XTL Biopharmaceuticals Announces Financial Results for the Year Ended December 31, 2008

07 April 2009 - 6:15AM

PR Newswire (US)

REHOVOT, Israel, April 6 /PRNewswire-FirstCall/ -- XTL

Biopharmaceuticals Ltd. (NASDAQ:XTLB)(TASE:XTL), a company engaged

in the acquisition, development and commercialization of

therapeutics for the treatment of multiple myeloma and hepatitis C,

announced today its financial results for the year ended December

31, 2008. At December 31, 2008, the Company had cash, cash

equivalents and short-term bank deposits of $2.9 million, compared

to $13.0 million at December 31, 2007. The decrease of $10.1

million during the year ended December 31, 2008 was attributable

primarily to operating expenditures associated with the Company's

Bicifadine clinical program and, to a certain extent, to the

preclinical hepatitis C program, which was out-licensed to Presidio

Pharmaceuticals, Inc., or Presidio, in 2008, offset by the $5.94

million non-refundable license payments received from Presidio. The

loss for the year ended December 31, 2008 was $9.2 million, or

$0.03 per ordinary share, compared to a loss of $24.9 million, or

$0.11 per ordinary share, for the year ended December 31, 2007,

representing a decrease in net loss of $15.7 million. The decreased

loss was primarily attributable to a $7.4 million decrease in

research and development costs, the recognition in the 2008 period

of the $5.94 million non-refundable license fee received from

Presidio and the reversal of $1.6 million in transaction advisory

fees in the form of stock appreciation rights associated with the

in-licensing of Bicifadine in 2008 that was recorded in 2007. The

transaction advisory fee in the form of a SAR is revalued, based on

the then current fair value, at each subsequent reporting date. For

the years ended December 31, 2008 and 2007, the Company's losses of

$9.2 million and $24.9 million, respectively, included $1.9 million

and $1.9 million, respectively, of non-cash stock option

compensation expense. The Company also announced today that in its

Annual Report on Form 20-F for the year ended December 31, 2008,

the Company's independent registered public accounting firm

expresses an unqualified opinion on the December 31, 2008

consolidated financial statements and will include an explanatory

paragraph expressing substantial doubt about the Company's ability

to continue as a going concern. David Grossman, co-Chief Executive

Officer of XTL, commented, "2008 was a disappointing year for XTL

with the failure of the Phase 2b Bicifadine clinical program in

November 2008." Mr. Grossman added, "In March 2009, we announced

the acquisition, subject to certain closing conditions including a

financing, of the rights for recombinant EPO, or rHuEPO, as a

potential treatment for multiple myeloma, a severe and incurable

blood cancer. We are excited about this opportunity and look

forward to embarking on a clinical trial with rHuEPO for the

treatment of multiple myeloma in the near term." ABOUT XTL

BIOPHARMACEUTICALS LTD. XTL Biopharmaceuticals Ltd. ("XTL") is

engaged in the acquisition, development and commercialization of

therapeutics for the treatment of multiple myeloma and hepatitis C.

XTL will be developing rHuEPO for the treatment of multiple

myeloma. XTL is publicly traded on the NASDAQ and Tel-Aviv Stock

Exchanges (NASDAQ:XTLB)(TASE:XTL). Cautionary Statement Some of the

statements included in this press release, particularly those

anticipating future business prospects growth and operating

strategies and similar matters, may be forward-looking statements

that involve a number of risks and uncertainties. For those

statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. Among the factors that could cause

our actual results to differ materially include: our ability to

maintain our Nasdaq Stock Market listing; our ability to raise

additional capital in order to continue to fund our operations and

the development of our drug candidates; our ability to successfully

close the transaction with Bio-Gal Ltd.; our ability to

successfully find successful merger or in-licensing opportunities;

and other risk factors identified from time to time in our reports

filed with the Securities and Exchange Commission, including our

annual report on Form 20-F filed with the Securities and Exchange

Commission on March 27, 2008. Any forward-looking statements set

forth in this press release speak only as of the date of this press

release. We do not intend to update any of these forward-looking

statements to reflect events or circumstances that occur after the

date hereof. This press release and prior releases are available at

http://www.xtlbio.com/. The information in our website is not

incorporated by reference into this press release and is included

as an inactive textual reference only. XTL Biopharmaceuticals Ltd.

Selected Consolidated Financial Data (Thousands of US Dollars,

Except Share and Per Share Data) Statements of Operations

Information: Year ended December 31, 2008 2007 -----------

----------- (unaudited) License Revenue: 5,940 907 Cost of license

revenues (with respect to royalties) -- 110 ----------- -----------

Gross margin 5,940 797 ----------- ----------- Research and

development costs (includes $7,500 initial upfront license fee in

2007 and also includes non-cash stock option compensation of $78

and $141, in 2008 and 2007, respectively) 11,490 18,998 Less -

participations -- 56 ----------- ----------- 11,490 18,942 General

and administrative expenses (includes non-cash stock option

compensation of $1,735 and $1,784, in 2008 and 2007, respectively)

5,143 5,582 Business development costs (includes stock appreciation

rights compensation (income) of ($1,553) and 1,560 in 2008 and

2007, respectively and also includes non-cash stock option

compensation of $85 and $22, in 2008 and 2007, respectively)

(1,102) 2,008 ----------- ----------- Operating loss 9,591 25,735

Financial and other income, net 314 590 ----------- -----------

Loss before income taxes 9,277 25,145 Income taxes (31) (206)

----------- ----------- Loss for the period 9,246 24,939

=========== =========== Basic and diluted loss per ordinary share

$0.03 $0.11 =========== =========== Weighted average number of

shares used in computing basic and diluted loss per ordinary share

292,769,320 228,492,818 =========== =========== Balance Sheet

Information: December 31, 2008 2007* ----------- -----------

(unaudited) Cash, cash equivalents, and bank deposits 2,924 12,977

Working capital 1,385 8,532 Total assets 3,430 14,127 Accumulated

deficit (149,108) (139,862) Total shareholders' equity 1,426 8,564

Condensed from audited financial statements. DATASOURCE: XTL

Biopharmaceuticals Ltd. CONTACT: David Grossman, co-Chief Executive

Officer of XTL Biopharmaceuticals Ltd., Tel: +972-8-930-4411 Web

Site: http://www.xtlbio.com/

Copyright

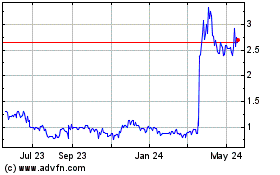

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Jun 2024 to Jul 2024

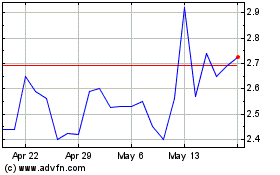

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Jul 2023 to Jul 2024