any of the provisions of this Agreement is or becomes invalid, illegal or unenforceable, the validity, legality or enforceability of the remaining provisions shall not in any way be affected or impaired. Notwithstanding the foregoing, the parties hereto shall thereupon negotiate in good faith in order to agree on the terms of a mutually satisfactory provision, achieving as nearly as possible the same commercial effect, to be substituted for the provision so found to be void or unenforceable. |

|

26.1 |

This Agreement constitutes the entire agreement and supersedes any previous agreements between the parties hereto whether oral or in writing regarding the subject matter hereof. |

|

27.1 |

The Investor shall pay the Investor’s transaction expenses, Investor’s legal and accounting expenses, incurred with respect to this transaction. |

|

28. |

NO PARTNERSHIP OR AGENCY |

|

28.1 |

Nothing in this Agreement shall be deemed to constitute a partnership between the parties hereto or constitute any party hereto the agent of any other Party for any purpose or entitle any party hereto to commit or bind any other party hereto in any manner or give rise to fiduciary duties by one party hereto in favour of any other. |

|

29.1 |

Each of the parties hereto agrees and acknowledges that in entering into this Agreement it is not relying on any representations, warranty or statement made by or on behalf of any other party, whether orally or in writing, unless the same is expressly set out herein. |

|

30.1 |

No waiver by a party hereto of a failure or failure by any other party to this Agreement to perform any provision of this Agreement shall operate or be construed as a waiver in respect of any other or further failure whether of a like or different character. |

|

31.1 |

This Agreement may be amended only by an instrument in writing signed by duly authorised representatives of each party to this Agreement. |

|

32.1 |

This Agreement may be entered into in two or more counterparts each of which, when executed and delivered, shall be an original, but all the counterparts shall together constitute one and the same instrument. |

|

33.1 |

Each party hereto shall do and execute and perform all such further deeds, documents, assurances, acts and things as may reasonably be required to give effect to the terms of this Agreement. |

[signature page follows]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the Effective Date.

| SIGNED AND DELIVERED BY |

|

| Oyster Bay Fund Limited |

|

| |

|

|

| By: |

/s/ Subiraj Gujadhur |

|

| Name: |

Subiraj Gujadhur |

|

| Title: |

Director |

|

| |

|

|

| SIGNED AND DELIVERED BY |

|

| Aeries Technology, Inc. |

|

| |

|

|

| By: |

/s/ Sudhir Appukuttan Panikassery |

|

| Name: |

Sudhir Appukuttan Panikassery |

|

| Title: |

Chief Executive Officer |

|

SCHEDULE I

COMPANY CERTIFICATE

To,

**************,

Kind Attn: - Mr. ________________

RE: CERTIFICATE

Dear Sir/Madam,

This

certificate is being issued pursuant to Clause 3.2 of the Share Subscription Agreement dated April _, 2024 between you and us (the

“Subscription Agreement”). Any undefined terms in this certificate shall have the meaning given to them under the

Subscription Agreement.

We hereby confirm that:

|

(i) |

the Company is not in material breach of any Material Contract, and to the Company’s knowledge, no other party to a Material Contract is in material breach of the same; and |

|

(ii) |

all representations and warranties in Clause 7 and Schedule III are true, accurate and correct in all respects on and as of the relevant date, and the Company has performed each of its respective obligations which are required to be performed by it prior to Closing. |

