UPDATE: Fed Sets Meetings On Capital One Plan To Buy ING Direct USA

27 August 2011 - 8:38AM

Dow Jones News

The U.S. Federal Reserve said Friday that it will hold three

public meetings on Capital One Financial Corp.'s (COF) plan to buy

ING Groep NV's (ING, INGA.AE) U.S. online-banking business, ING

Direct USA.

In addition, the Fed said it has extended the period for public

comment on the proposal through Wednesday, Oct. 12.

The Fed announcement comes as some consumer advocates, ING

customers and at least one U.S. lawmaker have voiced concern about

the deal.

The three meetings, set to help the Fed collect more information

on the proposal, will be held in Washington, D.C., Chicago, and San

Francisco.

The Fed, in a notice late Friday, said it wants to understand

whether the acquisition will produce benefits to the public such as

increased competition. It said it also wants to weigh any benefits

against any possible adverse effects, such as unsound banking

practices or risk to the U.S. financial system.

Some ING customers have voiced concern about the deal on ING

Direct's Facebook page.

"Why do good things have to disappear? They get swallowed up by

giants. That stinks," reads a June comment, one of almost 600

comments responding to a link to ING's June 16 announcement of the

acquisition.

Consumer advocates and Rep. Barney Frank (D., Mass) have urged

the Fed to slow down or reject the acquisition. In a letter sent

Aug. 17 to Fed Chairman Ben Bernanke, Frank, the top Democrat on

the House Financial Services Committee, said "care should be taken

to thoroughly examine the impact this purchase with respect to the

consolidation of banking assets, the provision of credit by the

resulting back" and compliance with a federal law mandating

investment in low-income neighborhoods.

In an interview Friday, John Taylor, chief executive of the

Washington-based National Community Reinvestment Coalition, said

allowing Capital One to purchase the ING online banking business

would increase the risks to the financial system by creating a

larger financial institution that could threaten the health of the

financial system. He argued that regulators should block the

merger, or at least put conditions on it that requires Capital One

to invest in local communities.

"This is a credit card company acquiring banks so it can do more

credit-card lending," he said.

The Washington, D.C., meeting will be held Tuesday, Sept. 20.

The Chicago meeting is set for Tuesday, Sept. 27, and the San

Francisco meeting is slated for Wednesday, Oct. 5.

"The Federal Reserve's review also includes an evaluation of the

financial and managerial resources of the acquiring firm," the Fed

said.

Capital One, currently the ninth-largest bank in the U.S. by

deposits, is set to pay $9 billion for ING Direct USA--$6.2 billion

in cash and $2.8 billion in stock. The McLean, Va., bank has also

announced plans to buy the U.S. credit-card business of HSBC

Holdings PLC for about $2.6 billion.

A Capital One spokesperson could not immediately be reached.

-By Maya Jackson Randall, Dow Jones Newswires; 202-862-6687,

maya.jackson-randall@dowjones.com

--Alan Zibel and Matthias Rieker contributed to this report.

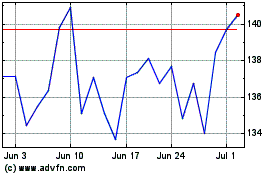

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024