It's Time to Buy Energy Stocks - Investment Ideas

07 July 2011 - 10:00AM

Zacks

Do you own any energy stocks?

Even with crude trading around $100 a barrel and

sky high gasoline prices, energy stocks seem to be out of favor

with most investors.

I hardly hear any buzz about them. Conversely, back

in 2007 and 2008 when crude was soaring to a new high of $147 a

barrel, all anyone wanted to be in were energy stocks.

Where's the love now?

Over the last 6 months, the perfect storm of higher

commodity prices and stronger demand has been taking shape which

means earnings estimates in the energy sector are rising. This

could be just the beginning of an earnings explosion.

It's Time To Get Back Into Energy

Without much fanfare, many energy stocks have been

moving higher over the last six months.

Does that mean it's too late to get in?

Never fear. While shares have moved higher, the

valuations are still extremely attractive. You won't see any

forward P/Es in the 50s or the 60s here like you will with the

popular Internet and technology stocks.

What you'll find is just the opposite. Energy

stocks are actually cheap. Now is the time to bulk up your

portfolio with solid names expected to grow earnings by the double

and triple digits.

Forget Big Oil

There are a lot of ways to "play" energy.

Most investors routinely turn to the large, well

known integrated energy stocks like Dow components Exxon and

Chevron when they're buying energy stocks. There's nothing wrong

with this strategy.

But you can do better. Seek out growth in the

lesser known names in the exploration, refining and drilling

services sectors.

All have their hand on the pulse of the energy

market but the upside possibility is greater than with the slower

growing Big Oil plays.

3 Amazing Energy Stocks to Buy Right Now

1. CVR Energy

2. Stone Energy

3. Complete Production Services

These 3 energy stocks are all cheap, are expected

to see huge earnings growth and have momentum as they're trading

near 52-week highs.

That is the triple threat- a stock with value,

growth and momentum all rolled into one.

1. CVR Energy, Inc. (CVI) is a mid-continent

refiner which also is majority owner of a nitrogen fertilizer

producer it spun off earlier this year.

Forward P/E: 8.7

Expected 2011 EPS Growth: 784%

This Zacks #1 Rank (strong buy) has a ton of

momentum, with shares at 52-week highs, up 76.5% in the last 6

months compared to the S&P 500's return of just 6.2%.

2. Stone Energy (SGY) is a mid-cap oil and

natural gas explorer with interests in the Gulf of Mexico and

Appalachia.

Forward P/E: 9.4

Expected 2011 EPS Growth: 66.4%

This Zacks #2 Rank (buy) has been trading in a more

narrow trading range recently and will tend to move with the price

of crude. Still, shares are new 52-week highs and have returned 50%

in the last 6 months.

3. Complete Production Services (CPX) is a

way to get in on the unconventional oil and gas plays in the shale

regions of North America. This Zacks #1 Rank (strong buy) provides

oilfield services which focus on the completion and production

phases of oil and gas wells.

Forward P/E: 12.8

Expected 2011 EPS Growth: 150.4%

The drilling service companies are hot. Shares have

risen 150% in the last 6 months, well outpacing the S&P 500's

6.2% return.

Buying Opportunity in Energy

Instead of complaining about the price of gas (as I

certainly do!)- you can get in the game by actually becoming an

owner of energy stocks.

These 3 energy stocks are cheap but are expected to

see huge growth in 2011. That's a winning combination.

[The author of this article owns shares of

Exxon.]

Tracey Ryniec is the Value Stock Strategist for

Zacks.com. She is also the Editor of the Turnaround Trader and

Insider Trader services. You can follow her at

twitter.com/traceyryniec.

COMPLETE PRODUC (CPX): Free Stock Analysis Report

CVR ENERGY INC (CVI): Free Stock Analysis Report

STONE ENERGY CP (SGY): Free Stock Analysis Report

Zacks Investment Research

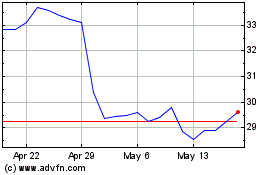

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

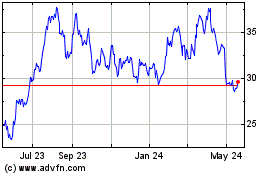

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Jul 2023 to Jul 2024