UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report Of Foreign Private Issuer

Pursuant To Rule 13a-16 Or 15d-16 Of

The Securities

Exchange Act Of 1934

For the month of August 2020

Commission File Number: 000-54290

Grupo Aval Acciones y Valores S.A.

(Exact name of registrant as specified

in its charter)

Carrera 13 No. 26A - 47

Bogotá D.C., Colombia

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

GRUPO AVAL ACCIONES Y VALORES S.A.

TABLE OF CONTENTS

|

ITEM

|

|

|

1.

|

Report of Second Quarter 2020 Consolidated Results

|

|

2.

|

Second Quarter 2020 Consolidated Earnings Results Presentation

|

Item

1

Report of 2Q2020 consolidated results

Information

reported in Ps billions(1) and under IFRS

(1) We refer to billions as thousands of millions.

|

Disclaimer

|

|

|

|

Grupo Aval Acciones y Valores S.A. (“Grupo

Aval”) is an issuer of securities in Colombia and in the United States.. As such, it is subject to compliance with securities

regulation in Colombia and applicable U.S. securities regulation. Grupo Aval is also subject to the inspection and supervision

of the Superintendency of Finance as holding company of the Aval financial conglomerate.

The consolidated financial information included

in this document is presented in accordance with IFRS as currently issued by the IASB. Details of the calculations of non-GAAP

measures such as ROAA and ROAE, among others, are explained when required in this report.

This report includes forward-looking statements.

In some cases, you can identify these forward-looking statements by words such as “may,” “will,” “should,”

“expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“potential,” or “continue,” or the negative of these and other comparable words. Actual results and events

may differ materially from those anticipated herein as a consequence of changes in general, economic and business conditions, changes

in interest and currency rates and other risk described from time to time in our filings with the Registro Nacional de Valores

y Emisores and the SEC.

Recipients of this document are responsible

for the assessment and use of the information provided herein. Matters described in this presentation and our knowledge of them

may change extensively and materially over time but we expressly disclaim any obligation to review, update or correct the information

provided in this report, including any forward looking statements, and do not intend to provide any update for such material developments

prior to our next earnings report.

The content of this document and the figures

included herein are intended to provide a summary of the subjects discussed rather than a comprehensive description.

When applicable, in this document we refer

to billions as thousands of millions.

|

1

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS, except per share information

|

|

|

|

Bogotá, August

27th, 2020. Grupo Aval S.A. (NYSE:AVAL) reported a consolidated attributable net income for 2Q2020 of Ps 323.4 billion or $14.5

pesos per share. ROAE was 6.6% and ROAA was 0.8% for the quarter.

Key results of the quarter:

|

|

•

|

Grupo Aval closed on the Multi Financial Group (MFG)

acquisition in Panama during the month of May.

|

|

|

•

|

The acquisition represented a one-time increase in consolidated

total assets of approximately Ps 18.6 trillion (USD 5.0 billion) and in consolidated total liabilities of approximately Ps 16.7

trillion (USD 4.4 billion).

|

|

|

•

|

Including the acquisition of MFG, Aval´s consolidated

assets grew by 25.8% in the last twelve months to Ps 333 trillion.

|

|

|

•

|

Consolidated gross loans grew in the last twelve months

to Ps 209 trillion, or 22.6%, including the MFG acquisition.

|

|

|

•

|

Consolidated deposits grew in the last twelve months

to Ps 212 trillion, or 27.8%, including the MFG acquisition.

|

|

|

•

|

Cost of risk during the semester increased significantly

to 2.7%, when compared to 2.1% during the first semester of 2019 and 2.3% during the second semester of last year. 40 to 50% of

loan provisions booked during this quarter were Covid-related.

|

|

|

•

|

Total NIM during the semester was 5.1%, a decrease of

almost 70 bps versus total NIM during the first half of 2019, and of 60 bps versus total NIM recorded during the second half of

last year. However, total NIM during the second quarter of 2020 improved by 50bps versus total NIM during the first quarter, driven

by a 456 bps increase in NIM on Investments.

|

|

|

•

|

Although gross fee income during the first semester was

in line with gross fee income during the first semester of last year, a sharp decrease (-19%) was recorded in fee income from

banking activities versus the previous quarter, mostly related to the region’s quarantine that resulted in a material decrease

in credit card usage.

|

|

|

•

|

Income from non-financial sector operations contracted

by 8.6% versus the first half of 2019 and by 10.6% versus the second semester of 2019, mainly driven by a contraction in revenues

from infrastructure investments, which decreased by 8.9% and 11.7% versus the first and second semesters of 2019. This decrease

was driven by the lockdown in Colombia that halted construction in our 4G concessions; however, the Government has already lifted

most restrictions and construction has restarted.

|

|

|

•

|

We continue to observe strong funding and liquidity positions,

as evidenced by the Deposits/Net Loans ratio of 1.04x and the Cash/Deposits ratio of 18.9%.

|

|

|

•

|

As a result, ROAA and ROAE for the semester were 1.3%

and 10.4% respectively.

|

|

2

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS, except per share information

|

|

|

|

Bogotá, August 27th, 2020. Grupo

Aval S.A. (NYSE:AVAL) reported a consolidated attributable net income for 2Q2020 of Ps 323.4 billion or $14.5 pesos per share.

ROAE was 6.6% and ROAA was 0.8% for the quarter.

Gross loans excludes interbank and

overnight funds. PDLs 90+ defined as loans more than 90 days past due. Net Interest Margin includes net interest

income plus net trading income from debt and equity investments at FVTPL divided by total average interest-earning assets. Fee

income ratio is calculated as net income from commissions and fees divided by net interest income plus net income from commissions

and fees, gross profit from sales of goods and services, net trading income, net income from other financial instruments mandatory

at FVTPL and total other income. Efficiency Ratio is calculated as total other expenses divided by net interest income plus

net income from commissions and fees, gross profit from sales of goods and services, net trading income, net income from other

financial instruments mandatory at FVTPL and total other income. ROAA is calculated as annualized Net Income divided by

average of total assets. ROAE is calculated as Net Income attributable to Aval's shareholders divided by average attributable

shareholders' equity. NS refers to non-significant figures.

|

3

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS,

|

|

|

|

Grupo Aval Acciones y Valores S.A.

