Maker of Jack Daniel's Grapples With Tariffs -- WSJ

30 August 2018 - 5:02PM

Dow Jones News

By Jennifer Maloney

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 30, 2018).

The maker of Jack Daniel's is feeling the sting of U.S. trade

disputes and retaliatory tariffs on American whiskeys.

Brown-Forman Corp., whose brands include Old Forester and

Woodford Reserve bourbon, warned that profits for its current

fiscal year would miss its prior forecasts because of the

uncertainty and added costs created by recently enacted European

tariffs.

The European Union in June started imposing 25% tariffs on U.S.

whiskey, Harley motorcycles and other goods in response to

President Trump's duties on steel and aluminum imports from the

bloc. In July, Harley-Davidson Inc. lowered its profit guidance,

and said it would shift production overseas to escape EU tariffs,

drawing the ire of Mr. Trump.

Brown-Forman executives said Wednesday they were delaying price

increases in some EU markets to minimize the impact on its

products. "In some ways we are buying time to see if these things

can be worked out," Chief Executive Paul Varga said, noting that

Scotch whisky posed a competitive threat in Europe.

The executives said the delayed price increases coupled with

higher costs and foreign-exchange fluctuations would erase 10 cents

a share in annual profits, or roughly $50 million. The company now

projects per-share earnings of $1.65 to $1.75 for fiscal 2019.

The threat of tariffs actually boosted results for the

Louisville, Ky., company in its July 31-ended fiscal first quarter,

driving a sales spike in Europe as wholesalers and retailers

stocked up ahead of the added levies.

Sales rose 6% overall in the quarter to $766 million, as strong

gains in international markets offset flat sales in the U.S.

Executives said half of a 12% sales gain in developed markets

overseas was the result of buying to build inventories ahead of

tariffs. Quarterly profit rose 12% to $200 million, or 41 cents a

share.

Class B shares of Brown-Forman were little changed in Wednesday

trading, gaining 9 cents to $52.41. The stock has climbed about 25%

in the past year.

On Wednesday, French spirits rival Pernod Ricard SA said pricing

conditions improved in its just-completed fiscal year, but

cautioned that it faced higher commodities prices for agave used in

tequila and grapes used in cognac. The maker of Jameson Irish

whiskey and Absolut vodka said profit for the fiscal year ended

June 30 rose 13% to EUR1.58 billion ($1.85 billion) on flat sales

of EUR8.99 billion. Excluding currency effects, sales rose 6% from

a year earlier, the company said.

Write to Jennifer Maloney at jennifer.maloney@wsj.com

(END) Dow Jones Newswires

August 30, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

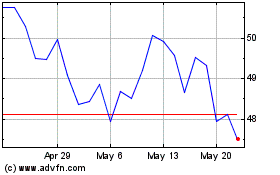

Brown Forman (NYSE:BF.A)

Historical Stock Chart

From Oct 2024 to Nov 2024

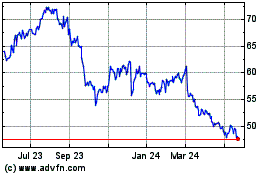

Brown Forman (NYSE:BF.A)

Historical Stock Chart

From Nov 2023 to Nov 2024