UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment No. 5)*

AMTD

IDEA GROUP

(Name

of Issuer)

Class

A Ordinary Shares, par value US$0.0001 per share

(Title

of Class of Securities)

00180G106**

(CUSIP

Number)

P&R

Finance Limited

Clear Radiant Limited

Unicorn Star Limited

Century City International Holdings Limited

c/o 11th Floor, 68 Yee Wo Street

Causeway Bay, Hong Kong

(852) 2894-7888

(Name,

Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

January

8, 2024

(Date

of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

| * | This

statement on Schedule 13D constitutes Amendment No. 5 to the initial Schedule 13D (the “ Initial

Schedule 13D”) filed on January 21, 2020 on behalf of each of P&R Finance Limited,

a Hong Kong company (“P&R Finance”), Clear Radiant Limited, a British

Virgin Islands company (“Clear Radiant”), Unicorn Star Limited, a British

Virgin Islands company (“Unicorn Star”), and Century City International

Holdings Limited, a Bermuda company (“Century City”), as amended and supplemented

by the Amendment No. 1 to the Initial Schedule 13D filed under Schedule 13D/A on January

27, 2020 (“Amendment No. 1”) and further amended and supplemented by the

Amendment No. 2 filed under Schedule 13D/A on May 14, 2020 (“Amendment No. 2”),

Amendment No. 3 filed under Schedule 13D/A on January 13, 2022 (“Amendment No. 3”)

and Amendment No. 4 filed under Schedule 13D/A on July 24, 2023 (“Amendment No. 4”,

and collectively with the Initial Schedule 13D, Amendment No.1, Amendment No. 2 and Amendment

No. 3, the “Prior Schedule 13D Filings”), with respect to the Ordinary

Shares (the “Ordinary Shares”), comprising Class A ordinary shares, par

value of $0.0001 per share (“Class A Ordinary Shares”), and Class B ordinary

shares, par value of $0.0001 per share (“Class B Ordinary Shares”), of

AMTD IDEA Group, a Cayman Islands company (the “Issuer” or “AMTD”).

The remainder of this cover page shall be filled out for the reporting persons’ initial

filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter the disclosures provided in a prior cover

page. |

| ** | The

CUSIP number of 00180G106 applies to the American depositary shares of the Issuer (“ADSs”).

Each American depositary share represents six Class A Ordinary Share. No CUSIP number has

been assigned to the Class A Ordinary Shares. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

| 1 |

|

NAMES

OF REPORTING PERSONS

P&R

Finance Limited |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐

(b) ☒

|

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS (See Instructions)

AF |

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Hong

Kong |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

|

7 |

|

SOLE

VOTING POWER

5,674,000(1) |

| |

8 |

|

SHARED

VOTING POWER

0 |

| |

9 |

|

SOLE

DISPOSITIVE POWER

5,674,000(1) |

| |

10 |

|

SHARED

DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,674,000 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.4% of the Class A Ordinary Shares (2) (or 1.2% of the total Ordinary Shares (3)(4) assuming conversion of

all outstanding Class B Ordinary Shares into the same number of Class A Ordinary Shares). |

| 14 |

|

TYPE

OF REPORTING PERSON (See Instructions)

CO |

| (1) | Represents

the sum of (i) 5,674,000 Class B Ordinary Shares of the Issuer in the aggregate, as

sold and transferred by AMTD Group Company Limited (“AMTD Group”) to P&R

Finance pursuant to SPA 1 (as defined in Prior Schedule 13D Filings), and as automatically

converted into 5,674,000 Class A Ordinary Shares upon such transfer in accordance with

the Memorandum and Articles of Association of the Issuer, (ii) 9,500,000 Class B Ordinary

Shares of the Issuer in the aggregate, as sold and transferred by AMTD Group to P&R Finance

pursuant to SPA 3 (as defined in Prior Schedule 13D Filings), and as automatically converted

into 9,500,000 Class A Ordinary Shares upon such transfer in accordance with the Memorandum

and Articles of Association of the Issuer, and (iii) the sale and transfer of 9,500,000 Class

A Ordinary Shares of the Issuer in the aggregate by P&R Finance Limited to AMTD Group

Inc. pursuant to SPA 4 (as defined in Prior Schedule 13D Filings). |

| (2) | Calculated

based upon 234,077,210 outstanding Class A Ordinary Shares of the Issuer, as set forth in

the Issuer’s report on Form 6-K filed on December 28, 2023. |

| (3) | Calculated

based upon 467,604,189 outstanding Ordinary Shares (including treasury shares) in the aggregate

as a single class, as set forth in the Issuer’s report on Form 6-K filed on December

28, 2023 |

| (4) | In

accordance with Rule 13d-3, the percentage reported does not reflect the twenty for one voting

power of the Class B Ordinary Shares because the Class B Ordinary Shares are not a registered

class of voting equity securities under the Act. The 5,674,000 Class A Ordinary Shares beneficially

owned by P&R Finance represents 0.2% of the aggregate combined voting power of the Class

A Ordinary Shares and the Class B Ordinary Shares of the Issuer as set out in (3) above. |

| 1 |

|

NAMES

OF REPORTING PERSONS

Clear

Radiant Limited |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐

(b) ☒

|

| 3 |

|

SEC

USE ONLY

|

| 4 |

|

SOURCE

OF FUNDS (See Instructions)

