- Third Quarter Net Income per Share of $0.29

and AFFO per Share of $0.42 -

- Closed Investments of $213.3 million at a

7.6% Weighted Average Cash Cap Rate -

- Issues 2024 AFFO Guidance of $1.71 to $1.75

per Share -

- Increases Bottom End of Range for 2023 AFFO

Guidance to $1.64 to $1.65 per Share -

Essential Properties Realty Trust, Inc. (NYSE: EPRT; “Essential

Properties” or the “Company”) today announced operating results for

the three and nine months ended September 30, 2023.

Third Quarter 2023 Financial and Operating

Highlights:

Operating Results (compared to Third

Quarter 2022):

- Investments (65 properties)

$ Invested

$213.3 million

Weighted Avg Cash Cap Rate

7.6%

- Dispositions (10 properties)

Net Proceeds

$28.5 million

Weighted Avg Cash Cap Rate

6.5%

Increased by 12%

$0.29

- Funds from Operations ("FFO") per Share

Increased by 18%

$0.45

- Core Funds from Operations ("Core FFO") per Share

Increased by 18%

$0.45

- Adjusted Funds from Operations ("AFFO") per Share

Increased by 11%

$0.42

Debt & Equity Activity:

- New $450mm 2029 Term Loan w/ Delayed Draw Feature

Amount drawn at Sept. 30,

2023

$375.0 million

- Equity Raised (Gross) - Follow-On Offering (Sept. 2023)(1)

$23.00/share

$276.1 million

- Equity Raised (Gross) - ATM Program(1)

$24.17/share

$10.7 million

- All shares were sold on a forward basis and are currently

unsettled.

Year to Date 2023 Financial and Operating Highlights:

Operating Results (compared to YTD Third

Quarter 2022):

- Investments (200 properties)

$ Invested

$697.8 million

Weighted Avg Cash Cap Rate

7.5%

- Dispositions (43 properties)

Net Proceeds

$107.4 million

Weighted Avg Cash Cap Rate

6.2%

Increased by 27%

$0.94

Increased by 12%

$1.31

Increased by 10%

$1.31

Increased by 7%

$1.23

Debt & Equity Activity:

- Equity Raised (Gross) - Follow-On Offerings

$24.60/share

$493.9 million

- Equity Raised (Gross) - ATM Program

$24.37/share

$97.3 million

Highlights Subsequent to Third Quarter 2023:

- Investments (12 properties)

$ Invested

$49.7 million

- Dispositions (1 property)

$ Gross Proceeds

$5.1 million

CEO Comments

Commenting on the third quarter 2023 results, the Company's

President and Chief Executive Officer, Pete Mavoides, said, “We are

pleased to report strong third quarter results, which were

highlighted by continued healthy tenant trends, solid investment

activity, and timely capital market executions. With quarter-end

pro forma leverage of 3.7x and nearly $1 billion of available

liquidity, our balance sheet is well-positioned to capitalize on

accretive investment opportunities in a marketplace characterized

by increasing pricing power for our capital. Our newly issued AFFO

per share guidance for 2024 assumes continued balance sheet

discipline and a measured pace of investment activity.”

Portfolio Highlights

The Company’s investment portfolio as of September 30, 2023 is

summarized as follows:

Number of properties

1,793

Weighted average lease term (WALT)

13.9 years

Weighted average rent coverage ratio

4.0x

Number of tenants

363

Number of concepts (i.e., brands)

584

Number of industries

16

Number of states

48

Weighted average occupancy

99.8%

Total square feet of rentable space

17,798,241

Cash ABR - service-oriented or

experience-based

92.8%

Cash ABR - properties subject to master

lease

65.1%

Portfolio Update

Investments

The Company’s investment activity during the three and nine

months ended September 30, 2023 is summarized as follows:

Quarter Ended September

30, 2023

Year to Date September

30, 2023

Investments:

