0001725057trueFY00017250572022-06-3000017250572023-02-2000017250572022-01-012022-12-31xbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-38467

Ceridian HCM Holding Inc.

(Exact name of Registrant as specified in its Charter)

|

|

Delaware |

46-3231686 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer

Identification No.) |

3311 East Old Shakopee Road

Minneapolis, Minnesota 55425

(952) 853-8100

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $.01 par value |

|

CDAY |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☐ |

|

Small reporting company |

|

☐ |

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the $47.08 closing price of the shares of common stock on the New York Stock Exchange on June 30, 2022, was $7,084.4 million.

The number of shares of Registrant’s Common Stock outstanding as of February 20, 2023 was 154,106,560.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement relating to the 2023 Annual Meeting of Stockholders, scheduled to be held on April 28, 2023, are incorporated by reference into Part III of this Form 10-K/A.

1 |  2022 Form 10-K/A

2022 Form 10-K/A

Explanatory Note

Ceridian HCM Holding Inc. (the “Company”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment” or “Form 10-K/A”) to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 1, 2023 (the “Original Form 10-K”) to make certain changes as described below.

Background

As previously disclosed in the Company’s earnings press release furnished as an exhibit to the Current Report on Form 8-K furnished with the SEC on November 1, 2023, the Company recently discovered an error in the presentation of one Canadian bank account balance within “customer funds” and “customer funds obligations” and related items on the Company’s consolidated balance sheets as of December 31, 2022 and 2021 and in the Company’s net cash provided by financing activities within its consolidated statements of cash flows in the three-year period ended December 31, 2022. There was an understatement of customer funds within current assets and a corresponding understatement of customer funds obligations within current liabilities on the Company’s consolidated balance sheets. As a result, the Company also erroneously presented certain changes related to customer funds and customer funds obligations on the Company’s consolidated statements of cash flows.

However, the Company determined that the incorrect presentation did not result in a material misstatement of the Company’s financial statements and, accordingly, it does not need to restate its previously issued financial statements contained in the Original Form 10-K or in the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023 and June 30, 2023.

Considering the foregoing, management reassessed the effectiveness of the Company’s internal control over financial reporting (“ICFR”) as of December 31, 2022, based on the framework established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. As a result of that reassessment, management identified a material weakness in its ICFR as the Company has determined that its control designed to assess the proper presentation of cash and cash equivalents for its Canada customer funds for financial reporting purposes was ineffective (“Canada Trust Material Weakness”).

With regard to the Canada Trust Material Weakness, the Company has implemented an additional control and training to ensure proper classification and presentation of cash and cash equivalents for its Canada customer funds. The Company expects the Canada Trust Material Weakness will be fully remediated before December 31, 2023, but remediation will not be considered complete until the applicable controls operate for a sufficient period of time subsequent to the additional training to enable management to test and to conclude on the operating effectiveness of the control.

Further, while reassessing the effectiveness of the Company’s ICFR, management identified, in the aggregate, a material weakness related to controls over certain Professional Services and Powerpay revenue accounts as of December 31, 2022 (the "Risk Assessment Material Weakness"). The Company has enhanced its risk assessment process and information technology general controls to prevent misstatements in Professional Services revenue accounts. The Company also expects to implement additional controls to prevent misstatements in Powerpay revenue accounts. The Company expects the Risk Assessment Material Weakness will be fully remediated before December 31, 2023, but remediation will not be considered complete until the applicable controls operate for a sufficient period of time to enable management to test and to conclude on the operating effectiveness of the controls.

In light of the Canada Trust Material Weakness and the Risk Assessment Material Weakness, which continue to exist as of December 31, 2022, the Company has performed additional analyses and other procedures to enable management to conclude that the existence of the material weaknesses did not result in a material misstatement of the Company’s previously issued financial statements.

As a result of the Canada Trust Material Weakness and the Risk Assessment Material Weakness, the Company concluded that its disclosure controls and procedures and ICFR were ineffective as of December 31, 2022. As a result, the Company is (a) amending and restating Part II, Item 9A Controls and Procedures in this Form 10-K/A to update its conclusions regarding the effectiveness of its disclosure controls and procedures and its internal control over financial reporting as of December 31, 2022 as a result of the material weaknesses and (b) including in Part II, Item 8, the issued audit report of KPMG LLP (“KPMG”), the Company’s independent registered public accounting firm (Auditor Firm ID: 185), as of December 31, 2022 regarding the Company’s internal control over financial reporting as a result of the material weaknesses.

