Successfully launched Upfront Title product via

a pilot program with a major mortgage software platform leader

Continues making progress towards reaching

adjusted EBITDA profitability

Core Underwriting platform continues to

demonstrate strong performance, benefitting from increased

operational efficiency and significant tech upgrades

Doma Holdings, Inc. (NYSE: DOMA) (“Doma” or the “Company”), a

leading force for disruptive change in the real estate industry,

today reported financial results and key operating data for the

three months and twelve months ended December 31, 2023.

Fourth Quarter 2023 Business Highlights (1)(2):

- Total revenues of $85 million, up 11% versus Q3 2023

- Retained premiums and fees of $17 million, up 7% versus Q3

2023

- Gross profit of $5 million, up 56% versus Q3 2023

- Adjusted gross profit of $8 million, up 29% versus Q3 2023

- Net loss of $18 million, compared to a net loss of $22 million

in Q3 2023

- Adjusted EBITDA loss of $3 million, compared to a loss of $5

million in Q3 2023

“2023 was a transformational year for Doma. As we continued to

navigate challenging market conditions, we successfully executed

significant cost reduction actions, divested our non-core local

agency operations, and streamlined our business to focus on our

core strengths and to support our invaluable customers,” said Max

Simkoff, CEO of Doma. “We narrowed our strategy to better address

the ever-growing market demand for more affordable and tech-driven

title insurance offerings, including the launch of an innovative,

new product, called Upfront Title.”

Mr. Simkoff added, “We are pleased to have successfully launched

our Upfront Title pilot program in the first quarter of this year

with one of the largest mortgage technology platforms in the

country and a major national lender customer. Housing affordability

remains a critical issue for the vast majority of Americans, and we

believe that by licensing our patented instant underwriting

technology upstream, directly to the largest mortgage market

participants in the country, while continuing to serve independent

agents through our underwriting channel, that we will be able to

ultimately lower costs for homeowners. We are already seeing

encouraging results, helping to validate that the future could

bring a transformational new configuration which can deliver both

meaningful savings and benefits to consumers and lenders alike. We

believe that based on these early results, that we are on track and

if we are successful, upon demonstrated pilot program success in

the first half of this year, we would be in a position to expand

our partnership in the second half of the year both on a geographic

basis, and also by offering a more enhanced Upfront Title product

configuration to additional lenders and mortgage technology

platforms. We do not expect revenue from this pilot program to be

material in the first half of the year; however, we are very

encouraged by the early results.”

“The public and political support for more affordable housing

outcomes being driven specifically through more innovative title

insurance solutions has grown significantly, and we believe we are

well positioned to address one specific opportunity that emerged

coming out of last week’s State of the Union Address. President Joe

Biden announced his plan to lower housing costs for the millions of

Americans who are struggling to afford the American dream of

homeownership, and he specifically mentioned a focus on reducing

title insurance costs. In a separate announcement immediately ahead

of the President’s address, The Federal Housing Finance Agency

(FHFA) announced that they have approved a pilot to waive the

requirement for lender’s title insurance on certain refinances.

FHFA’s Director Sandra Thompson further clarified that this “title

acceptance” pilot will waive the requirement for lender’s title

insurance or a legal opinion on certain low-risk refinance

transactions where there is confidence that the property is free

and clear of any prior lien or encumbrance. The pilot only impacts

the requirement for a lender’s title policy or AOL and does not

impact a borrower’s title risk, since it only applies to certain

refinance loans where the borrower has title to the property

already. We believe that Doma is one of the only companies in our

space who has the proven technology and underwriting capabilities

to participate in the pilot program announced by FHFA. We’re

excited by the actions taken by the administration, and we share a

desire and a sense of urgency to reduce closing costs for borrowers

by a wide margin compared to traditional non-technology-based

solutions. We think that based on what we’ve heard about the

announcements made last week, that it’s likely over time that the

majority of the refinance universe should qualify for our more

innovative approach to quantifying and helping the GSEs assess and

underwrite title risk, and we look forward to further exploring

this opportunity. This is a great example of the kinds of

innovation that could make a lasting impact on helping to alleviate

housing affordability challenges in this country in a safe and

appropriate manner,” said Mr. Simkoff.

