AZZ incorporated Reports Results for the First Quarter of Fiscal Year 2008

29 June 2007 - 8:00PM

PR Newswire (US)

For the first quarter - Revenues Up 44%, Segment Operating Income

Up 41% and Backlog Up 57%, FY 2008 earnings guidance increased to a

range of $1.65 to $1.75 per diluted share FORT WORTH, Texas, June

29 /PRNewswire-FirstCall/ -- AZZ incorporated (NYSE:AZZ), a

manufacturer of electrical products and a provider of galvanizing

services, today announced unaudited financial results for the first

quarter ended May 31, 2007. Revenues for the first quarter

increased 44 percent to $75.4 million compared to $52.5 million for

the same quarter last year. Net income for the quarter was $4.1

million, or $0.34 per diluted share, compared to net income of $4.1

million, or $0.35 per diluted share, in last year's first fiscal

quarter. Earnings per share numbers are stated after adjusting for

the two-for-one stock split effected in the form of a 100 percent

share dividend and paid on May 4, 2007. SG&A expenses

significantly increased in the first quarter as compared to the

same quarter of the prior fiscal year. This increase over the prior

period is primarily related to compensation expense for stock

appreciation rights that fully vested and were booked during the

quarter in the amount of approximately $4.4 million or 22 cents per

diluted share. Backlog at the end of the first quarter was $144.8

million versus $92.1 million at May 31, 2006, an increase of 57

percent. Backlog at February 28, 2007 year-end was $120.7 million.

Incoming orders for the first quarter totaled $99.5 million while

shipments for the quarter totaled $75.4 million, resulting in a

book to ship ratio of 132 percent. Incoming orders increased 41

percent over the same period last year and equaled the record

setting incoming order rate of the fourth quarter of the prior

fiscal year. Based upon current customer requested delivery dates

and our production schedules, 72 percent of the backlog at May 31,

2007 is expected to ship in the current fiscal year. Of the backlog

of $144.8 million, 35 percent is to be exported from the U.S.

Revenues for the Electrical and Industrial Products Segment

increased by 30 percent in the first quarter of the current fiscal

year to $40.9 million compared to $31.5 million in the same period

last year. Operating income for the segment increased 55 percent to

$6.3 million. Operating margins of 15.5 percent for the first

quarter compare favorably to the 13 percent in the first quarter of

last year. Revenues for the Company's Galvanizing Service Segment

for the first quarter were $34.5 million, an increase of 65 percent

compared to the $20.9 million in the same period last year.

Operating income improved 32 percent to $8.6 million. Revenues for

the first quarter continue to be favorably impacted by pricing

actions to offset increased zinc cost. Of the 65 percent increase

in revenues, 28 percent was attributable to volume and 37 percent

attributable to price. Our acquisition of Witt Galvanizing on

November 1, 2006, accounted for 69 percent of the volume increase.

David H. Dingus, president and chief executive officer of AZZ

incorporated, commented, "Regarding our Electrical and Industrial

Products Segment, we are pleased to report favorable increases in

our revenues, operating margins and backlog for the first quarter

of fiscal 2008. We have seen a continuation of improving market

demand and improved pricing. We continue our emphasis on booking

business at specific targeted margin levels and seeking out new

market opportunities. While the largest increases in our incoming

orders were related to our high voltage transmission products, all

of our served markets reflected an increase over the same period of

a year ago. Our domestic and international quotation and inquiry

levels continue at an encouraging pace. The operating margin

improvement is attributable to the leverage gained from increased

volumes, quick turn jobs, and pricing actions. The Galvanizing

Services Segment achieved record setting revenues in the first

quarter. Our operating results are reflective of strong market

conditions and good price realization required to offset the

increased cost of zinc. We are very pleased that the markets have

been strong enough to absorb this level of price increases. The

reduced volatility of zinc has not required us to significantly

adjust our pricing levels from the third and fourth quarter of last

year." Mr. Dingus concluded, "Cost escalation recovery through

pricing actions, expansion of domestic and international markets,

and seeking out new product opportunities to further enhance our

strategic position continue to be the focus and emphasis of our

activities. Based upon the evaluation of information currently

available to management, we are increasing our estimate of FY2008

earnings to be within the range of $1.65 to $1.75 per diluted share

and revenues to be within the range of $310 million to $320

million." AZZ incorporated will conduct a conference call to

discuss financial results for the first quarter of fiscal year 2008

at 11:00 A.M. ET on Friday, June 29, 2007. Interested parties can

access the conference call by dialing (877) 356-5706 or (706)

643-0580 (international). The call will be web cast via the

Internet at http://www.azz.com/AZZinvest.htm. A replay of the call

will be available for three days at (800) 642-1687 or (706)