1 |  2022 Form 10-K/A

2022 Form 10-K/A

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company is also including with this Form 10-K/A currently dated consent of KPMG and certifications of the Company’s principal executive officer and principal financial officer (included in Part IV, Item 15. “Exhibits, Financial Statement Schedules” and attached as Exhibits 23.1, 31.1, 31.2, 32.1, and 32.2). This Form 10-K/A should be read in conjunction with the Original Form 10-K, which continues to speak as of the date of the Original Form 10-K. Except as specifically noted above, this Form 10-K/A does not modify or update disclosures in the Original Form 10-K. Accordingly, this Form 10-K/A does not reflect events occurring after the date of the Original Form 10-K or modify or update any related or other disclosures, other than those discussed above. No other portions of the Original Form 10-K were changed.

Amendments of 2023 Quarterly Reports on Form 10-Q

In addition to this Form 10-K/A, the Company is concurrently filing amendments to its Quarterly Reports on Form 10-Q for the periods ended March 31, 2023 and June 30, 2023.

2 |  2022 Form 10-K/A

2022 Form 10-K/A

PART II

Item 8. Financial Statements and Supplementary Data.

In light of the material weaknesses described above and below, our independent registered public accounting firm has amended their audit report on the effectiveness of our internal control over financial reporting, which is included below.

3 |  2022 Form 10-K/A

2022 Form 10-K/A

Report of Independent Registered Public Accounting Firm

To the Stockholders and Board of Directors

Ceridian HCM Holding Inc.:

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated balance sheets of Ceridian HCM Holding Inc. and subsidiaries (the Company) as of December 31, 2022 and 2021, the related consolidated statements of operations, comprehensive income (loss), stockholders’ equity, and cash flows for each of the years in the three-year period ended December 31, 2022, and the related notes (collectively, the consolidated financial statements). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2021, and the results of its operations and its cash flows for each of the years in the three-year period ended December 31, 2022, in conformity with U.S. generally accepted accounting principles.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company’s internal control over financial reporting as of December 31, 2022, based on criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission, and our report dated March 1, 2023, except for the restatement as to the effectiveness of internal control over financial reporting for the material weaknesses related to cash and cash equivalents and obligations of Canada customer funds and certain revenue accounts, as to which the date is November 13, 2023, expressed an adverse opinion on the effectiveness of the Company's internal control over financial reporting.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the consolidated financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the consolidated financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

4 |  2022 Form 10-K/A

2022 Form 10-K/A

Customer funds and customer funds obligations

As discussed in Note 5 to the consolidated financial statements, in connection with the Company’s payroll and tax services, it (1) collects funds for payment of payroll and taxes, (2) temporarily holds such funds until payment is due, and (3) remits the funds to its customers’ employees and taxing authorities. The Company collects and manages large amounts of data and its applications are inherently complex. At December 31, 2022, customer funds and customer funds obligations were $4.2 billion and $4.3 billion, respectively.

We identified the evaluation of the sufficiency of audit evidence over customer funds and customer funds obligations as a critical audit matter. Specifically, complex auditor judgment was required to determine that the receipt and expenditure of funds used to develop the customer funds and customer funds obligations balances at December 31, 2022, reconciled to customers’ transaction data. This matter required the use of information technology (IT) professionals with specialized skills and knowledge.

The following are the primary procedures we performed to address this critical audit matter. We applied auditor judgment to determine the nature and extent of procedures to be performed to determine that the receipt and expenditure of funds used to develop the customer funds and customer funds obligations balances at December 31, 2022, reconciled to customers’ transaction data, including the extent of involvement of IT professionals. We evaluated the design and tested the operating effectiveness of certain internal controls related to the customer funds and customer funds obligations process. Specifically, we involved IT professionals with specialized skills and knowledge, who assisted in the identification and testing of general IT controls and process level IT risks and controls related to:

•receipt of customer transaction data

•the communication of that data to (1) banks for the purpose of receiving and expending customer funds, and to (2) the Company’s IT systems used to track customer funds and customer funds obligations.