Mr. Simkoff added, “Lastly, our core underwriting platform

continues to demonstrate strong performance despite continued

difficult market conditions. We continued to launch significant

tech initiatives in the Underwriting division, which have been

instrumental to our success, and which we believe will benefit our

independent agent-focused title production team by saving them time

and expense while also enabling them to improve their efficiency

through a partnership with Doma.”

“While our results fell just shy of our ambitious goal of

reaching adjusted EBITDA profitability in Q4, primarily due to the

continued degradation of the interest rate environment, we are

encouraged by the significant improvement we made in our cost

structure which allowed us to get within our striking distance of

our goal. Our adjusted EBITDA loss for continuing operations was $3

million in Q4, an improvement from our adjusted EBITDA loss for

continuing operations of $5 million in Q3 of 2023 and $11 million

in Q4 of 2022,” said Mike Smith, Chief Financial Officer of Doma.

“Looking ahead, our focus going forward is currently on growing our

revenue and expanding our margins through realization of

operational improvements.”

(1) Reconciliations of retained premiums and fees, adjusted

gross profit, and the other financial measures used in this press

release that are not calculated in accordance with generally

accepted accounting principles in the United States (“GAAP”) to the

nearest measures prepared in accordance with GAAP have been

provided in this press release in the accompanying tables. An

explanation of these measures is also included below under the

heading “Non-GAAP Financial Measures.”

(2) Doma has exited the Company’s local retail operations

nationwide. Local and associated operations are classified as

“discontinued operations” and segregated in the Company’s financial

results beginning in the third quarter ended September 30, 2023.

The financial results and key operating data highlighted today

reflect the continuing operations of Doma, excluding the

discontinued Local and associated operations.

Non-GAAP Financial Measures

Some of the financial information and data contained in this

press release, such as retained premiums and fees, adjusted gross

profit and adjusted EBITDA, have not been prepared in accordance

with United States generally accepted accounting principles

("GAAP"). Retained premiums and fees is defined as total revenue

less premiums retained by agents. Adjusted gross profit is defined

as gross profit (loss), adjusted to exclude the impact of

depreciation and amortization. Adjusted EBITDA is defined as net

income (loss) before interest, income taxes and depreciation and

amortization, and further adjusted to exclude the impact of net

loss from discontinued operations, stock-based compensation,

severance and interim salary costs, long-lived asset impairment,

accelerated contract expense, change in fair value of Local sales

deferred earnout, and the change in fair value of warrant and

sponsor covered shares liabilities. Doma believes that the use of

retained premiums and fees, adjusted gross profit and adjusted

EBITDA provides additional tools to assess operational performance

and trends in, and in comparing Doma's financial measures with,

other similar companies, many of which present similar non-GAAP

financial measures to investors. Doma’s non-GAAP financial measures

may be different from non-GAAP financial measures used by other

companies. The presentation of non-GAAP financial measures is not

intended to be considered in isolation or as a substitute for, or

superior to, financial measures determined in accordance with GAAP.

Because of the limitations of non-GAAP financial measures, you

should consider the non-GAAP financial measures presented herein in

conjunction with Doma’s financial statements and the related notes

thereto. Please refer to the non-GAAP reconciliations in this press

release for a reconciliation of these non-GAAP financial measures

to the most comparable financial measure prepared in accordance

with GAAP.

Conference Call Information

Doma will host a conference call at 5:00 PM Eastern Time today

on Tuesday, March 12, to present its fourth quarter and full year

2023 financial results.

Dial-in Details: To access the call by phone, please go to this

link (registration link) and you will be provided with dial-in

details. To avoid delays, we encourage participants to dial into

the conference call fifteen minutes ahead of the scheduled start

time.

The live webcast of the call will be accessible on the Company’s

website at investor.doma.com. Approximately two hours after

conclusion of the live event, an archived webcast of the conference

call will be accessible from the Investor Relations section of the

Company’s website for twelve months.

About Doma Holdings, Inc.

Doma is a real estate technology company that is disrupting a

century-old industry by building an instant and frictionless home

closing experience for buyers and sellers. Doma uses proprietary

machine intelligence technology and deep human expertise to create

a vastly more simple and affordable experience for everyone

involved in a residential real estate transaction, including

current and prospective homeowners, mortgage lenders, title agents,

and real estate professionals. With Doma, what used to take days

can now be done in minutes, replacing an arcane and cumbersome

process with a digital experience designed for today’s world. To

learn more visit doma.com.