AF |

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

British

Virgin Islands |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

|

7 |

|

SOLE

VOTING POWER

3,069,000(1) |

| |

8 |

|

SHARED

VOTING POWER

0 |

| |

9 |

|

SOLE

DISPOSITIVE POWER

3,069,000(1) |

| |

10 |

|

SHARED

DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,069,000 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.31%

of the Class A Ordinary Shares (2) (or 0.7% of the total Ordinary Shares (3)(4) assuming conversion of all

outstanding Class B Ordinary Shares into the same number of Class A Ordinary Shares). |

| 14 |

|

TYPE

OF REPORTING PERSON (See Instructions)

CO |

| (1) | Represents

in aggregate: 6,069,000 Class B Ordinary Shares of the Issuer in the aggregate, sold

and transferred by AMTD Group to Clear Radiant pursuant to SPA 2 (as defined in Prior Schedule

13D Filings), and automatically converted into 6,069,000 Class A Ordinary Shares upon

transfer in accordance with the Memorandum and Articles of Association of the Issuer; and

(ii) the sale and transfer of 500,000 ADSs (representing 3,000,000 Class A Ordinary Shares)

of the Issuer from Clear Radiant to Fortis Fund IV Limited, pursuant to the SPA 5 (as defined

in Item 4 of this Schedule 13D) |

| (2) | Calculated

based upon 234,077,210 outstanding Class A Ordinary Shares of the Issuer, as set forth in

the Issuer’s report on Form 6-K filed on December 28, 2023. |

| (3) | Calculated

based upon 467,604,189 outstanding Ordinary Shares (including treasury shares) in the aggregate

as a single class, as set forth in the Issuer’s report on Form 6-K filed on December

28, 2023. |

| (4) |

In

accordance

with Rule 13d-3, the percentage reported does not reflect the twenty for one voting power of the Class B Ordinary Shares because the

Class B Ordinary Shares are not a registered class of voting equity securities under the Act. The 3,069,000 Class A Ordinary Shares beneficially

owned by Clear Radiant represents 0.1% of the aggregate combined voting power of the Class A Ordinary Shares and the Class B Ordinary

Shares of the Issuer as set out in (3) above.

|

| 1 |

|

NAMES

OF REPORTING PERSONS

Unicorn

Star Limited |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐

(b) ☒

|

| 3 |

|

SEC USE

ONLY

|

| 4 |

|

SOURCE

OF FUNDS (See Instructions)

AF |

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

British

Virgin Islands |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

|

7 |

|

SOLE

VOTING POWER

601,724(1) |

| |

8 |

|

SHARED

VOTING POWER

0 |

| |

9 |

|

SOLE

DISPOSITIVE POWER

601,724(1) |

| |

10 |

|

SHARED

DISPOSITIVE POWER

0 |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

601,724 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.3%

of the Class A Ordinary Shares (2) (or 0.1% of the total Ordinary Shares (3)(4) assuming conversion of all

outstanding Class B Ordinary Shares into the same number of Class A Ordinary Shares). |

| 14 |

|

TYPE

OF REPORTING PERSON (See Instructions)

CO |

| (1) | Represents

the aggregate of (i) 461,538 Class A Ordinary Shares of the Issuer in the aggregate directly

acquired by Unicorn Star from AMTD before the initial public offering of the American depositary

shares representing the Class A Ordinary Shares of the Issuer, and (ii) 140,186 Class A Ordinary

Shares directly acquired by Unicorn Star from AMTD upon completion of the 2021 SPA (as defined

in Prior Schedule 13D Filings). |

| (2) | Calculated

based upon 234,077,210 outstanding Class A Ordinary Shares of the Issuer, as set forth in

the Issuer’s report on Form 6-K filed on December 28, 2023. |

| (3) | Calculated

based upon 467,604,189 outstanding Ordinary Shares (including treasury shares) in the aggregate

as a single class, as set forth in the Issuer’s report on Form 6-K filed on December

28, 2023. |

| (4) | In

accordance with Rule 13d-3, the percentage reported does not reflect the twenty for one voting

power of the Class B Ordinary Shares because the Class B Ordinary Shares are not a registered

class of voting equity securities under the Act. The 601,724 Class A Ordinary Shares beneficially

owned by Unicorn Star represents 0.02% of the aggregate combined voting power of the Class

A Ordinary Shares and the Class B Ordinary Shares of the Issuer as set out in (3) above. |

| 1 |

|

NAMES

OF REPORTING PERSONS

Century

City International Holdings Limited |

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐

(b) ☒

|

| 3 |

|

SEC USE

ONLY

|

| 4 |

|

SOURCE

OF FUNDS (See Instructions)

AF |

| 5 |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

| 6 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Bermuda |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

|

7 |

|

SOLE

VOTING POWER

0 |

| |

8 |

|

SHARED

VOTING POWER

9,344,724(1) |

| |

9 |

|

SOLE

DISPOSITIVE POWER

0 |

| |

10 |

|

SHARED

DISPOSITIVE POWER

9,344,724(1) |

| 11 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

9,344,724 |

| 12 |

|

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

☐ |

| 13 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.0%

of the Class A Ordinary Shares (2) (or 2.0% of the total Ordinary Shares (3)(4) assuming conversion of all

outstanding Class B Ordinary Shares into the same number of Class A Ordinary Shares). |

| 14 |

|

TYPE

OF REPORTING PERSON (See Instructions)