Investment volume

$213.3 million

$697.8 million

Number of transactions

30

83

Property count

65

200

Weighted average cash / GAAP cap rate

7.6%/8.7%

7.5%/8.8%

Weighted average lease escalation

2.0%

2.0%

% Subject to master lease

60%

66%

% Sale-leaseback transactions

100%

100%

% Existing relationship

86%

80%

% Required financial reporting

(tenant/guarantor)

100%

100%

WALT

17.6 years

18.7 years

Dispositions

The Company’s disposition activity during the three and nine

months ended September 30, 2023 is summarized as follows:

Quarter Ended September

30, 2023

Year to Date September

30, 2023

Dispositions:

Net proceeds

$28.5 million

$107.4 million

Number of properties sold

10

43

Net gain / (loss)

$1.9 million

$19.3 million

Weighted average cash cap rate (excluding

vacant properties and sales subject to a tenant purchase option

)

6.5%

6.2%

Loan Repayments

Loan repayments to the Company during the three and nine months

ended September 30, 2023 are summarized as follows:

Quarter Ended September

30, 2023

Year to Date September

30, 2023

Loan Repayments:

Proceeds—Principal

$3.7 million

$22.4 million

Proceeds—Prepayment penalties

$37 thousand

$0.2 million

Number of properties

4

16

Weighted average cash cap rate

7.1%

7.2%

Leverage and Balance Sheet and Liquidity

The Company's leverage, balance sheet and liquidity are

summarized in the following table.

September 30, 2023

Pro Forma September 30,

2023

Leverage:

Net debt to Annualized Adjusted

EBITDAre

4.5x

3.7x

Balance Sheet and Liquidity:

Cash and cash equivalents and restricted

cash

$42.0 million

$389.6 million

Unused revolving credit facility

capacity

$600.0 million

$600.0 million

2029 Term Loan - remaining availability

(1)

$75.0 million

$—

Forward equity sales - unsettled

$272.6 million

$—

Total available liquidity

$989.6 million

$989.6 million

ATM Program:

2022 ATM Program initial availability

$500.0 million

Aggregate gross sales under the 2022 ATM

Program

$172.7 million

Availability remaining under the 2022 ATM

Program

$327.3 million

Average price per share of gross sales

since inception in May 2022

$23.33

- In October 2023, the Company drew the remaining $75.0 million

available under its $450.0 million 2029 Term Loan and entered into

interest rate swaps to fix the interest rate on all of the $450.0

million of principal through maturity in February 2029.

Guidance

2024 Guidance

The Company currently expects 2024 AFFO per share on a fully

diluted basis to be within a range of $1.71 to $1.75.

2023 Guidance

The Company is updating its range for expected 2023 AFFO per

share on a fully diluted basis to $1.64 to $1.65 from its

previously announced range of $1.62 to $1.65.

Note: The Company does not provide guidance for the most

comparable GAAP financial measure, net income, or a reconciliation

of the forward-looking non-GAAP financial measure of AFFO to net

income computed in accordance with GAAP, because it is unable to

reasonably predict, without unreasonable efforts, certain items

that would be contained in the GAAP measure, including items that

are not indicative of the Company's ongoing operations, such as,

without limitation, potential impairments of real estate assets,

net gain/loss on dispositions of real estate assets, changes in

allowance for credit losses and stock-based compensation expense.

These items are uncertain, depend on various factors, and could

have a material impact on the Company's GAAP results for the

guidance period.

Dividend Information

As previously announced, on September 7, 2023, Essential

Properties' board of directors declared a cash dividend of $0.28

per share of common stock for the quarter ended September 30, 2023.

The dividend was paid on October 13, 2023 to stockholders of record

as of the close of business on September 29, 2023.

Conference Call Information

In conjunction with the release of Essential Properties’

operating results, the Company will host a conference call on

Thursday, October 26, 2023 at 10:00 a.m. EDT to discuss the

results. To access the conference, dial 877-407-9208

(International: 201-493-6784). A live webcast will also be

available in listen-only mode by clicking on the webcast link in

the Investor Relations section at

www.essentialproperties.com.