Forward-Looking Statements Legend

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

"estimate," "plan," "project," "forecast," "intend," "will,"

"expect," "anticipate," "believe," "seek," "target" or other

similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. The

absence of these words does not mean that a statement is not

forward-looking. Such statements are based on the beliefs of, as

well as assumptions made by information currently available to Doma

management. These forward-looking statements include, but are not

limited to, statements regarding our ability to offer our

technology through, and enter into commercial relationships with,

mortgage technology platforms (including any specific partner

mentioned), primary and/or secondary mortgage market participants

and/or their customers, estimates and forecasts of financial and

performance metrics, projections of market opportunity, total

addressable market ("TAM"), market share and competition, the

ability to expand our product offerings geographically and/or add

additional partners, and the impact of FHFA’s recently announced

“title acceptance” pilot and/or our level of participation, if any,

in such pilot. These statements are based on various assumptions,

whether or not identified in this press release, and on the current

expectation of Doma’s management and are not predictions of actual

performance. These forward-looking statements are provided to allow

potential investors the opportunity to understand management’s

beliefs and opinions in respect of the future so that they may use

such beliefs and opinions as one factor in evaluating an

investment. These statements are not guarantees of future

performance and undue reliance should not be placed on them. Actual

events and circumstances are difficult or impossible to predict,

will differ from assumptions and are beyond the control of

Doma.

These forward-looking statements are subject to a number of

risks and uncertainties, including changes in business, market,

financial, political and legal conditions; risks relating to the

uncertainty of the projected financial information with respect to

Doma; future global, regional or local economic, political, market

and social conditions, including due to the COVID-19 pandemic; the

development, effects and enforcement of laws and regulations,

including with respect to the title insurance industry; Doma’s

ability to manage its future growth or to develop or acquire

enhancements to its platform; the effects of competition on Doma’s

future business; the outcome of any potential litigation,

government and regulatory proceedings, investigations and

inquiries; and those other factors described in Part I, Item 1A -

“Risk Factors” of our Annual Report on Form 10-K for the year ended

December 31, 2022 and any subsequent reports filed by Doma from

time to time with the U.S. Securities and Exchange Commission (the

“SEC”).

If any of these risks materialize or Doma’s assumptions prove

incorrect, actual results could differ materially from the results

implied by these forward-looking statements. There may be

additional risks that Doma does not presently know or that Doma

currently believes are immaterial that could also cause actual

results to differ from those contained in the forward-looking

statements. In addition, forward-looking statements reflect Doma’s

expectations, plans or forecasts of future events and views as of

the date of this press release. Doma anticipates that subsequent

events and developments will cause Doma’s assessments to change.

However, while Doma may elect to update these forward-looking

statements at some point in the future, Doma specifically disclaims

any obligation to do so, except as required by law. These

forward-looking statements should not be relied upon as

representing Doma’s assessment as of any date subsequent to the

date of this press release. Accordingly, undue reliance should not

be placed upon the forward-looking statements.

Key Operating and Financial Indicators from Continuing

Operations

Three months ended December

31,

Year ended December

31,

2023

2022

2023

2022

(Unaudited - in thousands)

GAAP financial data:

Revenue (1)

$

84,612

$

88,875

$

310,943

$

399,978

Gross profit (2)

$

4,795

$

6,629

$

11,947

$

9,332

Net loss (3)

$

(17,563

)

$

(66,281

)

$

(95,288

)

$

(187,297

)

Non-GAAP financial data (4):

Retained premiums and fees

$

16,557

$

20,130

$

62,766

$

92,937

Adjusted gross profit

$

7,755

$

11,142

$

23,620

$

24,409

Ratio of adjusted gross profit to retained

premiums and fees

47

%

55

%

38

%

26

%

Adjusted EBITDA

$

(2,832

)

$

(10,740

)

$

(33,035

)

$

(99,932

)

____________________

(1)

Revenue is comprised of (i) net premiums

written, (ii) escrow, other title-related fees and other, and (iii)

investment, dividend and other income.

(2)

Gross profit, calculated in accordance

with GAAP, is calculated as total revenue, minus premiums retained

by agents, direct labor expense (including mainly personnel expense

for certain employees involved in the direct fulfillment of

policies) and direct non-labor expense (including mainly title

examination expense, provision for claims, and depreciation and

amortization). In our consolidated income statements, depreciation

and amortization is recorded under the “other operating expenses”

caption.