Best regards,

**************

SCHEDULE II

COMPANY WIRE TRANSFER DETAILS

SCHEDULE III

COMPANY REPRESENTATIONS AND WARRANTIES

The Company hereby represents and warrants to the Investor that as at the Effective Date and the Closing Date, respectively (except for those statements which are as of a specific date and in that case, those statements are made as of such specific date), the following statements are all true and correct; provided, however that all of such representations and warranties are in all cases qualified by the SEC Filings, and with respect to the foregoing, the Investor shall be deemed to have knowledge of the contents of the SEC Filings, and shall be deemed to have been provided with and received any documents that are SEC Filings:

|

(a) |

The Company is a public company, duly incorporated under the laws of The Cayman Islands with full power and authority to conduct the Business as it is now being conducted. The execution and delivery of this Agreement by the Company and the performance of its obligations hereunder has been or will be duly and validly authorized by all requisite action on its part and no other corporate action of the Company is or will be necessary to approve this Agreement or to perform its obligations hereunder. This Agreement has been duly and validly executed and delivered by the Company and constitutes a valid and binding obligation of the Company, enforceable against the Company in accordance with its terms; |

|

(b) |

The Company is in compliance with all material applicable Laws; |

|

(c) |

The Investor has been provided with true and accurate copies of the Memorandum of Association and Articles of Association of the Company and since such provision there has been no change made or authorized to the Articles of Association or the Memorandum of Association other than as provided for under the Agreement. The Company has materially complied with all the provisions of its Memorandum of Association and Articles of Association, and in particular, has not entered into any ultra vires transaction, or any transaction which has, had, or is likely to have a material adverse effect. The Company is not in contravention of any material requirements under appliable Law or the Memorandum of Association and Articles of Association; |

|

(d) |

To the Company’s knowledge, the Company has filed all statements, returns and other documents and filings required under applicable Law with Governmental Authorities, except where failure to file such statements, returns and other documents and filings would not reasonably be expected to be a material non-compliance with applicable Law; |

|

(e) |

The Company is in compliance with all applicable Laws for validly conducting the meetings of the Board and its shareholders, except where failure to so comply would not reasonably be expected to be a material non-compliance of applicable Law; and the minute books and other statutory registers of the Company, as applicable, have been properly and accurately maintained in accordance with applicable Law and are up to date in all respects and contain accurate records of all resolutions passed by the Directors and the shareholders of the Company as required under applicable Law; |

|

(a) |

The Company has the power and authority to enter into and perform, and has taken all necessary actions to authorize the entry into, performance and delivery of, this Agreement and the transactions contemplated thereby, and this Agreement, when executed, will constitute valid and binding obligation and be enforceable against the Company in accordance with its terms; |

|

(b) |

The entry into and performance by the Company of the transactions contemplated by this Agreement does not conflict with any other agreements to which the Company is a party nor, result in any additional Encumbrance upon any of the Assets or the suspension, revocation, impairment, forfeiture or non-renewal of any Governmental Authority material approval applicable to the Company, the Business or any of the Assets; |

|

(c) |

The Company has all material licenses and permits necessary for the conduct of the Business; and |

|

(d) |

The Board is duly elected and validly appointed as per the provisions of applicable Law and the Articles of Association and Memorandum of Association of the Company and none of the Directors is disqualified to continue as a director under any provisions of applicable Law. |

|

3. |

Outstanding Securities |

|

(a) |

There are no obligations, covenants or warranties provided by the Company which would prevent or otherwise restrict consummation of the transactions contemplated under this Agreement. |

|

4. |

Issuance of Securities: |

|

(a) |

The Investor Equity Shares will be validly issued and the subscription by Investor to the Investor Equity Shares will render the Investor as the sole legal owner of such Investor Equity Shares; |

|

(b) |

the Investor will have title to such Investor Equity Shares clear of Encumbrances; and |

|

(c) |

the Investor shall be entitled (save and except on account of its own acts, deeds and things and subject to the provisions of the Agreement) to all rights accorded under applicable Law and the Memorandum of Association and the Articles of Association to a holder of such Equity Shares. |

|

5. |

Investor Equity Shares: |

|

(a) |

The Investor Equity Shares are or will be duly issued and fully paid up and such issuance shall be in compliance with applicable Law. |

|

(a) |

This Agreement will constitute the legal, valid and binding obligation of the Company enforceable in accordance with its respective terms; |

|

(b) |

The execution, delivery and the performance by the Company, of this Agreement and its obligations in relation to the transaction contemplated hereunder, do not and will not: |

