Accelerating comparable growth in Gas & Services

sales

2017 objective confirmed

Regulatory News:

Air Liquide (Paris:AI)

Q3 2017 Key Figures

Group revenue:

€4,944M

-0.3%*

of which Gas & Services:

€4,787M

+0.1%*

Comparable growth**

Gas & Services revenue:

+4.0%

of which Industrial Merchant:

+4.3%

* Change as published. 2016 restated, Welding and Diving

activities reported as discontinued operations.** Excluding

currency and energy (natural gas and electricity) impacts.

Variation Q3 2017 vs. restated Q3 2016, adjusted as if on January

1, 2016 Airgas had been fully consolidated and the divestments

required by US competition regulators had been completed.

Q3 2017 Highlights

- External parameters: industrial

production index improving, negative currency impact, limited

impact of hurricanes in the United States.

- Airgas-related synergies ahead of

forecasts.

- Long-term contracts: hydrogen

for oil refining in Mexico, air gases for an energy and chemicals

customer in China.

- Business portfolio management:

closed divestment of Air Liquide Welding and of the Airgas’

refrigerant business, Healthcare acquisition in Japan.

- New markets: entry into the

Norwegian biogas market, launch of an e-health offer in Europe,

first hydrogen charging station in Dubai.

Commenting on the third quarter of 2017, Benoît Potier, Chairman

and CEO of Air Liquide, said:

“During this quarter, Gas & Services sales growth

accelerated on a comparable basis, supported by strong activity in

all business lines. The ramp-up in activity in Industrial Merchant

and the high growth in Electronics were confirmed over the period.

In terms of geography, growth was driven in particular by

developing economies and Asia-Pacific with very strong sales in

China. Activity in North America was slightly impacted by the

hurricanes which hit the United States, whereas Europe posted solid

growth. The third quarter was also marked by a negative currency

impact, which offset the positive impact of the first six months of

the year.

The Group continued to generate operational efficiency gains,

in addition to Airgas synergies which are ahead of our 2017

forecasts. Thanks to a good level of cash flow, debt now stands

below 15 billion euros.

The Group can also rely on its 2.1 billion euro investment

backlog, as well as on its innovations and new markets, to fuel

future growth, as highlighted by the solid performance of the

Global Markets & Technologies activity.

Assuming a comparable environment, Air Liquide is confident

in its ability to deliver net profit growth in 2017.”

Q3 2017 Group revenue reached 4,944 million euros,

an increase of +3.5% on a comparable basis as compared with

Q3 2016. Revenue was nearly flat at -0.3% as published, impacted by

a currency impact that turned negative this quarter (-4.0%). The

positive energy impact softened to +1.0% this quarter.

Gas & Services revenue, which totaled 4,787

million euros, was up +4.0% on a comparable basis versus

Q3 2016. This reflects an acceleration in sales growth compared

with the previous two quarters, despite the limited impact of the

hurricanes in the United States. Excluding this impact, comparable

growth reached +4.4%. Gas & Services revenue was stable at

+0.1% as published, affected by the negative currency impact.

The developing economies posted strong growth, with Gas

& Services revenue up +10.4% on a comparable basis.

Overall, all Gas & Services business lines grew this

quarter on a comparable basis:

- The ramp-up in activity continued in

Industrial Merchant with growth at +4.3%. Sales,

which were up in all regions, were particularly strong in

developing economies. In Europe, sales growth of +4.2% was

driven by increased bulk and cylinder volumes, as well as a

positive price impact. Business momentum was strong in Italy,

Iberia, France and Benelux. In North America, the recovery

was confirmed, notably with higher volumes. In the United States,

sales improved in almost all market segments, whereas in Canada

they were driven by the energy and metal fabrication sectors.

Asia-Pacific enjoyed strong sales in China, where growth

exceeded +15%, due to an increase in both prices and volumes. At

the global level, the price impact for the World Business Line was

positive at +1.3%.

