BGSF, Inc. (NYSE: BGSF), a growing provider of consulting,

managed services, and professional workforce solutions, today

reported financial results for the second fiscal quarter ended June

30, 2024.

Q2 2024 Sequential Comparison to Q1 2024:

- Revenues were $68.1 million for Q2, compared to $68.8 million

for Q1.

- Property Management segment revenues increased 4.8% from Q1,

mainly due to normal seasonal fluctuations.

- Professional segment revenues declined 4.1% from Q1, with

project completions outpacing the timing of new engagement

starts.

- Gross profit was $23.6 million, up from $23.4 million in Q1,

primarily due to higher sales in Property Management.

- Net loss was $0.8 million, or $0.07 per diluted share for Q2

and Q1.

- Adjusted EBITDA1 was $2.6 million (3.8% of revenues) in Q2 from

$2.7 million (4.0% of revenues) in Q1.

- Adjusted EPS1 was $0.07 for Q2 compared with $0.07 for Q1.

SUMMARY OF FINANCIAL RESULTS

(dollars in thousands)

(unaudited)

For the Thirteen Week Periods

Ended

June 30, 2024

July 2, 2023

March 31, 2024

Revenue:

Property Management

$

25,726

$

31,071

$

24,547

Professional

42,411

49,729

44,218

Total

$

68,137

$

80,800

$

68,765

Gross profit / Gross profit

percentage:

Property Management

$

9,596

37

%

$

12,652

41

%

$

9,343

38

%

Professional

14,034

33

%

16,922

34

%

14,095

32

%

Total

$

23,630

35

%

$

29,574

37

%

$

23,438

34

%

Operating income

$

81

$

5,050

$

415

Net (loss) Income

$

(761

)

$

2,604

$

(792

)

Net (loss) income per diluted share

$

(0.07

)

$

0.24

$

(0.07

)

Non-GAAP Financial Measures:

Adjusted EBITDA1

$

2,603

$

7,500

$

2,741

Adjusted EBITDA Margin (% of revenue)1

3.8

%

9.3

%

4.0

%

Adjusted EPS1

$

0.07

$

0.37

$

0.07

1

Adjusted EBITDA and Adjusted EPS are

non-GAAP financial measures as defined and reconciled below.

Beth A. Garvey, Chair, President, and CEO, said, “Despite weak

revenue and operating trends during the second quarter, we believe

that recent project wins will begin generating additional revenue

in the second half of 2024. In the first half of the year, we

reduced headcount and lowered fixed costs to align with both our

revenues and our strategic growth plans.

“Our territory mapping strategy, which derived out of our

Salesforce platform, in Property Management is showing early

positive results between the first and second quarters, and we are

confident in our strategy to deploy in additional markets in the

coming months. Although the Professional segment has experienced a

slowdown in customer spending due to macroeconomic headwinds and

sustained higher interest rates, we are seeing significant growth

in our managed services and consulting engagements. Notably, during

the second quarter, new contract wins outpaced contract ends by

approximately 25%. We won one of the most significant single

projects in our company’s history—a major IT transformation project

for a large international client, which will start contributing to

our financials in the third quarter.

“While our first-half results do not fully capture the momentum

from these recent business wins, we anticipate a strong revenue

ramp-up in the Professional division starting in the third quarter

and continuing into the fourth. Additionally, we are seeing an

increase in our permanent placement activity in our finance &

accounting services, with recent double-digit growth, which we

believe is a positive sign for the future.

“We are cautiously optimistic about what the second half of 2024

will bring.

“Regarding the review of strategic alternatives that we

announced in May, the Board and I continue to evaluate options to

maximize shareholder value. While there is no update at this time,

the process is ongoing, and we look forward to sharing the results

in the future. I want to extend my gratitude to all our

stakeholders—employees, clients, partners, and investors—for their

continued support and belief in our vision at BGSF.

“Lastly, I am pleased to announce that we have been recognized

in Staffing Industry Analysts' 2024 U.S. rankings, placing us in

the top 50 for U.S. IT staffing firms and the top 100 for overall

U.S. staffing firms. We remain committed to delivering value and

excellence to our customers and strategic partners.” concluded

Garvey.