Consolidated

Financial Statements Under IFRS

Information in Ps. Billions

|

Consolidated Statement of Financial Position

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

Cash and cash equivalents

|

|

29,824.7

|

|

40,136.8

|

|

40,109.2

|

|

-0.1%

|

34.5%

|

|

Trading assets

|

|

7,702.0

|

|

11,478.9

|

|

11,204.1

|

|

-2.4%

|

45.5%

|

|

Investment securities

|

|

24,316.2

|

|

28,999.9

|

|

33,302.6

|

|

14.8%

|

37.0%

|

|

Hedging derivatives assets

|

|

44.4

|

|

206.0

|

|

129.0

|

|

-37.4%

|

190.8%

|

|

Total loans, net

|

|

166,401.3

|

|

195,066.3

|

|

203,303.0

|

|

4.2%

|

22.2%

|

|

Tangible assets

|

|

8,863.4

|

|

9,295.5

|

|

9,437.8

|

|

1.5%

|

6.5%

|

|

Goodwill

|

|

7,249.3

|

|

8,571.5

|

|

8,236.5

|

|

-3.9%

|

13.6%

|

|

Concession arrangement rights

|

|

6,429.4

|

|

8,068.4

|

|

8,154.6

|

|

1.1%

|

26.8%

|

|

Other assets

|

|

13,845.4

|

|

18,604.4

|

|

19,086.7

|

|

2.6%

|

37.9%

|

|

Total assets

|

|

264,676.1

|

|

320,427.8

|

|

332,963.5

|

|

3.9%

|

25.8%

|

|

Trading liabilities

|

|

568.3

|

|

3,016.1

|

|

1,196.5

|

|

-60.3%

|

110.6%

|

|

Hedging derivatives liabilities

|

|

76.7

|

|

770.9

|

|

310.6

|

|

-59.7%

|

N.A.

|

|

Customer deposits

|

|

166,000.8

|

|

203,221.5

|

|

212,216.0

|

|

4.4%

|

27.8%

|

|

Interbank borrowings and overnight funds

|

|

10,416.7

|

|

7,768.2

|

|

11,004.5

|

|

41.7%

|

5.6%

|

|

Borrowings from banks and others

|

|

20,278.7

|

|

25,511.2

|

|

26,570.5

|

|

4.2%

|

31.0%

|

|

Bonds issued

|

|

20,105.5

|

|

28,684.4

|

|

28,829.1

|

|

0.5%

|

43.4%

|

|

Borrowings from development entities

|

|

3,290.4

|

|

3,799.6

|

|

4,103.0

|

|

8.0%

|

24.7%

|

|

Other liabilities

|

|

13,336.0

|

|

14,625.6

|

|

14,572.4

|

|

-0.4%

|

9.3%

|

|

Total liabilities

|

|

234,073.0

|

|

287,397.4

|

|

298,802.7

|

|

4.0%

|

27.7%

|

|

Equity attributable to owners of the parent

|

|

18,310.6

|

|

19,472.2

|

|

19,939.8

|

|

2.4%

|

8.9%

|

|

Non-controlling interest

|

|

12,292.5

|

|

13,558.1

|

|

14,221.0

|

|

4.9%

|

15.7%

|

|

Total equity

|

|

30,603.1

|

|

33,030.3

|

|

34,160.8

|

|

3.4%

|

11.6%

|

|

Total liabilities and equity

|

|

264,676.1

|

|

320,427.8

|

|

332,963.5

|

|

3.9%

|

25.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statement of Income

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

Interest income

|

|

4,885.8

|

|

5,097.5

|

|

5,199.9

|

|

2.0%

|

6.4%

|

|

Interest expense

|

|

2,054.4

|

|

2,172.0

|

|

2,246.4

|

|

3.4%

|

9.3%

|

|

Net interest income

|

|

2,831.3

|

|

2,925.5

|

|

2,953.6

|

|

1.0%

|

4.3%

|

|

Loans and other accounts receivable

|

|

1,040.9

|

|

1,101.4

|

|

1,642.1

|

|

49.1%

|

57.7%

|

|

Other financial assets

|

|

(33.2)

|

|

14.8

|

|

43.6

|

|

194.1%

|

N.A

|

|

Recovery of charged-off financial assets

|

|

(96.6)

|

|

(79.7)

|

|

(56.0)

|

|

-29.7%

|

-42.0%

|

|

Net impairment loss on financial assets

|

|

911.1

|

|

1,036.5

|

|

1,629.6

|

|

57.2%

|

78.9%

|

|

Net interest income, after impairment losses

|

|

1,920.2

|

|

1,889.0

|

|

1,323.9

|

|

-29.9%

|

-31.1%

|

|

Net income from commissions and fees

|

|

1,347.2

|

|

1,345.8

|

|

1,094.5

|

|

-18.7%

|

-18.8%

|

|

Gross profit from sales of goods and services

|

|

599.7

|

|

833.7

|

|

239.4

|

|

-71.3%

|

-60.1%

|

|

Net trading income

|

|

208.6

|

|

1,101.2

|

|

(93.6)

|

|

-108.5%

|

-144.9%

|

|

Net income from other financial instruments mandatory at FVTPL

|

|

53.4

|

|

73.3

|

|

59.7

|

|

-18.5%

|

11.7%

|

|

Total other income

|

|

266.1

|

|

(804.3)

|

|

853.2

|

|

N.A

|

N.A.

|

|

Total other expenses

|

|

2,409.2

|

|

2,576.4

|

|

2,621.6

|

|

1.8%

|

8.8%

|

|

Net income before income tax expense

|

|

1,986.1

|

|

1,862.3

|

|

855.6

|

|

-54.1%

|

-56.9%

|

|

Income tax expense

|

|

586.4

|

|

516.4

|

|

214.6

|

|

-58.4%

|

-63.4%

|

|

Net income for the period

|

|

1,399.7

|

|

1,345.8

|

|

641.0

|

|

-52.4%

|

-54.2%

|

|

Non-controlling interest

|

|

586.5

|

|

645.6

|

|

317.6

|

|

-50.8%

|

-45.8%

|

|

Net income attributable to owners of the parent

|

|

813.2

|

|

700.2

|

|

323.4

|

|

-53.8%

|

-60.2%

|

|

|

|

|

|

|

|

|

|

|

|

|

Key ratios

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

YTD 2019

|

YTD 2020

|

|

Net Interest Margin(1)

|

|

5.7%

|

|

5.3%

|

|

5.0%

|

|

5.6%

|

5.2%

|

|

Net Interest Margin (including net trading income)(1)

|

|

5.9%

|

|

4.8%

|

|

5.3%

|

|

5.8%

|

5.1%

|

|

Efficiency ratio(2)

|

|

45.4%

|

|

47.1%

|

|

51.3%

|

|

45.1%

|

49.1%

|

|

ROAA(3)

|

|

2.1%

|

|

1.8%

|

|

0.8%

|

|

2.1%

|

1.3%

|

|

ROAE(4)

|

|

18.3%

|

|

14.2%

|

|

6.6%

|

|

17.7%

|

10.4%

|

|

|

|

|

|

|

|

|

|

|

|

|

90 days PDL / Gross loans (5)

|

|

3.2%

|

|

3.1%

|

|

3.0%

|

|

3.2%

|

3.0%

|

|

Provision expense / Average gross loans (6)

|

|

2.2%

|

|

2.2%

|

|

3.1%

|

|

2.1%

|

2.7%

|

|

Allowance / 90 days PDL (5)

|

|

1.53

|

|

1.41

|

|

1.53

|

|

1.53

|

1.53

|

|

Allowance / Gross loans

|

|

4.9%

|

|

4.4%

|

|

4.6%

|

|

4.9%

|

4.6%

|

|

Charge-offs / Average gross loans (6)

|

|

2.3%

|

|

1.9%

|

|

1.8%

|

|

2.4%

|

1.9%

|

|

|

|

|

|

|

|

|

|

|

|

|

Total loans, net / Total assets

|

|

62.9%

|

|

60.9%

|

|

61.1%

|

|

62.9%

|

61.1%

|

|

Deposits / Total loans, net

|

|

99.8%

|

|

104.2%

|

|

104.4%

|

|

99.8%

|

104.4%

|

|

Equity / Assets

|

|

11.6%

|

|

10.3%

|

|

10.3%

|

|

11.6%

|

10.3%

|

|

Tangible equity ratio (7)

