UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

Emerson Electric Co.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Missouri | 1-278 | 43-0259330 |

---------------------------------

(State or Other Jurisdiction of Incorporation) |

(Commission | ---------------------------

(I.R.S. Employer Identification Number) |

| File Number) | |

| | | | | | | | | | | |

| 8000 West Florissant Avenue | | |

| St. Louis, | Missouri | | 63136 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | | | | | | | | | |

| Michael Tang |

| Senior Vice President, Secretary and Chief Legal Officer |

| (314) 553-2000 |

(Name and Telephone Number, Including Area Code, of the

Person to Contact in Connection with this Report.)

|

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

| | | | | | | | |

☒ | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023. |

Section 1 - Conflict Minerals Disclosure

Item 1.01 and 1.02 Conflict Minerals Disclosure and Report, Exhibit

This Form SD is filed by Emerson Electric Co. (the “Company”) pursuant to Rule 13p-1 promulgated under the Securities Exchange Act, as amended, for the reporting period January 1, 2023 to December 31, 2023.

A copy of the Company’s Conflict Minerals Report is provided as Exhibit 1.01 to this Form SD and incorporated by reference herein. The Company’s Conflict Minerals Report is available on the Company’s website at www.emerson.com/Investors/investor-resources/sec-filings. Information on our website does not constitute part of this document.

Section 2 - Exhibits

Item 2.01 Exhibits

The following exhibit is filed with this Form SD:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| | | | | | | | |

| Emerson Electric Co. | |

| By: | /s/ Michael Tang | |

| By: Michael Tang |

| Senior Vice President, Secretary and Chief Legal Officer |

Dated: May 31, 2024

Emerson Electric Co.

Conflict Minerals Report

For The Year Ended December 31, 2023

1. Overview

This report has been prepared by Emerson Electric Co. (“Emerson,” the “Company,” “we,” “us,” or “our”) pursuant to Rule 13p-1 (the “Rule”) promulgated under the Securities Exchange Act of 1934, as amended. The Rule relates to the disclosure of certain information relating to “conflict minerals”, which are defined in the Rule as gold, columbite-tantalite (coltan), cassiterite and wolframite, and their derivatives of tantalum, tin and tungsten (referred to in this report as “3TG”). Capitalized terms used in this report are those defined in the Rule except as otherwise stated.

Product Descriptions

The Company sells products and solutions that support customers in a variety of end markets, including process industries (such as chemical, power & renewables and energy), hybrid industries (life sciences, metals & mining, food & beverage, pulp & paper, and others), discrete industries (including automotive, medical, packaging and semiconductor) and more.

The Final Control segment is a leading global provider of control valves, isolation valves, shutoff valves, pressure relief valves, pressure safety valves, actuators, and regulators for process and hybrid industries. These solutions respond to commands from a control system to continuously and precisely control and regulate the flow of liquids or gases to achieve safe operation along with reliability and optimized performance.

The Measurement & Analytical segment is a leading supplier of intelligent instrumentation measuring the physical properties of liquids or gases, such as pressure, temperature, level, flow, acoustics, corrosion, pH, conductivity, water quality, toxic gases, and flame. The instrumentation transfers data to control systems and automation software allowing process and hybrid industry operators to make educated decisions regarding production, reliability and safety.

The Discrete Automation segment includes solenoid valves, pneumatic valves, valve position indicators, pneumatic cylinders and actuators, air preparation equipment, pressure and temperature switches, electric linear motion solutions, programmable automation control systems and software, electrical distribution equipment, and materials joining solutions used primarily in discrete industries.

The Safety & Productivity segment offers tools for professionals and homeowners that promote safety and productivity. Pipe-working tools include pipe wrenches, pipe cutters, pipe threading and roll grooving equipment, battery hydraulic tools for press connections, drain cleaners, tubing tools and diagnostic systems, including sewer inspection cameras and locating equipment. Electrical tools include conduit benders and cable pulling equipment, battery hydraulic tools for cutting and crimping electrical cable, and hole-making equipment. Other professional tools include water jetters, wet-dry vacuums, commercial vacuums and hand tools.

The Control Systems & Software segment provides control systems and software that control plant processes by collecting and analyzing information from measurement devices in the plant and using that information to adjust valves, pumps, motors, drives and other control hardware for maximum product quality, process efficiency and safety. These solutions include distributed control systems, safety instrumented systems, SCADA systems, application software, digital twins, asset performance management and cybersecurity. Control Systems & Software solutions are predominantly used by process and hybrid manufacturers.

