UPDATE: E*Trade Complies With Citadel, Hires Goldman For Review

09 August 2011 - 8:16AM

Dow Jones News

E*Trade Financial Corp. (ETFC) bowed to pressure from its

largest shareholder, Citadel LLC, and said its board formed a new

special committee of independent directors, which hired Goldman

Sachs Group Inc. (GS) to conduct a review of strategic

alternatives.

The move--for now--calms the heated battle for the future of the

online brokerage, which began last month. Citadel, a hedge-fund

manager and owner of 9.8% of the company's stock, has been

pressuring E*Trade to call a special shareholder meeting to discuss

options, including a potential sale of the company.

In a letter to E*Trade Chief Executive Steven Freiberg, Citadel

Chief Legal Officer Adam Cooper wrote, "We trust this new process,

involving all directors will be more transparent and

objective."

Additionally, Cooper said, "we believe it is appropriate to

suspend further shareholder action at this time, including our

request for a special meeting of E*Trade's shareholders."

The news initially sent shares of E*Trade up 3.3% to $11.29 in

after-hours trading as investors bet on the increased possibility

of a possible sale of the company; later, shares dropped, and

recently traded at $10.90, down 0.3%. Shares of E*Trade closed

Monday down 13% at $10.93 amid a broad market selloff.

In a statement, E*Trade said independent board members Frederick

Kanner, Joseph Sclafani and Joseph Velli would be on the new

committee. All three joined the board in the last three years,

after E*Trade's shares plunged in value and Citadel bought into the

company.

E*Trade said the new committee would "facilitate and manage the

strategic review process in collaboration with the full board of

directors, which will act as a whole in making all decisions

regarding the future direction of the company."

E*Trade said, "the decision and actions taken by the new special

committee are unanimously supported by all independent members of

the board."

The committee won't include Michael Parks, one of two board

members--along with Donna Weaver--that Citadel demanded E*Trade

replace with independent directors. Parks had been on an earlier

committee set up to review strategic alternatives.

As part of Citadel's demands, E*Trade let go of Morgan Stanley

(MS), which the online brokerage had hired last month to conduct a

review of strategic alternatives, according to people familiar with

the situation.

Citadel was unhappy E*Trade hired Morgan Stanley, which did

previous work for E*Trade, and instead wanted Goldman Sachs to

advise the company, these people said. The hedge fund had asked the

online brokerage to retain an investment bank that had not

previously advised the company or its board.

Citadel made that request, and leveled criticism at E* Trade's

management, in two recent letters to Freiberg. In one letter,

Citadel said E*Trade shareholders suffered "catastrophic losses"

over the past four years, when the company's stock plummeted as it

was rocked by souring mortgages in its banking arm.

Last month, Dow Jones Newswires, citing people familiar with the

matter, said Capital One Financial Corp. (COF) approached E*Trade

last fall about a potential bid for the online brokerage.

While an offer was never made, and Capital One ultimately didn't

pursue the matter further, those fruitless discussions are a key

reason Citadel founder Ken Griffin, who is on E*Trade's board, has

aggressively and publicly pushed E*Trade to sell itself.

-By Brett Philbin, Dow Jones Newswires; 212-416-2173;

brett.philbin@dowjones.com

-By Gina Chon, The Wall Street Journal

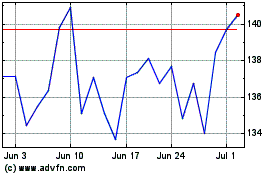

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024