CO |

| (1) | Represents

the sum of (i) 5,674,000 Class B Ordinary Shares of the Issuer in the aggregate, as

sold and transferred by AMTD Group to P&R Finance pursuant to SPA 1 (as defined in Prior

Schedule 13D Filings), and as automatically converted into 5,674,000 Class A Ordinary

Shares upon such transfer in accordance with the Memorandum and Articles of Association of

the Issuer, (ii) 9,500,000 Class B Ordinary Shares of the Issuer in the aggregate, as

sold and transferred by AMTD Group to P&R Finance pursuant to SPA 3 (as defined in Prior

Schedule 13D Filings), and as automatically converted into 9,500,000 Class A Ordinary

Shares upon such transfer in accordance with the Memorandum and Articles of Association of

the Issuer, and (iii) the sale and transfer of 9,500,000 Class A Ordinary Shares of the Issuer

in the aggregate by P&R Finance to AMTD Group Inc. pursuant to SPA 4 (as defined in Prior

Schedule 13D Filings), (iv) 6,069,000 Class B Ordinary Shares of the Issuer in the aggregate,

sold and transferred by AMTD Group to Clear Radiant pursuant to SPA 2 (as defined in Prior

Schedule 13D Filings), and automatically converted into 6,069,000 Class A Ordinary Shares

upon transfer in accordance with the Memorandum and Articles of Association of the Issuer,

(v) sale and transfer of 500,000 ADSs (representing 3,000,000 Class A Ordinary Shares) of

the Issuer from Clear Radiant to Fortis Fund IV Limited pursuant to the SPA 5 (as defined

in Item 4 of this Schedule 13D), (vi) 461,538 Class A Ordinary Shares of the Issuer in the

aggregate directly acquired by Unicorn Star from AMTD before the initial public offering

of the American depositary shares representing the Class A Ordinary Shares of the Issuer,

and (vii) 140,186 Class A Ordinary Shares directly acquired by Unicorn Star from AMTD upon

completion of the 2021 SPA (as defined in Prior Schedule 13D Filings). |

| (2) | Calculated

based upon 234,077,210 outstanding Class A Ordinary Shares of the Issuer, as set forth in

the Issuer’s report on Form 6-K filed on December 28, 2023. |

| (3) | Calculated

based upon 467,604,189 outstanding Ordinary Shares (including treasury shares) in the aggregate

as a single class, as set forth in the Issuer’s report on Form 6-K filed on December

28, 2023. |

| (4) | In

accordance with Rule 13d-3, the percentage reported does not reflect the twenty for one voting

power of the Class B Ordinary Shares because the Class B Ordinary Shares are not a registered

class of voting equity securities under the Act. The 9,344,724 Class A Ordinary Shares beneficially

owned by Century City represents 0.3% of the aggregate combined voting power of the Class

A Ordinary Shares and the Class B Ordinary Shares of the Issuer as set out in (3) above. |

EXPLANATORY

STATEMENT

Pursuant

to Rule 13d-2 promulgated under the Act, this Schedule 13D/A (this “Amendment No. 5”) amends and supplements the Prior

Schedule 13D Filings. Except as specifically provided herein, this Amendment No. 5 does not modify any of the information previously

reported in the Prior Schedule 13D Filings. All capitalized terms used herein which are not defined herein have the meanings given to

such terms in the Prior Schedule 13D Filings.

Item

2. Identity and Background.

The second

paragraph of Item 2 of the Prior Schedule 13D Filings is hereby amended and restated as follows:

Century

City indirectly owns 62.3% of the outstanding share capital of Paliburg Holdings Limited, a Bermuda company (“Paliburg Holdings”).

Paliburg Holdings indirectly owns 69.3% of the outstanding share capital of Regal Hotels International Holdings Limited, a Bermuda company

(“Regal Hotels”). Regal Hotels indirectly owns all of the outstanding share capital of Unicorn Star. Each of Paliburg

Holdings and Regal Hotels also indirectly owns 50% of the outstanding share capital of P&R Holdings Limited (“P&R Holdings”).

P&R Holdings directly owns all of the outstanding share capital of P&R Finance. P&R Holdings also indirectly owns 63.7% of

the outstanding share capital of Cosmopolitan International Holdings Limited, a Cayman Islands company (“Cosmopolitan”)

(on a fully diluted and as-converted basis), which in turn indirectly owns all of the outstanding share capital of Clear Radiant. Paliburg

Holdings indirectly owns 3.6% of the outstanding share capital of Cosmopolitan (on a fully diluted and as-converted basis). Regal Hotels

also indirectly owns 7.6% of the outstanding share capital of Cosmopolitan (on a fully diluted and as-converted basis). Regal Hotels

owns all the outstanding share capital of Honormate Nominees Limited, a Hong Kong company (“Honormate”).

Item

4. Purpose of Transaction.

Item

4 of the Prior Schedule 13D Filings is hereby amended and supplemented to include the following:

On

January 8, 2024, P&R Finance entered into a share purchase agreement (“SPA 5”) with Fortis Fund IV Limited, pursuant

to which Fortis Fund IV Limited agreed to purchase, and P&R Finance agreed to sell, 500,000 ADS (representing 3,000,000 Class A Shares)

of the Issuer, for the consideration of US$890,000. The SPA 5 was completed on January 9, 2024.

