0001747009false12/312023Q33111131111311113111166.6700017470092023-01-012023-09-3000017470092023-10-30xbrli:shares00017470092023-07-012023-09-30iso4217:USD00017470092022-07-012022-09-3000017470092022-01-012022-09-30iso4217:USDxbrli:shares00017470092022-12-3100017470092021-12-3100017470092023-09-3000017470092022-09-300001747009us-gaap:CommonStockMember2021-12-310001747009us-gaap:RetainedEarningsMember2021-12-310001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001747009us-gaap:NoncontrollingInterestMember2021-12-310001747009us-gaap:RetainedEarningsMember2022-01-012022-03-310001747009us-gaap:NoncontrollingInterestMember2022-01-012022-03-3100017470092022-01-012022-03-310001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310001747009us-gaap:CommonStockMember2022-01-012022-03-310001747009etrn:EQMMidstreamPartnersLPMember2022-01-012022-03-310001747009us-gaap:CommonStockMember2022-03-310001747009us-gaap:RetainedEarningsMember2022-03-310001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001747009us-gaap:NoncontrollingInterestMember2022-03-3100017470092022-03-310001747009us-gaap:RetainedEarningsMember2022-04-012022-06-300001747009us-gaap:NoncontrollingInterestMember2022-04-012022-06-3000017470092022-04-012022-06-300001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001747009us-gaap:CommonStockMember2022-04-012022-06-300001747009etrn:EQMMidstreamPartnersLPMember2022-04-012022-06-300001747009us-gaap:CommonStockMember2022-06-300001747009us-gaap:RetainedEarningsMember2022-06-300001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001747009us-gaap:NoncontrollingInterestMember2022-06-3000017470092022-06-300001747009us-gaap:RetainedEarningsMember2022-07-012022-09-300001747009us-gaap:NoncontrollingInterestMember2022-07-012022-09-300001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001747009us-gaap:CommonStockMember2022-07-012022-09-300001747009etrn:EQMMidstreamPartnersLPMember2022-07-012022-09-300001747009us-gaap:CommonStockMember2022-09-300001747009us-gaap:RetainedEarningsMember2022-09-300001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001747009us-gaap:NoncontrollingInterestMember2022-09-300001747009us-gaap:CommonStockMember2022-12-310001747009us-gaap:RetainedEarningsMember2022-12-310001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001747009us-gaap:NoncontrollingInterestMember2022-12-310001747009us-gaap:RetainedEarningsMember2023-01-012023-03-310001747009us-gaap:NoncontrollingInterestMember2023-01-012023-03-3100017470092023-01-012023-03-310001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001747009us-gaap:CommonStockMember2023-01-012023-03-310001747009etrn:EQMMidstreamPartnersLPMember2023-01-012023-03-310001747009us-gaap:CommonStockMember2023-03-310001747009us-gaap:RetainedEarningsMember2023-03-310001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001747009us-gaap:NoncontrollingInterestMember2023-03-3100017470092023-03-310001747009us-gaap:RetainedEarningsMember2023-04-012023-06-300001747009us-gaap:NoncontrollingInterestMember2023-04-012023-06-3000017470092023-04-012023-06-300001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001747009us-gaap:CommonStockMember2023-04-012023-06-300001747009etrn:EQMMidstreamPartnersLPMember2023-04-012023-06-300001747009us-gaap:CommonStockMember2023-06-300001747009us-gaap:RetainedEarningsMember2023-06-300001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001747009us-gaap:NoncontrollingInterestMember2023-06-3000017470092023-06-300001747009us-gaap:RetainedEarningsMember2023-07-012023-09-300001747009us-gaap:NoncontrollingInterestMember2023-07-012023-09-300001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001747009us-gaap:CommonStockMember2023-07-012023-09-300001747009etrn:EQMMidstreamPartnersLPMember2023-07-012023-09-300001747009us-gaap:CommonStockMember2023-09-300001747009us-gaap:RetainedEarningsMember2023-09-300001747009us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001747009us-gaap:NoncontrollingInterestMember2023-09-30etrn:primaryAssetetrn:segmentetrn:lineOfBusiness0001747009etrn:GasGatheringSegmentMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300001747009us-gaap:OperatingSegmentsMemberetrn:GasTransmissionSegmentMember2023-07-012023-09-300001747009us-gaap:OperatingSegmentsMemberetrn:GasTransmissionSegmentMember2022-07-012022-09-300001747009us-gaap:OperatingSegmentsMemberetrn:GasTransmissionSegmentMember2023-01-012023-09-300001747009us-gaap:OperatingSegmentsMemberetrn:GasTransmissionSegmentMember2022-01-012022-09-300001747009etrn:WaterServicesMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300001747009etrn:WaterServicesMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300001747009etrn:WaterServicesMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300001747009etrn:WaterServicesMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300001747009us-gaap:CorporateNonSegmentMember2023-07-012023-09-300001747009us-gaap:CorporateNonSegmentMember2022-07-012022-09-300001747009us-gaap:CorporateNonSegmentMember2023-01-012023-09-300001747009us-gaap:CorporateNonSegmentMember2022-01-012022-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:OperatingSegmentsMember2023-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:OperatingSegmentsMember2022-12-310001747009us-gaap:OperatingSegmentsMemberetrn:GasTransmissionSegmentMember2023-09-300001747009us-gaap:OperatingSegmentsMemberetrn:GasTransmissionSegmentMember2022-12-310001747009etrn:WaterServicesMemberus-gaap:OperatingSegmentsMember2023-09-300001747009etrn:WaterServicesMemberus-gaap:OperatingSegmentsMember2022-12-310001747009us-gaap:OperatingSegmentsMember2023-09-300001747009us-gaap:OperatingSegmentsMember2022-12-310001747009us-gaap:CorporateNonSegmentMember2023-09-300001747009us-gaap:CorporateNonSegmentMember2022-12-310001747009etrn:GasGatheringSegmentMemberus-gaap:OperatingSegmentsMemberetrn:EurekaMidstreamHoldingsLLCMember2023-07-012023-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:OperatingSegmentsMemberetrn:EurekaMidstreamHoldingsLLCMember2023-01-012023-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:OperatingSegmentsMemberetrn:EurekaMidstreamHoldingsLLCMember2022-07-012022-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:OperatingSegmentsMemberetrn:EurekaMidstreamHoldingsLLCMember2022-01-012022-09-300001747009us-gaap:OperatingSegmentsMemberetrn:MVPSouthgateProjectMemberetrn:GasTransmissionSegmentMember2023-07-012023-09-300001747009us-gaap:OperatingSegmentsMemberetrn:MVPSouthgateProjectMemberetrn:GasTransmissionSegmentMember2023-01-012023-09-300001747009us-gaap:OperatingSegmentsMemberetrn:MVPSouthgateProjectMemberetrn:GasTransmissionSegmentMember2022-07-012022-09-300001747009us-gaap:OperatingSegmentsMemberetrn:MVPSouthgateProjectMemberetrn:GasTransmissionSegmentMember2022-01-012022-09-300001747009us-gaap:FixedPriceContractMemberetrn:GasGatheringSegmentMember2023-07-012023-09-300001747009us-gaap:FixedPriceContractMemberetrn:GasTransmissionSegmentMember2023-07-012023-09-300001747009etrn:WaterServicesMemberus-gaap:FixedPriceContractMember2023-07-012023-09-300001747009us-gaap:FixedPriceContractMember2023-07-012023-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:TimeAndMaterialsContractMember2023-07-012023-09-300001747009etrn:GasTransmissionSegmentMemberus-gaap:TimeAndMaterialsContractMember2023-07-012023-09-300001747009etrn:WaterServicesMemberus-gaap:TimeAndMaterialsContractMember2023-07-012023-09-300001747009us-gaap:TimeAndMaterialsContractMember2023-07-012023-09-300001747009etrn:GasGatheringSegmentMember2023-07-012023-09-300001747009etrn:GasTransmissionSegmentMember2023-07-012023-09-300001747009etrn:WaterServicesMember2023-07-012023-09-300001747009us-gaap:FixedPriceContractMemberetrn:GasGatheringSegmentMember2022-07-012022-09-300001747009us-gaap:FixedPriceContractMemberetrn:GasTransmissionSegmentMember2022-07-012022-09-300001747009etrn:WaterServicesMemberus-gaap:FixedPriceContractMember2022-07-012022-09-300001747009us-gaap:FixedPriceContractMember2022-07-012022-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:TimeAndMaterialsContractMember2022-07-012022-09-300001747009etrn:GasTransmissionSegmentMemberus-gaap:TimeAndMaterialsContractMember2022-07-012022-09-300001747009etrn:WaterServicesMemberus-gaap:TimeAndMaterialsContractMember2022-07-012022-09-300001747009us-gaap:TimeAndMaterialsContractMember2022-07-012022-09-300001747009etrn:GasGatheringSegmentMember2022-07-012022-09-300001747009etrn:GasTransmissionSegmentMember2022-07-012022-09-300001747009etrn:WaterServicesMember2022-07-012022-09-300001747009us-gaap:FixedPriceContractMemberetrn:GasGatheringSegmentMember2023-01-012023-09-300001747009us-gaap:FixedPriceContractMemberetrn:GasTransmissionSegmentMember2023-01-012023-09-300001747009etrn:WaterServicesMemberus-gaap:FixedPriceContractMember2023-01-012023-09-300001747009us-gaap:FixedPriceContractMember2023-01-012023-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:TimeAndMaterialsContractMember2023-01-012023-09-300001747009etrn:GasTransmissionSegmentMemberus-gaap:TimeAndMaterialsContractMember2023-01-012023-09-300001747009etrn:WaterServicesMemberus-gaap:TimeAndMaterialsContractMember2023-01-012023-09-300001747009us-gaap:TimeAndMaterialsContractMember2023-01-012023-09-300001747009etrn:GasGatheringSegmentMember2023-01-012023-09-300001747009etrn:GasTransmissionSegmentMember2023-01-012023-09-300001747009etrn:WaterServicesMember2023-01-012023-09-300001747009us-gaap:FixedPriceContractMemberetrn:GasGatheringSegmentMember2022-01-012022-09-300001747009us-gaap:FixedPriceContractMemberetrn:GasTransmissionSegmentMember2022-01-012022-09-300001747009etrn:WaterServicesMemberus-gaap:FixedPriceContractMember2022-01-012022-09-300001747009us-gaap:FixedPriceContractMember2022-01-012022-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:TimeAndMaterialsContractMember2022-01-012022-09-300001747009etrn:GasTransmissionSegmentMemberus-gaap:TimeAndMaterialsContractMember2022-01-012022-09-300001747009etrn:WaterServicesMemberus-gaap:TimeAndMaterialsContractMember2022-01-012022-09-300001747009us-gaap:TimeAndMaterialsContractMember2022-01-012022-09-300001747009etrn:GasGatheringSegmentMember2022-01-012022-09-300001747009etrn:GasTransmissionSegmentMember2022-01-012022-09-300001747009etrn:WaterServicesMember2022-01-012022-09-300001747009etrn:GasGatheringSegmentMemberetrn:MinimumVolumeCommitmentContractMember2023-07-012023-09-300001747009etrn:GasGatheringSegmentMemberetrn:MinimumVolumeCommitmentContractMember2023-01-012023-09-300001747009etrn:GasGatheringSegmentMemberetrn:MinimumVolumeCommitmentContractMember2022-07-012022-09-300001747009etrn:GasGatheringSegmentMemberetrn:MinimumVolumeCommitmentContractMember2022-01-012022-09-300001747009etrn:ContractBuyoutsMember2023-01-012023-09-300001747009etrn:ContractBuyoutsMember2022-01-012022-09-3000017470092022-07-082022-07-080001747009etrn:GasGatheringSegmentMember2023-10-01us-gaap:TimeAndMaterialsContractMember2023-09-3000017470092024-01-01etrn:GasGatheringSegmentMemberus-gaap:TimeAndMaterialsContractMember2023-09-300001747009etrn:GasGatheringSegmentMember2025-01-01us-gaap:TimeAndMaterialsContractMember2023-09-3000017470092026-01-01etrn:GasGatheringSegmentMemberus-gaap:TimeAndMaterialsContractMember2023-09-3000017470092027-01-01etrn:GasGatheringSegmentMemberus-gaap:TimeAndMaterialsContractMember2023-09-300001747009etrn:GasGatheringSegmentMember2028-01-01us-