A telephone replay of the conference call can also be accessed

by calling 844-512-2921 (International: 412-317-6671) and entering

the access code: 13741522. The telephone replay will be available

through November 9, 2023.

A replay of the conference call webcast will be available on our

website approximately two hours after the conclusion of the live

broadcast. The webcast replay will be available for 90 days. No

access code is required for this replay.

Supplemental Materials

The Company’s Supplemental Operating & Financial Data—Third

Quarter Ended September 30, 2023 is available on Essential

Properties’ website at investors.essentialproperties.com.

About Essential Properties Realty Trust, Inc.

Essential Properties Realty Trust, Inc. is an internally managed

REIT that acquires, owns and manages primarily single- tenant

properties that are net leased on a long-term basis to companies

operating service-oriented or experience-based businesses. As of

September 30, 2023, the Company’s portfolio consisted of 1,793

freestanding net lease properties with a weighted average lease

term of 13.9 years and a weighted average rent coverage ratio of

4.0x. In addition, as of September 30, 2023, the Company’s

portfolio was 99.8% leased to 363 tenants operating 584 different

concepts in 16 industries across 48 states.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. When used in this press

release, the words “estimate,” “anticipate,” “expect,”

“believe,”“intend,” “may,” “will,” “should,” “seek,”

“approximately” or “plan,” or the negative of these words and

phrases or similar words or phrases that are predictions of or

indicate future events or trends and that do not relate solely to

historical matters are intended to identify forward-looking

statements. You can also identify forward-looking statements by

discussions of strategy, plans or intentions of management.

Forward-looking statements involve numerous risks and uncertainties

and you should not rely on them as predictions of future events.

Forward-looking statements depend on assumptions, data or methods

that may be incorrect or imprecise and the Company may not be able

to realize them. The Company does not guarantee that the

transactions and events described will happen as described (or that

they will happen at all). You are cautioned not to place undue

reliance on forward-looking statements, which speak only as of the

date of this press release. While forward-looking statements

reflect the Company’s good faith beliefs, they are not guarantees

of future performance. The Company undertakes no obligation to

publicly release the results of any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date of this press release or to reflect

the occurrence of unanticipated events, except as required by law.

In light of these risks and uncertainties, the forward-looking

events discussed in this press release might not occur as

described, or at all.

Additional information concerning factors that could cause

actual results to differ materially from these forward-looking

statements is contained in the company’s Securities and Exchange

Commission (the "Commission”) filings, including, but not limited

to, the Company’s most recent Annual Report on Form 10-K and

subsequent Quarterly Reports on Form 10-Q. Copies of each filing

may be obtained from the Company or the Commission. Such

forward-looking statements should be regarded solely as reflections

of the Company’s current operating plans and estimates. Actual

operating results may differ materially from what is expressed or

forecast in this press release.

The results reported in this press release are preliminary and

not final. There can be no assurance that these results will not

vary from the final results reported in the Company’s Quarterly

Report on Form 10-Q for the quarter ended September 30, 2023 that

it will file with the Commission.

Non-GAAP Financial Measures and Certain Definitions

The Company’s reported results are presented in accordance with

GAAP. The Company also discloses the following non-GAAP financial

measures: FFO, Core FFO, AFFO, earnings before interest, taxes,

depreciation and amortization (“EBITDA”), EBITDA further adjusted

to exclude gains (or losses) on sales of depreciable property and

real estate impairment losses (“EBITDAre”), adjusted EBITDAre,

annualized adjusted EBITDAre, net debt, net operating income

(“NOI”) and cash NOI (“Cash NOI”). The Company believes these

non-GAAP financial measures are industry measures used by analysts

and investors to compare the operating performance of REITs.