|

|

8.7%

|

|

7.5%

|

|

7.6%

|

|

8.7%

|

7.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding (EoP)

|

|

22,281,017,159

|

|

22,281,017,159

|

|

22,281,017,159

|

|

22,281,017,159

|

22,281,017,159

|

|

Shares outstanding (Average)

|

|

22,281,017,159

|

|

22,281,017,159

|

|

22,281,017,159

|

|

22,281,017,159

|

22,281,017,159

|

|

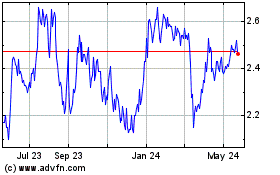

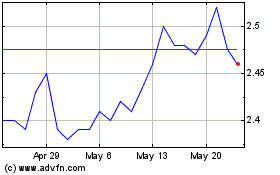

Common share price (EoP)

|

|

1,295.0

|

|

1,100.0

|

|

935.0

|

|

1,295.0

|

935.0

|

|

Preferred share price (EoP)

|

|

1,285.0

|

|

897.0

|

|

830.0

|

|

1,285.0

|

830.0

|

|

BV/ EoP shares in Ps.

|

|

821.8

|

|

873.9

|

|

894.9

|

|

821.8

|

894.9

|

|

EPS

|

|

36.5

|

|

31.4

|

|

14.5

|

|

70.7

|

45.9

|

|

|

|

|

|

|

|

|

|

|

|

|

P/E (8)

|

|

8.8

|

|

7.1

|

|

14.3

|

|

9.1

|

9.0

|

|

P/BV (8)

|

|

1.6

|

|

1.0

|

|

0.9

|

|

1.6

|

0.9

|

(1) NIM

is calculated as Net Interest Income divided by the average of Interest Earning Assets; (2) Efficiency Ratio is calculated as

total other expenses divided by net interest income plus net income from commissions and fees, gross profit from sales of goods

and services, net trading income, net income from other financial instruments mandatory at FVTPL and total other income; (3) ROAA

is calculated as Income before Minority Interest divided by the average of total assets for each quarter; (4) ROAE is calculated

as Net Income attributable to Grupo Aval’s shareholders divided by the average of shareholders´ attributable equity

for each quarter; (5) PDLs 90+ defined as loans more than 90 days past due include interest accounts receivables. Gross loans

excluding interbank and overnight funds; (6) Refers to average gross loans for the period; (7) Tangible Equity Ratio is calculated

as Total Equity minus Intangibles (excluding those related to concessions) divided by Total Assets minus Intangibles (excluding

those related to concessions); (8) Based on Preferred share prices.

|

4

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS,

|

|

|

|

Statement of Financial Position Analysis

1.

Assets

Total assets as of June 30th, 2020 totaled

Ps 332,963.5 billion showing an increase of 25.8% versus June 30th, 2019 and of 3.9% versus March 31st, 2020. Growth in assets

was mainly driven by (i) an 22.2% year over year growth in loans, net to Ps 203,303.0 billion,(ii) a 34.5% year over year growth

in cash and cash equivalents to Ps 40,109.2 billion and (iii) a 36.9% yearly growth for investment securities to Ps 33,302.6 billion.

When excluding FX movement in our Central American operation (“excluding FX”), asset growth would have been 19.7% versus

June 30th, 2019 and 6.5% versus March 31st, 2020; for total loans and receivables, net growth would have been 16.0% versus June

30th, 2019 and 7.0% versus March 31st, 2020; for cash and cash equivalents 26.3% and 3.0%; and for investment securities growth

would have been 30.7% versus June 30th, 2019 and 17.5% versus March 31th, 2020.

Multi Financial Group contributed with Ps. 18.6 trillion in assets

(USD 5.0 billion).

1.1

Loan portfolio

Gross loans (excluding interbank and overnight

funds) increased by 22.6% between June 30th, 2019 and June 30sth, 2020 to Ps 209,292.9 billion (16.6% excluding FX) mainly driven

by (i) a 25.6% increase in Commercial loans to Ps 118,617.5 billion (20.8% excluding FX), (ii) a 14.8% increase in Consumer loans

to Ps 65,122.3 billion (8.5% excluding FX), and (iii) a 32.0% increase Mortgages loans to Ps 25,168.6 billion (20.6% excluding

FX).

Multi Financial Group contributed with Ps.

12.7 trillion in gross loans (USD 3.4 billion). Ps. 7.1 trillion in commercial loans (USD 1.9 billion), Ps. 3.0 trillion in consumer

loans (USD 0.8 billion) and Ps. 2.6 trillion in mortgages loans (USD 0.7 billion).

Interbank & overnight funds decreased

by 13.1% to Ps 3,585.4 billion (-18.5% excluding FX) during the last twelve months.

Loss allowance was Ps 9,575.2 billion as

of June 30th, 2020 taking net loans to Ps 203,303.0 billion.

|

Total loans, net

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

Gross loans

|

|

|

|

|

|

|

|

|

|

|

Commercial loans

|

|

94,475.8

|

|

111,830.7

|

|

118,617.5

|

|

6.1%

|

25.6%

|

|

Consumer loans

|

|

56,705.3

|

|

65,205.6

|

|

65,122.3

|

|

-0.1%

|

14.8%

|

|

Mortgages loans

|

|

19,060.8

|

|

23,228.4

|

|

25,168.6

|

|

8.4%

|

32.0%

|

|

Microcredit loans

|

|

411.3

|

|

403.4

|

|

384.4

|

|

-4.7%

|

-6.5%

|

|

Gross loans

|

|

170,653.2

|

|

200,668.0

|

|

209,292.9

|

|

4.3%

|

22.6%

|

|

Interbank & overnight funds

|

|

4,123.6

|

|

3,282.2

|

|

3,585.4

|

|

9.2%

|

-13.1%

|

|

Total gross loans

|

|

174,776.8

|

|

203,950.2

|

|

212,878.3

|

|

4.4%

|

21.8%

|

|

Loss allowance

|

|

(8,375.5)

|

|

(8,883.9)

|

|

(9,575.2)

|

|

7.8%

|

14.3%

|

|

Allowance for impairment of commercial loans

|

|

(4,476.8)

|

|

(4,601.8)

|

|

(5,212.3)

|

|

13.3%

|

16.4%

|

|

Allowance for impairment of consumer loans

|

|

(3,488.9)

|

|

(3,783.5)

|

|

(3,843.9)

|

|

1.6%

|

10.2%

|

|

Allowance for impairment of mortgages

|

|

(323.6)

|

|

(406.5)

|

|

(429.6)

|

|

5.7%

|

32.8%

|

|

Allowance for impairment of microcredit loans

|

|

(86.2)

|

|

(92.1)

|

|

(89.5)

|

|

-2.8%

|

3.8%

|

|

Total loans, net

|

|

166,401.3

|

|

195,066.3

|

|

203,303.0

|

|

4.2%

|

22.2%

|

|

5

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS,

|

|

|

|

The following table shows the gross loan composition per product

of each of our loan categories.