gaap:TimeAndMaterialsContractMember2023-09-300001747009etrn:GasGatheringSegmentMemberus-gaap:TimeAndMaterialsContractMember2023-09-300001747009etrn:GasGatheringSegmentMember2023-10-01etrn:MinimumVolumeCommitmentContractMember2023-09-3000017470092024-01-01etrn:GasGatheringSegmentMemberetrn:MinimumVolumeCommitmentContractMember2023-09-300001747009etrn:GasGatheringSegmentMember2025-01-01etrn:MinimumVolumeCommitmentContractMember2023-09-3000017470092026-01-01etrn:GasGatheringSegmentMemberetrn:MinimumVolumeCommitmentContractMember2023-09-3000017470092027-01-01etrn:GasGatheringSegmentMemberetrn:MinimumVolumeCommitmentContractMember2023-09-300001747009etrn:GasGatheringSegmentMember2028-01-01etrn:MinimumVolumeCommitmentContractMember2023-09-300001747009etrn:GasGatheringSegmentMemberetrn:MinimumVolumeCommitmentContractMember2023-09-3000017470092023-10-01etrn:GasTransmissionSegmentMember2023-09-3000017470092024-01-01etrn:GasTransmissionSegmentMember2023-09-3000017470092025-01-01etrn:GasTransmissionSegmentMember2023-09-3000017470092026-01-01etrn:GasTransmissionSegmentMember2023-09-3000017470092027-01-01etrn:GasTransmissionSegmentMember2023-09-3000017470092028-01-01etrn:GasTransmissionSegmentMember2023-09-300001747009etrn:GasTransmissionSegmentMember2023-09-300001747009etrn:WaterServicesMember2023-10-012023-09-300001747009etrn:WaterServicesMember2024-01-012023-09-300001747009etrn:WaterServicesMember2025-01-012023-09-300001747009etrn:WaterServicesMember2026-01-012023-09-3000017470092027-01-01etrn:WaterServicesMember2023-09-300001747009etrn:WaterServicesMember2028-01-012023-09-300001747009etrn:WaterServicesMember2023-09-3000017470092023-10-012023-09-3000017470092024-01-012023-09-3000017470092025-01-012023-09-3000017470092026-01-012023-09-3000017470092027-01-012023-09-3000017470092028-01-012023-09-300001747009etrn:MountainValleyPipelineMember2023-09-30utr:mi0001747009etrn:EQMMidstreamPartnersLPMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberetrn:MVPJointVentureMember2023-09-30xbrli:pure0001747009srt:MaximumMemberetrn:ConEdisonMember2019-11-040001747009etrn:ConEdisonMembersrt:ScenarioForecastMemberetrn:MVPProjectMember2024-01-012024-03-310001747009srt:ScenarioForecastMemberetrn:MVPProjectMember2024-01-012024-03-310001747009etrn:EQMMidstreamPartnersLPMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberetrn:MVPJointVentureMembersrt:ScenarioForecastMember2024-03-310001747009us-gaap:MeasurementInputDiscountRateMemberetrn:MVPJointVentureMember2023-09-300001747009etrn:MVPJointVentureMember2023-01-012023-09-300001747009etrn:MVPJointVentureMember2023-09-300001747009us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberetrn:MVPProjectMember2023-09-012023-09-300001747009us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembersrt:ScenarioForecastMemberetrn:MVPProjectMember2023-10-012023-12-310001747009us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberetrn:MVPProjectMember2023-09-300001747009us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberus-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-09-300001747009us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberus-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-12-310001747009us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberus-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-07-012023-09-300001747009us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberus-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-07-012022-09-300001747009us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberus-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-01-012023-09-300001747009us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberus-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-01-012022-09-300001747009etrn:MVPSouthgateProjectMember2018-04-300001747009us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberetrn:MVPSouthgateProjectMember2023-09-300001747009us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMemberetrn:MVPSouthgateProjectMember2023-04-060001747009etrn:MountainValleyPipelineMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-09-300001747009etrn:MVPJointVentureMemberus-gaap:BeneficialOwnerMember2023-01-012023-09-300001747009etrn:LTIPParticipantsMemberetrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:A2018PlanMember2021-11-012021-11-010001747009etrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:SeniorExecutivesMemberetrn:A2018PlanMember2021-11-012021-11-010001747009etrn:LTIPParticipantsMemberetrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:A2018PlanMember2023-01-012023-09-300001747009etrn:LTIPParticipantsMemberetrn:MVPPerformanceShareUnitProgramAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberetrn:A2018PlanMember2023-01-012023-09-300001747009us-gaap:ShareBasedCompensationAwardTrancheTwoMemberetrn:LTIPParticipantsMemberetrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:A2018PlanMember2023-01-012023-09-300001747009etrn:LTIPParticipantsMemberetrn:MVPPerformanceShareUnitProgramAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMemberetrn:A2018PlanMember2023-01-012023-09-300001747009etrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:A2018PlanMember2023-01-012023-09-300001747009etrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:A2018PlanMember2023-09-300001747009etrn:LTIPParticipantsMemberetrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:A2018PlanMember2023-09-300001747009etrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:SeniorExecutivesT1Memberetrn:A2018PlanMember2023-09-300001747009etrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:SeniorExecutivesT1Memberetrn:A2018PlanMember2023-01-012023-09-300001747009etrn:SeniorExecutivesT2Memberetrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:A2018PlanMember2023-09-300001747009etrn:SeniorExecutivesT2Memberetrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:A2018PlanMember2023-01-012023-09-300001747009etrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:SeniorExecutivesT3Memberetrn:A2018PlanMember2023-09-300001747009etrn:MVPPerformanceShareUnitProgramAwardsMemberetrn:SeniorExecutivesT3Memberetrn:A2018PlanMember2023-01-012023-09-300001747009etrn:EQMCreditFacilityMember2023-09-300001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:LineOfCreditMember2023-09-300001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-09-30utr:Rate0001747009etrn:EQMMidstreamPartnersLPMemberus-gaap:SubsequentEventMemberetrn:EQMCreditFacilityMemberus-gaap:LineOfCreditMember2023-10-010001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:LineOfCreditMember2023-01-012023-09-300001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:LineOfCreditMember2023-07-012023-09-300001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-07-012023-09-300001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-09-300001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:LineOfCreditMember2022-07-012022-09-300001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:LineOfCreditMember2022-01-012022-09-300001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-07-012022-09-300001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-01-012022-09-300001747009etrn:EQMMidstreamPartnersLPMemberetrn:EQMCreditFacilityMemberus-gaap:LetterOfCreditMember2023-01-012023-09-300001747009etrn:EurekaCreditFacilityMemberus-gaap:LineOfCreditMemberetrn:EurekaMidstreamLLCMember2021-05-130001747009etrn:EurekaCreditFacilityMemberus-gaap:LineOfCreditMemberetrn:EurekaMidstreamLLCMember2021-05-132021-05-130001747009etrn:EurekaCreditFacilityMemberus-gaap:LineOfCreditMemberetrn:EurekaMidstreamLLCMember2023-09-300001747009etrn:EurekaCreditFacilityMemberus-gaap:LineOfCreditMemberetrn:EurekaMidstreamLLCMember2022-12-310001747009etrn:EurekaCreditFacilityMemberus-gaap:LineOfCreditMemberetrn:EurekaMidstreamLLCMember2023-07-012023-09-300001747009etrn:EurekaCreditFacilityMemberus-gaap:LineOfCreditMemberetrn:EurekaMidstreamLLCMember2023-01-012023-09-300001747009etrn:EurekaCreditFacilityMemberus-gaap:LineOfCreditMemberetrn:EurekaMidstreamLLCMember2022-01-012022-09-300001747009etrn:EurekaCreditFacilityMemberus-gaap:LineOfCreditMemberetrn:EurekaMidstreamLLCMember2022-07-012022-09-300001747009us-gaap:SeniorNotesMemberetrn:EQM4.75SeniorNotesDue2023Member2023-06-210001747009us-gaap:SeniorNotesMemberetrn:EQM4.75SeniorNotesDue2023Member2023-06-212023-06-210001747009us-gaap:SeniorNotesMemberetrn:A750SeniorNotesDue2027Member2022-06-070001747009us-gaap:SeniorNotesMemberetrn:A750SeniorNotesDue2030Member2022-06-070001747009us-gaap:SeniorNotesMemberetrn:A2022SeniorNotesMember2022-06-072022-06-070001747009us-gaap:SeniorNotesMemberetrn:A2022SeniorNotesMember2022-06-070001747009us-gaap:SeniorNotesMemberetrn:A2022SeniorNotesMemberetrn:EQTMidstreamPartnersLPMember2022-06-070001747009us-gaap:SeniorNotesMemberetrn:A600SeniorNotesDue2025Memberetrn:EQTMidstreamPartnersLPMember2022-06-070001747009us-gaap:SeniorNotesMemberetrn:EQTMidstreamPartnersLPMemberetrn:A400SeniorNotesDue2024Member2022-06-070001747009us-gaap:SeniorNotesMemberetrn:A400SeniorNotesDue2024And600SeniorNotesDue2025Memberetrn:EQTMidstreamPartnersLPMember2022-06-070001747009us-gaap:SeniorNotesMemberetrn:EQM4.75SeniorNotesDue2023Memberetrn:EQTMidstreamPartnersLPMember2022-06-090001747009us-gaap:SeniorNotesMemberetrn:EQM4.75SeniorNotesDue2023Memberetrn:EQTMidstreamPartnersLPMember2022-06-100001747009us-gaap:SeniorNotesMemberetrn:EQTMidstreamPartnersLPMemberetrn:A400SeniorNotesDue2024Member2022-06-140001747009us-gaap:SeniorNotesMemberetrn:A600SeniorNotesDue2025Memberetrn:EQTMidstreamPartnersLPMember2022-06-140001747009us-gaap:SeniorNotesMemberetrn:A400SeniorNotesDue2024And600SeniorNotesDue2025Memberetrn:EQTMidstreamPartnersLPMember2022-06-140001747009us-gaap:SeniorNotesMemberetrn:EQM4.75SeniorNotesDue2023Memberetrn:EQTMidstreamPartnersLPMember2022-01-012022-09-300001747009us-gaap:MeasurementInputPriceVolatilityMemberus-gaap:MarketApproachValuationTechniqueMember2023-09-300001747009us-gaap:OtherContractMember2023-09-300001747009us-gaap:OtherContractMemberus-gaap:OtherCurrentAssetsMember2023-09-300001747009us-gaap:OtherContractMemberus-gaap:OtherAssetsMember2023-09-300001747009us-gaap:OtherContractMember2022-12-310001747009etrn:EQMMidstreamPartnersLPMembersrt:AffiliatedEntityMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2023-09-300001747009etrn:EQMMidstreamPartnersLPMembersrt:AffiliatedEntityMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2022-12-310001747009etrn:EQMMidstreamPartnersLPMembersrt:AffiliatedEntityMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2023-09-300001747009etrn:EQMMidstreamPartnersLPMembersrt:AffiliatedEntityMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2022-12-310001747009us-gaap:PhantomShareUnitsPSUsMember2023-07-012023-09-300001747009us-gaap:PhantomShareUnitsPSUsMember2023-01-012023-09-300001747009us-gaap:PhantomShareUnitsPSUsMember2022-07-012022-09-300001747009us-gaap:PhantomShareUnitsPSUsMember2022-01-012022-09-300001747009us-gaap:SubsequentEventMemberetrn:EQMCreditFacilityMember2023-10-060001747009us-gaap:SubsequentEventMemberetrn:EQMCreditFacilityMemberus-gaap:LineOfCreditMember2023-10-060001747009etrn:EQMMidstreamPartnersLPMemberus-gaap:SubsequentEventMemberetrn:EQMCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-10-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| (Mark One) |

| | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2023

| | | | | | | | |

| or |

| | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| FOR THE TRANSITION PERIOD FROM TO |

| | |

| COMMISSION FILE NUMBER | 001-38629 |

EQUITRANS MIDSTREAM CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Pennsylvania | | 83-0516635 |

| (State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

2200 Energy Drive, Canonsburg, Pennsylvania 15317

(Address of principal executive offices) (Zip code)

(724) 271-7600

| | | | | |

| (Registrant's telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

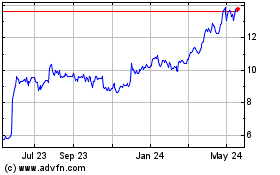

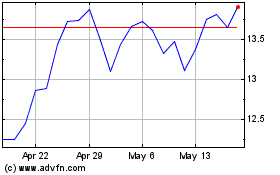

| Common Stock, no par value | | ETRN | | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☒ | | Accelerated Filer | ☐ | | Emerging Growth Company | ☐ | |

| Non-Accelerated Filer | ☐ | | Smaller Reporting Company | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares of common stock outstanding (in thousands), as of October 30, 2023: 433,261

EQUITRANS MIDSTREAM CORPORATION

Index

EQUITRANS MIDSTREAM CORPORATION

Glossary of Commonly Used Terms, Abbreviations and Measurements

2021 Water Services Agreement – that certain mixed-use water services agreement entered into on October 22, 2021 by the Company and EQT (as defined below), as subsequently amended, which became effective on March 1, 2022.

Allowance for Funds Used During Construction (AFUDC) – carrying costs for the construction of certain long-lived regulated assets are capitalized and amortized over the related assets' estimated useful lives. The capitalized amount for construction of regulated assets includes interest cost and a designated cost of equity for financing the construction of these regulated assets.

Amended EQM Credit Facility – that certain Third Amended and Restated Credit Agreement, dated as of October 31, 2018, among EQM, as borrower, Wells Fargo Bank, National Association, as the administrative agent, swing line lender, and a letter of credit (L/C) issuer, the lenders party thereto from time to time and any other persons party thereto from time to time (as amended by that certain First Amendment to Third Amended and Restated Credit Agreement, dated as of March 30, 2020, by that certain Second Amendment to Third Amended and Restated Credit Agreement, dated April 16, 2021, by that certain Third Amendment to the Third Amended and Restated Credit Agreement, dated as of April 22, 2022, by that certain Fourth Amendment to Third Amended Restated Credit Agreement, dated as of October 6, 2023, and as may be further amended, restated, amended and restated, supplemented or otherwise modified from time to time). For the avoidance of doubt, any reference to the Amended EQM Credit Facility as of any particular date shall mean the Amended EQM Credit Facility as in effect on such date.

Annual Revenue Commitments (ARC or ARCs) – contractual term in a water services agreement that obligates the customer to pay for a fixed amount of water services annually.

Appalachian Basin – the area of the United States composed of those portions of West Virginia, Pennsylvania, Ohio, Maryland, Kentucky and Virginia that lie in the Appalachian Mountains.