FFO, Core FFO and AFFO

The Company computes FFO in accordance with the definition

adopted by the Board of Governors of the National Association of

Real Estate Investment Trusts ("NAREIT"). NAREIT defines FFO as

GAAP net income or loss adjusted to exclude extraordinary items (as

defined by GAAP), net gain or loss from sales of depreciable real

estate assets, impairment write-downs associated with depreciable

real estate assets and real estate-related depreciation and

amortization (excluding amortization of deferred financing costs

and depreciation of non-real estate assets), including the pro rata

share of such adjustments of unconsolidated subsidiaries. FFO is

used by management, and may be useful to investors and analysts, to

facilitate meaningful comparisons of operating performance between

periods and among the Company’s peers primarily because it excludes

the effect of real estate depreciation and amortization and net

gains and losses on sales (which are dependent on historical costs

and implicitly assume that the value of real estate diminishes

predictably over time, rather than fluctuating based on existing

market conditions).

The Company computes Core FFO by adjusting FFO, as defined by

NAREIT, to exclude certain GAAP income and expense amounts that it

believes are infrequent and unusual in nature and/or not related to

its core real estate operations. Exclusion of these items from

similar FFO-type metrics is common within the equity REIT industry,

and management believes that presentation of Core FFO provides

investors with a metric to assist in their evaluation of our

operating performance across multiple periods and in comparison to

the operating performance of our peers, because it removes the

effect of unusual items that are not expected to impact our

operating performance on an ongoing basis.

Core FFO is used by management in evaluating the performance of

our core business operations. Items included in calculating FFO

that may be excluded in calculating Core FFO include certain

transaction related gains, losses, income or expense or other

non-core amounts as they occur.

To derive AFFO, the Company modifies its computation of Core FFO

to include other adjustments to GAAP net income related to certain

items that it believes are not indicative of the Company’s

operating performance, including straight-line rental revenue,

non-cash interest expense, non-cash compensation expense, other

amortization expense, other non-cash charges and capitalized

interest expense. Such items may cause short-term fluctuations in

net income but have no impact on operating cash flows or long-term

operating performance. The Company believes that AFFO is an

additional useful supplemental measure for investors to consider

when assessing the Company’s operating performance without the

distortions created by non-cash items and certain other revenues

and expenses.

FFO, Core FFO and AFFO do not include all items of revenue and

expense included in net income, they do not represent cash

generated from operating activities and they are not necessarily

indicative of cash available to fund cash requirements;

accordingly, they should not be considered alternatives to net

income as a performance measure or cash flows from operations as a

liquidity measure and should be considered in addition to, and not

in lieu of, GAAP financial measures. Additionally, our computation

of FFO, Core FFO and AFFO may differ from the methodology for

calculating these metrics used by other equity REITs and,

therefore, may not be comparable to similarly titled measures

reported by other equity REITs.

EBITDA and EBITDAre

The Company computes EBITDA as earnings before interest, income

taxes and depreciation and amortization. In 2017, NAREIT issued a

white paper recommending that companies that report EBITDA also

report EBITDAre. The Company computes EBITDAre in accordance with

the definition adopted by NAREIT. NAREIT defines EBITDAre as EBITDA

(as defined above) excluding gains (or losses) from the sales of

depreciable property and real estate impairment losses. The Company

presents EBITDA and EBITDAre as they are measures commonly used in

its industry and the Company believes that these measures are

useful to investors and analysts because they provide supplemental

information concerning its operating performance, exclusive of

certain non-cash items and other costs. The Company uses EBITDA and

EBITDAre as measures of its operating performance and not as

measures of liquidity.

EBITDA and EBITDAre do not include all items of revenue and

expense included in net income, they do not represent cash

generated from operating activities and they are not necessarily

indicative of cash available to fund cash requirements;

accordingly, they should not be considered alternatives to net

income as a performance measure or cash flows from operations as a

liquidity measure and should be considered in addition to, and not

in lieu of, GAAP financial measures. Additionally, the Company’s

computation of EBITDA and EBITDAre may differ from the methodology

for calculating these metrics used by other equity REITs and,

therefore, may not be comparable to similarly titled measures

reported by other equity REITs.

