UPDATE: Federal Reserve Board Approves Capital One Plan To Buy ING Bank

15 February 2012 - 10:52AM

Dow Jones News

The U.S. Federal Reserve Board, after delaying a decision twice

in a week, unanimously approved Capital One Financial Corp.'s (COF)

controversial bid to buy ING Groep NV's (ING, INGA.AE) U.S.

online-banking business, sending a signal that banks can expand

even in this new era of heightened scrutiny.

The acquisition, the biggest bank deal to win approval from the

Federal Reserve since the 2010 Dodd-Frank financial overhaul law

was passed, makes McLean, Va.-based Capital One the nation's

fifth-largest bank based on deposit size, according to the Fed. The

$9 billion acquisition bolsters Capital One's transformation from a

credit-card lender into a large, full-service national bank.

The Fed disagreed with consumer groups' claims that the merger

would result in a risky mega bank that would pose a potential risk

to the whole financial system. Fed officials said Capital One does

not engage in markets "to a degree that would pose significant risk

to other institutions." The Fed added that Capital One and ING Bank

do not engage in complex activities.

"The Board has concluded that consummation of the proposal can

reasonably be expected to produce public benefits that would

outweigh any likely adverse effects," said the Fed in an order

released late Tuesday.

Capital One announced in June its plan to buy ING Direct USA, an

Internet bank known for its orange lion logo and high-interest

savings accounts. The company Tuesday said it expects to close on

the deal "within the next few days as soon as the details

associated with the transaction are finalized."

"I think the ING deal is going to prove to be one of the

strategically most transformational things that's ever happened to

this company," Capital One Chief Executive Richard Fairbank said at

a financial conference last week.

The bank is also aiming to complete a separate $2.6 billion plan

to buy the U.S. credit-card business of HSBC Holdings PLC (HBC,

HSBA.LN, 0005.HK)in the second quarter.

Capital One's proposal was a closely watched test case of

Dodd-Frank, which requires the Fed to consider for the first time

whether deals would pose a risk to the financial system. The law

seeks to put an end to "too-big-to-fail" companies, or firms that

are so sprawling and interconnected that the government would have

to bail them out if they falter.

The Fed's approval proves that certain big U.S. banks can still

expand, but they might have to jump through more regulatory hoops.

In a rare move, the Fed extended a deadline for the public to

comment on the proposal and held three public meetings in

Washington, Chicago and San Francisco on Capital One's plan. The

last such public meetings occurred in 2008 as part of Bank of

America's purchase of Countrywide Financial Corp.

Regulators "are taking a more measured approach," wrote FBR

Capital Markets & Co. analyst Scott Valentin.

Groups such as the National Community Reinvestment Coalition and

Rev. Jesse Jackson's Rainbow PUSH Coalition had accused Capital One

of marketing expensive credit cards to vulnerable borrowers without

investing enough in local communities.

"Should a systemically important bank be allowed to become

bigger without a clear case that it will benefit society," said

NCRC President John Taylor. "The answer is emphatically no."

Capital One is one of the nation's largest banks with $321.4

billion in assets, according to SNL's most recent data. But the

firm is easily dwarfed by four, much larger, trillion-dollar banks:

J.P. Morgan Chase &Co. (JPM), Bank of America Corp. (BAC)

Citigroup Inc. (C), and Wells Fargo & Co. (WFC). All four have

more than $1 trillion in assets.

-By Maya Jackson Randall, Dow Jones Newswires; 202-862-6687;

maya.jackson-randall@dowjones.com

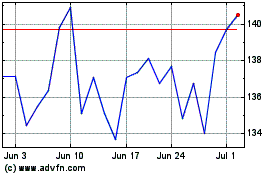

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024