British thermal unit – a measure of the amount of energy required to raise the temperature of one pound of water one-degree Fahrenheit.

delivery point – the point where gas is delivered into a downstream gathering system or transmission pipeline.

EQM – EQM Midstream Partners, LP and its subsidiaries. EQM is a wholly owned subsidiary of Equitrans Midstream Corporation.

EQT – EQT Corporation (NYSE: EQT) and its subsidiaries.

EQT Global GGA – that certain Gas Gathering and Compression Agreement entered into on February 26, 2020 (the EQT Global GGA Effective Date) by the Company with EQT and certain affiliates of EQT for the provision of certain gas gathering services to EQT in the Marcellus and Utica Shales of Pennsylvania and West Virginia, as subsequently amended.

Equitrans Midstream Preferred Shares – the Equitrans Midstream Corporation Series A Perpetual Convertible Preferred Shares, no par value.

firm contracts – contracts for gathering, transmission, storage and water services that reserve an agreed upon amount of pipeline or storage capacity regardless of the capacity used by the customer during each month, and generally obligate the customer to pay a fixed, monthly charge.

firm reservation fee revenues – contractually obligated revenues that include fixed monthly charges under firm contracts and fixed volumetric charges under MVC (as defined below) and ARC (as defined above) contracts.

gas – natural gas.

liquefied natural gas (LNG) – natural gas that has been cooled to minus 161 degrees Celsius for transportation, typically by ship. The cooling process reduces the volume of natural gas by 600 times.

Minimum volume commitments (MVC or MVCs) – contracts for gathering or water services that obligate the customer to pay for a fixed amount of volumes daily, monthly, annually or over the life of the contract.

Mountain Valley Pipeline (MVP) – an estimated 300-mile, 42-inch diameter natural gas interstate pipeline with a targeted capacity of 2.0 Bcf per day that is designed to span from the Company's existing transmission and storage system in Wetzel County, West Virginia to Pittsylvania County, Virginia, providing access to the growing Southeast demand markets.

Mountain Valley Pipeline, LLC (MVP Joint Venture) – a joint venture formed among the Company and, as applicable, affiliates of each of NextEra Energy, Inc., Consolidated Edison, Inc. (Con Edison), AltaGas Ltd. and RGC Resources, Inc. (RGC) for purposes of the MVP and the MVP Southgate (as defined below) projects.

MVP Southgate – a contemplated interstate pipeline that was approved by the FERC to extend approximately 75 miles from the MVP at Pittsylvania County, Virginia to new delivery points in Rockingham and Alamance Counties, North Carolina. The MVP Joint Venture is continuing to engage with the project shipper, Dominion Energy North Carolina, and a prospective customer regarding the project as discussed in "MVP Southgate Project" in "Outlook" in Part I, "Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations" of this Quarterly Report on Form 10-Q.

natural gas liquids (NGLs) – those hydrocarbons in natural gas that are separated from the gas as liquids through the process of absorption, condensation, adsorption or other methods in gas processing plants. Natural gas liquids include ethane, propane, pentane, butane and iso-butane.

Preferred Interest – the preferred interest that the Company has in EQT Energy Supply, LLC (EES), a subsidiary of EQT.

Rager Mountain natural gas storage field incident – that certain venting of natural gas, of which the Company first became aware on November 6, 2022, at a storage well (well 2244) at Equitrans, L.P.'s Rager Mountain natural gas storage facility, located in Jackson Township, a remote section of Cambria County, Pennsylvania.

throughput – the volume of natural gas transported or passing through a pipeline, plant, terminal or other facility during a particular period.

wellhead – the equipment at the surface of a well used to control the well's pressure and the point at which the hydrocarbons and water exit the ground.

Unless the context otherwise requires, a reference to a “Note” herein refers to the accompanying Notes to Consolidated Financial Statements contained in Part I, "Item 1. Financial Statements" of this Quarterly Report on Form 10-Q and all references to "we," "us," "our" and "the Company" refer to Equitrans Midstream Corporation and its subsidiaries.

| | | | | |

| Abbreviations | Measurements |

ASC – Accounting Standards Codification | Btu = one British thermal unit |

ASU – Accounting Standards Update | BBtu = billion British thermal units |

EPA – United States Environmental Protection Agency | Bcf = billion cubic feet |

FASB – Financial Accounting Standards Board | Mcf = thousand cubic feet |

FERC – United States Federal Energy Regulatory Commission | MMBtu = million British thermal units |

GAAP – United States Generally Accepted Accounting Principles | MMcf = million cubic feet |

IRS – United States Internal Revenue Service | MMgal = million gallons |

NGA – Natural Gas Act of 1938, as amended | |

NYMEX – New York Mercantile Exchange | |

NYSE – New York Stock Exchange | |

PHMSA – Pipeline and Hazardous Materials Safety Administration of the United States Department of Transportation | |

SEC – United States Securities and Exchange Commission | |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

EQUITRANS MIDSTREAM CORPORATION

Statements of Consolidated Comprehensive Income (Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 (a) | | 2023 | | 2022 (a) |

| | (Thousands, except per share amounts) |

Operating revenues | $ | 338,514 | | | $ | 331,751 | | | $ | 1,033,320 | | | $ | 1,002,508 | |

Operating expenses: | | | | | | | |

Operating and maintenance | 43,046 | | | 35,297 | | | 131,675 | | | 100,820 | |

Selling, general and administrative | 55,627 | | | 33,348 | | | 145,181 | | | 92,074 | |

| | | | | | | |

Depreciation | 69,348 | | | 68,572 | | | 208,783 | | | 203,272 | |

Amortization of intangible assets | 16,204 | | | 16,204 | | | 48,614 | | | 48,614 | |

| | | | | | | |

| | | | | | | |

Total operating expenses | 184,225 | | | 153,421 | | | 534,253 | | | 444,780 | |

Operating income | 154,289 | | | 178,330 | | | 499,067 | | | 557,728 | |

Equity income (b) | 73,810 | | | 48 | | | 97,618 | | | 91 | |

| Impairment of equity method investment | — | | | (583,057) | | | — | | | (583,057) | |

Other (expense) income, net | (3,037) | | | 2,465 | | | 8,670 | | | 8,124 | |

Loss on extinguishment of debt | — | | | — | | | — | | | (24,937) | |

Net interest expense | (106,334) | | | (101,085) | | | (314,935) | | | (289,323) | |

Income (loss) before income taxes | 118,728 | | | (503,299) | | | 290,420 | | | (331,374) | |

Income tax (benefit) expense | (10,976) | | | (366) | | | (14,295) | | | 7,927 | |

Net income (loss) | 129,704 | | | (502,933) | | | 304,715 | | | (339,301) | |

Net income attributable to noncontrolling interest | 2,272 | | | 2,932 | | | 8,356 | | | 10,655 | |

Net income (loss) attributable to Equitrans Midstream | 127,432 | | | (505,865) | | | 296,359 | | | (349,956) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Preferred dividends | 14,628 | | | 14,628 | | | 43,884 | | | 43,884 | |

Net income (loss) attributable to Equitrans Midstream common shareholders | $ | 112,804 | | | $ | (520,493) | | | $ | 252,475 | | | $ | (393,840) | |

| | | | | | | |

Earnings (loss) per share of common stock attributable to Equitrans Midstream common shareholders - basic | $ | 0.26 | | | $ | (1.20) | | | $ | 0.58 | | | $ | (0.91) | |

| | | | | | | |

| | | | | | | |

Earnings (loss) per share of common stock attributable to Equitrans Midstream common shareholders - diluted | $ | 0.26 | | | $ | (1.20) | | | $ | 0.58 | | | $ | (0.91) | |

| | | | | | | |

Weighted average common shares outstanding - basic | 434,080 | | | 433,348 | | | 433,917 | | | 433,333 | |

Weighted average common shares outstanding - diluted | 439,034 | | | 433,348 | | | 435,658 | | | 433,333 | |

| | | | | | | |

Statement of comprehensive income (loss): | | | | | | | |

Net income (loss) | $ | 129,704 | | | $ | (502,933) | | | $ | 304,715 | | | $ | (339,301) | |

Other comprehensive income, net of tax: | | | | | | | |

Pension and other post-retirement benefits liability adjustment, net of tax expense of $7, $10, $21 and $34 | 22 | | | 36 | | | 66 | | | 104 | |

Other comprehensive income | 22 | | | 36 | | | 66 | | | 104 | |

Comprehensive income (loss) | 129,726 | | | (502,897) | | | 304,781 | | | (339,197) | |

Less: Comprehensive income attributable to noncontrolling interest | 2,272 | | | 2,932 | | | 8,356 | | | 10,655 | |

Less: Comprehensive income attributable to preferred dividends | 14,628 | | | 14,628 | | | 43,884 | | | 43,884 | |

Comprehensive income (loss) attributable to Equitrans Midstream common shareholders | $ | 112,826 | | | $ | (520,457) | | | $ | 252,541 | | | $ | (393,736) | |

| | | | | | | |

Dividends declared per common share | $ | 0.15 | | | $ | 0.15 | | | $ | 0.45 | | | $ | 0.45 | |

(a)Certain line items of the previously issued unaudited interim consolidated financial statements for the three and nine months ended September 30, 2022 have been revised. See Note 1 for more information.