|

Gross loans

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

General purpose

|

|

65,885.1

|

|

77,982.4

|

|

81,815.3

|

|

4.9%

|

24.2%

|

|

Working capital

|

|

14,801.8

|

|

18,611.7

|

|

21,197.9

|

|

13.9%

|

43.2%

|

|

Financial leases

|

|

9,958.0

|

|

10,838.2

|

|

10,747.4

|

|

-0.8%

|

7.9%

|

|

Funded by development banks

|

|

3,067.7

|

|

3,497.7

|

|

3,950.9

|

|

13.0%

|

28.8%

|

|

Overdrafts

|

|

456.4

|

|

544.3

|

|

635.5

|

|

16.7%

|

39.2%

|

|

Credit cards

|

|

306.7

|

|

356.3

|

|

270.5

|

|

-24.1%

|

-11.8%

|

|

Commercial loans

|

|

94,475.8

|

|

111,830.6

|

|

118,617.5

|

|

6.1%

|

25.6%

|

|

Payroll loans

|

|

24,656.5

|

|

28,098.7

|

|

28,630.9

|

|

1.9%

|

16.1%

|

|

Personal loans

|

|

10,418.2

|

|

11,409.6

|

|

11,451.6

|

|

0.4%

|

9.9%

|

|

Credit cards

|

|

15,395.8

|

|

18,770.1

|

|

17,095.3

|

|

-8.9%

|

11.0%

|

|

Automobile and vehicle

|

|

5,746.2

|

|

6,399.2

|

|

7,447.8

|

|

16.4%

|

29.6%

|

|

Financial leases

|

|

257.7

|

|

302.3

|

|

287.3

|

|

-5.0%

|

11.5%

|

|

Overdrafts

|

|

93.3

|

|

89.7

|

|

80.6

|

|

-10.2%

|

-13.6%

|

|

Other

|

|

137.6

|

|

136.0

|

|

128.8

|

|

-5.3%

|

-6.4%

|

|

Consumer loans

|

|

56,705.2

|

|

65,205.6

|

|

65,122.3

|

|

-0.1%

|

14.8%

|

|

Mortgages

|

|

17,643.1

|

|

21,602.7

|

|

23,510.1

|

|

8.8%

|

33.3%

|

|

Housing leases

|

|

1,417.7

|

|

1,625.6

|

|

1,658.5

|

|

2.0%

|

17.0%

|

|

Mortgages loans

|

|

19,060.8

|

|

23,228.4

|

|

25,168.6

|

|

8.4%

|

32.0%

|

|

Microcredit loans

|

|

411.3

|

|

403.4

|

|

384.4

|

|

-4.7%

|

-6.5%

|

|

Gross loans

|

|

170,653.1

|

|

200,668.0

|

|

209,292.9

|

|

4.3%

|

22.6%

|

|

Interbank & overnight funds

|

|

4,123.6

|

|

3,282.2

|

|

3,585.4

|

|

9.2%

|

-13.1%

|

|

Total gross loans

|

|

174,776.8

|

|

203,950.2

|

|

212,878.3

|

|

4.4%

|

21.8%

|

Over the last twelve months, commercial

general purpose loans and payroll loans have driven our loan portfolio growth in accordance with our banks’ strategies.

In Colombia, gross loans increased by 11.5%

during the last twelve months and 1.0% during the quarter. As for Central America, loans and receivables grew by 48.4% between

June 30th, 2019 and June 30th, 2020 and 10.5% in the last quarter; when excluding FX, growth would have been 26.6% and 19.3%, respectively.

Commercial loans grew by 25.6% over the

year and 6.1% in the last quarter. In Colombia, commercial loans increased by 13.9% annually and 2.1% over the quarter. As for

Central America, commercial loans grew by 64.6% over the year and 16.6% in the last quarter; when excluding FX, growth in Central

America would have been 40.5% and 25.9%, respectively.

Consumer loans growth over the last year

and quarter was mainly driven by payrolls loans. In Colombia, Consumer loans grew by 6.7% during the last twelve months and decreased

1.3% between March 31st , 2020 and June 30th, 2020 mainly in credit cards. Growth of our Central American operations was 30.6%

over the year and 1.7% in the last quarter, excluding FX, growth would have been 11.5% during the last twelve months and 9.8% in

the quarter.

|

6

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS,

|

|

|

|

The following table shows the loans and

receivables composition per entity. During the last twelve months, Banco de Occidente showed the highest growth rate within our

banking operation in Colombia, driven by a strong performance in all loan categories (commercial loans grew 18.2%, consumer loans

grew 6.8% and mortgages grew 18.2%).

|

Gross loans / Bank ($)

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

Banco de Bogotá

|

|

109,904.9

|

|

134,807.7

|

|

141,757.5

|

|

5.2%

|

29.0%

|

|

Domestic

|

|

58,329.6

|

|

65,554.2

|

|

65,237.0

|

|

-0.5%

|

11.8%

|

|

Central America

|

|

51,575.3

|

|

69,253.5

|

|

76,520.5

|

|

10.5%

|

48.4%

|

|

Banco de Occidente

|

|

29,400.7

|

|

32,260.5

|

|

33,942.2

|

|

5.2%

|

15.4%

|

|

Banco Popular

|

|

19,280.8

|

|

20,767.5

|

|

21,469.1

|

|

3.4%

|

11.3%

|

|

Banco AV Villas

|

|

11,883.4

|

|

12,435.3

|

|

12,051.4

|

|

-3.1%

|

1.4%

|

|

Corficolombiana

|

|

1,761.3

|

|

2,000.4

|

|

1,821.3

|

|

-8.9%

|

3.4%

|

|

Eliminations

|

|

(1,578.0)

|

|

(1,603.5)

|

|

(1,748.7)

|

|

9.1%

|

10.8%

|

|

Gross loans

|

|

170,653.2

|

|

200,668.0

|

|

209,292.9

|

|

4.3%

|

22.6%

|

|

Interbank & overnight funds

|

|

4,123.6

|

|

3,282.2

|

|

3,585.4

|

|

9.2%

|

-13.1%

|

|

Total gross loans

|

|

174,776.8

|

|

203,950.2

|

|

212,878.3

|

|

4.4%

|

21.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross loans / Bank (%)

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

|

|

|

|

|

|

|

|

|

|

Banco de Bogotá

|

|

64.4%

|

|

67.2%

|

|

67.7%

|

|

|

|

|

Domestic

|

|

34.2%

|

|

32.7%

|

|

31.2%

|

|

|

|

|

Central America

|

|

30.2%

|

|

34.5%

|

|

36.6%

|

|

|

|

|

Banco de Occidente

|

|

17.2%

|

|

16.1%

|

|

16.2%

|

|

|

|

|

Banco Popular

|

|

11.3%

|

|

10.3%

|

|

10.3%

|

|

|

|

|

Banco AV Villas

|

|

7.0%

|

|

6.2%

|

|

5.8%

|

|

|

|

|

Corficolombiana

|

|

1.0%

|

|

1.0%

|

|

0.9%

|

|

|

|

|

Eliminations

|

|

-0.9%

|

|

-0.8%

|

|

-0.8%

|

|

|

|

|

Gross loans

|

|

100%

|

|

100%

|

|

100%

|

|

|

|

Of the total loans and receivables, 63.1%

are domestic and 36.9% are foreign. In terms of gross loans (excluding interbank and overnight funds), 63.4% are domestic and 36.6%

are foreign (reflecting the Central American operations).