(3)

Net loss is made up of the components of

revenue and expenses.

(4)

Retained premiums and fees, adjusted gross

profit and adjusted EBITDA are non-GAAP financial measures.

Non-GAAP Financial Measures

Retained premiums and fees

The following table reconciles our continuing operations

retained premiums and fees to our gross profit, the most closely

comparable GAAP financial measure, for the periods indicated:

Three months ended December

31,

Year ended December

31,

2023

2022

2023

2022

(Unaudited - in thousands)

Revenue

$

84,612

$

88,875

$

310,943

$

399,978

Minus:

Premiums retained by agents

68,055

68,745

248,177

307,041

Retained premiums and fees

$

16,557

$

20,130

$

62,766

$

92,937

Minus:

Direct labor

2,862

5,126

13,286

37,312

Provision for claims

2,810

880

14,764

14,781

Depreciation and amortization

2,960

4,513

11,673

15,077

Other direct costs (1)

3,130

2,982

11,096

16,435

Gross Profit

$

4,795

$

6,629

$

11,947

$

9,332

____________________

(1)

Includes title examination expense, office

supplies, and premium and other taxes.

Adjusted gross profit

The following table reconciles our continuing operations

adjusted gross profit to our gross profit, the most closely

comparable GAAP financial measure, for the periods indicated:

Three months ended December

31,

Year ended December

31,

2023

2022

2023

2022

(Unaudited - in thousands)

Gross Profit

$

4,795

$

6,629

$

11,947

$

9,332

Adjusted for:

Depreciation and amortization

2,960

4,513

11,673

15,077

Adjusted Gross Profit

$

7,755

$

11,142

$

23,620

$

24,409

Adjusted EBITDA

The following table reconciles our continuing operations

adjusted EBITDA to our net loss, the most closely comparable GAAP

financial measure, for the periods indicated:

Three months ended December

31,

Year ended December

31,

2023

2022

2023

2022

(Unaudited - in thousands)

Net loss (GAAP)

$

(20,788

)

$

(109,418

)

$

(124,414

)

$

(302,209

)

Adjusted for:

Depreciation and amortization

2,960

4,513

11,673

15,077

Interest expense

5,836

3,775

20,323

14,106

Income taxes

62

(1,712

)

528

(1,055

)

EBITDA

$

(11,930

)

$

(102,842

)

$

(91,890

)

$

(274,081

)

Adjusted for:

Loss from discontinued operations, net of

taxes

3,225

43,137

29,126

114,912

Stock-based compensation

4,656

5,572

17,141

29,679

Severance and interim salary costs

828

9,434

10,287

16,130

Long-lived asset impairment

86

29,524

1,499

29,524

Change in fair value of Warrant and

Sponsor Covered Shares liabilities

(67

)

(786

)

(453

)

(21,317

)

Accelerated contract expense

—

5,221

1,268

5,221

Change in fair value of Local Sales

Deferred Earnout

370

—

(13

)

—

Adjusted EBITDA

$

(2,832

)

$

(10,740

)

$

(33,035

)

$

(99,932

)

The following table reconciles our continuing operations

adjusted gross profit to our adjusted EBITDA, for the periods

indicated:

Three months ended December

31,

Year ended December

31,

2023

2022

2023

2022

(Unaudited - in thousands)

Adjusted Gross Profit

$

7,755

$

11,142

$

23,620

$

24,409

Minus:

Customer acquisition costs

1,573

2,785

7,071

19,486

Other indirect costs (1)

9,014

19,097

49,584

104,855

Adjusted EBITDA

$

(2,832

)

$

(10,740

)

$

(33,035

)

$

(99,932

)

____________________

(1)

Includes corporate support, research and

development, and other operating costs.

Doma Holdings, Inc.