(b)Represents equity income from Mountain Valley Pipeline, LLC (the MVP Joint Venture). See Note 4.

The accompanying notes are an integral part of these consolidated financial statements.

EQUITRANS MIDSTREAM CORPORATION

Statements of Consolidated Cash Flows (Unaudited)

| | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2023 | | 2022 (a) |

| | (Thousands) |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 304,715 | | | $ | (339,301) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation | 208,783 | | | 203,272 | |

| Amortization of intangible assets | 48,614 | | | 48,614 | |

| Provision for credit losses on accounts receivable and contract asset write-down | 10,234 | | | — | |

| Deferred income tax (benefit) expense | (20,832) | | | 7,392 | |

| Impairment of equity method investment | — | | | 583,057 | |

Equity income (b) | (97,618) | | | (91) | |

| Other income, net | (8,169) | | | (8,391) | |

| Loss on extinguishment of debt | — | | | 24,937 | |

| Non-cash long-term compensation expense | 33,423 | | | 12,142 | |

| Changes in other assets and liabilities: | | | |

| Accounts receivable | 37,050 | | | 34,921 | |

| | | |

| Accounts payable | (7,932) | | | 2,255 | |

| Accrued interest | (44,310) | | | (57,375) | |

| Deferred revenue | 240,414 | | | 261,013 | |

| Other assets and other liabilities | 20,488 | | | (25,906) | |

| Net cash provided by operating activities | 724,860 | | | 746,539 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (279,463) | | | (276,828) | |

| Capital contributions to the MVP Joint Venture | (280,471) | | | (158,178) | |

| Proceeds from sale of gathering assets | — | | | 3,719 | |

| Principal payments received on the Preferred Interest | 4,347 | | | 4,110 | |

| | | |

| Net cash used in investing activities | (555,587) | | | (427,177) | |

| Cash flows from financing activities: | | | |

| Proceeds from revolving credit facility borrowings | 627,000 | | | 284,500 | |

| Payments on revolving credit facility borrowings | (322,000) | | | (394,500) | |

| Proceeds from the issuance of long-term debt | — | | | 1,000,000 | |

| | | |

| Debt discounts, debt issuance costs and credit facility arrangement fees | (60) | | | (19,880) | |

| Payment for retirement of long-term debt | (98,941) | | | (1,021,459) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Dividends paid to holders of Equitrans Midstream Preferred Shares | (43,884) | | | (43,884) | |

| | | |

| Dividends paid to common shareholders | (194,930) | | | (194,733) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Distributions paid to noncontrolling interest | (22,440) | | | (16,000) | |

| Other items | (1,307) | | | — | |

| Net cash used in financing activities | (56,562) | | | (405,956) | |

| | | |

| Net change in cash and cash equivalents | 112,711 | | | (86,594) | |

| Cash and cash equivalents at beginning of period | 67,898 | | | 134,661 | |

| Cash and cash equivalents at end of period | $ | 180,609 | | | $ | 48,067 | |

| | | |

| Cash paid during the period for: | | | |

| Interest, net of amount capitalized | $ | 354,962 | | | $ | 339,285 | |

| Income taxes, net | $ | 4,505 | | | $ | 1,243 | |

| | | |

| | | |

| | | |

(a)Certain line items of the previously issued unaudited interim consolidated financial statements for the nine months ended September 30, 2022 have been revised. See Note 1 for more information.

(b)Represents equity income from the MVP Joint Venture. See Note 4.

The accompanying notes are an integral part of these consolidated financial statements.

EQUITRANS MIDSTREAM CORPORATION

Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| (Thousands) |

| ASSETS | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 180,609 | | | $ | 67,898 | |

| | | |

Accounts receivable (net of allowance for credit losses of $5,465 and $3,031 as of September 30, 2023 and December 31, 2022, respectively) | 240,006 | | | 246,887 | |

| | | |

| | | |

| | | |

| Other current assets | 67,210 | | | 74,917 | |

Total current assets | 487,825 | | | 389,702 | |

| | | |

| Property, plant and equipment | 9,633,507 | | | 9,365,051 | |

| Less: accumulated depreciation | (1,684,025) | | | (1,480,720) | |

| Net property, plant and equipment | 7,949,482 | | | 7,884,331 | |

| | | |

Investments in unconsolidated entities (a) | 1,290,996 | | | 819,743 | |

| Goodwill | 486,698 | | | 486,698 | |

| Net intangible assets | 538,338 | | | 586,952 | |

| | | |

| | | |

| | | |

| | | |

| Other assets | 279,318 | | | 278,159 | |

| Total assets | $ | 11,032,657 | | | $ | 10,445,585 | |

| | | |

| LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 299,616 | | | $ | 98,830 | |

| | | |

| Accounts payable | 53,998 | | | 60,528 | |

| | | |

| Capital contributions payable to the MVP Joint Venture | 126,564 | | | 34,355 | |

| Accrued interest | 91,452 | | | 135,762 | |

| Accrued liabilities | 79,300 | | | 83,835 | |

| Total current liabilities | 650,930 | | | 413,310 | |

| | | |

| Long-term liabilities: | | | |

| Revolving credit facility borrowings | 840,000 | | | 535,000 | |

| Long-term debt | 6,044,044 | | | 6,335,320 | |

| | | |

| | | |

| Contract liability | 1,211,919 | | | 968,535 | |

| | | |

| | | |

| Regulatory and other long-term liabilities | 131,370 | | | 112,974 | |

| Total liabilities | 8,878,263 | | | 8,365,139 | |

| | | |

| | | |

| Mezzanine equity: | | | |

Equitrans Midstream Preferred Shares, 30,018 shares issued and outstanding as of September 30, 2023 and December 31, 2022 | 681,842 | | | 681,842 | |

| | | |

| Shareholders' equity: | | | |

| | | |

Common stock, no par value, 433,261 and 432,781 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 4,009,368 | | | 3,974,127 | |

| Retained deficit | (3,000,865) | | | (3,053,590) | |

| Accumulated other comprehensive loss | (1,266) | | | (1,332) | |

| Total common shareholders' equity | 1,007,237 | | | 919,205 | |

| Noncontrolling interest | 465,315 | | | 479,399 | |

| Total shareholders' equity | 1,472,552 | | | 1,398,604 | |

| Total liabilities, mezzanine equity and shareholders' equity | $ | 11,032,657 | | | $ | 10,445,585 | |

(a)Represents investment in the MVP Joint Venture. See Note 4.

The accompanying notes are an integral part of these consolidated financial statements.

EQUITRANS MIDSTREAM CORPORATION

Statements of Consolidated Shareholders' Equity and Mezzanine Equity (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Mezzanine |

| | | | | | | | | | | | | | | Equity |

| | | | | | | | | Accumulated | | | | | | Equitrans |

| | | Common Stock | | | | Other | | | | | | Midstream |

| | | | Shares | | No | | Retained | | Comprehensive | | Noncontrolling | | Total | | Preferred |

| | | | Outstanding | | Par Value (a) | | Deficit (a) | | Loss | | Interest | | Equity (a) | | Shares |

| | | | (Thousands, except per share amounts) | | |

| Balance at January 1, 2022 | | | 432,522 | | | $ | 3,955,918 | | | $ | (2,464,573) | | | $ | (2,054) | | | $ | 483,195 | | | $ | 1,972,486 | | | $ | 681,842 | |

| Other comprehensive income (net of tax): | | | | | | | | | | | | | | | |

| Net income | | | — | | | — | | | 80,490 | | | — | | | 3,775 | | | 84,265 | | | 14,628 | |

Pension and other post-retirement benefits liability adjustment, net of tax expense of $12 | | | — | | | — | | | — | | | 34 | | | — | | | 34 | | | — | |

Dividends on common shares ($0.15 per share) | | | — | | | — | | | (65,584) | | | — | | | — | | | (65,584) | | | — | |

| Share-based compensation plans, net | | | 155 | | | 4,670 | | | — | | | — | | | — | | | 4,670 | | | — | |

| | | | | | | | | | | | | | | |

Dividends paid to holders of Equitrans Midstream Preferred Shares ($0.4873 per share) | | | — | | | — | | | — | | | — | | | — | | | — | | | (14,628) | |

| Balance at March 31, 2022 | | | 432,677 | | | $ | 3,960,588 | | | $ | (2,449,667) | | | $ | (2,020) | | | $ | 486,970 | | | $ | 1,995,871 | | | $ | 681,842 | |

| Other comprehensive income (net of tax): | | | | | | | | | | | | | | | |

| Net income | | | — | | | — | | | 46,163 | | | — | | | 3,948 | | | 50,111 | | | 14,628 | |

Pension and other post-retirement benefits liability adjustment, net of tax expense of $12 | | | — | | | — | | | — | | | 34 | | | — | | | 34 | | | — | |

