Atrium Mortgage Investment Corporation (TSX:AI) is pleased to

announce its results for the third quarter of 2013.

Highlights

- Earnings per share (basic and diluted) − $0.22 (Q3 last year −

$0.20)

- Dividends paid per share − $0.20

- Total assets − $276 million

- High quality mortgage portfolio:

- Increased first mortgages to 88.0% of portfolio

- 96% of all loans are less than or equal to 75% loan to

value

- Dollar amount in excess of 75% loan to value is $1.0

million

- Overall portfolio loan to value reduced to 62.6%

- Average mortgage interest rate stable at 8.7%

- Maintained a highly diversified portfolio of mortgage

investment

- Atrium recently increased its line of credit to $80 million,

reflecting the growth in business volumes and the confidence of its

bankers

Atrium continues to earn well above its dividend payout.

Year-to-date earnings are $0.63, versus dividends paid of $0.60.

Shareholders of record December 31, 2013 will receive a special

dividend on March 5, 2014 of the excess of taxable earnings over

dividends paid.

"We are very pleased with Atrium's results for the quarter. We

earned 109% of our dividend payout this quarter, and we expect to

be able to continue to operate at this elevated level of earnings

for the balance of the year. The recently closed $32.5 million

convertible debenture has allowed us to improve our leverage. Our

current debt to assets ratio is still less than 23%. We believe

that a gradual increase in our leverage, including the recently

increased line of credit, will provide further improvement in

earnings going forward," noted Robert Goodall, Chief Executive

Officer of Atrium.

Mr. Goodall continued, "We have successfully managed our risk

profile by maintaining a conservative loan to value ratio, both on

a portfolio and individual loan basis. We are proud of having more

than 96% of our portfolio in 'low ratio mortgages' (mortgages with

a loan to value of less than 75%). We have a diversified mortgage

portfolio which is focussed almost exclusively on major urban

centres where we have offices and local representation, in Ontario,

Alberta and British Columbia.

"The relatively short-term nature of our mortgages allows us to

continually alter our investment mix to minimize risk. It also

allows us to relatively quickly increase the interest rates on our

mortgages should bond yields increase."

Results of operations

For the three-month period ended September 30, 2013, mortgage

interest and fees aggregated $6.3 million, compared to $4.2 million

in the same period in the previous year, an increase of 48%. The

weighted average yield on the mortgage portfolio declined from 8.9%

at the end of 2012 to 8.7% in the third quarter of 2013, as we

continue our focus on higher quality assets.

Operating expenses aggregated $1.7 million, or 26.9% of

revenues, compared to $1.2 million or 29.0% of revenues in the

prior year period. The major component of operating expenses was

mortgage servicing and other fees paid to the manager (that is, the

management fee plus HST) which aggregated $0.7 million for the

three months ended September 30, 2013, compared with $0.4 million

in the comparative quarter, reflecting the growth of our mortgage

portfolio. Within operating expenses, expenses other than interest

and bank charges aggregated $850,385, which represented 0.3% of the

mortgage portfolio or 1.25% annualized. In other words, operating

costs in the quarter were about 125 basis points.

Net earnings for the three months ended September 30, 2013

aggregated $4.6 million, an increase of 52.9% from net earnings of

$3.0 million in the same period in the previous year. Basic and

diluted earnings per share were $0.22 per common for the three

months ended September 30, 2013, compared with basic and diluted

earnings of $0.20 per common share for the same period the previous

year.

For further details on the financial results, please refer to

the unaudited condensed interim financial statements and

management's discussion and analysis for the three-month and

nine-month periods ended September 30, 2013 and 2012, which are

available at www.sedar.com or at www.atriummic.com.

Mortgage portfolio

Atrium's mortgages receivable include 116 mortgage loans and

aggregated $276.4 million at September 30, 2013, an increase of

36.9% from December 31, 2012.

| |

September 30,

2013 |

December 31,

2012 |

| Mortgage

category |

Number |

Outstanding

amount |

% of Portfolio |

Number |

Outstanding

amount |

% of Portfolio |

| Mixed use real estate/commercial |

24 |

$90,271,277 |

32.6% |

15 |

$69,334,931 |

34.4% |

| Low rise residential |

17 |

63,003,641 |

22.7% |

8 |

24,302,272 |

12.1% |

| House and apartment |

48 |

61,090,350 |

22.0% |

31 |

43,061,190 |

21.3% |

| High rise residential |

4 |

25,036,000 |

9.0% |

4 |

23,686,000 |

11.8% |

| Construction |

9 |

22,108,507 |

8.0% |

4 |

15,087,981 |

7.5% |

| Midrise residential |

5 |

13,262,632 |

4.8% |

5 |

24,381,184 |

12.1% |

| Condominium corporation |

9 |

2,475,995 |

0.9% |

10 |

1,629,664 |

0.8% |

| Mortgage portfolio |

116 |

277,248,402 |

100.0% |

77 |

201,483,222 |

100.0% |

| |

|

|

|

|

|

|

| Accrued interest receivable |

|

1,430,636 |

|

|

2,589,639 |

|

| Mortgage discount* |

|

(391,442) |

|

|

385,508 |

|

| Mortgage origination fees* |

|

(714,733) |

|

|

(644,735) |

|

| Provision for mortgage losses |

|

(1,150,667) |

|

|

(1,087,667) |

|

| Mortgage receivable |

|

$276,422,196 |

|

|

$201,954,951 |

|

Atrium Mortgage Investment Corporation actively manages

its exposure, and has continued to shift the portfolio towards

commercial/mixed use, low rise residential properties and single

family homes and apartments, which represent 77.3% of the mortgage

portfolio at September 30, 2013, an increase of 9.5% since December

31, 2012.