- Large Industries revenue

increased by +2.0%. Excluding the impact of hurricanes in

the United States, sales were up +3.2%. The situation in North

America was contrasted. Activity in the United States was

impacted by customer unit shutdowns due to the hurricanes, in

particular refineries, whereas sales growth in Canada was driven by

greater demand for oxygen from steel producers. In Europe,

hydrogen demand increased at the end of the quarter, however

revenue for the region remained impacted by the cessation of

operations in Ukraine. Sales in Asia-Pacific grew markedly

(+8.1%) due to production unit start-ups in China and strong

customer demand in both China and South Korea. Finally, in

theMiddle-East, growth continued to be driven by the

hydrogen production units in Yanbu, Saudi Arabia.

- Electronics sales, which were up

+7.2%, saw a strong growth level, thanks in particular to

high demand in China and Taiwan. All regions contributed to growth.

Carrier gases sales remained robust while equipment and

installation sales were up slightly this quarter. Demand for

Advanced Materials continued to be sound with revenue growth in

this product category of almost +30%.

- Healthcare continued its steady

growth, up +4.5%. It benefited from sustained demand in home

healthcare services and robust specialty ingredients and medical

equipment sales. Activity was particularly strong in developing

economies, in particular in South America, which posted

double-digit revenue growth. Acquisitions also contributed to

growth in countries such as in Canada or Japan.

Engineering & Construction revenue totaled

75 million euros this quarter, down -25.1% on a

comparable basis, as a result of the low level of order intake in

2016. Order intake since the beginning of 2017 has improved

significantly compared with last year.

Global Markets & Technologies revenue amounted to

82 million euros this quarter. This represented an increase

of +13.2% on a comparable basis, in line with the two previous

quarters. Sales were particularly strong in the maritime and biogas

sectors. Moreover, the Group made an acquisition in the biogas

sector in Norway this quarter.

________

The Group continues to strengthen its competitiveness. Cumulated

operational efficiency gains since the beginning of the year

reached 229 million euros, in line with the annual

target of more than 300 million euros. Airgas acquisition

synergies are a few months ahead of annual forecasts thanks to

quicker project execution. The Group has therefore revised its

synergies target upward for 2017 and now forecasts by year end

2017 a cumulated delivery of 195 million US dollars in

synergies since the acquisition, versus the 175 million US

dollars previously announced.

Cash flow from operating activities before changes in

Working Capital Requirements increased and amounted to 2.9

billion euros at September 30, 2017, allowing the net

debt level to be brought back below 15 billion euros.

________

The slideshow that accompanies this press

release will be available starting at 9 am (Paris time) on the Air

Liquide corporate website: airliquide.com.

Follow the announcement of third quarter

revenue live on Twitter @AirLiquideGroup.

UPCOMING EVENTS

Actionaria trade show, Paris, FranceNovember 23-24,

2017

2017 Annual resultsFebruary 15, 2018

The world leader in gases, technologies and services for

Industry and Health, Air Liquide is present in 80 countries with

approximately 65,000 employees and serves more than 3 million

customers and patients. Oxygen, nitrogen and hydrogen are essential

small molecules for life, matter and energy. They embody Air

Liquide’s scientific territory and have been at the core of the

company’s activities since its creation in 1902.

Air Liquide’s ambition is to lead its industry, deliver long

term performance and contribute to sustainability. The company’s

customer-centric transformation strategy aims at profitable growth

over the long term. It relies on operational excellence, selective

investments, open innovation and a network organization implemented

by the Group worldwide. Through the commitment and inventiveness of

its people, Air Liquide leverages energy and environment

transition, changes in healthcare and digitization, and delivers

greater value to all its stakeholders.

Air Liquide’s revenue amounted to €18.1 billion in 2016 and its

solutions that protect life and the environment represented more

than 40% of sales. Air Liquide is listed on the Euronext Paris

stock exchange (compartment A) and belongs to the CAC 40,

EURO STOXX 50 and FTSE4Good indexes.

www.airliquide.comFollow us on Twitter

@airliquidegroup

3rd quarter 2017 revenue

The 3rd quarter 2017 saw an acceleration in Gas &

Services revenue growth on a comparable basis, at +4.0%.

Sales were up in all business lines, with a marked increase in

growth in Industrial Merchant and Electronics.