Conference Call

BGSF will discuss its second quarter 2024 financial results

during a conference call and webcast at 9:00 a.m. ET on August 8,

2024. Interested participants may dial 1-844-481-3017 (Toll Free)

or 1-412-317-1882 (International). A replay of the call will be

available until August 15, 2024. To access the replay, please dial

1-877-344-7529 (Toll Free), or 1-412-317-0088 (International) and

enter access code 4959867. The live webcast and archived replay are

accessible from the investor relations section of the Company’s

website at

https://investor.bgsf.com/events-and-presentations/default.aspx

About BGSF

BGSF provides consulting, managed services and professional

workforce solutions to a variety of industries through its various

divisions in IT, Finance & Accounting, Managed Solutions, and

Property Management. BGSF has integrated several regional and

national brands achieving scalable growth. The Company was ranked

by Staffing Industry Analysts as the 97th largest U.S. staffing

company and the 49th largest IT staffing firm in 2024. The

Company’s disciplined acquisition philosophy, which builds value

through both financial growth and the retention of unique and

dedicated talent within BGSF’s family of companies, has resulted in

a seasoned management team with strong tenure and the ability to

offer exceptional service to our field talent and client partners

while building value for investors. For more information on the

Company and its services, please visit its website at

www.bgsf.com.

Forward-Looking Statements

The forward-looking statements in this press release are made

under the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements may

include, but are not limited to, statements regarding our future

financial performance and the expectations and objectives of our

board or management. The Company’s actual results could differ

materially from those indicated by the forward-looking statements

because of various other risks and uncertainties, including, among

other things, risks relating to volatility and uncertainty in the

capital markets, availability of suitable third parties with which

to conduct any strategic transaction, whether the Company will be

able to pursue a strategic transaction, or whether any such

transaction, if pursued, will be completed successfully and on

attractive terms, or at all, the risks associated with undertaking

a review of strategic alternatives, including in respect of

relationships with stockholders, employees, customers, and

suppliers, as well as risks and uncertainties listed in Item 1A of

the Company’s Annual Report on Form 10-K and in the Company’s other

filings and reports with the Securities and Exchange Commission.

All of the risks and uncertainties are beyond the ability of the

Company to control, and in many cases, the Company cannot predict

the risks and uncertainties that could cause its actual results to

differ materially from those indicated by the forward-looking

statements. When used in this press release, the words “allows,”

“anticipates,” “believes,” “plans,” “expects,” “estimates,”

“should,” “would,” “may,” “might,” “forward,” “will,” “intends,”

“continue,” “outlook,” “temporarily,” “progressing,” "prospects,"

and “anticipates” and similar expressions as they relate to the

Company or its management are intended to identify forward-looking

statements. Except as required by law, the Company is not obligated

to publicly release any revisions to these forward-looking

statements to reflect the events or circumstances after the date of

this press release or to reflect the occurrence of unanticipated

events.

Source: BGSF, Inc.

UNAUDITED CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

amounts)

June 30, 2024

December 31, 2023

ASSETS

Current assets

Cash and cash equivalents

$

226

$

—

Accounts receivable (net of allowance for

credit losses of $674 and $554, respectively)

46,430

56,776

Prepaid expenses

2,870

2,963

Other current assets

3,416

7,172

Total current assets

52,942

66,911

Property and equipment, net

1,284

1,217

Other assets

Deposits

2,093

2,699

Software as a service, net

4,750

5,026

Deferred income taxes, net

7,398

7,271

Right-of-use asset - operating leases,

net

4,481

5,435

Intangible assets, net

27,655

30,370

Goodwill

59,151

59,588

Total other assets

105,528

110,389

Total assets

$

159,754

$

178,517

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities

Accounts payable

$

254

$

95

Accrued payroll and expenses

14,004

14,902

Line of credit (net of debt issuance costs

of $128)

—

24,746

Long-term debt, current portion (net of

debt issuance costs of $29 and $0, respectively)

3,371

34,000

Accrued interest

220

438

Income taxes payable

165

282

Contingent consideration, current

portion

—

4,208

Convertible note

4,368

4,368

Other current liabilities

2,116

—

Lease liabilities, current portion

1,719

2,016

Total current liabilities

26,217

85,055

Line of credit (net of debt issuance costs

of $318)

13,748

—

Long-term debt, less current portion (net

of debt issuance costs of $236)

29,514

—

Contingent consideration, less current

portion

3,981

4,112

Lease liabilities, less current

portion

3,133

3,814

Total liabilities

76,593

92,981

Commitments and contingencies

Preferred stock, $0.01 par value per

share, 500,000 shares authorized, -0- shares issued and

outstanding

—

—

Common stock, $0.01 par value per share;

19,500,000 shares authorized 10,956,137 and 10,887,509 shares

issued and outstanding, respectively, net of 3,930 shares of

treasury stock, at cost, respectively.

