Doma Holdings, Inc. (NYSE: DOMA), a leading force for innovation

in the real estate industry, today announced that it has entered

into a definitive agreement and plan of merger (the “transaction”)

with Title Resources Group (“TRG”), one of the nation’s leading

title insurance underwriters, subject to stockholder and regulatory

approvals. In the transaction, TRG would acquire all of the

outstanding shares of Doma for $6.29 per share of common stock in

an all-cash transaction, an approximate premium of 43.0% over

Doma’s closing share price on March 27, 2024, and an approximate

33.9% premium over the trailing 30-day volume weighted average

closing price ending March 27, 2024.

After the close of the transaction, Doma’s underwriting

division, Doma Title Insurance, Inc., and its technology division,

expected to be renamed Doma Technology LLC (“Doma TechCo”), are

expected to operate as subsidiaries of TRG with Doma TechCo

operating on a separately-capitalized basis. Hudson Structured

Capital Management Ltd. (conducting its insurance business as HSCM

Bermuda or “HSCM”) would maintain an investment in Doma through

Doma TechCo. Doma TechCo would continue to have access to

underwriting services and continued technology deployment for Doma

Title Insurance, Inc.

“Today’s announcement is a win for Doma’s stockholders and for

both companies’ employees and customers,” said Max Simkoff, Doma

CEO. “This transaction is an important step in the growth and

evolution of Doma, further strengthening us as we deploy our

market-tested technology for large mortgage market

participants.”

“We look forward to partnering with the Doma team and providing

excellent underwriting services to Doma’s many strong agents,”

Scott McCall, president and CEO of TRG, said.

Transaction Approvals and Timing

The transaction, which was unanimously approved by Doma’s Board

of Directors, acting on the unanimous recommendation of a special

committee of the Board of Directors comprised entirely of

independent directors, is expected to close in the second half of

2024, subject to certain closing conditions, including approval by

the holders of a majority of Doma’s common stock that are not

affiliated with the Lennar Stockholders (as defined below) and

certain other persons, and certain insurance regulatory approvals.

The transaction is not subject to a financing condition, though is

conditioned on the completion of certain specified transactions as

contemplated by the merger agreement for the transaction (the

“merger agreement”), an investment by Lennar into TRG and the

consummation of certain arrangements with HSCM.

LENX ST Investor, LLC and Len FW Investor, LLC (“Lennar” and

together with LENX ST Investor, LLC, the “Lennar Stockholders”),

representing approximately 25% of the voting power of Doma’s common

stock, have signed a voting agreement in support of the

transaction, agreeing to vote their shares of Doma’s common stock

in favor of the merger agreement and the transaction.

Under the terms of the merger agreement, Doma may solicit

alternative acquisition proposals from third parties during a

50-day “go-shop” period following the date of execution of the

merger agreement. The Doma Board of Directors will have the right

to terminate the merger agreement to enter into a superior proposal

subject to the terms and conditions of the merger agreement and the

payment of a break-up fee. There can be no assurances that the

“go-shop” will result in a superior proposal. Doma does not intend

to disclose developments related to the solicitation process unless

it determines such disclosure is appropriate or is otherwise

required.

Upon closing of the transaction, Doma will no longer be traded

or listed on any public securities exchange.

For further information regarding all terms and conditions

contained in the definitive merger agreement, please see Doma’s

Current Report on Form 8-K, which will be filed in connection with

this transaction.

Advisors

Houlihan Lokey Capital, Inc. is acting as financial advisor to

the special committee of the Doma Board of Directors and Latham

& Watkins is acting as legal counsel for the special committee

of the Doma Board of Directors. Davis Polk & Wardwell LLP is

acting as Doma’s legal counsel and Mayer Brown LLP is acting as

Doma’s insurance regulatory counsel. Willkie Farr & Gallagher

LLP is acting as legal counsel to TRG. Morrison Foerster LLP is

acting as legal counsel to the Lennar Stockholders.

About Doma Holdings, Inc.

Doma is a real estate technology company that is innovating a

century-old industry by building an instant and frictionless home

closing experience for buyers and sellers. Doma uses proprietary

machine intelligence technology and deep human expertise to create

a vastly more simple and affordable experience for everyone

involved in a residential real estate transaction, including

current and prospective homeowners, mortgage lenders, title agents,

and real estate professionals. With Doma, what used to take days

can now be done in minutes, replacing an arcane and cumbersome

process with a digital experience designed for today’s world. To

learn more visit doma.com.

About Title Resources Group (TRG)

Title Resources Group—the underwriter built for the real estate

industry—is one of the nation’s largest title insurance

underwriters, according to the American Land Title Association’s

2023 market share data. TRG serves title insurance agents in 38

states and the District of Columbia. Since its inception, in 1984

the company has consistently operated profitably without a net

operating loss in any fiscal year. With a mission to provide

knowledgeable and responsive underwriting solutions, TRG is

dedicated to growing lifelong relationships and maintaining quality

through integrity and financial stability. For more information,

please visit www.TRGUW.com.

Important Information and Where to Find It

This communication is being made in respect of the proposed

transaction involving Doma and affiliates of TRG. A stockholder

meeting will be announced soon to obtain stockholder approval in

connection with the proposed transaction. Doma expects to file with

the Securities and Exchange Commission (the “SEC”) a proxy

statement and other relevant documents in connection with the

proposed transaction. The definitive proxy statement will be sent

or given to the stockholders of Doma and will contain important

information about the proposed transaction and related matters.