Group revenue for the 3rd quarter 2017 reached 4,944

million euros, up +3.5% on a comparable basis. It

benefited from positive momentum in Gas & Services sales and

the development of the Global Markets & Technology business,

whereas the activity level in Engineering & Construction

remained weak. The change in revenue was almost flat at -0.3% as

published, affected by a negative currency impact this quarter

(-4.0%) and a weaker contribution of the energy impact (+1.0%). On

a comparable basis, Gas & Services revenue was up

+4.0% at 4,787 million euros, a marked acceleration

compared with growth of +2.7% in the 2nd quarter. The ramp-up in

activity continued in Industrial Merchant (+4.3%), with higher

liquid gas and cylinder volumes and pricing up slightly, at +1.3%.

Electronics was also a very solid growth driver this quarter

(+7.2%), benefiting from the start-up of new units and double-digit

growth in Advanced Materials. Healthcare continued its steady

development (+4.5%) and Large Industries revenue was in line with

2nd quarter growth (+2.0%). Revenue was up in all regions, with

marked growth in developing economies and in Asia, in particular

China. In North America, revenue was slightly impacted this quarter

by the hurricanes.

Ongoing efforts to improve productivity continued throughout the

Group, leading to 81 million euros in efficiencies

this quarter, or 229 million euros at the end of September, in line

with the NEOS objective. Airgas synergies are delivering

more quickly than anticipated and have reached 177 million US

dollars in total since 2016. The cumulated target at the end of

2017, which was exceeded at the end of September, has been revised

upwards to 195 million US dollars. The total amount of synergies

expected at the end of 2019 remains unchanged at 300 million US

dollars.

Cash flow from operating activities before changes in working

capital requirements amounted to 2,856 million euros at

the end of September, up +12.4%. The net debt was brought back

under 15 billion euros benefitting from a favorable currency

impact.

The 12-month portfolio of investment opportunities remained

stable at 2.1 billion euros at the end of September 2017.

Investment decisions totaled 610 million euros for the

quarter and 1.7 billion euros since the beginning of the

year. Net capital expenditures represented 10.7% of sales, in line

with the mid-term strategic plan.

Terms « published » and « comparable » used

in this document refer to the definitions below:

- Published

growth vs 2016 data is calculated in accordance with

IFRS 5. Other Activities (Aqua Lung and

Air Liquide Welding) are reported under “Net income from

discontinued operations” in the 2016 and 2017 income

statement.

- Adjusted 2016

revenue is computed as if, on January 1st 2016,

Airgas had been fully consolidated and the divestitures requested

by the U.S. Federal Trade Commission completed, and Aqua Lung

and Air Liquide Welding had been deconsolidated.

- Comparable

growth: in 2017, Air Liquide communicates a

comparable sales growth based on 2016 adjusted sales, excluding

currency and energy (natural gas and electricity)

impacts.

- Reference to

Airgas now corresponds to the Group’s Industrial

Merchant and Healthcare activities in the United States within

the new scope, after the merger of Airgas and

Air Liquide U.S. operations.

Unless otherwise stated, all variations in revenue outlined

below are on a comparable basis.

Q3 2017 Highlights

DEVELOPMENTS IN LARGE INDUSTRIES

- In early September, Air Liquide

announced the signature of a new long-term agreement with Pemex

Transformación Industrial, a subsidiary of Petróleos Mexicanos

(PEMEX), the state-owned oil & gas company, to supply

hydrogen to PEMEX’s refinery located at Tula de Allende, in the

state of Hidalgo in the central region of Mexico. Through a €50

million investment for the takeover and optimization of

PEMEX’s existing hydrogen production unit, this agreement will

allow Air Liquide to supply 90,000 Nm3 per hour of hydrogen to

PEMEX refinery and to strengthen its presence in central

Mexico.

- In mid-October, Air Liquide entered

into a new joint venture with Sinopec in Beijing, for the

takeover and optimization of three existing ASUs and the

building of a new nitrogen unit, for a total investment of

40 million euros. In the third quarter 2017, Air

Liquide also commissioned a new state-of-the art ASU for the supply

of oxygen and nitrogen to Sinopec in South China.