The

Reporting Persons intend to review their investment on a regular basis and, as a result thereof, may at any time or from time to time

determine, either alone or as part of a group, (i) to acquire additional securities of the Issuer, through open market purchases, privately

negotiated transactions or otherwise, (ii) to dispose of all or a portion of the securities of the Issuer owned by it in the open market,

in privately negotiated transactions or otherwise (subject to the lock-up requirement as described in Prior Schedule 13D Filings) or

(iii) to take any other available course of action, which could involve one or more of the types of transactions or have one or more

of the results described.

Item

7. Material to be Filed as Exhibits.

Item 7 of

the Prior Schedule 13D Filings is hereby amended and restated as follows:

| Exhibit No. |

|

Description |

| |

|

|

| 99.1* |

|

Joint Filing Agreement dated January 21, 2020 by and among the Reporting Persons (previously filed with the Securities and Exchange Commission as Exhibit 99.1 to the Original Schedule 13D filed by the Reporting Persons on January 21, 2020). |

| |

|

|

| 99.2* |

|

Share Purchase Agreement dated December 31, 2019 between P&R Finance Limited and AMTD Group Company Limited (previously filed with the Securities and Exchange Commission as Exhibit 99.2 to the Original Schedule 13D filed by the Reporting Persons on January 21, 2020). |

| |

|

|

| 99.3* |

|

Share Purchase Agreement dated December 31, 2019 between Clear Radiant Limited and AMTD Group Company Limited (previously filed with the Securities and Exchange Commission as Exhibit 99.3 to the Original Schedule 13D filed by the Reporting Persons on January 21, 2020 but refiled as Exhibit 99.3 to this statement on Schedule 13D to fix a clerical error in the previously filed version). |

| |

|

|

| 99.4* |

|

Share Purchase Agreement dated January 24, 2020 between P&R Finance Limited and AMTD Group Company Limited (previously filed with the Securities and Exchange Commission as Exhibit 99.4 to Amendment No. 1 filed by the Reporting Persons on January 27, 2020). |

| |

|

|

| 99.5* |

|

Amendment to the Share Purchase Agreement between Clear Radiant Limited and AMTD Group Company Limited dated March 31, 2020 (previously filed with the Securities and Exchange Commission as Exhibit 99.5 to Amendment No. 2 filed by the Reporting Persons on May 18, 2020). |

| |

|

|

| 99.6* |

|

Joint Filing Agreement dated January 13, 2022 by and among the Reporting Persons. (previously filed with the Securities and Exchange Commission as Exhibit 99.1 to Amendment No. 3 filed by the Reporting Persons on January 13, 2022). |

| |

|

|

| 99.7* |

|

Share Purchase Agreement dated December 29, 2021 between Unicorn Star Limited and AMTD International Inc. (previously filed with the Securities and Exchange Commission as Exhibit 99.2 to Amendment No. 3 filed by the Reporting Persons on January 13, 2022). |

| |

|

|

| 99.8* |

|

Put Option Agreement dated December 31, 2021 between International Merchants Holdings and Honormate Nominees Limited. (previously filed with the Securities and Exchange Commission as Exhibit 99.3 to Amendment No. 3 filed by the Reporting Persons on January 13, 2022). |

| |

|

|

| 99.9* |

|

Form of Share Purchase Agreement dated June 30, 2023 between AMTD Group Inc. and P&R Finance Limited |

| |

|

|

| 99.10 |

|

Form of Share Purchase Agreement dated January 8, 2024 between Fortis Fund IV Limited and Clear Radiant Limited |

SIGNATURE

After

reasonable inquiry and to the best of our knowledge and belief, we certify that the information set forth in this statement is true,

complete and correct.

Dated:

January 19, 2024

| P&R Finance Limited |

By: |

/s/

Kenneth Ng Kwai Kai |

| |

|

Name: |

Kenneth Ng Kwai Kai |

| |

|

Title: |

Director |

| |

|

|

|

| |

|

/s/

Allen Wan Tze Wai |

| |

|

Name: |

Allen Wan Tze Wai |

| |

|

Title: |

Director |

| |

|

|

|

| Clear Radiant Limited |

By: |

/s/

Kenneth Ng Kwai Kai |

| |

|

Name: |

Kenneth Ng Kwai Kai |

| |

|

Title: |

Director |

| |

|

|

|

| |

|

/s/

Kelvin Leung So Po |

| |

|

Name: |

Kelvin Leung So Po |

| |

|

Title: |

Director |

| |

|

|

|

| Unicorn Star Limited |

By: |

/s/

Kenneth Ng Kwai Kai |

| |

|

Name: |

Kenneth Ng Kwai Kai |

| |

|

Title: |

Director |

| |

|

|

|

| |

|

/s/

Allen Wan Tze Wai |

| |

|

Name: |

Allen Wan Tze Wai |

| |

|

Title: |

Director |

| |

|

|

|

| Century City International Holdings Limited |

By: |

/s/

Kenneth Ng Kwai Kai |

| |

|

Name: |

Kenneth Ng Kwai Kai |

| |

|

Title: |

Director |

| |

|

|

|

| |

|

/s/

Kelvin Leung So Po |

| |

|

Name: |

Kelvin Leung So Po |

| |

|

Title: |

Director |

8

Exhibit 99.10

THIS AGREEMENT is made on the

8th day of January 2024

BETWEEN:

| (1) | FORTIS FUND IV LIMITED, a company incorporated under the laws of Cayman Islands whose registered

office is situated at P.O. Box 472, Harbour Place, 2nd Floor, 103 South Church Street, George Town, Grand Cayman, Cayman Islands

KY1-1106 (the “Buyer”); and |

| (2) | CLEAR RADIANT LIMITED, a company incorporated under the laws of the laws of British Virgin Islands

whose registered office is situate at Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands

(“Seller”). |

Each a “Party” and collectively

the “Parties”.