Doma, certain of its affiliates and certain affiliates of TRG

intend to jointly file a transaction statement on Schedule 13E-3

(the “Schedule 13E-3”) with the SEC. INVESTORS OF DOMA ARE URGED TO

READ THE DEFINITIVE PROXY STATEMENT, THE SCHEDULE 13E-3 AND OTHER

RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED TRANSACTION AND RELATED MATTERS. Investors may obtain a

free copy of these materials (when they are available) and other

documents filed by Doma with the SEC at the SEC’s website at

www.sec.gov, at Doma’s website at

https://investor.doma.com/financial-information/sec-filings.

Participants in the Solicitation

Doma and certain of its directors, executive officers and other

members of management and employees may be deemed to be

participants in the solicitation of proxies from its stockholders

in connection with the proposed transaction. Information regarding

the persons who may, under the rules of the SEC, be considered to

be participants in the solicitation of Doma’s stockholders in

connection with the proposed transaction will be set forth in

Doma’s definitive proxy statement for its stockholder meeting.

Additional information regarding these individuals and any direct

or indirect interests they may have in the proposed transaction

will be set forth in the definitive proxy statement when and if it

is filed with the SEC in connection with the proposed

transaction.

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of federal securities laws, including Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements are based on Doma’s current expectations and projections

about future events, including the expected date of closing of the

proposed transaction and the potential benefits thereof, its

business and industry, management’s beliefs and certain assumptions

made by Doma and TRG, all of which are subject to change. All

statements, other than statements of present or historical fact

included in this communication, about our plans, strategies and

prospects, both business and financial, are forward-looking

statements. Any statements that refer to projections, forecasts or

other characterizations of future events or circumstances,

including any underlying assumptions, are forward-looking

statements. In some cases, you can identify forward-looking

statements by terminology such as “may,” “should,” “could,”

“would,” “expect,” “plan,” “anticipate,” “intend,” “believe,”

“estimate,” “continue,” “goal,” “project” or the negative of such

terms or other similar expressions. Moreover, the absence of these

words does not mean that a statement is not forward-looking. The

forward-looking statements in this communication include statements

regarding the transaction and the ability to consummate the

transaction. Forward-looking statements speak only as of the date

they are made, and Doma undertakes no obligation to update any of

them publicly in light of new information or future events. Actual

results could differ materially from those contained in any

forward-looking statement as a result of various factors,

including, without limitation: (i) the completion of the proposed

transaction on anticipated terms and timing, including obtaining

required stockholder and regulatory approvals, anticipated tax

treatment, unforeseen liabilities, future capital expenditures,

revenues, expenses, earnings, synergies, economic performance,

indebtedness, financial condition, losses, future prospects,

business and management strategies for the management, expansion

and growth of Doma’s business and other conditions to the

completion of the transaction; (ii) conditions to the closing of

the transaction may not be satisfied; (iii) the transaction may

involve unexpected costs, liabilities or delays; (iv) the outcome

of any legal proceedings related to the transaction; (v) the

occurrence of any event, change, or other circumstance or condition

that could give rise to the termination of the merger agreement,

including in circumstances requiring Doma to pay a termination fee;

(vi) Doma’s ability to implement its business strategy; (vii)

significant transaction costs associated with the proposed

transaction; (viii) potential litigation relating to the proposed

transaction; (ix) the risk that disruptions from the proposed

transaction will harm Doma’s business, including current plans and

operations; (x) the ability of Doma to retain and hire key

personnel; (xi) potential adverse reactions or changes to business

relationships resulting from the announcement or completion of the

proposed transaction; (xii) legislative, regulatory and economic

developments affecting Doma’s business; (xiii) general economic,

technology, residential housing and market developments and

conditions, including federal monetary policy, interest rates,

inflation, home price fluctuations, housing inventory, labor

shortages and supply chain issues; (xiv) the evolving legal,

regulatory and tax regimes under which Doma operates; (xv)

potential business uncertainty, including changes to existing

business relationships, during the pendency of the merger that

could affect Doma’s financial performance; (xvi) restrictions

during the pendency of the proposed transaction that may impact

Doma’s ability to pursue certain business opportunities or

strategic transactions; and (xvii) unpredictability and severity of

catastrophic events, including, but not limited to, acts of

terrorism or outbreak of war or hostilities, as well as Doma’s

response to any of the aforementioned factors. While the list of

factors presented here is considered representative, such list

should not be considered to be a complete statement of all

potential risks and uncertainties. Unlisted factors may present

significant additional obstacles to the realization of

forward-looking statements. Consequences of material differences in

results as compared with those anticipated in the forward-looking

statements could include, among other things, business disruption,

operational problems, financial loss, legal liability to third

parties and similar risks, any of which could have a material

adverse effect on Doma’s financial condition, results of

operations, or liquidity. Doma does not assume any obligation to

publicly provide revisions or updates to any forward-looking

statements, whether as a result of new information, future

developments or otherwise, should circumstances change, except as

otherwise required by securities and other applicable laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240328798413/en/

Investor Contact: Dave DeHorn | Chief Strategy Officer

and Interim Head of Investor Relations for Doma | ir@doma.com

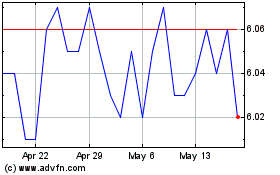

Doma (NYSE:DOMA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Doma (NYSE:DOMA)

Historical Stock Chart

From Jan 2024 to Jan 2025