Air Liquide Enters Exclusive Negotiations with Montagu Private Equity to Sell Aqua Lung

05 October 2016 - 2:35AM

Business Wire

Regulatory News:

Air Liquide (Paris:AI) announced today that it has entered into

exclusive negotiations with Montagu Private Equity, a leading

European private equity firm, for the potential sale of Aqua Lung,

a key player in personal aquatic equipment for recreational and

professional use. Air Liquide is focused on its Gas & Services

activities following the Group’s acquisition of Airgas, as well as

on the implementation of its company program NEOS for the 2016-2020

period.

If completed, the acquisition by Montagu Private Equity will

support Aqua Lung’s next phase of growth and its transformation as

a major consumer products player.

The transaction would be subject to the final and definitive

agreement between the parties and customary conditions and

provisions.

About Aqua LungPresent in

around 90 countries with approximately 1,000 employees, Air Liquide

subsidiary Aqua Lung is a key player in personal aquatic equipment

for recreational and professional use. Founded in 1946, Aqua Lung

is a historical expert in SCUBA diving and has expanded its

offering to complementary areas such as swimming, aqua fitness and

free diving. In 2015, Aqua Lung generated approximately €200

million in revenue.

About Montagu Private

EquityMontagu Private Equity is one of Europe’s leading

private equity firms. Founded in 1968, Montagu can look back on

more than 45 years’ experience in investing in more than 400

transactions. Montagu has a strong track record of supporting

portfolio companies, dedicating significant resources to management

teams as well as providing additional capital expenditure to fund

further growth. Montagu also has considerable expertise helping

businesses to accelerate their growth in their home markets as well

as to internationalise and expand their customer base. The firm has

assets under management of just over €5 billion.

_______________________________________________

The world leader in gases, technologies and services for

Industry and Health, Air Liquide is present in 80 countries with

approximately 68,000 employees and serves more than 3 million

customers and patients*. Oxygen, nitrogen and hydrogen are

essential small molecules for life, matter and energy. They embody

Air Liquide’s scientific territory and have been at the core of the

company’s activities since its creation in 1902.

Air Liquide’s ambition is to lead its industry, deliver

long-term performance and contribute to sustainability. The

company’s customer-centric transformation strategy aims at

profitable growth over the long term. It relies on operational

excellence, selective investments, open innovation and a network

organization implemented by the Group worldwide. Through the

commitment and inventiveness of its people, Air Liquide leverages

energy and environment transition, changes in healthcare and

digitization, and delivers greater value to all its

stakeholders.

Air Liquide’s revenues amounted to €16.4 billion in 2015, and

its solutions that protect life and the environment represented

more than 40% of sales. On 23 May 2016, Air Liquide completed its

acquisition of Airgas, which had revenues amounting to $5.3 billion

(around €4.8 billion) for the fiscal year ending 31 March 2016.Air

Liquide is listed on the Paris Euronext stock exchange (compartment

A) and belongs to the CAC 40 and Dow Jones Euro Stoxx 50

indexes.

* Following the acquisition of Airgas on 23 May 2016

www.airliquide.comFollow us on Twitter

@airliquidegroup

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161004006189/en/

Air LiquideCorporate CommunicationsCaroline

Philips, +33 (0)1 40 62 50 84Aurélie Wayser-Langevin, +33 (0)1 40

62 56 19Caroline Brugier, +33 (0)1 40 62 50 59orInvestor

RelationsParis+33 (0)1 40 62 50 87Radnor+1 610 263 8277

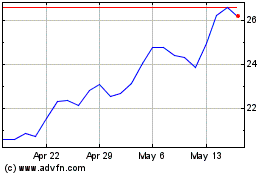

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2024 to Jul 2024

C3 AI (NYSE:AI)

Historical Stock Chart

From Jul 2023 to Jul 2024