DEVELOPMENTS IN HEALTHCARE

- In early September, Air Liquide

announced the deployment of “Chronic Care Connect™”, an

e-health solution in order to support remotely patients with

chronic conditions at home using digital. Thanks to this

technology, patients are monitored on a daily basis remotely with

individualized support provided by Air Liquide nurses via a

certified nursing center. This solution helps to improve patients’

quality of life. As for their physicians, they have access to an

operational solution that allows for preventive management of

patient condition evolution. By avoiding hospitalization, the Air

Liquide connected solution for the remote monitoring of

patients also meets the challenges facing health authorities.

- At the end of September, Air Liquide

announced a major Healthcare acquisition in Japan. Air Liquide is

expanding its healthcare business in Japan with the

acquisition of Sogo Sangyo Kabushiki Kaisha (“SSKK”),

a major Japanese player with a strong presence in the home

healthcare and medical gases markets especially in the Tokyo

region. Present in the Japanese market for 60 years, SSKK is

specialized in the medical gases field serving more than 2,000

hospitals and clinics and home treatment for patients suffering

from respiratory diseases including: sleep apnea, Chronic

Obstructive Pulmonary Disease and chronic respiratory failure. This

acquisition increases the number of patients served at home

by Air Liquide in Japan to reach 20,000.

PORTFOLIO MANAGEMENT

- At the end of July 2017, Air Liquide

announced that it had completed the sale of Air Liquide

Welding, its subsidiary specialized in the manufacture of

welding and cutting technologies, to Lincoln Electric France SAS,

subsidiary of Lincoln Electric Holdings, Inc. (“Lincoln

Electric”). Lincoln Electric is the world leader in design,

development and manufacture of arc welding products, robotic arc

welding systems, plasma and oxy-fuel cutting equipment. This sale

follows the signed agreement announced on April 27th 2017 with

Lincoln Electric, and the related usual regulatory approvals,

including competition authorities’ approval.

- On October 10th, Airgas, completed

the sale of Airgas-Refrigerants, Inc., its subsidiary

specializing in the distribution, packaging and reclamation of

refrigerant gases, to Hudson Technologies, Inc. The

sale of this Airgas subsidiary is reflective of Airgas’ focus on

its core business.

Analysis of 3rd quarter revenue

REVENUE

Revenue

(in millions of euros)

Q3 2016 Q3

2017

2017/2016publishedchange

2017/2016comparablechange

Gas & Services

4,783 4,787

+0.1% +4.0% Engineering &

Construction 105 75

-28.1% -25.1%

Global Markets & Technologies 73

82 +11.5%

+13.2%

TOTAL REVENUE

4,961 4,944

-0.3% +3.5%

Group

Group revenue for the third quarter of 2017 totaled 4,944

million euros, up +3.5% on a comparable basis. The

quarter benefited from a significant acceleration in Gas &

Services sales growth and activities in development in Global

Markets & Technologies, whereas activity level remained weak in

Engineering & Construction. The currency impact turned negative

this quarter, at -4.0%, due to the appreciation of the euro against

the US dollar, Japanese yen and Chinese yuan. The energy impact

softened and only accounted for +1.0%. Thus, revenue as published

was almost flat at -0.3%.

Gas & Services

Gas & Services revenue totaled 4,787 million

euros. Comparable growth at +4.0%, and +4.4% excluding

the limited impact of hurricanes in North America, was stronger

than in the 1st half (+2.8%). Sales improved in all business lines,

in particular in Industrial Merchant (+4.3%) and Electronics

(+7.2%). The contribution from the base business was strong,

exceeding +2.5%, to which is being added sales from the start-up

and ramp-up of new units. Sales as published were stable at +0.1%,

impacted by a negative currency effect of -4.1% and by a weaker

energy contribution (+1.0%).