Net Debt

The Company calculates its net debt as its gross debt (defined

as total debt plus net deferred financing costs on its secured

borrowings) less cash and cash equivalents and restricted cash

available for future investment. The Company believes excluding

cash and cash equivalents and restricted cash available for future

investment from gross debt, all of which could be used to repay

debt, provides an estimate of the net contractual amount of

borrowed capital to be repaid, which it believes is a beneficial

disclosure to investors and analysts.

NOI and Cash NOI

The Company computes NOI as total revenues less property

expenses. NOI excludes all other items of expense and income

included in the financial statements in calculating net income or

loss. Cash NOI further excludes non-cash items included in total

revenues and property expenses, such as straight-line rental

revenue and other amortization and non-cash charges. The Company

believes NOI and Cash NOI provide useful information because they

reflect only those revenue and expense items that are incurred at

the property level and present such items on an unlevered

basis.

NOI and Cash NOI are not measures of financial performance under

GAAP. You should not consider the Company’s NOI and Cash NOI as

alternatives to net income or cash flows from operating activities

determined in accordance with GAAP. Additionally, the Company’s

computation of NOI and Cash NOI may differ from the methodology for

calculating these metrics used by other equity REITs and,

therefore, may not be comparable to similarly titled measures

reported by other equity REITs.

Adjusted EBITDAre / Adjusted NOI / Adjusted Cash NOI

The Company further adjusts EBITDAre, NOI and Cash NOI i) based

on an estimate calculated as if all investment and disposition

activity that took place during the quarter had occurred on the

first day of the quarter, ii) to exclude certain GAAP income and

expense amounts that the Company believes are infrequent and

unusual in nature and iii) to eliminate the impact of lease

termination or loan prepayment fees and contingent rental revenue

from its tenants which is subject to sales thresholds specified in

the lease. The Company then annualizes these estimates for the

current quarter by multiplying them by four, which it believes

provides a meaningful estimate of the Company’s current run rate

for all investments as of the end of the current quarter. You

should not unduly rely on these measures, as they are based on

assumptions and estimates that may prove to be inaccurate. The

Company’s actual reported EBITDAre, NOI and Cash NOI for future

periods may be significantly less than these estimates of current

run rates.

Cash ABR

Cash ABR means annualized contractually specified cash base rent

in effect as of the end of the current quarter for all of the

Company’s leases (including those accounted for as direct financing

leases) commenced as of that date and annualized cash interest on

its mortgage loans receivable as of that date.

Cash Cap Rate

Cash Cap Rate means annualized contractually specified cash base

rent for the first full month after investment or disposition

divided by the purchase or sale price, as applicable, for the

property.

GAAP Cap Rate

GAAP Cap Rate means annualized rental income computed in

accordance with GAAP for the first full month after investment

divided by the purchase price, as applicable, for the property.

Rent Coverage Ratio

Rent coverage ratio means the ratio of tenant-reported or, when

unavailable, management’s estimate based on tenant-reported

financial information, annual EBITDA and cash rent attributable to

the leased property (or properties, in the case of a master lease)

to the annualized base rental obligation as of a specified

date.

Essential Properties Realty

Trust, Inc. Consolidated Statements of Operations

Three months ended September

30,

Nine months ended September

30,

(in thousands, except share and per

share data)

2023

2022

2023

2022

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Revenues:

Rental revenue1,2

$

86,969

$

66,525

$

246,960

$

199,726

Interest on loans and direct financing

lease receivables

4,568

3,719

13,548

11,490

Other revenue

120

419

1,353

1,014

Total revenues

91,657

70,663

261,861

212,230

Expenses:

General and administrative

7,174

7,868

23,343

22,956

Property expenses3

1,359

830

3,346

2,668

Depreciation and amortization

26,212

22,054

74,779

64,441

Provision for impairment of real

estate

165

349

1,645

10,541

Change in provision for credit losses

(63

)

(30

)

(85

)

136

Total expenses

34,847

31,071

103,028

100,742

Other operating income:

Gain on dispositions of real estate,

net

1,859

6,329

19,320

18,082

Income from operations

58,669

45,921

178,153

129,570

Other (expense)/income:

Loss on debt extinguishment4

(116

)

