AZZ incorporated Issues Revenue and Earnings Guidance for Fiscal - Year 2010

16 January 2009 - 9:00PM

PR Newswire (US)

FORT WORTH, Texas, Jan. 16 /PRNewswire-FirstCall/ -- AZZ

incorporated (NYSE:AZZ), a manufacturer of electrical products and

a provider of galvanizing services today announced revenue and

earnings guidance for Fiscal Year 2010. Fiscal Year 2010 refers to

the 12 month period beginning March 1, 2009 and ending on February

28, 2010. David H. Dingus, president and chief executive officer of

the company stated, "Based upon the evaluation of information

currently available to management, we are pleased to project what

we believe will be another excellent year for AZZ in Fiscal 2010,

the second strongest in our history, and also the 23rd consecutive

year of profitability. Our earnings are estimated to be within the

range of $2.75 and $2.95 per diluted share, and revenues are

estimated to be within the range of $420 to $440 million. We

continue to build upon the success we have been able to achieve,

and continually strive to enhance the performance of the Company.

The growth that we are projecting in our Electrical and Industrial

Products Segment will not fully offset the reduction that is

projected in our Galvanizing Services business. The growth in the

Electrical and Industrial Products Segment should approximate 9

percent, and the reduction in galvanizing will approximate 9

percent. The decrease in revenues for the Galvanizing Services

Segment will be the result of lower pricing brought about from

softer demand associated with economic conditions. Our estimates

assume that we will see a continuation of strong domestic and

international demand for our products and services. It is

anticipated that 59 percent of our revenues will be derived from

the Electrical and Industrial Products Segment and 41 percent from

Galvanizing Services Segment. Margins for both Segments are

projected to remain very strong, and should be in the range of 16.5

to 17.5 percent for the Electrical and Industrial Products Segment

and 22 to 23 percent in the Galvanizing Services Segment. Further

information is provided in our Form 8-K filing on January 16,

2009." Mr. Dingus continued, "Our next, regularly scheduled

quarterly conference call is in April 2009, where we will be

reporting the operating results for the fourth quarter and 2009

fiscal year. We are encouraged with the excellent growth and

expansion of the company both in revenues and in earnings over the

past few years and are continuing our efforts to seek out

additional growth and expansion opportunities. The strength of our

balance sheet fully supports this strategy." AZZ incorporated is a

specialty electrical equipment manufacturer serving the global

markets of industrial, power generation, transmission and

distributions, as well as a leading provider of hot dip galvanizing

services to the steel fabrication market nationwide. Except for the

statements of historical fact, this release may contain

forward-looking statements that involve risks and uncertainties

some of which are detailed from time to time in documents filed by

the company with the SEC. Those risks and uncertainties include,

but are not limited to: changes in customer demand and response to

products and services offered by the company, including demand by

the electrical power generation markets, electrical transmission

and distribution markets, the industrial markets, and the hot dip

galvanizing markets; prices and raw material costs, including zinc

and natural gas which are used in the hot dip galvanizing process

and steel, aluminum and copper which are used in the electrical and

industrial segment; changes in the economic conditions of the

various markets the company serves, foreign and domestic, customer

requested delays of shipments, acquisition opportunities, adequacy

of financing, currency fluctuations, and availability of

experienced management employees to implement the company's growth

strategy. The company can give no assurance that such

forward-looking statements will prove to be correct. We undertake

no obligation to affirm, publicly update or revise any

forward-looking statements, whether as a result of information,

future events or otherwise. Contact: Dana Perry, Senior Vice

President - Finance and CFO AZZ incorporated 817-810-0095 Internet:

http://www.azz.com/ Lytham Partners 602-889-9700 Joe Dorame or

Robert Blum Internet: http://www.lythampartners.com/ DATASOURCE:

AZZ incorporated CONTACT: Dana Perry, Senior Vice President -

Finance and CFO of AZZ incorporated, +1-817-810-0095; or Joe Dorame

or Robert Blum, both of Lytham Partners, +1-602-889-9700, for AZZ

incorporated Web Site: http://www.azz.com/

http://www.lythampartners.com/

Copyright

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

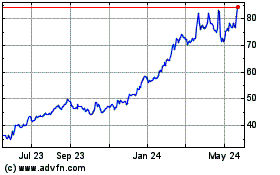

AZZ (NYSE:AZZ)

Historical Stock Chart

From Jul 2023 to Jul 2024