We evaluated the customer funds and customer funds obligations by obtaining the amounts from the Company’s IT systems used to track customer funds and customer funds obligations, and comparing them to the general ledger, third-party bank statements or confirmations, and underlying documentation for reconciling items. We evaluated the sufficiency of audit evidence obtained by assessing the results of procedures performed, including the appropriateness of the nature and extent of such evidence.

Stand-alone selling price (SSP) of cloud Dayforce professional services

As discussed in Note 2 and Note 12 to the consolidated financial statements, the Company recognized $181.7 million of cloud Dayforce professional services and other revenue for the year ended December 31, 2022, and $68.5 million of contract assets as of December 31, 2022. Cloud Dayforce professional services includes implementation services to activate new accounts. The Company’s cloud services arrangements include multiple performance obligations and the transaction price allocation is based on the SSP for the performance obligations. The SSP for cloud Dayforce implementation services is estimated based on market conditions and observable inputs, including rates charged by third parties to perform implementation services, as well as an estimate of the hours expected to be incurred.

We identified the assessment of the Company’s estimated hours expected to be incurred that were used to determine the SSP of cloud Dayforce implementation services as a critical audit matter. Subjective auditor judgment was required to evaluate the professional services hours assumption that involved unobservable market data and was susceptible to manipulation.

5 |  2022 Form 10-K/A

2022 Form 10-K/A

The following are the primary procedures we performed to address this critical audit matter. We evaluated the design and tested the operating effectiveness of certain internal controls related to the Company’s estimated hours to be incurred that were used to determine the SSP of cloud Dayforce implementation services. To evaluate the Company’s retrospective review of its estimated implementation services hours, we compared the historical estimated implementation hours to actual implementation hours incurred for a selection of contracts. For a sample of contracts entered into during the year ended December 31, 2022:

•we obtained the Company's models for allocating the transaction price and compared certain inputs in those models to the project managers estimate of implementation service hours to be incurred and to the results of the Company's retrospective review of its estimated implementation service hours

•we inquired of the project manager regarding the estimation of the total hours to be incurred.

/s/ KPMG LLP

We have served as the Company’s auditor since 1958.e Company’s auditor since 1958.

Minneapolis, Minnesota

March 1, 2023, except for the restatement as to the effectiveness of internal control over financial reporting for the material weaknesses related to cash and cash equivalents and obligations of Canada customer funds and certain revenue accounts, as to which the date is November 13, 2023

6 |  2022 Form 10-K/A

2022 Form 10-K/A

Report of Independent Registered Public Accounting Firm

To the Stockholders and Board of Directors

Ceridian HCM Holding Inc.:

Opinion on Internal Control Over Financial Reporting

We have audited Ceridian HCM Holding Inc. and subsidiaries' (the Company) internal control over financial reporting as of December 31, 2022, based on criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. In our opinion, because of the effect of the material weaknesses, described below, on the achievement of the objectives of the control criteria, the Company has not maintained effective internal control over financial reporting as of December 31, 2022, based on criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated balance sheets of the Company as of December 31, 2022 and 2021, the related consolidated statements of operations, comprehensive income (loss), stockholders’ equity, and cash flows for each of the years in the three-year period ended December 31, 2022, and the related notes (collectively, the consolidated financial statements), and our report dated March 1, 2023, except for the restatement as to the effectiveness of internal control over financial reporting for the material weaknesses related to cash and cash equivalents and obligations of Canada customer funds and certain revenue accounts, as to which the date is November 13, 2023, expressed an unqualified opinion on those consolidated financial statements.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company's annual or interim financial statements will not be prevented or detected on a timely basis. The material weaknesses related to (1) a control that failed to operate effectively that was designed to assess the proper presentation of cash and cash equivalents and obligations for the Company's Canada customer funds, and (2) an ineffective risk assessment process to identify the risks of material misstatement and design and implement controls in certain Professional Services and Powerpay revenue accounts. The material weaknesses were considered in determining the nature, timing, and extent of audit tests applied in our audit of the 2022 consolidated financial statements, and this report does not affect our report on those consolidated financial statements.