—

(116

)

(2,138

)

Interest expense

(12,633

)

(9,892

)

(36,837

)

(28,242

)

Interest income

330

752

1,416

800

Income before income tax

expense

46,250

36,781

142,616

99,990

Income tax expense

162

190

472

769

Net income

46,088

36,591

142,144

99,221

Net income attributable to non-controlling

interests

(174

)

(163

)

(532

)

(441

)

Net income attributable to

stockholders

$

45,914

$

36,428

$

141,612

$

98,780

Basic weighted-average shares

outstanding

155,917,176

139,068,188

150,314,073

132,438,157

Basic net income per share

$

0.29

$

0.26

$

0.94

$

0.74

Diluted weighted-average shares

outstanding

157,182,984

139,890,693

151,609,426

133,321,987

Diluted net income per share

$

0.29

$

0.26

$

0.94

$

0.74

- Includes contingent rent (based on a percentage of the tenant's

gross sales at the leased property) of $198, $210, $518 and $526

for the three and nine months ended September 30, 2023 and 2022,

respectively.

- Includes reimbursable income from the Company’s tenants of

$820, $530, $2,161 and $1,584 for the three and nine months ended

September 30, 2023 and 2022, respectively.

- Includes reimbursable expenses from the Company’s tenants of

$820, $530, $2,161 and $1,584 for the three and nine months ended

September 30, 2023 and 2022, respectively.

- During the nine months ended September 30, 2022, includes debt

extinguishment costs associated with the Company's restructuring of

its credit and term loan facilities.

Essential Properties Realty

Trust, Inc. Consolidated Balance Sheets

(in thousands, expect share and per

share amounts)

September 30, 2023

December 31, 2022

(Unaudited)

(Audited)

ASSETS

Investments:

Real estate investments, at cost:

Land and improvements

$

1,431,441

$

1,228,687

Building and improvements

2,798,181

2,440,630

Lease incentive

16,894

18,352

Construction in progress

69,113

34,537

Intangible lease assets

87,849

88,364

Total real estate investments, at cost

4,403,478

3,810,570

Less: accumulated depreciation and

amortization

(343,637

)

(276,307

)

Total real estate investments, net

4,059,841

3,534,263

Loans and direct financing lease

receivables, net

227,114

240,035

Real estate investments held for sale,

net

3,539

4,780

Net investments

4,290,494

3,779,078

Cash and cash equivalents

36,106

62,345

Restricted cash

5,912

9,155

Straight-line rent receivable, net

98,620

78,587

Derivative assets

54,314

47,877

Rent receivables, prepaid expenses and

other assets, net

26,735

22,991

Total assets

$

4,512,181

$

4,000,033

LIABILITIES AND EQUITY

Unsecured term loans, net of deferred

financing costs

$

1,197,155

$

1,025,492

Senior unsecured notes, net

395,706

395,286

Revolving credit facility

—

—

Intangible lease liabilities, net

11,230

11,551

Dividend payable

43,943

39,398

Derivative liabilities

660

2,274

Accrued liabilities and other payables

25,697

29,261

Total liabilities

1,674,391

1,503,262

Commitments and contingencies

—

—

Stockholders' equity:

Preferred stock, $0.01 par value;

150,000,000 authorized; none issued and outstanding as of September

30, 2023 and December 31, 2022

—

—

Common stock, $0.01 par value; 500,000,000

authorized; 156,024,222 and 142,379,655 issued and outstanding as

of September 30, 2023 and December 31, 2022, respectively

1,560

1,424

Additional paid-in capital

2,885,825

2,563,305

Distributions in excess of cumulative

earnings

(107,592

)

(117,187

)

Accumulated other comprehensive loss

49,422

40,719

Total stockholders' equity

2,829,215

2,488,261

Non-controlling interests

8,575

8,510

Total equity

2,837,790

2,496,771

Total liabilities and equity

$

4,512,181

$

4,000,033

Essential Properties Realty

Trust, Inc. Reconciliation of Non-GAAP Financial

Measures

Three months ended September

30,

Nine months ended September

30,

(unaudited, in thousands except per

share amounts)