(in millions of euros)

Q3 2016 Q3

2017

2017/2016publishedchange

2017/2016comparablechange

Americas 2,042

1,968 -3.6% +2.8%

Europe 1,601

1,657 +3.5% +2.5%

Asia-Pacific 997

1,010 +1.3% +7.6%

Middle East & Africa 143

152 +6.8%

+10.9%

GAS & SERVICES REVENUE

4,783 4,787

+0.1% +4.0%

Large Industries 1,261

1,286 +2.0%

+2.0% Industrial Merchant 2,308

2,265 -1.9%

+4.3% Healthcare 814

833 +2.3%

+4.5% Electronics 400

403 +0.8%

+7.2%

Americas

Gas & Services revenue in the Americas zone stood at

1,968 million euros, up +2.8% on a comparable

basis and up +3.9% excluding the impact of the hurricanes which hit

North America. They affected Large Industries sales and, to a

lesser extent, those of Industrial Merchant. Excluding the impact

of hurricane Harvey, Large Industries volumes remained sustained.

The recovery continued in Industrial Merchant, with revenue growth

of +3.8%, despite the unfavorable impact of one less working day.

In South America, sales continued to climb strongly in all

activities.

Americas Gas & Services 3rd quarter

2017 revenue

- Large Industries posted sales

that were down -3.0% but up +1.4% excluding the

impact of the hurricanes in the United States. In Canada, air gases

sales benefitted from stronger demand from steel makers. In South

America, high hydrogen volumes drove growth in this activity.

- The recovery in Industrial

Merchant continued, with sales growth of +3.8%,

+4.2% excluding the impact of hurricanes, despite one less

working day than in the 3rd quarter 2016. Liquid gas and cylinder

volumes were up in the United States and Canada. In the United

States, sales improved in almost all market segments. In Canada,

sales increased markedly in the energy and metal fabrication

sectors. Growth in South America remained dynamic and improved

notably in Brazil. The price effect in the zone was +1.2%.

- Healthcare revenue was up

+4.8%, driven by solid growth in Canada, which benefited

from the contribution from bolt-on acquisitions, and in South

America where Home Healthcare continued to grow.

- Electronics revenue was up

+6.0%, driven by double-digit growth in Advanced

Materials.

Europe

Revenue in Europe zone totaled 1,657 million euros,

up +2.5% over the quarter. In Large Industries, volumes were

strong even though sales remained slightly down by -0.9%, in

particular due to the termination of activity in Ukraine. The

ramp-up in activity continued in Industrial Merchant with growth of

+4.2%, despite an unfavorable working day impact. Healthcare

continued to improve regularly (+3.7%), with the contribution to

growth of bolt-on acquisitions remaining limited.

Europe Gas & Services 3rd quarter 2017

revenue

- Down slightly by -0.9%, Large

Industries remained penalized in particular by the termination

of activity in Ukraine. Sales improved on a sequential basis in

particular with hydrogen volumes experiencing a marked improvement

during the quarter due to the positive activity level of

refineries. Demand in Eastern Europe remained sustained.

- Industrial Merchant revenue was

up +4.2%. The recovery continued in almost all countries,

and was more pronounced in Southern Europe (Iberia, Italy), Benelux

and France. Both liquid gas and cylinder volumes were growing.

Sales continued their sustained increase in developing economies.

At +0.6%, pricing continued to improve and was positive for the

second quarter in a row.

- Healthcare continued to improve

regularly posting sales growth of +3.7%, with new

acquisitions having a limited contribution. The number of patients

continued to increase in Home Healthcare. Sales in Specialty

Ingredients grew significantly, driven by a small acquisition.

Asia-Pacific

Revenue in Asia-Pacific zone totaled 1,010 million

euros in the 3rd quarter, up +7.6%. Strong growth was

achieved across all business lines. In Large Industries, sales were

very dynamic (+8.1%), driven by the start-up of new units and

strong volumes. Industrial Merchant was up markedly (+5.4%) with

very high growth in China. Electronics sales (+7.8%) enjoyed

increased production capacities and the momentum of Advanced

Materials.

Asia Pacific Gas & Services

3rd quarter 2017 revenue

- Large Industries sales were up

+8.1%, driven by the start-up of three air separation units

in China including one takeover, the ramp-up of a unit in Australia

and strong customer demand, in particular in China and South

Korea.