53

52

Additional paid in capital

69,367

68,551

Retained earnings

13,741

16,933

Total stockholders’ equity

83,161

85,536

Total liabilities and stockholders’

equity

$

159,754

$

178,517

UNAUDITED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per share

and dividend amounts)

For the Thirteen and Twenty-six

Week Periods Ended June 30, 2024 and July 2, 2023

Thirteen Weeks Ended

Twenty-six Weeks Ended

2024

2023

2024

2023

Revenues

$

68,137

$

80,800

$

136,903

$

156,116

Cost of services

44,507

51,226

89,835

99,758

Gross profit

23,630

29,574

47,068

56,358

Selling, general and administrative

expenses

21,568

22,584

42,583

45,796

Impairment losses

—

—

—

22,545

Depreciation and amortization

1,981

1,940

3,988

3,696

Operating income (loss)

81

5,050

497

(15,679

)

Interest expense, net

(1,061

)

(1,502

)

(2,297

)

(2,703

)

(Loss) income before income taxes

(980

)

3,548

(1,800

)

(18,382

)

Income tax benefit (expense)

219

(944

)

247

4,520

Net (loss) income

$

(761

)

$

2,604

$

(1,553

)

$

(13,862

)

Net (loss) income per share:

Basic

$

(0.07

)

$

0.24

$

(0.14

)

$

(1.29

)

Diluted

$

(0.07

)

$

0.24

$

(0.14

)

$

(1.29

)

Weighted-average shares outstanding:

Basic

10,880

10,759

10,858

10,731

Diluted

10,880

10,770

10,858

10,731

Cash dividends declared per common

share

$

—

$

0.15

$

0.15

$

0.30

BUSINESS SEGMENTS

(dollars in thousands)

(unaudited)

Thirteen Weeks Ended

Twenty-six Weeks Ended

June 30, 2024

July 2, 2023

June 30, 2024

July 2, 2023

Revenue:

Property Management

$

25,726

38

%

$

31,071

38

%

$

50,273

37

%

$

59,477

38

%

Professional

42,411

62

49,729

62

86,630

63

96,639

62

Total

$

68,137

100

%

$

80,800

100

%

$

136,903

100

%

$

156,116

100

%

Gross profit:

Property Management

9,596

41

%

$

12,652

43

%

$

18,939

40

%

$

23,999

43

%

Professional

14,034

59

16,922

57

28,129

60

32,359

57

Total

$

23,630

100

%

$

29,574

100

%

$

47,068

100

%

$

56,358

100

%

Operating income (loss):

Property Management

$

3,203

$

5,774

$

6,605

$

10,464

Professional -without impairment

losses

1,556

3,786

3,230

6,413

Professional - impairment losses

—

—

—

(22,545

)

Home office

(4,678

)

(4,510

)

(9,338

)

(10,011

)

Total

$

81

$

5,050

$

497

$

(15,679

)

UNAUDITED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

For the Twenty-six Week Periods

Ended June 30, 2024 and July 2, 2023

2024

2023

Cash flows from operating activities

Net loss

$

(1,553

)

$

(13,862

)

Adjustments to reconcile net loss to net

cash provided by activities:

Depreciation

184

238

Amortization

3,804

3,458

Impairment losses

—

22,545

Loss on disposal of property and

equipment

9

—

Amortization of debt issuance costs

89

92

Interest expense on contingent

consideration payable

(90

)

202

Provision for credit losses

1,116

321

Share-based compensation

471

436

Deferred income taxes, net of acquired

deferred tax liability

(127

)

(5,287

)

Net changes in operating assets and

liabilities, net of effects of acquisitions:

Accounts receivable

9,230

7,672

Prepaid expenses

93

(93

)

Other current assets

1,597

2,572

Deposits

607

(9

)

Software as a service

358

362

Accounts payable

160

(1,515

)

Accrued payroll and expenses

(219

)

(5,033

)

Accrued interest

(218

)

264

Income taxes receivable and payable

(771

)

274

Operating leases

(23

)

(88

)

Net cash provided by operating

activities

14,717

12,549

Cash flows from investing activities

Businesses acquired, net of cash

received

—

(6,740

)

Capital expenditures

(995

)

(1,490

)

Net cash used in investing activities

(995

)

(8,230

)

Cash flows from financing activities

Net (payments) borrowings under line of

credit

(10,808

)

2,438

Principal payments on long-term debt

(850

)

(2,000

)

Payments of dividends

(1,639

)

(3,244

)

Issuance of ESPP shares

244

292

Issuance of shares under the 2013

Long-Term Incentive Plan, net of exercises

102

30

Contingent consideration paid

—

(1,110

)

Debt issuance costs

(545

)

(65

)

Net cash used in financing activities

(13,496

)

(3,659

)

Net change in cash and cash

equivalents

226

660

Cash and cash equivalents, beginning of

period

—

—

Cash and cash equivalents, end of

period

$

226

$

660

Supplemental cash flow information:

Cash paid for interest, net

$

2,417

$

2,036

Cash paid for taxes, net of refunds

$

636

$

484

NON-GAAP FINANCIAL MEASURES

The financial results of BGSF, Inc. are prepared in conformity

with accounting principles generally accepted in the United States

of America (“GAAP”) and the rules of the U.S. Securities and

Exchange Commission. To help the readers understand the Company's

financial performance, the Company supplements its GAAP financial

results with Adjusted EBITDA and Adjusted EPS.