Consolidated Statements of

Operations

(Unaudited)

Year ended December

31,

(In thousands, except share and per share

information)

2023

2022

Revenues:

Net premiums written (1)

$

301,703

$

385,253

Escrow, other title-related fees and

other

3,342

11,694

Investment, dividend and other income

5,898

3,031

Total revenues

$

310,943

$

399,978

Expenses:

Premiums retained by agents (2)

$

248,177

$

307,041

Title examination expense

3,859

8,142

Provision for claims

14,764

14,781

Personnel costs

71,074

163,604

Other operating expenses

46,460

72,449

Long-lived asset impairment

1,499

29,524

Total operating expenses

$

385,833

$

595,541

Operating loss from continuing

operations

$

(74,890

)

$

(195,563

)

Other (expense) income:

Change in fair value of Warrant and

Sponsor Covered Shares liabilities

453

21,317

Interest expense

(20,323

)

(14,106

)

Loss from continuing operations before

income taxes

$

(94,760

)

$

(188,352

)

Income tax benefit (expense)

(528

)

1,055

Loss from continuing operations, net of

taxes

$

(95,288

)

$

(187,297

)

Loss from discontinued operations, net

of taxes

(29,126

)

(114,912

)

Net loss

$

(124,414

)

$

(302,209

)

Earnings per share:

Net loss from continuing operations per

share attributable to stockholders - basic and diluted

$

(7.14

)

$

(14.36

)

Net loss per share attributable to

stockholders - basic and diluted

$

(9.32

)

$

(23.17

)

Weighted average shares outstanding common

stock - basic and diluted

13,342,913

13,041,337

____________________

(1)

Net premiums written includes revenues

from a related party of $139.2 million and $134.9 million for the

years ended December 31, 2023, and 2022, respectively.

(2)

Premiums retained by agents includes

expenses associated with a related party of $112.0 million and

$108.4 million during the years ended December 31, 2023, and 2022,

respectively.

Doma Holdings, Inc.

Consolidated Balance

Sheets

(Unaudited)

December 31,

(In thousands, except share

information)

2023

2022

Assets

Cash and cash equivalents

$

65,939

$

78,450

Restricted cash

5,228

2,933

Investments:

Fixed maturities

Held-to-maturity debt securities, at

amortized cost (net of allowance for credit losses of $125 at

December 31, 2023 and $440 at December 31, 2022)

18,179

90,328

Available-for-sale debt securities, at

fair value (amortized cost of $58,516 at December 31, 2023 and

$59,191 at December 31, 2022)

58,032

58,254

Mortgage loans

45

297

Total investments

$

76,256

$

148,879

Trade and other receivables (net of

allowance for credit losses of $1,802 and $1,413 at December 31,

2023 and 2022, respectively)

24,452

20,541

Prepaid expenses, deposits and other

assets

4,614

6,687

Lease right-of-use assets

4,175

4,724

Fixed assets (net of accumulated

depreciation of $26,272 and $16,685 at December 31, 2023 and 2022,

respectively)

30,945

37,024

Title plants

2,716

2,716

Goodwill

23,413

23,413

Assets held for disposal

2,563

53,141

Total assets

$

240,301

$

378,508

Liabilities and stockholders’

(deficit) equity

Accounts payable

$

1,798

$

2,407

Accrued expenses and other liabilities

12,700

23,347

Leases liabilities

8,838

10,793

Senior secured credit agreement, net of

debt issuance costs and original issue discount

154,087

147,374

Liability for loss and loss adjustment

expenses

81,894

81,873

Warrant liabilities

26

347

Sponsor Covered Shares liability

86

219

Liabilities held for disposal

6,783

30,356

Total liabilities

$

266,212

$

296,716

Commitments and contingencies

Stockholders’ (deficit)

equity:

Common stock, 0.0001 par value; 80,000,000

shares authorized at December 31, 2023 and 2022; 13,524,203 and

13,165,919 shares issued and outstanding as of December 31, 2023

and 2022, respectively

1

1

Additional paid-in capital

593,772

577,515

Accumulated deficit

(619,201

)

(494,787

)

Accumulated other comprehensive income

(483

)

(937

)

Total stockholders’ (deficit)

equity

$

(25,911

)

$

81,792

Total liabilities and stockholders’

(deficit) equity

$

240,301

$

378,508

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240312587194/en/

Investor Contact: Dave DeHorn | Chief Strategy

Officer and Interim Head of Investor Relations for Doma |

ir@doma.com

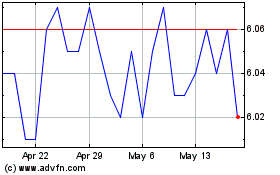

Doma (NYSE:DOMA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Doma (NYSE:DOMA)

Historical Stock Chart

From Jan 2024 to Jan 2025