- Industrial Merchant reported a

growth of +5.4% over the quarter. In China, growth exceeded

+15% for the second quarter in a row, driven by increases in

pricing and in liquid gas and cylinder volumes. Sales in Japan were

down due to weak demand. Business in Australia enjoyed positive

growth despite a sluggish environment. Pricing strengthened to

+1.8% and was particularly strong in China.

- Electronics revenue was up by an

impressive +7.8% over the quarter, driven in particular by

double-digit sales growth in China and Taiwan. Advanced Materials

and carrier gases were the growth engines in Asia. This quarter saw

the end of the unfavorable comparison basis, in particular in

Equipment & Installation sales.

Middle East and Africa

Revenue of Middle East and Africa zone amounted to 152

million euros, a comparable increase of +10.9%. In the

3rd quarter, sales benefited from the operation at full

capacity of the two large hydrogen production units in Yanbu, Saudi

Arabia. In Egypt, the start-up of production units supported Large

Industries and Industrial Merchant sales growth. South Africa

continued its sustained growth in Healthcare.

Engineering & Construction

Engineering & Construction revenue totaled

75 million euros in the 3rd quarter of 2017, down

-25.1%, due to the low level of order intake in 2016.

Order intake reached 175 million euros in the 3rd quarter of

2017 and 504 million euros at the end of September, twice

that of the first nine months of 2016. Around 80% of orders

concerned air separation units (ASU). These included Group projects

as well as orders for third party customers, in particular in the

Energy and Chemicals sectors. The number of calls for tender

continued to increase.

Global Markets & Technologies

Global Markets & Technologies revenue was up +13.2%

at 82 million euros. Sales were particularly strong in

biogas, which benefited from the contribution of an acquisition in

Norway, and in the maritime sectors. Helium sales increased in the

3rd quarter despite logistical challenges relating to the

geopolitical context in Qatar.

Order intake totaled 45 million euros over the quarter.

Investment cycle

The Group’s steady long-term growth is largely due to its

ability to invest in new projects every year. Investment projects

in the industrial gas business are spread throughout the world,

highly capital intensive and supported by long-term contracts, in

particular for Large Industries.

INVESTMENT OPPORTUNITIES

The 12-month portfolio of opportunities totaled

2.1 billion euros at the end of September 2017 and

remained stable compared to the end of June 2017. New projects

entering the portfolio offset those signed by the Group, awarded to

the competition or delayed.

Developing economies represented a little under half of the

investment opportunities in the 12-month portfolio, down slightly

compared with the breakdown at June 30, 2017. The share of projects

in the Americas remained the highest, followed by Europe and then

Asia. This breakdown of the portfolio of opportunities is similar

to the new breakdown of Group sales.

More than 40% of the amount of the portfolio of opportunities

corresponds to projects with investments less than 50 million

euros; a few projects have investments greater than

100 million euros. The more modest size of projects

contributes to a better distribution of risk.

INVESTMENT DECISIONS AND INVESTMENT BACKLOG

Industrial and financial investment decisions totaled

610 million euros for the quarter, and

1.7 billion euros since the beginning of the year.

Industrial decisions accounted for more than 90% of that amount.

They include, in particular, the takeover of a hydrogen unit for a

major customer in Large Industries in Mexico and four ultra-pure

nitrogen supply contracts for Electronics in China and Singapore.

Financial decisions included a strategic Healthcare acquisition in

Japan, a majority equity investment in a Norwegian biogas company

and three bolt-on acquisitions carried out by Airgas.

The total investment backlog amounted to 2.1 billion

euros, an increase as compared with 2.0 billion euros at

the end of June 2017. The investment backlog should lead to a

future contribution to annual sales of approximately

0.8 billion euros per year after the full ramp-up of the

units.

START-UPS

Seven new production units started up during the 3rd

quarter of 2017, some of which in September. These included five

units in China of which three Air Separation Units for Large

Industries and two ultra-pure nitrogen production units for

Electronics, one unit for Large Industries in Egypt and a CO2 unit

for Industrial Merchant in Canada.

The contribution of these unit start-ups and ramp-ups to sales

totaled 51 million euros over the quarter and approximately

120 million euros since the beginning of the year.