WHEREAS

The Seller is the legal and beneficial owner of

the Sale Shares (as defined below) free from any Encumbrance.

AND NOW IT IS HEREBY AGREED as follows:

| 1. | DEFINITIONS

AND INTERPRETATION |

| 1.1 | In this Agreement, unless otherwise expressed or required by context, the following expressions shall

have the respective meanings set opposite thereto, as follows: |

| |

Expression |

Meaning |

| |

|

|

| |

“ADS(s)” |

American Depositary Share(s) |

| |

|

|

| |

“Agreement” |

this agreement, as may be amended or supplemented by agreement between the Parties from time to time |

| |

|

|

| |

“Business Day” |

a day (excluding Saturday, Sunday and other general holidays in Hong Kong and any day on which a tropical cyclone warning no.8 or above or a “black” rainstorm warning is hoisted at any time between 9:00 a.m. and 5:00 p.m.) on which licensed banks in Hong Kong are generally open for business |

| |

|

|

| |

“Company” |

AMTD IDEA Group (ticker number: AMTD), a company incorporated in Cayman Islands with limited liability, the ADSs of which are listed on the New York Stock Exchange |

| |

|

|

| |

“Completion” |

completion of the sale and purchase of the Sale Shares on the Completion Date in accordance with the terms and conditions of this Agreement |

| |

|

|

| |

“Completion Date” |

9 January 2024 or such other date as the Buyer and Seller may agree in writing |

| |

|

|

| |

“Consideration” |

a total sum of US$890,000, being the total consideration for the Sale Shares |

| |

|

|

| |

“Encumbrance” |

any mortgage, charge (whether fixed or floating), pledge, lien, hypothecation, assignment, deed of trust, title retention, security interest or other encumbrance of any kind securing, or conferring any priority of payment in respect of, any obligation of any person or entity, including without limitation any right granted by a transaction which, in legal terms, is not the granting of security but which has an economic or financial effect similar to the granting of security under applicable laws |

| |

“HK$” |

Hong Kong dollars, the lawful currency of Hong Kong |

| |

|

|

| |

“Hong Kong” |

the Hong Kong Special Administrative Region of the People’s Republic of China |

| |

|

|

| |

“Parties” |

the parties to this Agreement and “Party” means either or them |

| |

|

|

| |

“Sale Shares” |

500,000 ADSs (representing 3,000,000 Class A Shares) of the Company, which are legally and beneficially owned by Seller as at the date hereof |

| |

|

|

| |

“Warranties” |

the warranties, representations, undertakings and indemnities given by Seller in favour of Buyer as set out in Clause 5 |

| 1.2 | The headings to the clauses of this Agreement are for ease of reference only and shall be ignored in interpreting

this Agreement. |

| 1.3 | References herein to “Recitals”, “Clauses”, “Schedules” and “Annexure”

are references to recitals and clauses of, and schedules and annexure to, this Agreement. The Schedules to this Agreement shall be deemed

to form part of this Agreement. |

| 1.4 | Unless the context otherwise requires: |

| (a) | words and expressions in the singular include the plural and vice versa; |

| (b) | words importing any gender include all genders; |

| (c) | references to a person include any public body and any body of persons, corporate or unincorporated; and |

| (d) | references to a “company” shall be construed so as to include any company, corporation or other

body corporate, wherever and however incorporated or established. |

| 1.5 | The expressions “Seller” and “Buyer” shall, where the context permits, include their

respective successors, personal representatives and permitted assigns. |

| 1.6 | References to writing shall include any modes of reproducing words in a legible and non-transitory form. |

| 1.7 | References to person include any public body and any body of persons, corporate or unincorporate. |

| 1.8 | References to Ordinances, statutes, legislations or enactments shall be construed as references to such

Ordinances, statutes, legislations or enactments as may be amended or re-enacted from time to time and for the time being in force. |

| 1.9 | References to times of a day are, unless otherwise provided herein, to Hong Kong time. |

| 1.10 | Any document expressed to be “in the agreed form” means a document approved by the Parties,

if not entered into contemporaneously with this Agreement. |

| 2. | SALE

AND PURCHASE AND ASSIGNMENT |

| 2.1 | On the terms and subject to the conditions contained in this Agreement, Seller shall sell, and Buyer shall

purchase the Sale Shares free from any and all Encumbrances together with all rights and benefits at any time accruing thereto on or after

the Completion Date, including the right to all dividends or distributions made or declared on or after the Completion Date. |