|

Gross loans

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

Domestic

|

|

|

|

|

|

|

|

|

|

|

Commercial loans

|

|

72,716.9

|

|

81,115.8

|

|

82,806.2

|

|

2.1%

|

13.9%

|

|

Consumer loans

|

|

37,464.6

|

|

40,497.7

|

|

39,985.9

|

|

-1.3%

|

6.7%

|

|

Mortgages loans

|

|

8,485.0

|

|

9,397.6

|

|

9,595.8

|

|

2.1%

|

13.1%

|

|

Microcredit loans

|

|

411.3

|

|

403.4

|

|

384.4

|

|

-4.7%

|

-6.5%

|

|

Interbank & overnight funds

|

|

2,509.3

|

|

1,611.9

|

|

1,471.4

|

|

-8.7%

|

-41.4%

|

|

Total domestic loans

|

|

121,587.2

|

|

133,026.3

|

|

134,243.7

|

|

0.9%

|

10.4%

|

|

Foreign

|

|

|

|

|

|

|

|

|

|

|

Commercial loans

|

|

21,758.9

|

|

30,714.9

|

|

35,811.2

|

|

16.6%

|

64.6%

|

|

Consumer loans

|

|

19,240.6

|

|

24,707.9

|

|

25,136.4

|

|

1.7%

|

30.6%

|

|

Mortgages loans

|

|

10,575.8

|

|

13,830.7

|

|

15,572.8

|

|

12.6%

|

47.2%

|

|

Microcredit loans

|

|

-

|

|

-

|

|

-

|

|

-

|

-

|

|

Interbank & overnight funds

|

|

1,614.3

|

|

1,670.3

|

|

2,114.0

|

|

26.6%

|

31.0%

|

|

Total foreign loans

|

|

53,189.6

|

|

70,923.9

|

|

78,634.5

|

|

10.9%

|

47.8%

|

|

Total gross loans

|

|

174,776.8

|

|

203,950.2

|

|

212,878.3

|

|

4.4%

|

21.8%

|

|

7

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS,

|

|

|

|

The quality of our loan portfolio improved during the quarter.

Our 30 days PDL to total loans closed 2Q20 in 4.1%, compared

to 4.2% in 1Q20 and 4.5% in 2Q19. The ratio of 90 days PDL to total loans was 3.0% for 2Q20, compared to 3.1% for 1Q20 and 3.2%

in 2Q19. Finally, the ratio of CDE Loans to total loans was 6.8% in 2Q20, 6.9% in 1Q20, and 7.1% in 2Q19.

Commercial

loans 30 days PDL ratio was 4.1% for 2Q20 and 1Q20, and 4.2% for 2Q19; 90 days PDL ratio was 3.6%, 3.5% and 3.6%, respectively.

Consumer loans 30 days PDL ratio was 3.8% for 2Q20, 4.1% for 1Q20 and 4.9% for 2Q19; 90 days PDL ratio was 2.0%, 2.6% and 2.7%,

respectively. Mortgages’ 30 days PDL ratio was 4.4% for 2Q20 and 1Q20, and 4.6% for 2Q19; 90 days PDL ratio was 2.7%, 3.0%

and 2.6%, respectively.

|

Total gross loans

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

''A'' normal risk

|

|

153,775.8

|

|

181,576.2

|

|

188,606.9

|

|

3.9%

|

22.7%

|

|

''B'' acceptable risk

|

|

4,749.9

|

|

5,305.3

|

|

6,491.7

|

|

22.4%

|

36.7%

|

|

''C'' appreciable risk

|

|

5,394.5

|

|

6,253.8

|

|

6,562.8

|

|

4.9%

|

21.7%

|

|

''D'' significant risk

|

|

3,762.6

|

|

3,886.3

|

|

3,875.4

|

|

-0.3%

|

3.0%

|

|

''E'' unrecoverable

|

|

2,970.4

|

|

3,646.3

|

|

3,756.1

|

|

3.0%

|

26.5%

|

|

Gross loans

|

|

170,653.2

|

|

200,668.0

|

|

209,292.9

|

|

4.3%

|

22.6%

|

|

Interbank and overnight funds

|

|

4,123.6

|

|

3,282.2

|

|

3,585.4

|

|

9.2%

|

-13.1%

|

|

Total gross loans

|

|

174,776.8

|

|

203,950.2

|

|

212,878.3

|

|

4.4%

|

21.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

CDE loans / Total loans (*)

|

|

7.1%

|

|

6.9%

|

|

6.8%

|

|

|

|

|

Past due loans

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

Performing

|

|

90,507.7

|

|

107,237.1

|

|

113,778.3

|

|

6.1%

|

25.7%

|

|

Between 31 and 90 days past due

|

|

552.6

|

|

734.4

|

|

574.4

|

|

-21.8%

|

3.9%

|

|

+90 days past due

|

|

3,415.4

|

|

3,859.2

|

|

4,264.8

|

|

10.5%

|

24.9%

|

|

Commercial loans

|

|

94,475.8

|

|

111,830.7

|

|

118,617.5

|

|

6.1%

|

25.6%

|

|

Performing

|

|

53,904.5

|

|

62,523.2

|

|

62,647.4

|

|

0.2%

|

16.2%

|

|

Between 31 and 90 days past due

|

|

1,273.7

|

|

987.1

|

|

1,198.3

|

|

21.4%

|

-5.9%

|

|

+90 days past due

|

|

1,527.1

|

|

1,695.3

|

|

1,276.6

|

|

-24.7%

|

-16.4%

|

|

Consumer loans

|

|

56,705.3

|

|

65,205.6

|

|

65,122.3

|

|

-0.1%

|

14.8%

|

|

Performing

|

|

18,183.2

|

|

22,212.5

|

|

24,050.9

|

|

8.3%

|

32.3%

|

|

Between 31 and 90 days past due

|

|

380.5

|

|

323.3

|

|

435.0

|

|

34.6%

|

14.3%

|

|

+90 days past due

|

|

497.1

|

|

692.6

|

|

682.8

|

|

-1.4%

|

37.4%

|

|

Mortgages loans

|

|

19,060.8

|

|

23,228.4

|

|

25,168.6

|

|

8.4%

|

32.0%

|

|

Performing

|

|

341.7

|

|

342.3

|

|

333.2

|

|

-2.7%

|

-2.5%

|

|

Between 31 and 90 days past due

|

|

18.6

|

|

3.1

|

|

4.6

|

|

46.7%

|

-75.2%

|

|

+90 days past due

|

|

51.1

|

|

58.0

|

|

46.7

|

|

-19.5%

|

-8.6%

|

|

Microcredit loans

|

|

411.3

|

|

403.4

|

|

384.4

|

|

-4.7%

|

-6.5%

|

|

Gross loans

|

|

170,653.2

|

|

200,668.0

|

|

209,292.9

|

|

4.3%

|

22.6%

|

|

Interbank & overnight funds

|

|

4,123.6

|

|

3,282.2

|

|

3,585.4

|

|

9.2%

|

-13.1%

|

|

Total gross loans

|

|

174,776.8

|

|

203,950.2

|

|

212,878.3

|

|

4.4%

|

21.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30

Days PDL / Total loans (*)

|

|

4.5%

|

|

4.2%

|

|

4.1%

|

|

|

|

|

90

Days PDL / Total loans (*)

|

|

3.2%

|

|

3.1%

|

|

3.0%

|

|

|

|

(*) Total loans excluding

interbank and overnight funds. 30 days past due and 90 days past due are calculated on a capital plus interest accounts receivable

basis.

