HSBC to Move US Fund Unit to Dublin - Analyst Blog

04 February 2012 - 2:49AM

Zacks

On Thursday, The Wall Street Journal reported that

HSBC Holdings Plc. (HBC) is planning to shift its

US fund administration division to Ireland. The primary reason

behind this move is to control costs and reorganize the company’s

businesses.

HSBC’s plan to relocate its fund services operations to Dublin

is expected to lead to retrenchment of nearly 200 employees in New

York. However, the final decision regarding retrenchment of

employees is likely to be taken over the next couple of

quarters.

The fund administration unit is a part of HSBC’s Securities

Services business and offers accounting and valuation services,

corporate and statutory compliance, and fund transfers. Though the

company will continue to provide services to a portion of its

clients from Dublin, others have been advised to look for other

fund administrators.

Moreover, this is a part of HSBC’s long-term strategy to bring

down its operating expenses. Back in May 2011, the CEO of the

company had announced plans to reduce the operating expenses by

$3.5 million by the end of 2013 through restructuring and

contraction of its global business.

Though US remain an important market for HSBC, this is not the

first time that the company is revamping its operations here. Last

year, the company had announced the sale of its 195 non-strategic

branches to First Niagara Financial Group Inc.

(FNFG) and its credit card business to Capital One

Financial Corporation (COF).

HSBC’s decision to scale back its operations from the US stems

from the fact that the company is facing tough regulatory and

economic environment in this country. Following the financial

crisis in 2008, various new regulations and low interest rates are

affecting the profitability in the banking sector.

Additionally, as a result of low corporate-tax rate and

proximity to Europe, Ireland is gradually becoming a preferred

destination for many companies to set up businesses and expand the

existing operations.

Further, HSBC is not new in Ireland. The company provides

corporate banking, private banking, fund administration and

insurance services through its 400 employees in that country.

Therefore, we believe that HSBC’s plan to move its fund

administration business to Dublin will benefit the company in the

long run. The company will be able to gain market share in Ireland

and this would further improve the company’s financials.

Currently, HSBC retains a Zacks #4 Rank, which translates into a

short-term ‘Sell’ rating.

CAPITAL ONE FIN (COF): Free Stock Analysis Report

FIRST NIAGARA (FNFG): Free Stock Analysis Report

HSBC HOLDINGS (HBC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

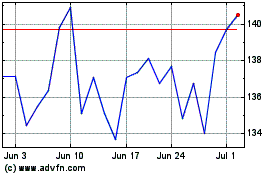

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024