2023

2022

2023

2022

Net income

$

46,088

$

36,591

$

142,144

$

99,221

Depreciation and amortization of real

estate

26,186

22,028

74,701

64,363

Provision for impairment of real

estate

165

349

1,645

10,541

Gain on dispositions of real estate,

net

(1,859

)

(6,329

)

(19,320

)

(18,082

)

Funds from Operations

70,580

52,639

199,170

156,043

Non-core expense (income)1

116

250

(588

)

2,388

Core Funds from Operations

70,696

52,889

198,582

158,431

Adjustments:

Straight-line rental revenue, net

(7,191

)

(3,810

)

(20,739

)

(16,610

)

Non-cash interest expense

762

645

2,195

1,995

Non-cash compensation expense

2,144

2,233

7,022

7,257

Other amortization expense

708

1,775

1,244

2,177

Other non-cash charges

(68

)

(34

)

(101

)

126

Capitalized interest expense

(750

)

(236

)

(1,765

)

(363

)

Adjusted Funds from Operations

$

66,301

$

53,462

$

186,438

$

153,013

Net income per share2:

Basic

$

0.29

$

0.26

$

0.94

$

0.74

Diluted

$

0.29

$

0.26

$

0.94

$

0.74

FFO per share2:

Basic

$

0.45

$

0.38

$

1.32

$

1.17

Diluted

$

0.45

$

0.38

$

1.31

$

1.17

Core FFO per share2:

Basic

$

0.45

$

0.38

$

1.31

$

1.19

Diluted

$

0.45

$

0.38

$

1.31

$

1.19

AFFO per share2:

Basic

$

0.42

$

0.38

$

1.23

$

1.15

Diluted

$

0.42

$

0.38

$

1.23

$

1.15

- Includes the following during the: i) three months ended

September 30, 2023 — $0.1 million loss on debt extinguishment; ii)

nine months ended September 30, 2023 — $0.1 million loss on debt

extinguishment, $0.9 million of insurance recovery income and $0.2

million of severance expense and non-cash compensation expense in

connection with the departure of one of our junior executives; iii)

three and nine months ended September 30, 2022 — $0.2 million of

fees incurred in conjunction with a term loan amendment and $2.1

million loss on debt extinguishment.

- Calculations exclude $101, $93, $304 and $280 from the

numerator for the three and nine months ended September 30, 2023

and 2022, respectively, related to dividends paid on unvested

restricted stock awards and restricted stock units.

Essential Properties Realty

Trust, Inc. Reconciliation of Non-GAAP Financial

Measures

(in thousands)

Three months ended September

30, 2023

Net income

$

46,088

Depreciation and amortization

26,212

Interest expense

12,633

Interest income

(330

)

Income tax expense

162

EBITDA

84,765

Provision for impairment of real

estate

165

Gain on dispositions of real estate,

net

(1,859

)

EBITDAre

83,071

Adjustment for current quarter re-leasing,

acquisition and disposition activity1

3,647

Adjustment to exclude other non-core or

non-recurring activity2

(16

)

Adjustment to exclude

termination/prepayment fees and certain percentage rent3

(205

)

Adjusted EBITDAre - Current Estimated

Run Rate

86,497

General and administrative expense

6,969

Adjusted net operating income

("NOI")

93,466

Straight-line rental revenue, net1

(8,966

)

Other amortization expense

708

Adjusted Cash NOI

$

85,208

Annualized EBITDAre

$

332,284

Annualized Adjusted EBITDAre

$

345,988

Annualized Adjusted NOI

$

373,864

Annualized Adjusted Cash NOI

$

340,832

- Adjustment is made to reflect EBITDAre, NOI and Cash NOI as if

all re-leasing activity, investments in and dispositions of real

estate and loan repayments completed during the three months ended

September 30, 2023 had occurred on July 1, 2023.