Dividends on common shares ($0.15 per share) | | | — | | | — | | | (64,991) | | | — | | | — | | | (64,991) | | | — | |

| Share-based compensation plans, net | | | 104 | | | 4,470 | | | — | | | — | | | — | | | 4,470 | | | — | |

Dividends paid to holders of Equitrans Midstream Preferred Shares ($0.4873 per share) | | | — | | | — | | | — | | | — | | | — | | | — | | | (14,628) | |

| Balance at June 30, 2022 | | | 432,781 | | | $ | 3,965,058 | | | $ | (2,468,495) | | | $ | (1,986) | | | $ | 490,918 | | | $ | 1,985,495 | | | $ | 681,842 | |

| Other comprehensive income (net of tax): | | | | | | | | | | | | | | | |

| Net (loss) income | | | — | | | — | | | (520,493) | | | — | | | 2,932 | | | (517,561) | | | 14,628 | |

Pension and other post-retirement benefits liability adjustment, net of tax expense of $10 | | | — | | | — | | | — | | | 36 | | | — | | | 36 | | | — | |

Dividends on common shares ($0.15 per share) | | | — | | | — | | | (65,681) | | | — | | | — | | | (65,681) | | | — | |

| Share-based compensation plans, net | | | — | | | 4,533 | | | — | | | — | | | — | | | 4,533 | | | — | |

| Distributions paid to noncontrolling interest in Eureka Midstream Holdings, LLC | | | — | | | — | | | — | | | — | | | (16,000) | | | (16,000) | | | — | |

Dividends paid to holders of Equitrans Midstream Preferred Shares ($0.4873 per share) | | | — | | | — | | | — | | | — | | | — | | | — | | | (14,628) | |

| Balance at September 30, 2022 | | | 432,781 | | | $ | 3,969,591 | | | $ | (3,054,669) | | | $ | (1,950) | | | $ | 477,850 | | | $ | 1,390,822 | | | $ | 681,842 | |

(a)Certain line items of the previously issued unaudited interim consolidated financial statements for the three and nine months ended September 30, 2022 have been revised. See Note 1 for more information.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Mezzanine |

| | | | | | | | | | | | | Equity |

| | | | | | | Accumulated | | | | | | Equitrans |

| Common Stock | | | | Other | | | | | | Midstream |

| Shares | | No | | Retained | | Comprehensive | | Noncontrolling | | Total | | Preferred |

| Outstanding | | Par Value | | Deficit | | Loss | | Interest | | Equity | | Shares |

| (Thousands, except per share amounts) |

| Balance at January 1, 2023 | 432,781 | | | $ | 3,974,127 | | | $ | (3,053,590) | | | $ | (1,332) | | | $ | 479,399 | | | $ | 1,398,604 | | | $ | 681,842 | |

| Other comprehensive income (net of tax): | | | | | | | | | | | | | |

| Net income | — | | | — | | | 87,054 | | | — | | | 4,409 | | | 91,463 | | | 14,628 | |

Pension and other post-retirement benefits liability adjustment, net of tax expense of $7 | — | | | — | | | — | | | 22 | | | — | | | 22 | | | — | |

Dividends on common shares ($0.15 per share) | — | | | — | | | (65,121) | | | — | | | — | | | (65,121) | | | — | |

| Share-based compensation plans, net | 402 | | | 3,050 | | | — | | | — | | | — | | | 3,050 | | | — | |

| Distributions paid to noncontrolling interest in Eureka Midstream Holdings, LLC | — | | | — | | | — | | | — | | | (8,000) | | | (8,000) | | | — | |

Dividends paid to holders of Equitrans Midstream Preferred Shares ($0.4873 per share) | — | | | — | | | — | | | — | | | — | | | — | | | (14,628) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance at March 31, 2023 | 433,183 | | | $ | 3,977,177 | | | $ | (3,031,657) | | | $ | (1,310) | | | $ | 475,808 | | | $ | 1,420,018 | | | $ | 681,842 | |

| Other comprehensive income (net of tax): | | | | | | | | | | | | | |

| Net income | — | | | — | | | 52,617 | | | — | | | 1,675 | | | 54,292 | | | 14,628 | |

Pension and other post-retirement benefits liability adjustment, net of tax expense of $7 | — | | | — | | | — | | | 22 | | | — | | | 22 | | | — | |

Dividends on common shares ($0.15 per share) | — | | | — | | | (68,227) | | | — | | | — | | | (68,227) | | | — | |

| Share-based compensation plans, net | 78 | | | 23,853 | | | — | | | — | | | — | | | 23,853 | | | — | |

| Distributions paid to noncontrolling interest in Eureka Midstream Holdings, LLC | — | | | — | | | — | | | — | | | (12,000) | | | (12,000) | | | — | |

Dividends paid to holders of Equitrans Midstream Preferred Shares ($0.4873 per share) | — | | | — | | | — | | | — | | | — | | | — | | | (14,628) | |

| Balance at June 30, 2023 | 433,261 | | | $ | 4,001,030 | | | $ | (3,047,267) | | | $ | (1,288) | | | $ | 465,483 | | | $ | 1,417,958 | | | $ | 681,842 | |

| Other comprehensive income (net of tax): | | | | | | | | | | | | | |

| Net income | — | | | — | | | 112,804 | | | — | | | 2,272 | | | 115,076 | | | 14,628 | |

Pension and other post-retirement benefits liability adjustment, net of tax expense of $7 | — | | | — | | | — | | | 22 | | | — | | | 22 | | | — | |

Dividends on common shares ($0.15 per share) | — | | | — | | | (66,402) | | | — | | | — | | | (66,402) | | | — | |

| Share-based compensation plans, net | — | | | 8,338 | | | — | | | — | | | — | | | 8,338 | | | — | |

| Distributions paid to noncontrolling interest in Eureka Midstream Holdings, LLC | — | | | — | | | — | | | — | | | (2,440) | | | (2,440) | | | — | |

| | | | | | | | | | | | | |

Dividends paid to holders of Equitrans Midstream Preferred Shares ($0.4873 per share) | — | | | — | | | — | | | — | | | — | | | — | | | (14,628) | |

| Balance at September 30, 2023 | 433,261 | | | $ | 4,009,368 | | | $ | (3,000,865) | | | $ | (1,266) | | | $ | 465,315 | | | $ | 1,472,552 | | | $ | 681,842 | |

The accompanying notes are an integral part of these consolidated financial statements.

EQUITRANS MIDSTREAM CORPORATION

Notes to Consolidated Financial Statements (Unaudited)

1. Financial Statements

Nature of Business. The Company's operating subsidiaries provide midstream services to the Company's customers in Pennsylvania, West Virginia and Ohio through three primary assets: the gathering system, which includes predominantly dry gas gathering systems of high-pressure gathering lines; the transmission system, which includes FERC-regulated interstate pipelines and storage systems; and the water network, which primarily consists of water pipelines and other facilities that support well completion activities and produced water handling activities.

Basis of Presentation. References in these financial statements to Equitrans Midstream or the Company refer collectively to Equitrans Midstream Corporation and its consolidated subsidiaries for all periods presented, unless otherwise indicated.

The accompanying unaudited consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (GAAP) for interim financial information and with the requirements of Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. In the opinion of management, these unaudited consolidated financial statements include all adjustments (consisting of only normal, recurring adjustments, unless otherwise disclosed in this Quarterly Report on Form 10-Q) necessary for a fair presentation of the financial position of the Company as of September 30, 2023, the results of its operations and equity for the three and nine months ended September 30, 2023 and 2022 and its cash flows for the nine months ended September 30, 2023 and 2022. The consolidated balance sheet at December 31, 2022 has been derived from the audited financial statements at that date, but does not include all of the information and notes required by GAAP for complete financial statements. This Quarterly Report on Form 10-Q should be read in conjunction with the Company's Annual Report on Form 10-K for the year ended December 31, 2022, which includes all disclosures required by GAAP.

Due to, among other things, the seasonal nature of the Company's utility customer contracts, as well as producers’ well completion activities and varying needs for fresh and produced water (which are primarily driven by horizontal lateral lengths and the number of completion stages per well), the interim statements for the three and nine months ended September 30, 2023 are not necessarily indicative of the results that may be expected for the year ending December 31, 2023.

For further information, refer to the Company's consolidated financial statements and related notes in the Company's Annual Report on Form 10-K for the year ended December 31, 2022, as well as Part I, "Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations" contained herein.

Revisions of Previously Issued Financial Statements.

In the course of its 2022 year-end process, the Company identified certain corrections in its previously issued unaudited interim consolidated financial statements primarily related to the accounting for the Henry Hub cash bonus payment provision (as defined in Note 7). In accordance with Staff Accounting Bulletin (SAB) No. 99, Materiality, and SAB No. 108, Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements, the Company evaluated the corrections and, based on its analysis of quantitative and qualitative factors, determined that the related impact was not material to the Company's affected unaudited interim consolidated financial statements presented within this Quarterly Report on Form 10-Q. The Company has made the appropriate revisions to its previously issued interim consolidated financial statements in order to correct the Henry Hub cash bonus payment provision, and also made other immaterial revisions to its nine months ended September 30, 2022 unaudited interim consolidated financial statements. For more information, see Notes 1 and 16 to the consolidated financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2022.