The AspenTech segment provides asset optimization software that enables industrial manufacturers to design, operate and maintain their operations for a maximum performance. AspenTech combines decades of modeling, simulation, and optimization capabilities with industrial operations expertise and applies advanced analytics to improve the profitability and sustainability of production assets. The purpose-built software drives value for customers by improving operational efficiency and maximizing productivity, reducing unplanned downtime and safety risks, and minimizing energy consumption and

emissions. The Company owns 56 percent of the outstanding shares of AspenTech common stock (on a fully diluted basis).

The Test & Measurement segment is composed of the business of National Instruments Corporation (“NI”), which was acquired by Emerson on 11 October 2023 and therefore included in this Conflict Minerals Report for the first time for the 2023 calendar year. This segment provides software-connected automated test and measurement systems that enable enterprises to bring products to market faster and at a lower cost. The Test & Measurement platform spans the full range of customer needs including modular instrumentation, data acquisition and control solutions, and general-purpose development software.

The Company’s sales by geographic destination in 2023 were: Americas, 51 percent; Asia, Middle East & Africa, 30 percent (China, 12 percent); and, Europe, 19 percent.

Conflict Minerals Policy Statement

Emerson’s conflict minerals policy statement is publicly available on our website at www.emerson.com. Information on our website does not constitute part of this document.

Brief Description of Supply Chain

The products that we manufacture are typically highly engineered, complex and contain thousands of parts from a vast network of direct suppliers around the world. There are generally multiple tiers of suppliers between the 3TG mines, smelters, and our direct suppliers. As a downstream purchaser, we are limited to relying on our direct suppliers to work with their upstream suppliers to provide us with accurate information about the origin of 3TG in the components, parts, or assemblies we purchase. Most of our supplier purchase contracts contain terms of years, but we include when possible new contract terms with flow-down requirements that compel our suppliers to support our due diligence efforts with respect to 3TG content.

2. Reasonable Country of Origin Inquiry

We conducted a risk-based engineering analysis of all of the products we manufacture or contract to manufacture to identify all direct suppliers providing us with items known to contain, or with a high probability of containing, 3TG. We then requested all of our identified direct 3TG suppliers to provide information to us regarding their 3TG content and smelters using the template developed by the Responsible Business Alliance® (RBA®) and The Global e-Sustainability Initiative (GeSI), known as the RBA-GeSI Conflict Minerals Reporting Template (the “Template”). The Template was developed to facilitate disclosure and communication of information regarding smelters and refiners that provide material to a manufacturer’s supply chain. It includes questions regarding a direct supplier’s conflict-free policy, its due diligence process, and information about its supply chain such as the names and locations of smelters and refiners as well as the origin of 3TG used by those facilities. Our supplier outreach efforts also included web-based training opportunities and escalation procedures for non-responding suppliers.

Based on this reasonable country of origin inquiry, we concluded that we do not have sufficient reason to believe 3TG materials in our supply chain did not originate in a Covered Country or were from recycled or scrap sources. Accordingly, the Company further pursued its supply chain inquiry and conducted due diligence on that supply chain as required by the Rule. There was significant overlap between our reasonable country of origin inquiry efforts and our due diligence efforts, described below.

3. Due Diligence

Our due diligence measures have been designed to conform, in all material respects, with the due diligence framework presented by The Organisation for Economic Co-operation and Development (“OECD”) in the publication OECD (2013) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas: Second Edition, OECD Publishing (“OECD Guidance”) and the related Supplements for gold and for tin, tantalum and tungsten, including the Final Downstream Report on one-year pilot implementation of the Supplement on Tin, Tantalum and Tungsten.

OECD Step 1: MANAGEMENT SYSTEMS

Vendor Expectations

We have adopted a conflict minerals policy statement related to our sourcing of 3TG and expect all our suppliers to comply with that policy statement. In addition, our standard procurement contracts require compliance with all applicable legal requirements and Emerson’s Supplier Code of Conduct which is also available on our website indicated above.

Internal Team

We have established a management system to support supply chain due diligence related to 3TG. Our management system includes an attorney who oversees a team that coordinates communication and follow up with suppliers as well as representatives from each of our businesses, supply chain, engineering, law, and internal audit. Together, this team is responsible for implementing our Conflict Minerals compliance strategy.

Control Systems

Together with other major manufacturers, we are members of the Responsible Minerals Initiative (“RMI”) that is working to develop conflict-free supply chains. We have established a records retention policy with respect to relevant documents. We continue to support the development of a common Template to better allow for digital information-sharing systems.

Grievance Mechanism

Employees and third parties may report a concern related to business conduct issues, including concerns related to conflict minerals, at the following website: https://www.tnwgrc.com/emerson/ Alternatively, any employee or third party may contact the Board of Directors or any of its Committees directly by writing to the Corporate Secretary at: Emerson Electric Co. Board of Directors, c/o Corporate Secretary, 8000 W. Florissant Avenue, St. Louis, Missouri, 63136, USA.