|

i) |

constitute a breach or a default under its Memorandum of Association and Articles of Association; |

|

ii) |

result in a material breach of, or constitute a material default under, any Material Contract so as to give a counterparty the right to terminate such Material Contract; or |

|

iii) |

result in a material violation or material breach of or material default under any applicable Law or of any order, judgment or decree of any Governmental Authority to which any of the Company or any of the Assets is bound that would materially affect the transactions contemplated herein; and |

|

(c) |

There is no injunction or other equitable action that would prevent the allotment of the Investor Equity Shares to the Investor as contemplated hereunder. |

|

(a) |

Save and except as required to be obtained as a Condition Precedent, all authorizations and approvals from any Governmental Authority or from any other third parties required for the entry into, performance, validity and enforceability of the transactions contemplated by the Agreement have been obtained or effected or will be obtained or effected (as appropriate) and are in or will be in full force. |

|

8. |

Related Party Transactions: |

|

(a) |

To the Company’s knowledge, all related party transactions entered into by the Company have been entered on an arms’ length basis. |

|

9. |

Licenses and Permissions: |

|

(a) |

The Company has all material licenses and material permissions that are required to carry out the Business and to own and operate the Assets, and is not in breach or violation of any of such licenses/permissions to which it is subject in any material respect. Each of the licenses and permissions referred to in this paragraph are in full force and effect; |

|

(b) |

To the Company’s knowledge, there are no proceedings pending or threatened in writing, that seek the revocation, cancellation, suspension, allege failure to renew or adverse modification of any such material licenses and material permissions held by the Company; and |

|

(c) |

In connection with the Business, the Company materially complies with all applicable data privacy Laws in the jurisdictions in which the Company operates. |

|

10. |

Financing and Indebtedness: |

|

(a) |

The Company does not have any material financial indebtedness, or material monetary liabilities or material obligations, whether accrued, absolute, contingent, asserted, present or future, except liabilities or obligations (i) stated or adequately reserved against in the Financial Statements, or (ii) incurred in the Ordinary Course of Business since the date of the Financial Statements; |

|

(b) |

No written demand or other written notice requiring the payment or repayment of money before its normal or originally stated maturity has been received by the Company in respect of any of its borrowings; and |

|

(c) |

The Company has satisfied all charges created pursuant to earlier credit facilities availed by the Company and none of the Assets continue to be charged in respect of credit facilities that have been repaid. |

|

(a) |

To the Company’s knowledge, there is no lawsuit or arbitration filed against the Company involving a sum in excess of US$5,000,000, or investigation or other proceeding by a Governmental Authority which would be expected to a have material effect on the Business; and |

|

(b) |

The Company has not issued or received any written notice to or from any person threatening to commence legal proceedings, other than in the Ordinary Course of Business. |

|

13. |

Employees, Directors, etc: |

|

(a) |

To the Company’s knowledge, none of the senior officers of the Company are in breach of their respective employment contracts with the Company; |

|

(b) |

To the Company’s knowledge, no senior officer presently intends to terminate her/his employment with the Company nor does the Company presently intend to terminate the employment of any such senior officer; |

|

(c) |

The Company has, in relation to each of its respective employees, materially complied with its respective obligations under applicable labour Laws; |

|

(d) |

The Company is complying with all material obligations under applicable Law in relation to its employees, independent contractors, subcontractors, or other persons providing services to or on behalf of the Company; |

|

(e) |

The Company has not entered into any collective bargaining agreements, arrangements and other similar understanding with any staff association or other body representing the employees of the Company; |

|

(f) |

The management team of the Company is not obligated under any contract or other agreement, or subject to any judgment, decree or order of any court or administrative agency, that would materially interfere with the use of his or her efforts to promote the interests of the Company or that would materially impair the Business as currently conducted; |

|

(g) |

The Company has not received any written notice or written claim from any Government Authority regarding non-compliance with applicable labour Laws. |