|

8

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS,

|

|

|

|

Grupo Aval’s coverage over its 90

days PDL was 1.5x for 2Q20, 1.4x for 1Q20 and 1.5x for 2Q19. Allowance to CDE Loans was 0.7x for 2Q20, 0.6x for 1Q20 and 0.7x for

2Q19, and allowance to 30 days PDL was 1.1x for 2Q20, 1Q20 and 2Q19. Impairment loss, net of recoveries of charged off assets to

average total loans was 3.1% in 2Q20, and 2.2% in 1Q20 and 2Q19. Charge-offs to average total loans was 1.8% in 2Q20, 1.9% in 1Q20,

and 2.3% in 2Q19.

|

Total gross loans

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for impairment / CDE loans

|

|

0.7

|

|

0.6

|

|

0.7

|

|

Allowance for impairment / 30 Days PDL

|

|

1.1

|

|

1.1

|

|

1.1

|

|

Allowance for impairment / 90 Days PDL

|

|

1.5

|

|

1.4

|

|

1.5

|

|

Allowance for impairment / Total loans (*)

|

|

4.9%

|

|

4.4%

|

|

4.6%

|

|

|

|

|

|

|

|

|

|

Impairment loss / CDE loans

|

|

0.3

|

|

0.3

|

|

0.5

|

|

Impairment loss / 30 Days PDL

|

|

0.5

|

|

0.5

|

|

0.8

|

|

Impairment loss / 90 Days PDL

|

|

0.8

|

|

0.7

|

|

1.0

|

|

Impairment loss / Average total loans (*)

|

|

2.5%

|

|

2.3%

|

|

3.2%

|

|

Impairment loss, net of recoveries of charged-off assets / Average total loans (*)

|

|

2.2%

|

|

2.2%

|

|

3.1%

|

|

|

|

|

|

|

|

|

|

Charge-offs / Average total loans (*)

|

|

2.3%

|

|

1.9%

|

|

1.8%

|

(*) Total loans excluding interbank and overnight

funds. 30 days past due and 90 days past due are calculated on a capital plus interest accounts receivable basis.

1.2

Investment securities and trading assets

Total investment securities and trading

assets increased 39.0% to Ps 44,506.7 billion between June 30th, 2019 and June 30th, 2020 and 10.0% versus March 31st, 2020. Ps

37,518.5 billion of our total portfolio is invested in debt securities, which increased by 38.7% between June 30th, 2019 and June

30th, 2020 and by 15.3% since March 31st, 2020. Ps 5,619.6 billion of our total investment securities is invested in equity securities,

which increased by 26.8% between June 30th, 2019 and June 30th, 2020 and by 11.5% versus March 31st, 2020.

Multi Financial Group contributed with Ps.

4.2 trillion of investment and trading assets (USD 1.1 billion).

|

Investment and trading assets

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

Debt securities

|

|

4,011.4

|

|

4,883.0

|

|

5,600.7

|

|

14.7%

|

39.6%

|

|

Equity securities

|

|

3,157.1

|

|

3,708.1

|

|

4,234.8

|

|

14.2%

|

34.1%

|

|

Derivative assets

|

|

533.5

|

|

2,887.8

|

|

1,368.5

|

|

-52.6%

|

156.5%

|

|

Trading assets

|

|

7,702.0

|

|

11,478.9

|

|

11,204.1

|

|

-2.4%

|

45.5%

|

|

Investments in debt securities at FVTPL (non compliant with SPPI test)

|

|

25.1

|

|

9.3

|

|

8.8

|

|

-4.8%

|

-64.8%

|

|

Debt securities at FVOCI

|

|

20,030.6

|

|

24,426.3

|

|

27,001.1

|

|

10.5%

|

34.8%

|

|

Equity securities at FVOCI

|

|

1,276.0

|

|

1,330.7

|

|

1,384.8

|

|

4.1%

|

8.5%

|

|

Investments in securities at FVOCI

|

|

21,306.6

|

|

25,757.0

|

|

28,386.0

|

|

10.2%

|

33.2%

|

|

Investments in debt securities at AC

|

|

2,984.5

|

|

3,233.7

|

|

4,907.8

|

|

51.8%

|

64.4%

|

|

Investment and trading assets

|

|

32,018.2

|

|

40,478.8

|

|

44,506.7

|

|

10.0%

|

39.0%

|

|

9

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS,

|

|

|

|

The average yield on our debt and equity

investment securities (trading assets, investments in debt securities at FVTPL, investments in securities at FVOCI and investments

in debt securities at AC) was 6.6% for 2Q20, 1.4% for 1Q20 and 5.7% in 2Q19.

1.3

Cash and Cash Equivalents

As of June 30th, 2020 cash and cash equivalents

had a balance of Ps 40,109.2 billion showing an increase of 34.5% versus June 30th, 2019 and decreasing 0.1% versus March 31st,

2020 (26.3% and 3.0% excluding FX).

The ratio of cash and cash equivalents to

customer deposits was 18.9% at June 30th, 2020, 19.8% at March 31st, 2020, and 18.0% at June 30th, 2019.

1.4

Goodwill and Other Intangibles

Goodwill and other intangibles as of June

30th, 2020 reached Ps 17,856.9 billion, increasing by 21.1% versus June 30th, 2019 and decreasing 0.3% versus March 31st, 2020.

Goodwill as of June 30th, 2020 was Ps 8,236.5

billion, increasing by 13.6% versus June 30th, 2019 and decreasing 3.9% versus March 31st, 2020, explained by fluctuations in the

exchange rate.

Other intangibles, which include “concession

arrangement rights” and other intangibles, mainly reflect the value of road concessions recorded for the most part at Corficolombiana.

Other intangibles as of June 30th, 2020 reached Ps 9,620.4 billion and grew by 28.3% versus June 30th, 2019 and 3.0% versus March

31st, 2020.

2.

Liabilities

As of June 30th, 2020 funding represented

94.6% of total liabilities and other liabilities represented 5.4%.

2.1

Funding

Total Funding (Total financial liabilities

at amortized cost) which includes (i) Customer deposits, (ii) Interbank borrowings and overnight funds, (iii) Borrowings from banks

and others, (iv) Bonds issued, and (v) Borrowing from development entities had a balance of Ps 282,723.1 billion as of June 30th,

2020 showing an increase of 28.5% versus June 30th, 2019 and of 5.1% versus March 31st, 2020 (22.5% and 7.6% increase excluding

FX). Total customer deposits represented 75.1% of total funding as of the end of 2Q20, 75.6% for 1Q20 and 75.4% for 2Q19.

Multi Financial Group contributed with Ps. 16.3 trillion in total

funding (USD 4.3 billion).