The Consideration

shall be settled in cash by the Buyer to the Seller (or its designated nominee) upon Completion. Seller’s (or its designated nominee’s)

receipt of the Consideration under this Agreement shall constitute a full and sufficient discharge of the obligations of Buyer to pay

Consideration under this Agreement

| 4.1 | Completion shall take place on the Completion Date remotely when all (but not part) of the following businesses

shall be transacted simultaneously: |

| (a) | Seller shall deliver or cause to be delivered the following to Buyer: |

| (i) | settlement instruction form designating the Buyer (or its nominee) as transferee of the Sale Shares, duly

completed and executed by Seller; |

| (ii) | copy resolutions of the board of directors of Seller approving the entering into and the execution of

this Agreement and all other documents referred to in this Agreement and the performance of its obligations hereunder and thereunder; |

| (b) | against compliance of the obligations of Seller under Sub-Clause (a) above, Buyer shall deliver to Seller: |

| (i) | copy resolutions of the board of directors of Buyer approving the entering into and the execution of this

Agreement and all other documents referred to in this Agreement and the performance of its obligations hereunder and thereunder; and |

| (ii) | evidence of payment or settlement of the Consideration in accordance with Clause 3. |

| 4.2 | No Party is obliged to complete this Agreement unless the other Parties comply fully with the requirements

of Clause 4.1. If the respective obligations of the Parties under Clause 4.1 are not complied with on the Completion Date, Buyer may by

notice in writing to Seller (if Seller is unable or unwilling to comply with its obligations under this Agreement) or Seller may by notice

in writing to Buyer (if Buyer is unable or unwilling to comply with its obligations under this Agreement): |

| (a) | postpone Completion to a date (being a Business Day) falling not more than 10 Business Days after the

Completion Date initially set in which event the provisions of this Agreement shall apply as if the date set for Completion were the date

to which Completion is so postponed; |

| (b) | proceed to Completion as far as practicable (without limiting its rights

under this Agreement); or |

| (c) | terminate this Agreement, in which case the provisions of Clause 6

shall apply. |

| 5.1 | Seller hereby represents and warrants to and undertakes with Buyer that save as otherwise disclosed, each

of the matters set out in the Recital of this Agreement and in this Clause 5 are as at the date hereof and will at the Completion Date

be true, accurate and correct in all material respects and not misleading in any material respect. |

| 5.1.1 | Seller has full power to enter into this Agreement and to exercise its rights and perform its obligations

hereunder and (where relevant) all corporate and other actions required to authorise its execution of this Agreement and its performance

of its obligations hereunder have been duly taken and this Agreement will, when executed by it, be a legal, valid and binding agreement

on it and enforceable in accordance with the terms hereof. |

| 5.1.2 | The obligations of Seller under this Agreement will at all times constitute direct, unconditional, unsecured,

unsubordinated and general obligations of, and will rank at least pari passu with, all other present and future outstanding unsecured

obligations created or assumed by it. |

| 5.1.3 | The execution and delivery of, and the performance by Seller of its obligations under this Agreement do

not and will not result in a breach of: |

| (a) | any provision of its memorandum or articles of association; |

| (b) | any order, judgment or decree of any court or authority by which Seller is bound; or |

| (c) | any mortgage, contract or other undertaking or instrument to which Seller is a party or which is binding

upon it or any of its assets, and does not and will not result in the creation or imposition of any Encumbrance on any of its assets pursuant

to the provisions of any such mortgage, contract or other undertaking or instrument. |

| 5.1.4 | All consents, permissions, approvals and agreements which are necessary or desirable for Seller to obtain

in order to enter into and perform this Agreement in accordance with its terms have been unconditionally obtained. |

| 5.1.5 | No consent, licence, approval or authorisation of or filing or registration with or other requirement

of any governmental department, authority or agency in Hong Kong or any jurisdiction in which Seller is incorporated or any part thereof

is required of Seller in connection with the valid execution, delivery or performance of this Agreement by it (or for ensuring the validity

or enforceability thereof) and the sale of the Sale Shares provided hereunder. |

| 5.2 | The Warranties shall be deemed to be repeated at Completion (save as otherwise provided in this Agreement)

as if all references therein to the date of this Agreement were (save where the context precludes) references to the Completion Date. |

| 5.3 | Intentionally left blank. |

| 5.4 | Each of the Warranties shall constitute a separate and independent warranty, and Buyer shall have a separate

claim and right of action in respect of every breach of the Warranties and, save as expressly provided, shall not be limited by reference

to any other clause or anything in this Agreement or the Schedules. |

| 5.5 | Seller agrees that if after the signing of this Agreement and

before Completion, any event shall occur or matter shall arise which results in any of the Warranties being untrue or inaccurate in any

respect at Completion, Seller shall promptly notify Buyer in writing thereof. |

| 5.6 | Seller shall not be liable under any of the Warranties unless notice of a claim under the Warranties specifying

in reasonable detail the event or default to which the claim relates has been received by Seller not later than the last day of a period

of 12 calendar months following the Completion Date. Any claim in respect of which notice has been given as aforesaid shall be deemed

to have been irrevocably withdrawn and lapsed if (not having been previously satisfied, settled or withdrawn) proceedings in respect of

such claim have not been issued and served on Seller before the expiry of a period of six (6) months after the date of such notice. |

| 5.7 | Notwithstanding anything herein contained or implied to the contrary, the following provisions shall apply

to limit the Seller’s liability under this Agreement: |

| (a) | Seller shall have no liability whatsoever in respect of any claim under this Agreement unless the amount