- Adjustment is made to i) exclude non-core income and expense

adjustments made in computing Core FFO, ii) exclude changes in our

provision for credit losses and iii) eliminate the impact of

seasonal fluctuation in certain non-cash compensation expense

recorded in the period.

- Adjustment excludes lease termination or loan prepayment fees

and contingent rent (based on a percentage of the tenant's gross

sales at the leased property) where payment is subject to exceeding

a sales threshold specified in the lease, if any.

Essential Properties Realty

Trust, Inc. Reconciliation of Non-GAAP Financial

Measures

(dollars in thousands, except share and

per share amounts)

September 30, 2023

Rate

Wtd. Avg. Maturity

Unsecured debt:

February 2027 term loan1

$

430,000

2.4

%

3.4 years

January 2028 term loan1

400,000

4.6

%

4.3 years

February 2029 term loan1,2

375,000

4.1

%

5.4 years

Senior unsecured notes due July 2031

400,000

3.1

%

7.8 years

Revolving credit facility3

—

—

%

2.4 years

Total unsecured debt

1,605,000

3.5

%

5.2 years

Gross debt

1,605,000

Less: cash & cash equivalents

(36,106

)

Less: restricted cash available for future

investment

(5,912

)

Net debt

1,562,982

Equity:

Preferred stock

—

Common stock and OP units (156,578,069

shares @ $21.63/share as of 9/30/23)4

3,386,784

Total equity

3,386,784

Total enterprise value ("TEV")

$

4,949,766

Pro forma adjustments to Net Debt and

TEV:5

Net debt

$

1,562,982

Less: cash received — unsettled forward

equity

(272,602

)

Pro forma net debt

1,290,380

Total equity

3,386,784

Common stock — unsettled forward equity

(12,447,580 shares @ $21.63/share as of 9/30/23)

269,241

Pro forma TEV

$

4,946,405

Gross Debt / Undepreciated Gross

Assets

33.1

%

Net Debt / TEV

31.6

%

Net Debt / Annualized Adjusted

EBITDAre

4.5x

Pro Forma Gross Debt / Undepreciated

Gross Assets

31.3

%

Pro Forma Net Debt / Pro Forma

TEV

26.1

%

Pro Forma Net Debt / Annualized

Adjusted EBITDAre

3.7x

- Rates presented for the Company's term loans are fixed at the

stated rates after giving effect to its interest rate swaps,

applicable margin of 85bps (for 2027 and 2028 Term Loans) or 95bps

(for 2029 Term Loan) and SOFR premium of 10bps.

- Weighted average maturity calculation is made after giving

effect to extension options exercisable at the Company's

election.

- The Company's revolving credit facility provides a maximum

aggregate initial original principal amount of up to $600 million

and includes an accordion feature to increase, subject to certain

conditions, the maximum availability of the facility by up to $600

million. Borrowings bear interest at Term SOFR plus applicable

margin of 77.5bps and SOFR premium of 10bps.

- Common stock and OP units as of September 30, 2023, based on

156,024,222 common shares outstanding (including unvested

restricted share awards) and 553,847 OP units held by

non-controlling interests.

- Pro forma adjustments have been made to reflect 12,447,580

shares sold on a forward basis in the Company's September 2023

follow-on offering or through the Company's ATM Program as if they

had been physically settled on September 30, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231025351443/en/

Investor/Media: Essential Properties Realty Trust, Inc.

Robert W. Salisbury, CFA Senior Vice President, Capital Markets

609-436-0619 investors@essentialproperties.com

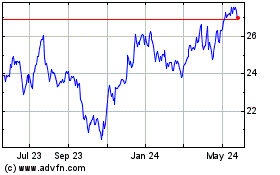

Essential Properties Rea... (NYSE:EPRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

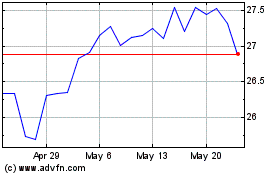

Essential Properties Rea... (NYSE:EPRT)

Historical Stock Chart

From Nov 2023 to Nov 2024