Average cost of funds was 3.3% for 2Q20, 3.5% for 1Q20 and 3.8% for 2Q19.

|

10

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS,

|

|

|

|

2.1.1

Customer deposits

|

Customer deposits

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

Checking accounts

|

|

14,811.2

|

|

18,843.7

|

|

25,290.1

|

|

34.2%

|

70.7%

|

|

Other deposits

|

|

526.6

|

|

388.6

|

|

499.8

|

|

28.6%

|

-5.1%

|

|

Non-interest bearing

|

|

15,337.8

|

|

19,232.3

|

|

25,789.9

|

|

34.1%

|

68.1%

|

|

Checking accounts

|

|

23,479.6

|

|

34,215.8

|

|

26,486.3

|

|

-22.6%

|

12.8%

|

|

Time deposits

|

|

71,687.7

|

|

81,071.4

|

|

86,638.2

|

|

6.9%

|

20.9%

|

|

Savings deposits

|

|

55,495.7

|

|

68,701.9

|

|

73,301.6

|

|

6.7%

|

32.1%

|

|

Interest bearing

|

|

150,663.0

|

|

183,989.2

|

|

186,426.2

|

|

1.3%

|

23.7%

|

|

Customer deposits

|

|

166,000.8

|

|

203,221.5

|

|

212,216.0

|

|

4.4%

|

27.8%

|

Of our total customer deposits as of June 30th, 2020 checking

accounts represented 24.4%, time deposits 40.8%, savings accounts 34.5%, and other deposits 0.2%.

Multi Financial Group contributed with Ps. 11.0 trillion in deposits

(USD 2.9 billion).

The following table shows the customer deposits

composition by bank. During the last twelve months, Banco de Bogotá showed the highest growth rate in customer deposits

within our banking operation in Colombia.

|

Deposits / Bank ($)

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

Banco de Bogotá

|

|

107,408.4

|

|

143,581.6

|

|

148,550.2

|

|

3.5%

|

38.3%

|

|

Domestic

|

|

56,458.0

|

|

72,181.8

|

|

67,964.0

|

|

-5.8%

|

20.4%

|

|

Central America

|

|

50,950.4

|

|

71,399.8

|

|

80,586.2

|

|

12.9%

|

58.2%

|

|

Banco de Occidente

|

|

26,706.2

|

|

31,476.6

|

|

30,764.9

|

|

-2.3%

|

15.2%

|

|

Banco Popular

|

|

19,096.1

|

|

18,516.9

|

|

21,579.6

|

|

16.5%

|

13.0%

|

|

Banco AV Villas

|

|

11,307.6

|

|

12,694.2

|

|

12,821.0

|

|

1.0%

|

13.4%

|

|

Corficolombiana

|

|

4,006.2

|

|

4,671.5

|

|

4,765.1

|

|

2.0%

|

18.9%

|

|

Eliminations

|

|

(2,523.5)

|

|

(7,719.5)

|

|

(6,264.7)

|

|

-18.8%

|

148.2%

|

|

Total Grupo Aval

|

|

166,000.8

|

|

203,221.5

|

|

212,216.0

|

|

4.4%

|

27.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits / Bank (%)

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

|

|

|

Banco de Bogotá

|

|

64.7%

|

|

70.7%

|

|

70.0%

|

|

|

|

|

Domestic

|

|

34.0%

|

|

35.5%

|

|

32.0%

|

|

|

|

|

Central America

|

|

30.7%

|

|

35.1%

|

|

38.0%

|

|

|

|

|

Banco de Occidente

|

|

16.1%

|

|

15.5%

|

|

14.5%

|

|

|

|

|

Banco Popular

|

|

11.5%

|

|

9.1%

|

|

10.2%

|

|

|

|

|

Banco AV Villas

|

|

6.8%

|

|

6.2%

|

|

6.0%

|

|

|

|

|

Corficolombiana

|

|

2.4%

|

|

2.3%

|

|

2.2%

|

|

|

|

|

Eliminations

|

|

-1.5%

|

|

-3.8%

|

|

-3.0%

|

|

|

|

|

Total Grupo Aval

|

|

100.0%

|

|

100.0%

|

|

100.0%

|

|

|

|

|

11

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS,

|

|

|

|

2.1.2

Borrowings from Banks and Other (includes borrowings from development entities)

As of June 30th, 2020 borrowings from banks

and other totaled Ps 30,673.5 billion, showing an increase of 30.1% versus June 30th, 2019 and of 4.6% versus March 31st, 2020.

Excluding FX, borrowings from banks and other increased 21.8% versus June 30th, 2019 and 7.7% versus March 31st, 2020.

2.1.3

Bonds issued

Total bonds issued as of June 30th, 2020 totaled Ps 28,829.1

billion increased 43.4% versus June 30th, 2019 and 0.5% versus March 31st, 2020. Excluding FX, bonds increased 42.1% versus June

30th, 2019 and 0.8% versus March 31st, 2020.

3.

Non-controlling Interest

Non-controlling Interest in Grupo Aval reflects:

(i) the minority stakes that third party shareholders hold in each of its direct consolidated subsidiaries (Banco de Bogotá,

Banco de Occidente, Banco Popular, Banco AV Villas and Corficolombiana), and (ii) the minority stakes that third party shareholders

hold in the consolidated subsidiaries at the bank level (mainly Porvenir). As of June 30th, 2020 non-controlling interest was Ps

14,221.0 billion which increased by 15.7% versus June 30th, 2019 and 4.9% versus March 31st, 2020. Total non-controlling interest

represents 41.6% of total equity as of 2Q20, compared to 41.0% in 1Q20 and 40.2% in 2Q19. Total non-controlling interest derives

from the sum of the combined minority interests of our banks and of Grupo Aval, applying eliminations associated with the consolidation

process of Grupo Aval.

|

Percentage consolidated by Aval

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

Banco de Bogotá

|

|

68.7%

|

|

68.7%

|

|

68.7%

|

|

-

|

-

|

|

Banco de Occidente

|

|

72.3%

|

|

72.3%

|

|

72.3%

|

|

-

|

-

|

|

Banco Popular

|

|

93.7%

|

|

93.7%

|

|

93.7%

|

|

-

|

-

|

|

Banco AV Villas

|

|

79.9%

|

|

79.9%

|

|

79.9%

|

|

-

|

-

|

|

BAC Credomatic (1)

|

|

68.7%

|

|

68.7%

|

|

68.7%

|

|

-

|

-

|

|

Porvenir (2)

|

|

75.7%

|

|

75.7%

|

|

75.7%

|

|

-

|

0

|

|

Corficolombiana

|

|

38.2%

|

|

38.6%

|

|

38.6%

|

|

-

|

40

|

(1) BAC Credomatic is fully owned by Banco de Bogotá;

(2) Grupo Aval indirectly owns a 100% of Porvenir as follows: 20.0% in Grupo Aval, 46.9% in Banco de Bogotá and 33.1% in

Banco de Occidente. Porvenir's results consolidate into Banco de Bogotá.

4.