(excluding interest and costs) that would be recoverable from Seller in respect of each individual claim or when aggregated together exceeds

HK$100,000; |

| (b) | the maximum liability of Seller (on an aggregated basis) for all claims under this Agreement shall not

exceed the amount of the Consideration received by Seller; |

| (c) | Seller shall not be liable for any claim under this Agreement which would not have arisen but for a voluntary

act or transaction by Buyer occurring after the Completion Date without relying on Seller’s Warranties or any new

legislation not in force at the date of this Agreement or any change in current legislation (all with retrospective effect); |

| (d) | Intentionally left blank; |

| (e) | Buyer shall not be entitled to recover more than once in respect of any fact, matter, event or circumstance

giving rise to a claim under this Agreement (including the Warranties); and |

| (f) | Seller shall not be liable for a claim under this Agreement if and to the extent that the claim arises

from facts, events or circumstances that have been disclosed or arises from performance of Seller’s obligations as required by the terms

of this Agreement. |

| 6.1 | This Agreement may be terminated on or prior to Completion: |

| (a) | by mutual written consent of Buyer and Seller; |

| (b) | by Buyer, upon written notice to Seller, pursuant to Clause 4.2(c); or |

| (c) | by Seller, upon written notice to Buyer, pursuant to Clause 4.2(c). |

| 6.2 | Unless otherwise provided by Clause 6.3, if this Agreement is

terminated by the provisions of this Agreement, all rights and obligations of the Parties will cease immediately upon termination and

no Party shall make any claim of whatsoever nature against the other Parties under or in relation to this Agreement. Termination of this

Agreement shall not prejudice to any rights any Party may have under or in relation to this Agreement against the other Parties in respect

of any breach under or in relation to this Agreement before the termination. |

| 6.3 | The Parties agree that any adverse change after the date of this Agreement on the legal, financial, business

or otherwise status of the Company shall not entitle any Party to terminate this Agreement. |

| 6.4 | The Parties agree that irreparable damage would occur if any provision of this Agreement were not performed

in accordance with the terms hereof. The Parties shall be entitled to apply for specific performance of the terms hereof, in addition

to any other remedy to which they are entitled at law or in equity. |

| 7. | SEVERABILITY

AND SURVIVAL |

| 7.1 | If at any time any one or more provisions hereof is or becomes

invalid, illegal, unenforceable or incapable of performance in any respect, the validity, legality, enforceability or performance of

the remaining provisions hereof shall not thereby in any way be affected or impaired. |

| 7.2 | All provisions of this Agreement (including all warranties,

representations, undertakings and indemnities) shall, in so far as they are capable of being performed or observed, remain in full force

and effect notwithstanding Completion. |

| 7.3 | This Agreement together with the Schedules and Annexure constitute

the entire agreement and understanding between the Parties in connection with the subject-matter of this Agreement and supersede all

previous proposals, representations, warranties, agreements or undertakings relating thereto whether oral, written or otherwise (save

as expressly provided or reserved herein) and none of the Parties has relied on any such proposals, representations, warranties, agreements

or undertakings. |

| 8. | TIME,

FURTHER ASSURANCES AND INDULGENCE |

| 8.1 | Time shall be of the essence of this Agreement. No indulgence given by any Party to the other shall be

deemed or in any way be construed as a waiver of any of its rights and remedies hereunder. |

| 8.2 | The Parties hereto shall do and execute or procure to be done and executed all such further acts, deeds,

documents and things as are, in each case, within their respective powers to do and execute or to procure to be done and executed, so

as to give full effect to the terms and intent of this Agreement. |

| 8.3 | No delay in exercising or non-exercise by a Party of any right, power or remedy provided by law or under

this Agreement shall impair, or otherwise operate as a waiver or release of, that right, power or remedy. Any waiver or release must be

specifically granted in writing signed by the Party granting it and shall: be confined to the specific circumstances in which it is given;

not affect any other enforcement of the same or any other right; and (unless it is expressed to be irrevocable) be revocable at any time

in writing. Any single or partial exercise of any right, power or remedy provided by law or under this Agreement shall not preclude any

other or further exercise of it or the exercise of any other right, power or remedy. |

| 9.1 | Each Party hereto acknowledges that in entering into this Agreement,

it is not relying on any representation, warranty or other statement relating to the subject matters of this Agreement which is not set

out in this Agreement. |

At all times during

the continuance of this Agreement and after the termination hereof (howsoever caused), each Party shall, and shall procure that its shareholders,

officers, employees, agents and advisors shall keep secret and confidential, and not without the prior written consent of the other Parties

disclose to any person or make use of for its own purposes (otherwise than in the context of an addition to its general experience, knowledge

or expertise) any of the confidential information, reports and documents received by it relating to the other Parties or (in respect of

Buyer only) the Company save where disclosure is required either by reason of law or applicable rules or regulations or if the relevant

information comes to the public domain otherwise than by reason of its own default or the default of such shareholders, officers, employees,

agents or advisors.