Supplier Engagement

We maintain a database of all our 3TG suppliers and a record of their responses to our 3TG inquiries. This information allows us to monitor the progress of our 3TG suppliers in providing 3TG information and whether that progress is consistent with our values and policies, the OECD Guidance, the Rule, and applicable laws.

OECD Step 2: IDENTIFY AND ASSESS RISK IN THE SUPPLY CHAIN

Survey Responses

Where responses were received from our suppliers, they were provided using the Template as well as other forms. We reviewed the results to determine which required further engagement. The criteria included non-responses, incomplete responses as well as inconsistencies within the data reported by those suppliers. We then engaged with as many of those suppliers as possible, seeking responses, additional information or clarifications as needed. We conducted multiple rounds of inquiries.

A portion of our responding suppliers provided a list of smelters they used to process 3TG content contained in the components supplied to their customers. These responses were provided primarily on a company-wide basis and included the names of facilities listed by our suppliers as smelters or refiners. It was not possible to identify smelters by products with certainty. Where the smelter identification number was provided, we verified that the facility was listed on the RMI smelter list included in the Template. We notified in writing those suppliers where the smelter identification number provided was not listed on the RMI smelter list. We flagged those facilities not certified “conflict free” under the Responsible Minerals Assurance Process (“RMAP”) and asked those facilities to participate in the RMAP.

Efforts to Determine Mine or Location of Origin

We believe that requesting our direct suppliers to complete the Template and cross-checking to the RMAP database of conflict free smelters represents the best reasonable means to attempt to determine the mines or locations of origin of 3TG in our supply chain. We have reached this conclusion based on the recommendations resulting from the OECD Final Downstream Report on one-year pilot implementation of the Supplement on Tin, Tantalum and Tungsten.

As outlined in the OECD Guidance, we support an industry initiative that audits smelters’ and refiners’ due diligence activities. That industry initiative is the RBA and GeSI’s Responsible Minerals Initiative. The data on which we relied for certain statements in this declaration were obtained through our membership in the RMI, RBA Unique Code: EMRS.

OECD Step 3: DESIGN AND IMPLEMENT A STRATEGY TO RESPOND TO RISKS

| | | | | | | | | | | | | | |

• | We have adopted and implemented a risk management plan that outlines the Company’s responses to identified 3TG risks described above. |

• | Senior management is briefed about our due diligence efforts on a regular basis. |

• | We have established a conflict minerals program. |

• | For this reporting period, to date, we are not aware of any instance where it was necessary to temporarily suspend trade or disengage with a supplier under our conflicts minerals policy. |

• | We engage in regular ongoing risk assessment through our suppliers’ annual data submissions, publicly available information and, where appropriate, targeted follow-up activities, as well as ongoing supplier engagement. |

OECD Step 4: CARRY OUT INDEPENDENT THIRD PARTY AUDIT OF SMELTER/REFINER’S DUE DILIGENCE PRACTICES

We do not typically have direct relationships with 3TG smelters and refiners and therefore do not perform audits of these entities. We support audits conducted by third parties through participation in the RMI.

OECD Step 5: REPORT ON SUPPLY CHAIN DUE DILIGENCE

This Conflict Minerals Report constitutes our annual report on our 3TG due diligence, is available on our website at www.emerson.com and is filed with the SEC. Information on our website does not constitute part of this document.

4. Steps to be taken to mitigate risk

We intend to continue to take the following steps to improve the due diligence conducted to further mitigate the risk that the 3TG in our products finance or benefit armed groups in the Covered Countries:

•Continue to include a conflict minerals flow-down clause in new or renewed supplier contracts;

•Continue to increase our focus on suppliers representing the highest risk of providing products containing 3TG;

•Continue to engage directly with suppliers and provide them information and training resources to attempt to increase the response rates and improve the content of the supplier survey responses;

•Continue to engage with and review our relationships with suppliers not cooperating with our due diligence efforts or found to be providing us with components or materials containing 3TG from sources that support conflict in the Covered Countries, and take action, where necessary or appropriate, to comply with our conflict minerals statement;

•Continue to participate in the Responsible Minerals Initiative in order to increase the number of smelters and refiners participating in the Responsible Minerals Assurance Process; and

•Continue to apply the principles and use the framework provided by the OECD and continue working with our suppliers, and relevant trade associations to define and improve best practices and encourage responsible sourcing of 3TG.

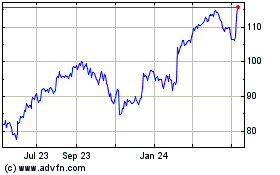

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From May 2024 to Jun 2024

Emerson Electric (NYSE:EMR)

Historical Stock Chart

From Jun 2023 to Jun 2024