Attributable Shareholders’ Equity

Attributable shareholders’ equity as of June 30th, 2020

was Ps 19,939.8 billion, showing an increase of 8.9% versus June 30th, 2019 and a increase of 2.4% versus March 31st, 2020.

|

12

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS,

|

|

|

|

Income Statement Analysis

Our net income attributable to the owners of the parent company

for 2Q20 of Ps 323.4 billion showed a 60.2% decrease versus 2Q19 and a 53.8% decrease versus 1Q20.

|

Consolidated Statement of Income

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

Interest income

|

|

4,885.8

|

|

5,097.5

|

|

5,199.9

|

|

2.0%

|

6.4%

|

|

Interest expense

|

|

2,054.4

|

|

2,172.0

|

|

2,246.4

|

|

3.4%

|

9.3%

|

|

Net interest income

|

|

2,831.3

|

|

2,925.5

|

|

2,953.6

|

|

1.0%

|

4.3%

|

|

Loans and other accounts receivable

|

|

1,040.9

|

|

1,101.4

|

|

1,642.1

|

|

49.1%

|

57.7%

|

|

Other financial assets

|

|

(33.2)

|

|

14.8

|

|

43.6

|

|

194.1%

|

N.A

|

|

Recovery of charged-off financial assets

|

|

(96.6)

|

|

(79.7)

|

|

(56.0)

|

|

-29.7%

|

-42.0%

|

|

Net impairment loss on financial assets

|

|

911.1

|

|

1,036.5

|

|

1,629.6

|

|

57.2%

|

78.9%

|

|

Net income from commissions and fees

|

|

1,347.2

|

|

1,345.8

|

|

1,094.5

|

|

-18.7%

|

-18.8%

|

|

Gross profit from sales of goods and services

|

|

599.7

|

|

833.7

|

|

239.4

|

|

-71.3%

|

-60.1%

|

|

Net trading income

|

|

208.6

|

|

1,101.2

|

|

(93.6)

|

|

-108.5%

|

-144.9%

|

|

Net income from other financial instruments mandatory at FVTPL

|

|

53.4

|

|

73.3

|

|

59.7

|

|

-18.5%

|

11.7%

|

|

Total other income

|

|

266.1

|

|

(804.3)

|

|

853.2

|

|

N.A

|

N.A.

|

|

Total other expenses

|

|

2,409.2

|

|

2,576.4

|

|

2,621.6

|

|

1.8%

|

8.8%

|

|

Net income before income tax expense

|

|

1,986.1

|

|

1,862.3

|

|

855.6

|

|

-54.1%

|

-56.9%

|

|

Income tax expense

|

|

586.4

|

|

516.4

|

|

214.6

|

|

-58.4%

|

-63.4%

|

|

Net income for the period

|

|

1,399.7

|

|

1,345.8

|

|

641.0

|

|

-52.4%

|

-54.2%

|

|

Non-controlling interest

|

|

586.5

|

|

645.6

|

|

317.6

|

|

-50.8%

|

-45.8%

|

|

Net income attributable to owners of the parent

|

|

813.2

|

|

700.2

|

|

323.4

|

|

-53.8%

|

-60.2%

|

1.

Net Interest Income

|

Net interest income

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|

|

Interest income

|

|

|

|

|

|

|

|

|

|

|

Commercial

|

|

1,842.9

|

|

1,889.1

|

|

1,963.6

|

|

3.9%

|

6.5%

|

|

Interbank and overnight funds

|

|

108.5

|

|

81.9

|

|

43.7

|

|

-46.6%

|

-59.7%

|

|

Consumer

|

|

2,224.8

|

|

2,322.9

|

|

2,374.0

|

|

2.2%

|

6.7%

|

|

Mortgages and housing leases

|

|

403.9

|

|

455.2

|

|

466.1

|

|

2.4%

|

15.4%

|

|

Microcredit

|

|

25.5

|

|

25.7

|

|

22.5

|

|

-12.5%

|

-11.6%

|

|

Loan portfolio

|

|

4,605.7

|

|

4,774.8

|

|

4,870.0

|

|

2.0%

|

5.7%

|

|

Interests on investments in debt securities

|

|

280.0

|

|

322.6

|

|

330.0

|

|

2.3%

|

17.8%

|

|

Total interest income

|

|

4,885.8

|

|

5,097.5

|

|

5,199.9

|

|

2.0%

|

6.4%

|

|

Interest expense

|

|

|

|

|

|

|

|

|

|

|

Checking accounts

|

|

103.6

|

|

93.7

|

|

81.7

|

|

-12.8%

|

-21.2%

|

|

Time deposits

|

|

888.5

|

|

948.4

|

|

968.9

|

|

2.2%

|

9.0%

|

|

Savings deposits

|

|

374.2

|

|

427.1

|

|

422.4

|

|

-1.1%

|

12.9%

|

|

Total interest expenses on deposits

|

|

1,366.4

|

|

1,469.2

|

|

1,473.0

|

|

0.3%

|

7.8%

|

|

Interbank borrowings and overnight funds

|

|

84.3

|

|

84.5

|

|

97.7

|

|

15.7%

|

16.0%

|

|

Borrowings from banks and others

|

|

277.3

|

|

220.4

|

|

242.3

|

|

9.9%

|

-12.7%

|

|

Bonds issued

|

|

294.4

|

|

359.4

|

|

397.8

|

|

10.7%

|

35.1%

|

|

Borrowings from development entities

|

|

32.0

|

|

38.5

|

|

35.7

|

|

-7.3%

|

11.5%

|

|

Total interest expenses on financial obligations

|

|

688.0

|

|

702.7

|

|

773.4

|

|

10.1%

|

12.4%

|

|

Total interest expense

|

|

2,054.4

|

|

2,172.0

|

|

2,246.4

|

|

3.4%

|

9.3%

|

|

Net interest income

|

|

2,831.3

|

|

2,925.5

|

|

2,953.6

|

|

1.0%

|

4.3%

|

|

13

|

|

|

Report of 2Q2020 consolidated results

Information reported in Ps billions

and under IFRS,

|

|

|

|

Our net interest income increased by 4.3%

to Ps 2,953.6 billion for 2Q20 versus 2Q19 and increased 1.0% versus 1Q20. The increase versus 2Q19 was derived from a 6.4% increase

in total interest income that was partially offset by a 9.3% increase in total interest expense.

Our Net Interest

Margin(1) was 5.3% for 2Q20, 4.8% in 1Q20 and 5.9% in 2Q19. Net Interest Margin on Loans was 5.8% for 2Q20, 6.1% in

1Q20 and 6.6% in 2Q19. On the other hand, our Net Investments Margin was 2.9% in 2Q20 versus -1.7% in 1Q20 and 2.3% in 2Q19.

In our Colombian operations, our Net Interest

Margin was 4.9% for 2Q20, 4.0% for 1Q20, and 5.4% for 2Q19. Net Interest Margin on Loans was 5.3% for 2Q20, 5.6% in 1Q20 and 6.2%

in 2Q19. On the other hand, our Net Investments Margin was 3.4% in 2Q20 versus -3.3% in 1Q20 and 2.0% in 2Q19.

In our Central American operations, our

Net Interest Margin was 6.0% for 2Q20, 6.4% in 1Q20 and 6.9% in 2Q19. Net Interest Margin on Loans was 6.8% for 2Q20, 7.0% in 1Q20

and 7.5% in 2Q19. On the other hand, our Net Investments Margin was 1.5% for 2Q20, 2.7% in 1Q20 versus 3.0% in 2Q19.

2.

Impairment loss on financial assets, net

Our impairment loss on financial assets,

net increased by 78.9% to Ps 1,629.6 billion for 2Q20 versus 2Q19 and 57.2% versus 1Q20.

|

Net impairment loss on financial assets

|

|

2Q19

|

|

1Q20

|

|

2Q20

|

|

D

|

|

|

|

|

|

2Q20 vs. 1Q20

|

2Q20 vs. 2Q19

|