A non-GAAP financial measure is a numerical measure of a

company's financial performance that excludes or includes amounts

so as to be different than the most directly comparable measure

calculated and presented in accordance with GAAP in the statement

of income, balance sheet or statement of cash flows of a company.

Adjusted EBITDA and Adjusted EPS are not measurements of financial

performance under GAAP and should not be considered as alternatives

to net income, net income per diluted share, operating income, or

any other performance measure derived in accordance with GAAP, or

as alternatives to cash flow from operating activities or measures

of our liquidity. We believe that Adjusted EBITDA and Adjusted EPS

are useful performance measures and are used by us to facilitate a

comparison of our operating performance on a consistent basis from

period-to-period and to provide for a more complete understanding

of factors and trends affecting our business than measures under

GAAP can provide alone. In addition, the financial covenants in our

credit agreement are based on EBITDA as defined in the credit

agreement.

We define “Adjusted EBITDA" as earnings before interest expense,

income taxes, depreciation and amortization expense, costs

associated with the evaluation of potential strategic alternatives

(“Strategic alternatives review”), transaction fees, and certain

non-cash expenses such as impairment losses and share-based

compensation expense, as well as certain specific events that

management does not consider in assessing our on-going operating

performance.

We define “Adjusted EPS” as diluted earnings per share

eliminating amortization expense of intangible assets from

acquisitions, the Strategic Alternatives Review, transaction fees,

and certain non-cash expenses such as impairment losses, as well as

certain specific events that management does not consider in

assessing our on-going operating performance, net of the respective

income tax effect.

Reconciliation of Net (Loss)

Income to Adjusted EBITDA

(dollars in thousands)

Thirteen Weeks Ended

Twenty-six Weeks Ended

Thirteen Weeks Ended

June 30, 2024

July 2, 2023

June 30, 2024

July 2, 2023

March 31, 2024

Net (loss) income

$

(761

)

$

2,604

$

(1,553

)

$

(13,862

)

$

(792

)

Income tax (benefit) expense

(219

)

944

(247

)

(4,520

)

(28

)

Interest expense, net

1,061

1,502

2,297

2,703

1,235

Operating income (loss)

81

5,050

497

(15,679

)

415

Depreciation and amortization

1,981

1,940

3,988

3,696

2,007

Impairment losses

—

—

—

22,545

—

Share-based compensation

236

75

471

436

235

Strategic alternatives review

280

—

348

—

68

Transaction fees

25

435

40

753

16

Adjusted EBITDA

$

2,603

$

7,500

$

5,344

$

11,751

$

2,741

Adjusted EBITDA Margin

(% of revenue)

3.8

%

9.3

%

3.9

%

7.5

%

4.0

%

Reconciliation of Net (Loss)

Income EPS to Adjusted EPS

Thirteen Weeks Ended

Twenty-six Weeks Ended

Thirteen Weeks Ended

June 30, 2024

July 2, 2023

June 30, 2024

July 2, 2023

March 31, 2024

Net (loss) income per diluted share

$

(0.07

)

$

0.24

$

(0.14

)

$

(1.29

)

$

(0.07

)

Acquisition amortization

0.15

0.14

0.29

0.27

0.15

Impairment losses (pre-tax)

—

—

—

2.10

—

Strategic alternatives review

0.03

—

0.03

—

0.01

Transaction fees

—

0.04

—

0.07

—

Income tax expense adjustment

(0.04

)

(0.05

)

(0.04

)

(0.60

)

(0.02

)

Adjusted EPS

$

0.07

$

0.37

$

0.14

$

0.55

$

0.07

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807354173/en/

Steven Hooser or Sandy Martin Three Part Advisors

ir@bgstaffing.com 214.872.2710 or 214.616.2207

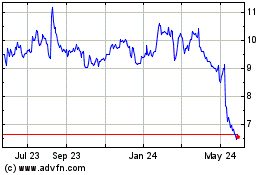

BGSF (NYSE:BGSF)

Historical Stock Chart

From Jan 2025 to Feb 2025

BGSF (NYSE:BGSF)

Historical Stock Chart

From Feb 2024 to Feb 2025