Recently Issued Accounting Standards.

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848), which provides practical expedients for contract modifications and certain hedging relationships associated with the transition from reference rates that are expected to be discontinued. This guidance is applicable to the calculation of each dividend following March 31, 2024 for the Equitrans Midstream Preferred Shares pursuant to the Company's Second Amended and Restated Articles of Incorporation, as well as any Company contracts that use the London Inter-Bank Offered Rate as a reference rate. In December 2022, the FASB also issued ASU 2022-06, which amended Topic 848 to defer the sunset date to apply the practical expedients until December 31, 2024. The Company adopted this standard on April 1, 2023 and it had no impact on the Company's financial statements and related disclosures.

2. Financial Information by Business Segment

The Company reports its operations in three segments that reflect its three lines of business of Gathering, Transmission and Water, which reflects the manner in which management evaluates the business for making operating decisions and assessing performance.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (Thousands) |

| Revenues from customers: | | | | | | | |

| Gathering | $ | 220,087 | | | $ | 227,180 | | | $ | 641,033 | | | $ | 672,284 | |

| Transmission | 98,575 | | | 91,557 | | | 330,021 | | | 293,430 | |

| Water | 19,852 | | | 13,014 | | | 62,266 | | | 36,794 | |

| Total operating revenues | $ | 338,514 | | | $ | 331,751 | | | $ | 1,033,320 | | | $ | 1,002,508 | |

| Operating income (loss): | | | | | | | |

| Gathering | $ | 101,134 | | | $ | 112,279 | | | $ | 286,448 | | | $ | 345,695 | |

| Transmission | 55,808 | | | 64,077 | | | 203,181 | | | 209,480 | |

| Water | (2,251) | | | 2,342 | | | 10,652 | | | 3,537 | |

Headquarters (a) | (402) | | | (368) | | | (1,214) | | | (984) | |

| Total operating income | $ | 154,289 | | | $ | 178,330 | | | $ | 499,067 | | | $ | 557,728 | |

| | | | | | | |

| Reconciliation of operating income to net income (loss): | | | | | | | |

Equity income (b) | $ | 73,810 | | | $ | 48 | | | $ | 97,618 | | | $ | 91 | |

Impairment of equity method investment (b) | — | | | (583,057) | | | — | | | (583,057) | |

Other (expense) income, net (c) | (3,037) | | | 2,465 | | | 8,670 | | | 8,124 | |

Loss on extinguishment of debt | — | | | — | | | — | | | (24,937) | |

Net interest expense | (106,334) | | | (101,085) | | | (314,935) | | | (289,323) | |

Income tax (benefit) expense | (10,976) | | | (366) | | | (14,295) | | | 7,927 | |

Net income (loss) | $ | 129,704 | | | $ | (502,933) | | | $ | 304,715 | | | $ | (339,301) | |

(a)Includes certain unallocated corporate expenses.

(b)Equity income and impairment of equity method investment are included in the Transmission segment.

(c)Includes unrealized (loss) gain on derivative instruments recorded in the Gathering segment.

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| | (Thousands) |

| Segment assets: | | | |

| Gathering | $ | 7,605,477 | | | $ | 7,610,233 | |

Transmission (a) | 2,808,259 | | | 2,333,896 | |

| Water | 209,967 | | | 218,680 | |

| Total operating segments | 10,623,703 | | | 10,162,809 | |

| Headquarters, including cash | 408,954 | | | 282,776 | |

| Total assets | $ | 11,032,657 | | | $ | 10,445,585 | |

(a)The equity method investment in the MVP Joint Venture is included in the Transmission segment.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (Thousands) |

| Depreciation: | | | | | | | |

| Gathering | $ | 48,585 | | | $ | 49,125 | | | $ | 147,321 | | | $ | 145,953 | |

| Transmission | 14,004 | | | 13,909 | | | 41,796 | | | 41,707 | |

| Water | 6,655 | | | 5,162 | | | 19,029 | | | 14,483 | |

| Headquarters | 104 | | | 376 | | | 637 | | | 1,129 | |

| Total | $ | 69,348 | | | $ | 68,572 | | | $ | 208,783 | | | $ | 203,272 | |

| Capital expenditures: | | | | | | | |

Gathering (a) | $ | 67,551 | | | $ | 73,589 | | | $ | 199,157 | | | $ | 195,925 | |

Transmission (b) | 31,332 | | | 12,429 | | | 54,896 | | | 22,994 | |

| Water | 9,574 | | | 17,041 | | | 31,798 | | | 49,132 | |

| Headquarters | — | | | — | | | — | | | 13 | |

Total (c) | $ | 108,457 | | | $ | 103,059 | | | $ | 285,851 | | | $ | 268,064 | |

(a)Includes capital expenditures related to the noncontrolling interest in Eureka Midstream Holdings, LLC (Eureka Midstream) of approximately $3.3 million and $11.5 million for the three and nine months ended September 30, 2023, respectively, and approximately $5.9 million and $17.6 million for the three and nine months ended September 30, 2022, respectively.

(b)Transmission capital expenditures do not include aggregate capital contributions made to the MVP Joint Venture for the MVP and MVP Southgate projects of approximately $209.9 million and $280.5 million for the three and nine months ended September 30, 2023, respectively, and approximately $46.4 million and $158.2 million for the three and nine months ended September 30, 2022, respectively.

(c)The Company accrues capital expenditures when the work has been completed but the associated bills have not yet been paid. Accrued capital expenditures are excluded from the statements of consolidated cash flows until they are paid. The net impact of non-cash capital expenditures, including the effect of accrued capital expenditures, transfers to/from inventory as assets are completed/assigned to a project and capitalized share-based compensation costs were $(0.9) million and $(6.4) million for the three and nine months ended September 30, 2023, respectively, and $10.7 million and $8.8 million for the three and nine months ended September 30, 2022, respectively.

3. Revenue from Contracts with Customers

For the three and nine months ended September 30, 2023 and 2022, substantially all revenues recognized on the Company's statements of consolidated comprehensive income were from contracts with customers. As of September 30, 2023 and December 31, 2022, all receivables recorded on the Company's consolidated balance sheets represented performance obligations that have been satisfied and for which an unconditional right to consideration exists.

Summary of disaggregated revenues. The tables below provide disaggregated revenue information by business segment. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2023 |

| | Gathering | | Transmission | | Water | | Total |

| | (Thousands) |

Firm reservation fee revenues (a) | | $ | 147,137 | | | $ | 82,508 | | | $ | 11,029 | | | $ | 240,674 | |

| Volumetric-based fee revenues | | 72,950 | | | 16,067 | | | 8,823 | | | 97,840 | |

| | | | | | | | |

| Total operating revenues | | $ | 220,087 | | | $ | 98,575 | | | $ | 19,852 | | | $ | 338,514 | |

| | | | | | | | |

| | Three Months Ended September 30, 2022 |

| | Gathering | | Transmission | | Water | | Total |

| | (Thousands) |

Firm reservation fee revenues (a) | | $ | 144,730 | | | $ | 84,584 | | | $ | 9,375 | | | $ | 238,689 | |

| Volumetric-based fee revenues | | 82,450 | | | 6,973 | | | 3,639 | | | 93,062 | |

| | | | | | | | |

| Total operating revenues | | $ | 227,180 | | | $ | 91,557 | | | $ | 13,014 | | | $ | 331,751 | |

| | | | | | | | |

| | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | |

| | | | | | | | |

| | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2023 |

| | Gathering | | Transmission | | Water | | Total |

| | (Thousands) |

Firm reservation fee revenues (a) | | $ | 428,945 | | | $ | 266,477 | | | $ | 29,793 | | | $ | 725,215 | |

Volumetric-based fee revenues (b) | | 212,088 | | | 63,544 | | | 32,473 | | | 308,105 | |

| | | | | | | | |

| Total operating revenues | | $ | 641,033 | | | $ | 330,021 | | | $ | 62,266 | | | $ | 1,033,320 | |

| | | | | | | | |

| | Nine Months Ended September 30, 2022 |

| | Gathering | | Transmission | | Water | | Total |

| | (Thousands) |

Firm reservation fee revenues (a) | | $ | 415,932 | | | $ | 272,129 | | | $ | 24,502 | | | $ | 712,563 | |

| Volumetric-based fee revenues | | 256,352 | | | 21,301 | | | 12,292 | | | 289,945 | |

| | | | | | | | |

| Total operating revenues | | $ | 672,284 | | | $ | 293,430 | | | $ | 36,794 | | | $ | 1,002,508 | |

(a) Firm reservation fee revenues associated with Gathering included MVC unbilled revenues of approximately $1.8 million and $7.5 million for the three and nine months ended September 30, 2023, respectively, and $8.5 million and $17.4 million for the three and nine months ended September 30, 2022, respectively.

(b) For the nine months ended September 30, 2023, volumetric-based fee revenues associated with Gathering and Transmission included one-time contract buyouts by a customer for approximately $5.0 million and $23.8 million, respectively.