Thus, for 2017 as a whole, the contribution to sales of unit

ramp-ups and start-ups should reach approximately

170 million euros. This contribution is expected to be

significantly higher in 2018, exceeding 370 million euros,

as several major unit start-ups are scheduled for the end of 2017

and the 1st half of 2018.

Operating Performance

Group efficiency gains reached 81 million

euros in the 3rd quarter and 229 million euros at the

end of September, in line with the annual target of more than 300

million euros. This performance is part of an ongoing effort and

includes numerous projects throughout the Group. More than 40% of

these efficiencies related to industrial projects (optimization of

production units in China and Benelux in particular, logistics, and

maintenance), more than one third to purchasing gains (energy in

Large Industries, molecules in Electronics), and the balance mainly

to administrative efficiencies and restructuring. The Large

Industries and Industrial Merchant were the business lines

generating most of the efficiencies and accounted for almost two

thirds of total efficiencies.

Thanks to projects delivering a few months ahead of plan, Airgas

synergies have been achieved more rapidly than anticipated, in

particular cost synergies. 3rd quarter synergies thus stood at

39 million US dollars and total synergies since January 2017

at 132 million US dollars, which exceeded the target for the year.

This target has been revised upwards and now stands at 150 million

US dollars. Since the acquisition of Airgas, total synergies of 177

million US dollars have been generated and the total target for the

end of 2017 now stands at 195 million US dollars. The total

amount of synergies expected at the end of 2019 remains

unchanged at 300 million US dollars.

Cash flow from operating activities before changes in working

capital requirements for the first nine months of the year

corresponded to 18.7% of sales. It allows in particular the

financing of net capital expenditure that reached

1,625 million euros at the end of September, including 1,609

million euros for industrial capital expenditure. Net capital

expenditure represented 10.7% of sales, in line with the

mid-term strategic plan. The net debt amounted to

14.9 billion euros and benefitted from a favorable

currency impact.

Outlook

During this quarter, Gas & Services sales growth accelerated

on a comparable basis, supported by strong activity in all business

lines. The ramp-up in activity in Industrial Merchant and the high

growth in Electronics were confirmed over the period. In terms of

geography, growth was driven in particular by developing economies

and Asia-Pacific with very strong sales in China. Activity in North

America was slightly impacted by the hurricanes which hit the

United States, whereas Europe posted solid growth. The third

quarter was also marked by a negative currency impact, which offset

the positive impact of the first six months of the year.

The Group continued to generate operational efficiency gains, in

addition to Airgas synergies which are ahead of our 2017 forecasts.

Thanks to a good level of cash flow, debt now stands below 15

billion euros.

The Group can also rely on its 2.1-billion-euro investment

backlog, as well as on its innovations and new markets, to fuel

future growth, as highlighted by the solid performance of the

Global Markets & Technologies activity.

Assuming a comparable environment, Air Liquide is confident in

its ability to deliver net profit growth in 2017.

APPENDICES

Significant scope, currency and energy impact

(Quarter)

Applied method

In addition to the comparison of published figures, financial

information is given excluding significant scope, currency, and

natural gas and electricity price fluctuation impact.

- The significant scope effect

corresponds to the impact on sales of all acquisitions or disposals

of a significant size for the Group. These changes in scope of

consolidation are determined:

- for acquisitions during the period, by

deducting from the aggregates for the period the contribution of

the acquisition,

- for acquisitions during the previous

period, by deducting from the aggregates for the period the

contribution of the acquisition between January 1 of the current

period and the anniversary date of the acquisition,

- for disposals during the period, by

deducting from the aggregates for the previous period the

contribution of the disposed entity as of the anniversary date of

the disposal,

- for disposals during the previous

period, by deducting from the aggregates for the previous period

the contribution of the disposed entity.

- Since industrial and medical gases are

rarely exported, the impact of currency fluctuations on activity

levels and results is limited to euro translation impacts with

respect to the financial statements of subsidiaries located outside

the euro zone. The currency effect is calculated based on the

aggregates for the period converted at the exchange rate for the

previous period.