|

(a) |

The Company has executed written contracts and arrangements with its material customers regarding the Business as currently conducted which are, to Company’s knowledge, valid and binding on each of the applicable parties (collectively, the “Material Contracts”); and |

|

(b) |

To the Company’s knowledge, all Material Contracts to which the Company is a party are valid, binding and enforceable obligations of the parties thereto. No written notice of termination of a Material Contract has been received by the Company. To the Company’s knowledge, no circumstance exist that might reasonably result in the termination of such Material Contracts by the other party. |

|

(a) |

The Company has filed all necessary tax returns on a timely basis and the Company is not in material default of payment of any uncontested taxes and no material uncontested claim is being asserted by a Governmental Authority with respect to any taxes allegedly due to it by the Company; |

|

(b) |

The Company has complied with all material requirements as specified under applicable tax Laws in relation to returns, computations, notices and information which are required to be made or given by the Company; |

|

(c) |

No relief (whether by way of deduction, reduction, set-off, exemption, postponement, roll- over, hold-over, repayment or allowance or otherwise) from, against or in respect of any taxation has been claimed and/or given to the Company which could or might prevent or materially delay the consummation of the transactions contemplated by this Agreement; |

|

(d) |

The Company does not have any uncontested tax disputes or other uncontested liabilities with respect to taxes in respect of which a written claim notice has been received by the Company. To the Company’s knowledge, the Company has no pending uncontested audits, uncontested investigations or uncontested claims for or relating to any material liability in respect of taxes; |

|

(e) |

The Company has maintained all material records as required to be maintained for tax purposes under applicable Law in connection with the Business; |

|

(f) |

There are no uncontested amounts payable to Government Authority regarding taxes in respect of any employees (including any tax deductible from any amounts paid to an employee, and any national insurance, social fund or similar contributions required to be made in respect of employees) currently due and payable by Company and outstanding; |

|

(g) |

All tax returns of the Company due prior to the Closing Date have been timely filed, and to the Company’s knowledge, are true and correct in all material respects and reflect the tax liability of the Company. All uncontested taxes and withholding amounts due and payable by the Company have been paid; |

|

(h) |

The Company has withheld and paid all uncontested taxes required to be withheld and paid over, including maintenance of required records under applicable Law, in connection with the amounts paid or owing to any creditor, distributor, agent, independent contractor or other third party; |

|

(i) |

The Company does not have any liability in respect of any periods ending on or before the Closing Date, for unpaid taxes in excess of amounts that are both (i) set forth as reserves for taxes in the Financial Statements, (ii) taken into account in calculating working capital. |

|

(j) |

There are no tax sharing agreements or similar agreements (including indemnity arrangements) with respect to or involving the Company. The Company is not bound by any such tax sharing agreements and the Company does not have any liability there under for amounts due in respect of periods prior to the Closing Date. |

|

(a) |

The books of accounts of the Company have been accurately maintained, and the accounts of the Company, including the Financial Statements, have been prepared, in accordance with applicable Law and in accordance with International Financial Reporting Standards (“IFRS”) and/or Generally Accepted Accounting Principles (“GAAP”), as applicable, and give a true and fair view of the Business, including the Assets, liabilities and general state of affairs; |

|

(b) |

To the Company’s knowledge, the books of account, minute books, stock record books, and other records of the Company, as applicable, are accurate in all material respects. As of the date hereof, all of those books and records are in the possession of the Company; |

|

(c) |

The Company is a going concern carrying on the Business; |

|

(d) |

Since the date of the Financial Statements provided to the Investor, there has been no event or a condition of any type that has or would reasonably be expected to have a material adverse effect on the Business; |

|

(e) |

To the Company’s knowledge, there are no liabilities (contingent or otherwise) that may arise, accrue and/or attach to the Investor other than under applicable Law as a result of the consummation of the transactions contemplated by this Agreement; |