Basis for Opinion

The Company's management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management's Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company's internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

7 |  2022 Form 10-K/A

2022 Form 10-K/A

Definition and Limitations of Internal Control Over Financial Reporting

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

/s/ KPMG LLP

Minneapolis, Minnesota

March 1, 2023, except for the restatement as to the effectiveness of internal control over financial reporting for the material weaknesses related to cash and cash equivalents and obligations of Canada customer funds and certain revenue accounts, as to which the date is November 13, 2023

8 |  2022 Form 10-K/A

2022 Form 10-K/A

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Management, under the supervision and with the participation of the Chief Executive Officer and Chief Financial Officer, have conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act). Disclosure controls and procedures are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to our management, including our principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that as of December 31, 2022, our disclosure controls and procedures were not effective due to the material weaknesses in internal control over financial reporting described below under the heading "Management's Report on Internal Control Over Financial Reporting (Restated)." We have in place and are executing a remediation plan to address the material weaknesses described below.

In light of the material weaknesses described below, management performed additional analyses and other procedures to ensure that our consolidated financial statements were prepared in accordance with U.S. Generally Accepted Accounting Principles ("U.S. GAAP"). Accordingly, management believes that the consolidated financial statements included in the Original Form 10-K fairly present, in all material respects, our financial position, results of operations, and cash flows as of and for the periods presented, in accordance with U.S. GAAP.

Management's Report on Internal Control over Financial Reporting (Restated)

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) under the Exchange Act). Management conducted an assessment of the effectiveness of our internal control over financial reporting based on the criteria set forth in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework). Based on the assessment, management has concluded that its internal control over financial reporting was not effective as of December 31, 2022 because of the material weaknesses in internal control over financial reporting described below.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

We identified a material weakness in our internal control over financial reporting as we have determined that our control was not operating effectively to assess the proper presentation of cash and cash equivalents for our Canada customer funds for financial reporting purposes, including the corresponding customer funds and customer funds obligations and related statements of cash flows presentation as of December 31, 2022. This material weakness was the result of the control operator not appropriately detecting and correcting the error, as a result of insufficient training.

Further, while reassessing the effectiveness of the Company’s internal control over financial reporting, management identified, in the aggregate, a material weakness related to controls over certain Professional Services and Powerpay revenue accounts as of December 31, 2022, resulting from an ineffective risk assessment process to properly design and implement controls over (1) certain process level activities related to Powerpay revenue, and (2) information technology access pertaining to a system implemented in September 2022 that adversely impacted the accuracy and completeness of information that is used to measure a component of its Professional Services revenue.

On March 1, 2021, we completed the acquisition of Ascender. Prior to this acquisition, Ascender was a privately-held company not subject to the Sarbanes-Oxley Act of 2002, the rules and regulations of the SEC, or other corporate governance requirements to which public companies may be subject. In accordance with guidance issued by the SEC, companies are permitted to exclude acquisitions from their final assessment of internal control over financial reporting during the year of acquisition. As of the end of fiscal 2022, we have completed our integration

9 |  2022 Form 10-K/A

2022 Form 10-K/A

activities related to internal control over financial reporting for Ascender. Accordingly, we have included Ascender within our assessment of internal control over financial reporting as of December 31, 2022.

Management’s Plan to Remediate the Identified Material Weaknesses

With regard to the Canada Trust Material Weakness, the Company has implemented an additional control and training to ensure proper classification and presentation of cash and cash equivalents for its Canada customer funds.

In addition, we have enhanced our revenue risk assessment process and information technology general controls to prevent misstatements in Professional Services revenue accounts. We will also implement additional controls to prevent misstatements in Powerpay revenue accounts. We anticipate that the two material weaknesses will be fully remediated before December 31, 2023, but the material weaknesses cannot be considered fully remediated until the improved controls have been in place and operate for a sufficient period of time to enable management to test and to conclude on the operating effectiveness of the controls. Our independent registered public accounting firm, KPMG LLP, who audited the consolidated financial statements included in the Original Form 10-K, issued an adverse opinion on the effectiveness of the Company’s internal control over financial reporting as of December 31, 2022, which appears in Part II, Item 8 of this Form 10-K/A.

