Okeanis Eco Tankers Corp. – New Financing Update

21 June 2024 - 6:10AM

Okeanis Eco Tankers Corp. (“we”, the “Company”, “OET” or “Okeanis”)

(NYSE:ECO / OSE:OET) is pleased to announce the following financing

update relating to its fleet.

On June 20, 2024, we entered into a new $31.11

million senior secured credit facility to finance the option to

purchase back the Suezmax vessel Poliegos from its current sale and

leaseback financier (the “Poliegos New Facility”). The Poliegos New

Facility is provided by Bank SinoPac Co., Ltd, and the transaction

is expected to close in July 2024. The Poliegos New Facility

contains an interest rate of Term SOFR plus 160 basis points,

matures in six years, and will be repaid in quarterly instalments

of approximately $0.78 million each, together with a balloon

instalment of approximately $12.44 million payable at maturity. The

Poliegos New Facility is secured by, among other things, security

over the Poliegos, and is guaranteed by the Company.

Iraklis Sbarounis, CFO of the Company,

commented:

“We are very pleased to announce this

transaction that marks an important milestone in our continuous

efforts to improve our capital structure, with a significant

reduction in pricing compared to the vessel’s previous sale and

leaseback financing.

We have strategically targeted setting foot in

this new financing market and are satisfied to enter into our first

transaction. We believe it may open new opportunities for us in the

future, and adds diversity and flexibility to our debt financing

options, especially considering the challenges that may start

affecting part of the more traditional ship financing markets due

to the implementation of the Basel IV banking reforms. We have

strong relationships with and access to multiple Asian financing

markets that we believe tactically and effectively complement our

mix of financiers.

Since June 2023, we have refinanced our entire

fleet, except for our two VLCC vessels that are financed through

sale and leaseback facilities and whose purchase options are not

initially exercisable by us until the first half of 2026. With

respect to the remaining twelve vessels that have been refinanced,

we have significantly improved pricing, extended maturities, added

flexibility, and accessed new financing markets. Indicatively (and

also taking into account the transition of the benchmark interest

rate from LIBOR to SOFR in 2023), we have reduced the applicable

pricing on our banking debt on these vessels (the principal of

which is more than $550 million), on a weighted basis, by

approximately 125 basis points. Furthermore, we have extended

maturities staggered between 2028 and 2031.

We look forward to continuing working with our

financiers to source the best refinancing options for the Nissos

Rhenia and the Nissos Despotiko in 2026, or if the opportunity

arises for other accretive deals.”

Contacts

Company:

Iraklis Sbarounis, CFO Tel: +30 210 480 4200

ir@okeanisecotankers.com

Investor Relations / Media

Contact:

Nicolas Bornozis, PresidentCapital Link, Inc.230 Park Avenue,

Suite 1540, New York, N.Y. 10169Tel: +1 (212)

661-7566okeanisecotankers@capitallink.com

This information is subject to the disclosure

requirements pursuant to Section 5-12 of the Norwegian Securities

Trading Act.

About OET

OET is a leading international tanker company

providing seaborne transportation of crude oil and refined

products. The Company was incorporated on April 30, 2018 under the

laws of the Republic of the Marshall Islands and is listed on Oslo

Børs under the symbol OET and the New York Stock Exchange under the

symbol ECO. The sailing fleet consists of six modern

scrubber-fitted Suezmax tankers and eight modern scrubber-fitted

VLCC tankers.

Forward-Looking Statements

This communication contains “forward-looking

statements”, including as defined under U.S. federal securities

laws. Forward-looking statements provide the Company’s current

expectations or forecasts of future events. Forward-looking

statements include statements about the Company’s expectations,

beliefs, plans, objectives, intentions, assumptions and other

statements that are not historical facts or that are not present

facts or conditions. Words or phrases such as “anticipate,”

“believe,” “continue,” “estimate,” “expect,” “hope,” “intend,”

“may,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“should,” “will” or similar words or phrases, or the negatives of

those words or phrases, may identify forward-looking statements,

but the absence of these words does not necessarily mean that a

statement is not forward-looking. Forward-looking statements are

subject to known and unknown risks and uncertainties and are based

on potentially inaccurate assumptions that could cause actual

results to differ materially from those expected or implied by the

forward-looking statements. The Company’s actual results could

differ materially from those anticipated in forward-looking

statements for many reasons, including as described in the

Company’s filings with the U.S. Securities and Exchange Commission.

Accordingly, you should not unduly rely on these forward-looking

statements, which speak only as of the date of this communication.

Factors that could cause actual results to differ materially

include, but are not limited to, the Company's operating or

financial results; the Company's liquidity, including its ability

to service its indebtedness; competitive factors in the market in

which the Company operates; shipping industry trends, including

charter rates, vessel values and factors affecting vessel supply

and demand; future, pending or recent acquisitions and

dispositions, business strategy, areas of possible expansion or

contraction, and expected capital spending or operating expenses;

risks associated with operations; broader market impacts arising

from war (or threatened war) or international hostilities; risks

associated with pandemics (including COVID-19), including effects

on demand for oil and other products transported by tankers and the

transportation thereof; and other factors listed from time to time

in the Company's filings with the U.S. Securities and Exchange

Commission. Except to the extent required by law, the Company

expressly disclaims any obligations or undertaking to release

publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in the Company's

expectations with respect thereto or any change in events,

conditions or circumstances on which any statement is based. You

should, however, review the factors and risks the Company describes

in the reports it files and furnishes from time to time with the

U.S. Securities and Exchange Commission, which can be obtained free

of charge on the U.S. Securities and Exchange Commission’s website

at www.sec.gov.

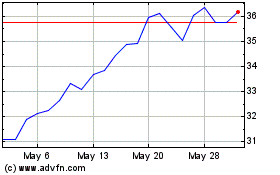

Okeanis Eco Tankers (NYSE:ECO)

Historical Stock Chart

From May 2024 to Jun 2024

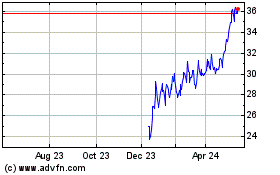

Okeanis Eco Tankers (NYSE:ECO)

Historical Stock Chart

From Jun 2023 to Jun 2024