An analysis of mortgages by size is presented below.

| |

September 30,

2013 |

December 31,

2012 |

| Mortgage amount |

Number |

Outstanding

amount |

% of Portfolio |

Number |

Outstanding

amount |

% of Portfolio |

| $0 – $2,500,000 |

78 |

$83,340,747 |

30.1% |

50 |

$48,628,362 |

24.2% |

| $2,500,001 - $5,000,000 |

24 |

80,421,992 |

29.0% |

16 |

55,814,860 |

27.7% |

| $5,000,001 - $7,500,000 |

7 |

44,649,842 |

16.1% |

5 |

30,670,000 |

15.2% |

| $7,500,001 + |

7 |

68,835,821 |

24.8% |

6 |

66,370,000 |

32.9% |

| |

116 |

$277,248,402 |

100% |

77 |

$201,483,222 |

100% |

As of September 30, 2013, the mortgage portfolio consisted of

116 investments with an average outstanding balance of $2.4 million

and a median outstanding balance of $1.5 million.

Analysis of mortgages as at September 30, 2013 by type of

mortgage, nature of the underlying property, and location of the

underlying property is set out below:

| Description |

Number of

mortgages |

Amount |

Percentage |

Weighted average

yield |

| |

|

|

|

|

| Type of mortgage |

|

|

|

|

| First mortgages |

105 |

$243,835,522 |

88.0% |

8.4% |

| Second and third mortgages |

11 |

33,412,880 |

12.0% |

10.8% |

| |

116 |

$277,248,402 |

100.0% |

8.7% |

| |

|

|

|

|

| Nature of underlying

property |

|

|

|

|

| Residential |

92 |

$186,977,125 |

67.4% |

8.7% |

| Commercial |

24 |

90,271,277 |

32.6% |

8.7% |

| |

116 |

$277,248,402 |

100.0% |

8.7% |

| |

|

|

|

|

| Location of underlying

property |

|

|

|

|

| Greater Toronto

Area |

96 |

$222,805,983 |

80.4% |

8.7% |

| Non-GTA

Ontario |

6 |

22,464,599 |

8.1% |

9.1% |

| British Columbia |

9 |

12,469,255 |

4.5% |

8.4% |

| Alberta |

5 |

19,508,565 |

7.0% |

8.6% |

| |

116 |

$277,248,402 |

100.0% |

8.7% |

The exceptionally high percentage of first mortgages is a core

strategy and is unmatched by Atrium's peer group. The company

expects its geographic diversification strategy to accelerate in

2014, as business in Alberta has increased substantially during the

past 30-60 days.

The average loan-to-value in the portfolio improved further to

62.6%, compared to 65.5% last quarter. As importantly, only 3.6% of

Atrium's mortgages are over 75% loan to value which is the lowest

percentage in the industry.

Conference call

Atrium will host a conference call for investors and

shareholders to discuss its results on Monday October 28, 2013 at

4:00 p.m. EDT. To participate or listen to the conference call

live, please call 1 (866) 544-4631 or (416) 849-5571.

For a replay of the conference call (available until August 15,

2013) please call 1 (866) 245-6755, access code 457028.

About Atrium

As a mortgage investment corporation, Atrium is a non-bank

provider of residential and commercial real estate mortgages that

lends in major urban centres in Canada where the stability and

liquidity of real estate are high. Atrium's objectives are to

provide its shareholders with stable and secure dividends and

preserve shareholders' equity by lending within conservative risk

parameters.

Forward-Looking Statements

Certain information included in this news release is

forward-looking, within the meaning of applicable securities laws.

Much of this information can be identified by words such as

"believe", "expects", "expected", "will", "intends", "projects",

"anticipates", "estimates", "continues" or similar expressions

suggesting future outcomes or events. Forward looking statements

regarding earnings and portfolio growth are based upon the

following key assumptions: that other factors such as revenues and

expenses continue to follow current trends, and that current trends

in portfolio growth continue. Atrium believes the expectations

reflected in all forward-looking statements are reasonable but no

assurance can be given that these expectations will prove to be

correct and such forward-looking statements should not be unduly

relied upon.

Forward-looking statements are based on current information and

expectations that involve a number of risks and uncertainties,

which could cause actual results or events to differ materially

from those anticipated. These risks include, but are not limited

to, the uncertainty associated with accessing capital markets and

the risks related to Atrium's business, including those identified

in Atrium's annual information form dated December 31, 2012 and

short form prospectus dated June 11, 2013 under the heading "Risk

Factors" (copies of which may be obtained at www.sedar.com).

Forward looking statements contained in this news release are made

as of the date hereof and are subject to change. All

forward-looking statements in this news release are qualified by

these cautionary statements. Except as required by applicable law,

Atrium undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

CONTACT: For further information, please contact

Robert G. Goodall

President and Chief Executive Officer

Jeffrey D. Sherman

Chief Financial Officer

(416) 607-4200

ir@atriummic.com

www.atriummic.com

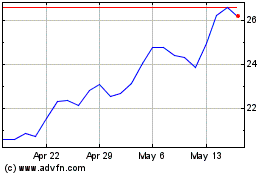

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2024 to Jul 2024

C3 AI (NYSE:AI)

Historical Stock Chart

From Jul 2023 to Jul 2024