645-9291 (international), confirmation #9773188, or for 30 days at

http://www.azz.com/AZZinvest.htm. AZZ incorporated is a specialty

electrical equipment manufacturer serving the global markets of

power generation, transmission and distribution and industrial, as

well as a leading provider of hot dip galvanizing services to the

steel fabrication market nationwide. Except for the statements of

historical fact, this release may contain forward-looking

statements that involve risks and uncertainties some of which are

detailed from time to time in documents filed by the Company with

the SEC. Those risks and uncertainties include, but are not limited

to: changes in customer demand and response to products and

services offered by the company, including demand by the electrical

power generation markets, electrical transmission and distribution

markets, the industrial markets, and the hot dip galvanizing

markets; prices and raw material cost, including zinc and natural

gas which are used in the hot dip galvanizing process; changes in

the economic conditions of the various markets the Company serves,

foreign and domestic, customer request delays of shipments,

acquisition opportunities, adequacy of financing, and availability

of experienced management employees to implement the Company's

growth strategy. The Company can give no assurance that such

forward-looking statements will prove to be correct. We undertake

no obligation to affirm, publicly update or revise any

forward-looking statements, whether as a result of information,

future events or otherwise. Contact: Dana Perry, Senior Vice

President - Finance and CFO AZZ incorporated 817-810-0095 Internet:

http://www.azz.com/ Lytham Partners 602-889-9700 Joe Dorame, Joe

Diaz or Robert Blum Internet: http://www.lythampartners.com/ AZZ

incorporated Condensed Consolidated Statement of Income (in

thousands except per share amounts) Three Months Ended May 31, 2007

May 31, 2006 (unaudited) (unaudited) Net sales $75,377 $52,453

Costs and Expenses: Cost of Sales 56,208 38,708 Selling, General

and Administrative 12,004 7,277 Interest Expense 535 388 Net (Gain)

Loss on Sales or Insurance Settlement of Property, Plant and

Equipment 3 (443) Other (Income) (194) (189) Other Expense - -

$68,556 $45,741 Income before income taxes and accounting change

$6,821 $6,712 Income Tax Expense 2,675 2,501 Income Before

Cumulative Effect of Changes in Accounting Principles 4,146 4,211

Cumulative Effect of Changes in Accounting Principles (Net of Tax)

- 85 Net income $4,146 $4,126 Net income per share Basic $0.35

$0.36 Diluted $0.34 $0.35 Diluted average shares outstanding 12,025

11,669 Segment Reporting (in thousands) Three Months Ended May 31,

2007 2006 (unaudited) (unaudited) Net Sales: Electrical and

Industrial Products $40,874 $31,506 Galvanizing Services 34,503

20,947 $75,377 $52,453 Segment Operating Income (a): Electrical and

Industrial Products $6,344 $4,080 Galvanizing Services 8,611 6,505

Total Segment Operating Income $14,955 $10,585 Condensed

Consolidated Balance Sheet (in thousands) May 31, 2007 February 28,

2007 (unaudited) (audited) Assets: Current assets $109,885 $111,967

Net property, plant and equipment $ 47,412 $ 46,628 Other assets,

net $ 42,290 $ 42,313 Total assets $199,587 $200,908 Liabilities

and shareholders' equity: Current liabilities $ 46,844 $ 49,715

Long term debt due after one year $ 27,700 $ 35,200 Other

liabilities $ 4,446 $ 4,845 Shareholders' equity $120,567 $111,148

Total liabilities and shareholders' equity $199,587 $200,908

Condensed Consolidated Statement of Cash Flows (in thousands) Three

Months Ended May 31, 2007 May 31, 2006 (unaudited) (unaudited) Net

cash provided by (used in) operating activities $ 7,668 $ 4,017 Net

cash provided by (used in) investing activities ($ 2,684) ($ 1,574)

Net cash provided by (used in) financing activities ($ 2,610) ($

1,115) Net increase (decrease) in cash and cash equivalents $ 2,374

$ 1,328 Cash and cash equivalents at beginning of period $ 1,703 $

1,259 Cash and cash equivalents at end of period $ 4,077 $ 2,587

DATASOURCE: AZZ incorporated CONTACT: Dana Perry, Senior Vice

President - Finance and CFO of AZZ incorporated, +1-817-810-0095;

or Joe Dorame or Joe Diaz or Robert Blum, all of Lytham Partners,

+1-602-889-9700, for AZZ incorporated Web site: http://www.azz.com/

Copyright

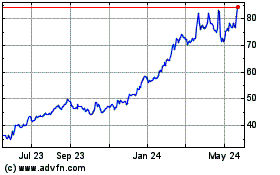

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jul 2023 to Jul 2024