Contract assets. The Company's contract assets related to the Company's future MVC deficiency payments are generally expected to be collected within the next twelve months and are primarily included in other current assets in the Company's consolidated balance sheets until such time as the MVC deficiency payments are invoiced to the customer.

The following table presents changes in the Company's unbilled revenue balance: | | | | | | | | | | | | | |

| | | |

| Nine Months Ended September 30, | | |

| 2023 | | 2022 | | |

| (Thousands) | | |

| Balance as of beginning of period | $ | 27,493 | | | $ | 16,772 | | | |

Revenue recognized in excess of amounts invoiced (a) | 7,530 | | | 19,436 | | | |

Minimum volume commitments invoiced (b) | (23,558) | | | (14,884) | | | |

Amortization (c) | (494) | | | (334) | | | |

| Balance as of end of period | $ | 10,971 | | | $ | 20,990 | | | |

| | | | | |

(a)Primarily includes revenues associated with MVCs that are generally included in firm reservation fee revenues within the Gathering and Water segments.

(b)Unbilled revenues are transferred to accounts receivable once the Company has an unconditional right to consideration from the customer.

(c)Amortization of capitalized contract costs paid to customers over the expected life of the agreement.

Contract liabilities. The Company's contract liabilities consist of deferred revenue primarily associated with the EQT Global GGA. Contract liabilities are classified as current or non-current according to when such amounts are expected to be recognized.

On July 8, 2022, the Company received written notice from EQT, pursuant to the EQT Global GGA, of EQT’s irrevocable election under the agreement to forgo up to approximately $145 million of potential gathering fee relief in the first twelve-month period beginning the first day of the quarter in which the MVP full in-service date occurs and up to approximately $90 million of potential gathering fee relief in the second such twelve-month period in exchange for a cash payment from the Company to EQT in the amount of approximately $195.8 million (the EQT Cash Option). As a result of EQT’s election to forgo potential rate relief in exchange for the cash option payment, the Company recorded a reduction to the contract liability of approximately $195.8 million and an increase to the EQT Cash Option liability on the consolidated balance sheets as of September 30, 2022. The Company utilized borrowings under the Amended EQM Credit Facility to effect such payment and the payment was made to EQT on October 4, 2022.

The following table presents changes in the Company's contract liability balances:

| | | | | | | | | | | | | |

| | | |

| | | Nine Months Ended September 30, |

| | | 2023 | | 2022 |

| | | (Thousands) |

| Balance as of beginning of period | | | $ | 973,087 | | | $ | 822,416 | |

Amounts recorded during the period (a) | | | 250,061 | | | 266,792 | |

Change in estimated variable consideration (b) | | | (5,330) | | | (4,837) | |

Amounts transferred during the period (c) | | | (4,317) | | | (942) | |

EQT Cash Option | | | — | | | (195,820) | |

| Balance as of end of period | | | $ | 1,213,501 | | | $ | 887,609 | |

| | | | | |

(a)Includes deferred billed revenue during the nine months ended September 30, 2023 and 2022 primarily associated with the EQT Global GGA.

(b)For the nine months ended September 30, 2023, the change in estimated variable consideration represents the decrease in total deferred revenue due to changes in MVP timing assumptions. For the nine months ended September 30, 2022, the change in estimated variable consideration represents the decrease in total deferred revenue required for gathering MVC revenue with a declining rate structure, resulting from the EQT Cash Option election that required total estimated gathering consideration to be increased.

(c)Deferred revenues are recognized as revenue upon satisfaction of the Company's performance obligation to the customer.

Summary of remaining performance obligations. The following table summarizes the estimated transaction price allocated to the Company's remaining performance obligations under all contracts with firm reservation fees, MVCs and/or ARCs as of September 30, 2023 that the Company will invoice or transfer from contract liabilities and recognize in future periods.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2023(a) | | 2024 | | 2025 | | 2026 | | 2027 | | Thereafter | | Total |

| | (Thousands) |

Gathering firm reservation fees | | $ | 25,390 | | | $ | 156,078 | | | $ | 177,127 | | | $ | 167,692 | | | $ | 161,018 | | | $ | 1,726,068 | | | $ | 2,413,373 | |

Gathering revenues supported by MVCs | | 114,809 | | | 427,169 | | | 456,995 | | | 489,335 | | | 487,366 | | | 3,169,121 | | | 5,144,795 | |

Transmission firm reservation fees | | 94,184 | | | 394,879 | | | 394,766 | | | 393,300 | | | 394,490 | | | 3,149,178 | | | 4,820,797 | |

Water revenues supported by ARCs | | 9,375 | | | 45,706 | | | 48,441 | | | 45,159 | | | 44,065 | | | 166,644 | | | 359,390 | |

Total (b) | | $ | 243,758 | | | $ | 1,023,832 | | | $ | 1,077,329 | | | $ | 1,095,486 | | | $ | 1,086,939 | | | $ | 8,211,011 | | | $ | 12,738,355 | |

(a) October 1, 2023 through December 31, 2023.

(b) Includes assumptions regarding timing for placing certain projects in-service. Such assumptions may not be realized and delays in the in-service dates for projects have substantially altered, and any future additional delays may further substantially alter, the remaining performance obligations for certain contracts with firm reservation fees, MVCs and/or ARCs. The MVP Joint Venture is accounted for as an equity method investment and those amounts are not included in the table above.

Based on total projected contractual revenues, including projected contractual revenues from future capacity expected from expansion projects that are not yet fully constructed or not yet fully in-service for which the Company has executed firm contracts, the Company's firm gathering contracts and firm transmission and storage contracts had weighted average remaining terms of approximately 13 years and 11 years, respectively, as of September 30, 2023.

4. Investment in Unconsolidated Entities

Mountain Valley Pipeline. The MVP Joint Venture is constructing the Mountain Valley Pipeline (MVP), an estimated 300-mile natural gas interstate pipeline that is designed to span from northern West Virginia to southern Virginia. The Company will operate the MVP and owned a 47.7% interest in the MVP project as of September 30, 2023. On November 4, 2019, Consolidated Edison, Inc. (Con Edison) exercised an option to cap its investment in the construction of the MVP project at approximately $530 million (excluding AFUDC). On May 4, 2023, RGC Resources, Inc. (RGC) also exercised an option for the Company to fund RGC's portion of future capital contributions with respect to the MVP project, which funding the Company commenced in June 2023 and will continue through the full in-service date of the MVP. The Company and NextEra Energy, Inc. are obligated to, and RGC prior to the exercise of its option described above had opted to, fund the shortfall in Con Edison's capital contributions, on a pro rata basis. Following RGC's exercise of its option, the Company is also funding RGC's portion of Con Edison's shortfall. Such funding by the Company in respect of the Con Edison shortfall and RGC's portion of capital contributions has and will correspondingly increase the Company's interests in the MVP project and decrease Con Edison's and RGC's respective interests, as applicable, in the MVP project.

On June 3, 2023, the President of the United States signed into law the Fiscal Responsibility Act of 2023 that, among other things, ratified and approved all permits and authorizations necessary for the construction and initial operation of the MVP, directed the applicable federal officials and agencies to maintain such authorizations, required the Secretary of the Army to issue not later than June 24, 2023 all permits or verifications necessary to complete construction of the MVP and allow for the MVP’s operation and maintenance, and divested courts of jurisdiction to review agency actions on approvals necessary for MVP construction and initial operation. Following enactment of the Fiscal Responsibility Act of 2023, the Fourth Circuit issued a stay halting MVP project construction in the Jefferson National Forest and a stay of the new Biological Opinion and Incidental Take Statement for the MVP project effectively halting forward construction for the entirety of the project, on July 10, 2023 and July 11, 2023, respectively. The MVP Joint Venture subsequently filed an emergency application to vacate the stays with the U.S. Supreme Court and the U.S. Supreme Court vacated the stays on July 27, 2023. Accordingly, the MVP Joint Venture recommenced forward construction.

On October 18, 2023, the Company announced that following the MVP Joint Venture's comprehensive review of progress achieved since the resumption of forward construction in August 2023 and construction activity remaining for completion of the MVP project, the MVP Joint Venture refined the targeted timing for completing construction of the project from year-end 2023 to the first quarter of 2024, with the total project cost anticipated to be approximately $7.2 billion (excluding AFUDC), which includes approximately $120 million of contingency. Based on such targeted completion timing and following in-service authorization from the FERC, contractual obligations accordingly would commence on or before April 1, 2024. If the project were to be completed in the first quarter of 2024 and at a total project cost of approximately $7.2 billion (excluding AFUDC), the Company expects its equity ownership in the MVP project would progressively increase from approximately 47.7% to approximately 48.8%.

The MVP Joint Venture is a variable interest entity because it has insufficient equity to finance its activities during the construction stage of the project. The Company is not the primary beneficiary of the MVP Joint Venture because the Company does not have the power to direct the activities that most significantly affect the MVP Joint Venture's economic performance. Certain business decisions, such as decisions to make distributions of cash, require a greater than 66 2/3% ownership interest approval, and no one member owns more than a 66 2/3% interest.