- In addition, the Group passes on

variations in the cost of energy (electricity and natural gas) to

its customers via indexed invoicing integrated into their medium

and long-term contracts. This indexing can lead to significant

variations in sales (mainly in the Large Industries Business Line)

from one period to another depending on fluctuations in prices on

the energy market.An energy impact is calculated based on the sales

of each of the main subsidiaries in Large Industries. Their

consolidation allows the determination of the energy impact for the

Group as a whole. The foreign exchange rate used is the average

annual exchange rate for the year N-1.Thus, at the subsidiary

level, the following formula provides the energy impact, calculated

for natural gas and electricity respectively:Energy impact = Share

of sales indexed to energy year (N-1) x (Average energy price over

the year (N) - Average energy price over the year

(N-1))Neutralizing the impact of variations in energy prices

against sales allows analysis of evolution in revenue on a

comparable basis.

Consolidated Q3 2017 revenue includes the following impact:

(in millions of euros)

Revenue Q32017

Q3 2017/2016Change

Currency

Natural gas Electricity

Q3

2017/2016Comparablechange

Group 4,944

-0.3% (199) 41

9 +3.5% Gas and

Services 4,787 +0.1%

(194) 41

9 +4.0%

(a) Comparable change based on 2016 adjusted sales excluding

currency and energy impacts.

For the Group,

- The currency impact was -4.0%.

- The impact of natural gas price

fluctuations was +0.8%.

- The impact of electricity price

fluctuations was +0.2%.

For Gas & Services,

- The currency impact was -4.1%.

- The impact of natural gas price

fluctuations was +0.8%.

- The impact of electricity price

fluctuations was +0.2%.

Consolidated Revenue Year-to-Date 2016

Impact of currency, energy (natural gas and electricity) on

year-to-date 2016 revenue:

(in millions of euros)

Revenue YTD2017

YTD2017/2016Change

Currency

Natural gas Electricity

YTD2017/2016Comparablechange

(a)

Group 15,237

+17.4% (32) 220

52 +2.3%

Gas & Services 14,765

+19.1% (29) 220

52 +3.2%

(a) Comparable change based on 2016 adjusted sales excluding

currency and energy impacts.

BY GEOGRAPHY

Revenue

(in millions of euros)

YTD 2016 YTD

2017

Publishedchange

Comparablechange

(a)

Americas 4,227

6,219 +47.1% +3.1%

Europe 4,826

5,028 +4.2% +2.2%

Asia-Pacific 2,917

3,042 +4.3% +4.5%

Middle-East & Africa 431

476 +10.5%

+6.0%

Gas & Services Revenue

12,401 14,765

+19.1%

+3.2% Engineering & Construction

359 221

-38.4% -38.0% Global Markets

& Technologies 219

251 +14.3% +15.3%

GROUP REVENUE 12,979

15,237

+17.4% +2.3%

BY WORLD BUSINESS LINE

Revenue

(in millions of euros)

YTD 2016 YTD

2017

Publishedchange

Comparablechange

(a)

Large industries 3,649

3,980 +9.1%

+2.2% Industrial Merchant 5,272

7,022 +33.2%

+3.3% Healthcare

2,265 2,523 +11.4%

+4.5% Electronics

1,215 1,240 +2.1%

+2.6%

GAS & SERVICES REVENUE

12,401

14,765 +19.1%

+3.2%

(a) Comparable change based on 2016 adjusted sales excluding

currency and energy impacts.

This activity report is also available on our

website:https://www.airliquide.com/investors/documents-presentations

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171024006605/en/

Corporate CommunicationsAnnie Fournier+33 (0)1 40 62 51

31Caroline Philips+33 (0)1 40 62 50 84orInvestor

RelationsParis - France+33 (0)1 40 62 50 87Philadelphia - USA+1

610 263 8277

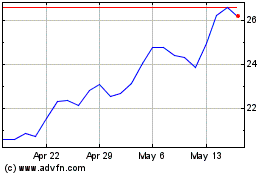

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2024 to Jul 2024

C3 AI (NYSE:AI)

Historical Stock Chart

From Jul 2023 to Jul 2024