| 11.1 | All notices, requests, reports, submissions and other communications to be given under this Agreement

shall be deemed to have been duly given if such notice or communication shall be in writing and delivered by personal delivery or by facsimile

transmission or other commercial means of prepaid delivery, postage or costs of transmission and delivery prepaid (if delivery necessitates

prepayment of such postage or cost), to the Parties at the following addresses or fax numbers set out below (or such other address or

fax number as the addressee has by five (5) Business Days prior written notice specified to the other Parties): |

| |

To Seller: |

11/F, 68 Yee Wo Street |

| |

|

Causeway Bay |

| |

|

Hong Kong |

| |

|

Attn.: |

Board of Directors |

| |

To Buyer : |

Room 2202, Causeway Plaza I |

| |

|

489 Hennessy Road |

| |

|

Causeway Bay |

| |

|

Hong Kong |

| |

|

Attn.: |

Board of Directors |

| 11.2 | Any notice, demand or other communication so addressed to the relevant Party shall be deemed to be validly

given, (a) if delivered personally, at the time of such delivery, (b) if given or made by letter, two (2) days or (if to an overseas address)

seven (7) days after posting and it shall be sufficient to prove that such notice, demand or other communication was properly addressed,

stamped and posted and (c) if given or made by facsimile at the time of dispatch (with full transmission report). |

| 11.3 | Each notice, demand or other communication given or made by any Party to the other Parties in relation

to this Agreement shall be in the English language, and any other documents or instruments required to be delivered by one Party to the

other Parties hereunder, shall be in the English and/or Chinese languages. |

| 12.1 | Buyer irrevocably appoints orientiert XYZ Securities Limited

of Room 3301, Tower One, Lippo Centre, No.89 Queensway, Hong Kong, as its agent in Hong Kong to receive, accept and acknowledge on its

behalf service of any writ, summons, order, judgment or other notices, documents or process in any proceedings of whatsoever nature arising

out of or in connection with this Agreement by Seller or its agent for and on its behalf. If for any reason it is desired that the agent

named above (or its successor) no longer serves as agent of Buyer for this purpose, Buyer shall promptly appoint a successor agent resident

in Hong Kong and notify Seller, failing which Seller shall be entitled to treat the agent named above (or its successor) as the continuing

agent of Buyer for the purpose of this Clause. |

| 12.2 | Seller irrevocably appoints Century City (Secretaries) Limited of 11/F, 68 Yee Wo Street, Causeway Bay,

Hong Kong, as its agent in Hong Kong to receive, accept and acknowledge on its behalf service of any writ, summons, order, judgment or

other notices, documents or process in any proceedings of whatsoever nature arising out of or in connection with this Agreement by Buyer

or its agent for and on their behalf. If for any reason it is desired that the agent named above (or its successor) no longer serves as

agent of Seller for this purpose, Seller shall promptly appoint a successor agent resident in Hong Kong and notify Buyer, failing which

Buyer shall be entitled to treat the agent named above (or its successor) as the continuing agent of the Seller for the purpose of this

Clause. |

The Buyer and the

Seller shall pay for their own legal and professional fees, costs and expenses of and incidental to the negotiation, preparation, finalisation,

execution and completion of this Agreement and any other documents referred to herein and the performance thereof. The stamp duty, if

any, incurred in connection with the sale and purchase of the Sale Shares shall be borne by Buyer and Seller in equal proportion.

This Agreement may

be entered into in any number of counterparts and by the Parties to it on separate counterparts, each of which when so executed and delivered

shall be an original, but all the counterparts shall together constitute one and the same instrument.

| 15. | ASSIGNMENT AND THIRD PARTY RIGHTS |

| 15.1 | This Agreement shall be binding on and shall enure for the benefits of the successors and assigns of the

Parties but shall not be assigned by any Party without the prior written consent of the other Parties. |

| 15.2 | No person other than the Parties would have any rights under the Contracts (Rights of Third Parties) Ordinance

(Chapter 623 of the Laws of Hong Kong) to enforce or enjoy the benefit of any of the provision of this Agreement. |

| 16. | GOVERNING LAW AND DISPUTE RESOLUTION |

This Agreement is

governed by and shall be construed in accordance with the laws of Hong Kong and the Parties agree to submit to the exclusive jurisdiction

of the courts of Hong Kong.

EXECUTION

IN WITNESS whereof the Parties have executed

this Agreement the day and year first above written.

| Buyer |

|

| |

|

| SIGNED by |

) |

|

| |

) |

|

| for and on behalf of |

) |

|

| FORTIS FUND IV LIMITED |

) |

|

| in the presence of: |

) |

|

| Seller |

|

| |

|

| SIGNED by |

) |

|

| |

) |

|

| for and on behalf of |

) |

|

| CLEAR RADIANT LIMITED |

) |

|

| in the presence of: |

) |

|

9

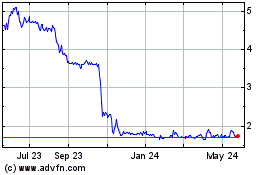

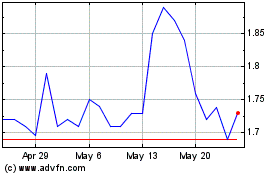

AMTD IDEA (NYSE:AMTD)

Historical Stock Chart

From Jan 2025 to Feb 2025

AMTD IDEA (NYSE:AMTD)

Historical Stock Chart

From Feb 2024 to Feb 2025