Changes in Internal Control Over Financial Reporting

With the exception of internal control-related integration activities related to our acquisition of Ascender and the controls implemented in response to the material weaknesses identified above, there were no changes in our internal control over financial reporting identified in connection with the evaluation required by Rule 13a-15(d) and 15d-15(d) of the Exchange Act that occurred during the fiscal quarter ended December 31, 2022, that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Inherent Limitations on Effectiveness of Controls

Our management, including our Chief Executive Officer and Chief Financial Officer, believes that our disclosure controls and procedures and internal control over financial reporting are not designed to provide reasonable assurance of achieving their objectives and are not effective at the reasonable assurance level. Our management does not expect that our disclosure controls and procedures or our internal control over financial reporting will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. These inherent limitations include the realities that judgments in decision making can be faulty, and that breakdowns can occur because of a simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people or by management override of the controls. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions; over time, controls may become inadequate because of changes in conditions, or the degree of compliance with policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

10 |  2022 Form 10-K/A

2022 Form 10-K/A

PART IV

Item 15. Exhibits, Financial Statement Schedules.

Exhibits

The following is a list of exhibits filed as part of this Form 10-K/A.

^ Filed herewith.

# In accordance with Item 601(b)(32)(ii) of Regulation S-K and SEC Release Nos. 33-8238 and 34-47986, Final Rule: Management’s Reports on Internal Control Over Financial Reporting and Certification of Disclosure in Exchange Act Periodic Reports, the certifications furnished in Exhibits 32.1 and 32.2 hereto are deemed to accompany this Annual Report on Form 10-K/A and will not be deemed “filed” for purpose of Section 18 of the Exchange Act. Such certifications will not be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, except to the extent that the registrant specifically incorporates it by reference.

11 |  2022 Form 10-K/A

2022 Form 10-K/A

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

CERIDIAN HCM HOLDING INC. |

|

|

|

|

Date: November 13, 2023 |

|

By: |

/s/ David D. Ossip |

|

|

|

Name: David D. Ossip |

|

|

|

Title: Chief Executive Officer |

12 |  2022 Form 10-K/A

2022 Form 10-K/A

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the registration statements (No. 333-231639) on Form S-3 and (Nos. 333-224438, 333-228578, 333-231632, 333-248624, 333-255827, 333-266700) on Form S-8 of our report dated March 1, 2023, except for the restatement as to the effectiveness of internal control over financial reporting for the material weaknesses related to customer fund presentation matters and risk assessment related to certain revenue accounts, as to which the date is November 13, 2023, with respect to the consolidated financial statements of Ceridian HCM Holding Inc., and our report dated March 1, 2023, except for the restatement as to the effectiveness of internal control over financial reporting for the material weaknesses related to cash and cash equivalents and obligations of Canada customer funds and certain revenue accounts, as to which the date is November 13, 2023, with respect to the effectiveness of internal control over financial reporting.

/s/ KPMG LLP

Minneapolis, Minnesota

November 13, 2023

Exhibit 31.1

CERTIFICATION PURSUANT TO

RULES 13a-14(a) AND 15d-14(a) UNDER THE SECURITIES EXCHANGE ACT OF 1934,

AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, David D. Ossip, certify that:

1.I have reviewed this Annual Report on Form 10-K/A of Ceridian HCM Holding Inc. (the “registrant”) for the year ended December 31, 2022;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and

5.The registrant's other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions):

(a)All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and

(b)Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting.

|

|

|

|

Date: November 13, 2023 |

|

By: |

/s/ David D. Ossip |

|

|

|

David D. Ossip |

|

|

|

Chief Executive Officer |

Exhibit 31.2

CERTIFICATION PURSUANT TO

RULES 13a-14(a) AND 15d-14(a) UNDER THE SECURITIES EXCHANGE ACT OF 1934,

AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Noémie C. Heuland, certify that:

1.I have reviewed this Annual Report on Form 10-K/A of Ceridian HCM Holding Inc. (the “registrant”) for the year ended December 31, 2022;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and

5.The registrant's other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions):

(a)All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and

(b)Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting.

|

|

|

|

Date: November 13, 2023 |

|

By: |

/s/ Noémie C. Heuland |

|

|

|

Noémie C. Heuland |

|

|

|

Executive Vice President and Chief Financial Officer |

Exhibit 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Annual Report of Ceridian HCM Holding Inc. (the “Company”) on Form 10-K/A for the year ended December 31, 2022 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I certify, pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, that:

(1)The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2)The information contained in the Report fairly presents, in all material respects, the financial condition and result of operations of the Company.

|

|

|

|

Date: November 13, 2023 |

|

By: |

/s/ David D. Ossip |

|

|

|

David D. Ossip |

|

|

|

Chief Executive Officer |

This certification accompanies the Form 10-K/A to which it relates, is not deemed filed with the Securities and Exchange Commission and is not to be incorporated by reference into any filing of Ceridian HCM Holding Inc. under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (whether made before or after the date of the Form 10-K/A), irrespective of any general incorporation language contained in such filing.