|

(f) |

There are no material actual or material contingent liabilities of the Company except for: |

|

i) |

liabilities disclosed or provided for in the Financial Statements; or |

|

ii) |

liabilities incurred in the Ordinary Course of Business since the date of this Agreement; |

|

(g) |

The Company has devised and maintained systems of internal accounting controls with respect to the Business sufficient to provide reasonable assurances that (i) all material transactions are executed in accordance with management’s general or specific authorization, and (ii) all transactions are recorded as necessary to permit the preparation of financial statements in conformity with IFRS and/or GAAP, as applicable, and to maintain proper accountability for items. |

|

(a) |

No written order has been received and no written resolution has been passed for the winding up or bankruptcy or insolvency of Company and no written petition has been presented for the purpose of winding up or bankruptcy or insolvency of Company; |

|

(b) |

To the Company’s knowledge, no receiver (which expression shall include an administrative receiver) has been appointed in respect of the Company or all or any of its material Assets; and |

|

(c) |

No written arrangement with creditors has been agreed by the Company in respect of its material Assets that is outside the Ordinary Course of Business. |

|

(a) |

The Company is not in material breach of any Material Contract to which it is a party. Each Material Contract has been duly authorized, executed and delivered by the Company, and to the Company’s knowledge, by each other party thereto. Each such contract constitutes valid and binding obligations of the Company and to the Company’s knowledge, of each other party thereto. No counterparty to any Material Contract has indicated in writing that the Company is in material default of such Material Contract or that such counterparty otherwise intends to terminate such Material Contract. |

Exhibit 99.1

Aeries

Technology, Inc. Announces $5 Million PIPE

NEW YORK, April 12, 2024 (GLOBE NEWSWIRE) – Aeries Technology, Inc.

(“Aeries” or “the Company”) (Nasdaq: AERT), a global professional services and consulting partner, today announced

that it has entered into a Subscription Agreement totaling $5 million at a purchase price of $2.21 per share in a private placement.

Sudhir Panikassery, Aeries CEO, said: “This $5 million investment

in Aeries is in important step for our growth strategy. We are grateful for the commitment and support we have received from our new PIPE

investor. We look forward to welcoming this investor and working with this investor on the exciting next phase of Aeries’ growth

story.”

Norton Rose Fulbright represented Aeries Technology in this transaction.

About Aeries Technology

Aeries Technology (Nasdaq: AERT) is a global

professional services and consulting partner for businesses in transformation mode and their stakeholders, including private equity sponsors

and their portfolio companies, with customized engagement models that are designed to provide the right mix of deep vertical specialty,

functional expertise, and digital systems and solutions to scale, optimize and transform a client’s business operations. Founded

in 2012, Aeries Technology now has over 1,600 professionals specializing in Technology Services and Solutions, Business Process Management,

and Digital Transformation initiatives, geared towards providing tailored solutions to drive business success. Aeries Technology’s

approach to staffing and developing its workforce has earned it the Great Place to Work Certification.

Contacts

Ryan Gardella

AeriesIR@icrinc.com

v3.24.1.u1

Cover

|

Apr. 08, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Apr. 08, 2024

|

| Entity File Number |

001-40920

|

| Entity Registrant Name |

Aeries Technology, Inc.

|

| Entity Central Index Key |

0001853044

|

| Entity Tax Identification Number |

98-1587626

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

60 Paya Lebar Road

|

| Entity Address, Address Line Two |

#08-13

|

| Entity Address, Address Line Three |

Paya Lebar Square

|

| Entity Address, City or Town |

Singapore

|

| Entity Address, Country |

SG

|

| Entity Address, Postal Zip Code |

409051

|

| City Area Code |

(919)

|

| Local Phone Number |

228-6404

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A ordinary shares, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A ordinary shares,

par value $0.0001 per share

|

| Trading Symbol |

AERT

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable warrants, each

whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50

|

| Trading Symbol |

AERTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |