Filed by: Arch

Resources, Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed

filed pursuant to Rule 14a-12

under the Securities

Exchange Act of 1934

Subject Company: Arch Resources, Inc.

Commission File No.: 001-13105

| NEWS | Investor Relations |

| RELEASE | 314/994-2916 |

FOR IMMEDIATE RELEASE

Arch Resources Reports Third

Quarter 2024 Results

Achieves milestone in pending

merger with CONSOL Energy with the October expiration of HSR waiting period

Receives all necessary international

approvals to complete the merger

Manages through extended outage

of CBT shiploader to ship 2.1 million tons of coking coal

Declares fixed quarterly cash

dividend of $0.25 per share payable on November 26

Merger Update

Arch currently expects the merger with CONSOL Energy to close by the

end of the first quarter of 2025. Completion of the merger is subject to the satisfaction of the remaining customary closing conditions,

including approval by both companies’ stockholders.

Among many projected benefits, the merger:

| · | Joins best-in-sector operating platforms anchored by world-class, high-quality, low-cost, long-lived longwall coal-mining assets |

| · | Creates a broad, diverse portfolio of coal qualities and blends capable of serving multiple growth markets and geographies |

| · | Expands North American logistics and export capabilities, including ownership interests in two East Coast terminals and longstanding

relationships with West Coast and Gulf Coast ports |

| · | Creates visible revenue stream with meaningful upside opportunities, balancing CONSOL’s seaborne industrial business with Arch’s

exposure to higher-value metallurgical coals and associated demand dynamics |

| · | Enables robust adjusted EBITDA and free cash flow generation |

| · | Is expected to unlock additional value creation from $110 million to $140 million of annual cost savings and synergies, and |

| · | Creates the potential for robust capital returns and investments in innovation and growth underpinned by industry-leading cash generation

and a strong balance sheet |

Looking Ahead

“We are enthusiastic about the excellent progress the two companies

are making to bring the merger to a successful closing, and remain focused on ensuring a speedy, efficient, and successful integration,”

Lang said. “At the same time, we believe we have positioned the metallurgical portfolio for a sustained period of operational excellence.

We are more confident than ever that the pending merger will create a global industry leader well-equipped to capitalize on promising

market dynamics in both of its core lines of business – global metallurgical and high-rank seaborne thermal coal.”

Given the pending merger, Arch has elected to discontinue formal guidance

at this time.

Arch Resources is a premier producer of

high-quality metallurgical products for the global steel industry. The company operates large, modern and highly efficient mines

that consistently set the industry standard for both mine safety and environmental stewardship. Arch Resources from time to time

utilizes its website – www.archrsc.com – as a channel of distribution for material company information. To learn

more about us and our premium metallurgical products, go to www.archrsc.com.

Cautionary Statement Regarding Forward-Looking Information

This communication contains certain “forward-looking

statements” within the meaning of federal securities laws. Forward-looking statements may be identified by words such as “anticipates,”

“believes,” “could,” “continue,” “estimate,” “expects,” “intends,”

“will,” “should,” “may,” “plan,” “predict,” “project,” “would”

and similar expressions. Forward-looking statements are not statements of historical fact and reflect CONSOL’s and Arch’s

current views about future events. Such forward-looking statements include, without limitation, statements about the benefits of the proposed

transaction involving CONSOL and Arch, including future financial and operating results, CONSOL’s and Arch’s plans, objectives,

expectations and intentions, the expected timing and likelihood of completion of the proposed transaction, and other statements that are

not historical facts, including estimates of coal reserves, estimates of future production, assumptions regarding future coal pricing,

planned delivery of coal to markets and the associated costs, future results of operations, projected cash flow and liquidity, business

strategy and other plans and objectives for future operations. No assurances can be given that the forward-looking statements contained

in this communication will occur as projected, and actual results may differ materially from those projected. Forward-looking statements

are based on current expectations, estimates and assumptions that involve a number of risks and uncertainties that could cause actual

results to differ materially from those projected. These risks and uncertainties include, without limitation, the ability to obtain the

requisite CONSOL and Arch stockholder approvals; the risk that an event, change or other circumstance could give rise to the termination

of the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied; the risk of delays

in completing the proposed transaction; the risk that the businesses will not be integrated successfully; the risk that the cost savings

and any other synergies from the proposed transaction may not be fully realized or may take longer to realize than expected; the risk

that any announcement relating to the proposed transaction could have adverse effects on the market price of CONSOL’s common stock

or Arch’s common stock; the risk of litigation related to the proposed transaction; the risk that the credit ratings of the combined

company or its subsidiaries may be different from what the companies expect; the diversion of management time from ongoing business operations

and opportunities as a result of the proposed transaction; the risk of adverse reactions or changes to business or employee relationships,

including those resulting from the announcement or completion of the proposed transaction; the dilution caused by CONSOL’s issuance

of additional shares of its capital stock in connection with the proposed transaction; changes in coal prices, which may be caused by

numerous factors, including changes in the domestic and foreign supply of and demand for coal and the domestic and foreign demand for

steel and electricity; the volatility in commodity and capital equipment prices for coal mining operations; the presence or recoverability

of estimated reserves; the ability to replace reserves; environmental and geological risks; mining and operating risks; the risks related

to the availability, reliability and cost-effectiveness of transportation facilities and fluctuations in transportation costs; foreign

currency, competition, government regulation or other actions; the ability of management to execute its plans to meet its goals; risks

associated with the evolving legal, regulatory and tax regimes; changes in economic, financial, political and regulatory conditions; natural

and man-made disasters; civil unrest, pandemics, and conditions that may result from legislative, regulatory, trade and policy changes;

and other risks inherent in CONSOL’s and Arch’s businesses.

All such factors are difficult to predict, are

beyond CONSOL’s and Arch’s control, and are subject to additional risks and uncertainties, including those detailed in CONSOL’s

annual report on Form 10-K for the year ended December 31, 2023, quarterly reports on Form 10-Q, and current reports on

Form 8-K that are available on its website at https://investors.consolenergy.com/sec-filings and on the SEC’s website at http://www.sec.gov,

and those detailed in Arch’s annual report on Form 10-K for the year ended December 31, 2023, quarterly reports on Form 10-Q

and current reports on Form 8-K that are available on Arch’s website at https://investor.archrsc.com/sec-filings/ and on the

SEC’s website at http://www.sec.gov.

Forward-looking statements are based on the estimates

and opinions of management at the time the statements are made. Neither CONSOL nor Arch undertakes any obligation to publicly update any

forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Readers are

cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

No Offer or Solicitation

This communication is not intended to be, and

shall not constitute, an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any

vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except

by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction

and Where to Find It

In connection with the proposed transaction, CONSOL

filed with the SEC on October 1, 2024 a registration statement on Form S-4 that includes a preliminary joint proxy statement

of Arch and CONSOL and that also constitutes a prospectus of CONSOL. Each of Arch and CONSOL may also file other relevant documents with

the SEC regarding the proposed transaction. This document is not a substitute for the definitive joint proxy statement/prospectus or registration

statement or any other document that Arch or CONSOL may file with the SEC. The definitive joint proxy statement/prospectus (if and when

available) will be mailed to stockholders of Arch and CONSOL. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT,

JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

ABOUT ARCH, CONSOL AND THE PROPOSED TRANSACTION.

Investors and security holders will be able to

obtain free copies of the registration statement, preliminary joint proxy statement/prospectus and definitive joint proxy statement/prospectus

(if and when available) and other documents containing important information about Arch, CONSOL and the proposed transaction, once such

documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the registration statement

and preliminary joint proxy statement/prospectus, definitive joint proxy statement/prospectus (if and when available) and other documents

filed with the SEC by Arch may be obtained free of charge on Arch’s website at https://investor.archrsc.com/sec-filings/ or, alternatively,

by directing a request by mail to Arch’s Corporate Secretary at One CityPlace Drive, Suite 300, St. Louis, Missouri, 63141.

Copies of the registration statement, preliminary joint proxy statement/prospectus and definitive joint proxy statement/prospectus (if

and when available) and other documents filed with the SEC by CONSOL may be obtained free of charge on CONSOL’s website at https://investors.consolenergy.com/sec-filings

or, alternatively, by directing a request by mail to CONSOL’s Corporate Secretary at 275 Technology Drive, Suite 101, Canonsburg,

Pennsylvania 15317.

Participants in the Solicitation

Arch, CONSOL and certain of their respective directors

and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information

about the directors and executive officers of Arch, including a description of their direct or indirect interests, by security holdings

or otherwise, is set forth in Arch’s proxy statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on

March 27, 2024, including under the headings “Executive Compensation,” “Director Compensation,” “Equity

Compensation Plan Information,” and “Security Ownership of Directors and Executive Officers.” To the extent holdings

of Arch common stock by the directors and executive officers of Arch have changed from the amounts of Arch common stock held by such persons

as reflected therein, such changes have been or will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3

(“Form 3”), Statements of Changes in Beneficial Ownership on Form 4 (“Form 4”) or Annual Statements

of Changes in Beneficial Ownership of Securities on Form 5 (“Form 5”), in each case filed with the SEC, including:

the Form 3 filed by George John Schuller on March 19, 2024; and the Forms 4 filed by Pamela Butcher on March 13, 2024,

March 18, 2024, June 17, 2024 and September 16, 2024, James Chapman on March 11, 2024, Paul Demzik on March 5,

2024, John Eaves on March 8, 2024, Patrick Kriegshauser on March 18, 2024, June 17, 2024 and September 16, 2024, Holly

Koeppel on March 18, 2024, June 17, 2024 and September 16, 2024, Richard Navarre on March 18, 2024, June 17,

2024 and September 16, 2024, George John Schuller on March 21, 2024, Peifang Zhang on March 18, 2024, June 17, 2024

and September 16, 2024, John Ziegler on March 8, 2024, John Drexler on October 15, 2024, Rosemary Klein on October 15,

2024, Deck Slone on October 15, 2024 and Matthew Giljum on October 15, 2024. Information about the directors and executive officers

of CONSOL, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in CONSOL’s

proxy statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 1, 2024, including under the headings

“Board of Directors and Compensation Information,” “Executive Compensation Information” and “Beneficial

Ownership of Securities.” To the extent holdings of CONSOL common stock by the directors and executive officers of CONSOL have changed

from the amounts of CONSOL common stock held by such persons as reflected therein, such changes have been or will be reflected on Forms

3, Forms 4 or Forms 5, in each case filed with the SEC, including: the Forms 4 filed by James Brock on May 24, 2024 and July 1,

2024, John Mills on May 9, 2024, Cassandra Chia-Wei Pan on May 9, 2024, Valli Perera on May 9, 2024, Joseph Platt on May 9,

2024 and John Rothka on March 8, 2024. Other information regarding the participants in the proxy solicitations and a description

of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement and joint proxy

statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become

available. Investors and security holders should read the registration statement and joint proxy statement/prospectus carefully when it

becomes available before making any voting or investment decisions. You may obtain free copies of any of the documents referenced herein

from Arch or CONSOL using the sources indicated above.

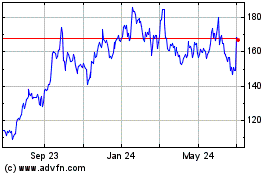

Arch Resources (NYSE:ARCH)

Historical Stock Chart

From Dec 2024 to Jan 2025

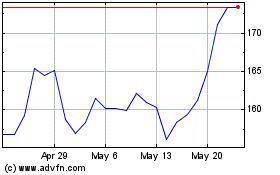

Arch Resources (NYSE:ARCH)

Historical Stock Chart

From Jan 2024 to Jan 2025