Exhibit 32.2

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Annual Report of Ceridian HCM Holding Inc. (the “Company”) on Form 10-K/A for the year ended December 31, 2022 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), I certify, pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, that:

(1)The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2)The information contained in the Report fairly presents, in all material respects, the financial condition and result of operations of the Company.

|

|

|

|

Date: November 13, 2023 |

|

By: |

/s/ Noémie C. Heuland |

|

|

|

Noémie C. Heuland |

|

|

|

Executive Vice President and Chief Financial Officer |

v3.23.3

Document and Entity Information - USD ($)

$ in Millions |

12 Months Ended |

|

|

Dec. 31, 2022 |

Feb. 20, 2023 |

Jun. 30, 2022 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Amendment Flag |

true

|

|

|

| Document Period End Date |

Dec. 31, 2022

|

|

|

| Document Fiscal Year Focus |

2022

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Entity Registrant Name |

Ceridian HCM Holding Inc.

|

|

|

| Entity Central Index Key |

0001725057

|

|

|

| Current Fiscal Year End Date |

--12-31

|

|

|

| Entity Well-known Seasoned Issuer |

Yes

|

|

|

| Entity Current Reporting Status |

Yes

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity Filer Category |

Large Accelerated Filer

|

|

|

| Entity Small Business |

false

|

|

|

| Entity Emerging Growth Company |

false

|

|

|

| Document Financial Statement Error Correction [Flag] |

false

|

|

|

| Entity Shell Company |

false

|

|

|

| Entity Common Stock, Shares Outstanding |

|

154,106,560

|

|

| Entity Public Float |

|

|

$ 7,084.4

|

| Entity File Number |

001-38467

|

|

|

| Entity Tax Identification Number |

46-3231686

|

|

|

| Entity Address Address Line1 |

3311 East Old Shakopee Road

|

|

|

| Entity Address City Or Town |

Minneapolis

|

|

|

| Entity Address State Or Province |

MN

|

|

|

| Entity Address Postal Zip Code |

55425

|

|

|

| City Area Code |

952

|

|

|

| Local Phone Number |

853-8100

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Entity Incorporation State Country Code |

DE

|

|

|

| Document Annual Report |

true

|

|

|

| Document Transition Report |

false

|

|

|

| ICFR Auditor Attestation Flag |

true

|

|

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

|

|

| Trading Symbol |

CDAY

|

|

|

| Security Exchange Name |

NYSE

|

|

|

| Documents Incorporated by Reference |

Portions of the Registrant’s Definitive Proxy Statement relating to the 2023 Annual Meeting of Stockholders, scheduled to be held on April 28, 2023, are incorporated by reference into Part III of this Form 10-K/A.

