Angel Oak Mortgage REIT, Inc. Announces Pricing of Public Offering of Senior Notes

19 July 2024 - 7:47AM

Business Wire

Angel Oak Mortgage REIT, Inc. (NYSE: AOMR) (the “Company”) today

announced that it has priced an underwritten public offering of

$50,000,000 aggregate principal amount of its 9.500% Senior Notes

due 2029 (the “Notes”). The Notes will be fully and unconditionally

guaranteed on a senior unsecured basis by Angel Oak Mortgage

Operating Partnership, LP through which the Company holds

substantially all of its assets and conducts its operations. The

Notes will be issued in minimum denominations and integral

multiples of $25.00. The underwriters for the offering do not have

an over-allotment option to purchase additional Notes. The Company

intends to use the majority of the net proceeds from the offering

for general corporate purposes, which may include the acquisition

of non-qualified residential mortgage loans and other target assets

primarily sourced from its affiliated proprietary mortgage lending

platform or other target assets through the secondary market in a

manner consistent with the Company’s strategy and investment

guidelines. Additionally, the Company intends to use the net

proceeds from the offering to repurchase approximately $20.0

million of shares of its common stock owned by Xylem Finance LLC,

an affiliate of Davidson Kempner Capital Management LP.

RBC Capital Markets, LLC, UBS Securities LLC, Wells Fargo

Securities, LLC and Piper Sandler & Co. are serving as joint

book-running managers for the offering. B. Riley Securities, Inc.

and Janney Montgomery Scott LLC are serving as co-managers for the

offering.

The offering is expected to close on July 25, 2024 and is

subject to the satisfaction of customary closing conditions. The

Company intends to apply to list the Notes on the New York Stock

Exchange under the symbol “AOMN” and, if the application is

approved, trading is expected to commence within 30 days of the

closing of the offering.

The offering is being made pursuant to an effective shelf

registration statement and prospectus and related prospectus

supplement, a copy of which, when available, may be obtained free

of charge at the SEC’s website at www.sec.gov or from the

underwriters by contacting: RBC Capital Markets, LLC at (866)

375-6829 (toll-free), UBS Securities LLC at (888) 827-7275

(toll-free), Wells Fargo Securities, LLC at (800) 645-3751 (U.S.

toll-free) and Piper Sandler & Co. by emailing

fsg-dcm@psc.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any of the Company’s securities,

nor shall there be any sale of the Company’s securities in any

state in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of

any such state or jurisdiction.

Forward-Looking Statements

This press release contains certain forward-looking statements

that are subject to various risks and uncertainties, including,

without limitation, statements relating to the Company’s business

plans. Forward-looking statements are generally identifiable by use

of forward-looking terminology such as “may,” “will,” “should,”

“potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,”

“estimate,” “believe,” “could,” “project,” “predict,” “continue,”

or by the negative of these words and phrases or other similar

words or expressions. Forward-looking statements are based on

certain assumptions, discuss future expectations, describe existing

or future plans and strategies, contain projections of results of

operations, liquidity and/or financial condition, or state other

forward-looking information. The Company’s ability to predict

future events or conditions, their impact or the actual effect of

existing or future plans or strategies is inherently uncertain.

Although the Company believes that such forward-looking statements

are based on reasonable assumptions, actual results and performance

in the future could differ materially from those set forth in or

implied by such forward-looking statements. You are cautioned not

to place undue reliance on these forward‐looking statements, which

reflect the Company’s views only as of the date of this press

release. Additional information concerning factors that could cause

actual results and performance to differ materially from these

forward-looking statements is contained from time to time in the

Company’s filings with the Securities and Exchange Commission.

Except as required by applicable law, neither the Company nor any

other person assumes responsibility for the accuracy and

completeness of the forward‐looking statements. The Company does

not undertake any obligation to update any forward-looking

statements contained in this press release as a result of new

information, future events or otherwise.

About Angel Oak Mortgage REIT, Inc.

Angel Oak Mortgage REIT, Inc. (NYSE: AOMR) is a real estate

finance company focused on acquiring and investing in first lien

non-qualified residential mortgage loans and other mortgage-related

assets in the U.S. mortgage market. The Company is externally

managed and advised by an affiliate of Angel Oak Capital Advisors,

LLC, which, collectively with its affiliates, is a leading

alternative credit manager with a vertically integrated mortgage

origination platform.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240718949678/en/

Investors: investorrelations@angeloakreit.com

855-502-3920 IR Agency Contact: Nick Teves or Joseph

Caminiti Alpha IR Group AOMR@alpha-ir.com 312-445-2870 Company

Contact: KC Kelleher, Angel Oak Mortgage REIT, Inc.

404-528-2684 kc.kelleher@angeloakcapital.com

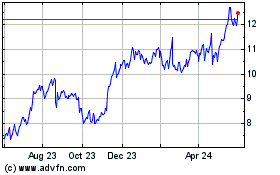

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

From Dec 2024 to Jan 2025

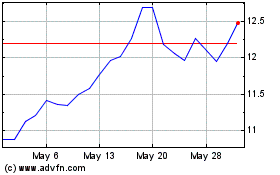

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

From Jan 2024 to Jan 2025