|

|

|

| Auditor Name |

KPMG LLP

|

|

|

| Auditor Firm ID |

185

|

|

|

| Auditor Location |

Minneapolis, Minnesota

|

|

|

| Amendment Description |

Ceridian HCM Holding Inc. (the “Company”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment” or “Form 10-K/A”) to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 1, 2023 (the “Original Form 10-K”) to make certain changes as described below.BackgroundAs previously disclosed in the Company’s earnings press release furnished as an exhibit to the Current Report on Form 8-K furnished with the SEC on November 1, 2023, the Company recently discovered an error in the presentation of one Canadian bank account balance within “customer funds” and “customer funds obligations” and related items on the Company’s consolidated balance sheets as of December 31, 2022 and 2021 and in the Company’s net cash provided by financing activities within its consolidated statements of cash flows in the three-year period ended December 31, 2022. There was an understatement of customer funds within current assets and a corresponding understatement of customer funds obligations within current liabilities on the Company’s consolidated balance sheets. As a result, the Company also erroneously presented certain changes related to customer funds and customer funds obligations on the Company’s consolidated statements of cash flows. However, the Company determined that the incorrect presentation did not result in a material misstatement of the Company’s financial statements and, accordingly, it does not need to restate its previously issued financial statements contained in the Original Form 10-K or in the Company’s Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023 and June 30, 2023. Considering the foregoing, management reassessed the effectiveness of the Company’s internal control over financial reporting (“ICFR”) as of December 31, 2022, based on the framework established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. As a result of that reassessment, management identified a material weakness in its ICFR as the Company has determined that its control designed to assess the proper presentation of cash and cash equivalents for its Canada customer funds for financial reporting purposes was ineffective (“Canada Trust Material Weakness”). With regard to the Canada Trust Material Weakness, the Company has implemented an additional control and training to ensure proper classification and presentation of cash and cash equivalents for its Canada customer funds. The Company expects the Canada Trust Material Weakness will be fully remediated before December 31, 2023, but remediation will not be considered complete until the applicable controls operate for a sufficient period of time subsequent to the additional training to enable management to test and to conclude on the operating effectiveness of the control.Further, while reassessing the effectiveness of the Company’s ICFR, management identified, in the aggregate, a material weakness related to controls over certain Professional Services and Powerpay revenue accounts as of December 31, 2022 (the "Risk Assessment Material Weakness"). The Company has enhanced its risk assessment process and information technology general controls to prevent misstatements in Professional Services revenue accounts. The Company also expects to implement additional controls to prevent misstatements in Powerpay revenue accounts. The Company expects the Risk Assessment Material Weakness will be fully remediated before December 31, 2023, but remediation will not be considered complete until the applicable controls operate for a sufficient period of time to enable management to test and to conclude on the operating effectiveness of the controls.In light of the Canada Trust Material Weakness and the Risk Assessment Material Weakness, which continue to exist as of December 31, 2022, the Company has performed additional analyses and other procedures to enable management to conclude that the existence of the material weaknesses did not result in a material misstatement of the Company’s previously issued financial statements.As a result of the Canada Trust Material Weakness and the Risk Assessment Material Weakness, the Company concluded that its disclosure controls and procedures and ICFR were ineffective as of December 31, 2022. As a result, the Company is (a) amending and restating Part II, Item 9A Controls and Procedures in this Form 10-K/A to update its conclusions regarding the effectiveness of its disclosure controls and procedures and its internal control over financial reporting as of December 31, 2022 as a result of the material weaknesses and (b) including in Part II, Item 8, the issued audit report of KPMG LLP (“KPMG”), the Company’s independent registered public accounting firm (Auditor Firm ID: 185), as of December 31, 2022 regarding the Company’s internal control over financial reporting as a result of the material weaknesses. In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company is also including with this Form 10-K/A currently dated consent of KPMG and certifications of the Company’s principal executive officer and principal financial officer (included in Part IV, Item 15. “Exhibits, Financial Statement Schedules” and attached as Exhibits 23.1, 31.1, 31.2, 32.1, and 32.2). This Form 10-K/A should be read in conjunction with the Original Form 10-K, which continues to speak as of the date of the Original Form 10-K. Except as specifically noted above, this Form 10-K/A does not modify or update disclosures in the Original Form 10-K. Accordingly, this Form 10-K/A does not reflect events occurring after the date of the Original Form 10-K or modify or update any related or other disclosures, other than those discussed above. No other portions of the Original Form 10-K were changed.Amendments of 2023 Quarterly Reports on Form 10-QIn addition to this Form 10-K/A, the Company is concurrently filing amendments to its Quarterly Reports on Form 10-Q for the periods ended March 31, 2023 and June 30, 2023.

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionDocuments incorporated by reference. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-23

| Name: |

dei_DocumentsIncorporatedByReferenceTextBlock |

| Namespace Prefix: |

dei_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

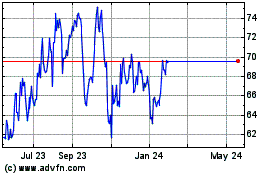

Ceridian HCM (NYSE:CDAY)

Historical Stock Chart

From Apr 2024 to May 2024

Ceridian HCM (NYSE:CDAY)

Historical Stock Chart

From May 2023 to May 2024