Eaton Vance Tax-Managed Diversified Equity Income Fund Report of Earnings as of July 31, 2008

30 September 2008 - 5:10AM

Business Wire

Eaton Vance Tax-Managed Diversified Equity Income Fund (NYSE: ETY),

a diversified closed-end investment company, today announced the

earnings of the Fund for the three months ended July 31, 2008 and

for the nine months ended July 31, 2008. The Fund�s fiscal year

ends on October 31, 2008. For the three months ended July 31, 2008,

the Fund had net investment income of $8,483,430 ($0.056 per common

share). For the nine months ended July 31, 2008, the Fund had net

investment income of $35,228,165 ($0.235 per common share). In

comparison, for the three months ended July 31, 2007, the Fund had

net investment income of $60,687,240 ($0.405 per common share). For

the period from the start of business, November 30, 2006, to July

31, 2007, the Fund had net investment income of $166,524,025

($1.130 per common share). Net realized and unrealized losses for

the three months ended July 31, 2008 were $139,246,701 ($0.928 per

common share) and net realized and unrealized losses for the nine

months ended July 31, 2008 were $262,357,091 ($1.752 per common

share). In comparison, net realized and unrealized losses for the

three months ended July 31, 2007 were $149,843,311 ($1.000 per

common share). Net realized and unrealized gains for the period

from the start of business, November 30, 2006, to July 31, 2007

were $4,084,626 ($0.017 per common share). On July 31, 2008, net

assets of the Fund were $2,498,856,966. The net asset value per

common share on July 31, 2008 was $16.69 based on 149,711,079

common shares outstanding. In comparison, on July 31, 2007, net

assets of the Fund were $2,891,441,674. The net asset value per

common share on July 31, 2007 was $19.31 based on 149,711,079

common shares outstanding. The Fund is managed by Eaton Vance

Management, a subsidiary of Eaton Vance Corp, which is listed on

the New York Stock Exchange under the symbol EV. Eaton Vance and

its affiliates had $155.8 billion in assets under management on

July 31, 2008. Eaton Vance Management will make available periodic

summary information regarding portfolio investments. Those

interested should call Eaton Vance Marketing at (800) 262-1122.

EATON VANCE TAX-MANAGED DIVERSIFIED EQUITY INCOME FUND SUMMARY OF

RESULTS OF OPERATIONS (in thousands, except per share amounts) � �

� � � � � � Three Months Ended Nine Months Ended July 31, July 31,

2008 2007 2008 2007(1) Gross investment income $15,292 $68,716

$56,164 $186,925 Operating expenses ($6,809) ($8,029) ($20,936)

($20,401) Net investment income $8,483 $60,687 $35,228 $166,524 Net

realized and unrealized gains (losses) on investments ($139,247)

($149,483) ($262,357) $4,085 Net increase (decrease) in net assets

from operations ($130,764) ($88,796) ($227,129) $170,609 � Earnings

per Share Outstanding Gross investment income $0.102 $0.459 $0.375

$1.269 Operating expenses ($0.046) ($0.054) ($0.140) ($0.139) Net

investment income $0.056 $0.405 $0.235 $1.130 Net realized and

unrealized gains (losses) on investments ($0.928) ($1.000) ($1.752)

$0.017 Net increase (decrease) in net assets from operations

($0.872) ($0.595) ($1.517) $1.147 � � Net Asset Value at July 31

(Common Shares ) Net assets (000) $2,498,857 $2,891,442 Shares

outstanding (000) 149,711 149,711 Net asset value per share

outstanding $16.69 $19.31 � Market Value Summary (Common Shares )

Market price on NYSE at July 31 $14.85 $18.70 High market price

(period ended July 31) $17.17 $20.66 Low market price (period ended

July 31) $13.68 $18.53 � � � (1) For the period from the start of

business, November 30, 2006, to July 31, 2007.

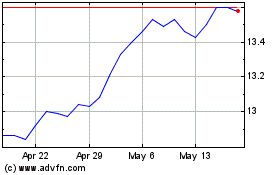

Eaton Vance Tax Managed ... (NYSE:ETY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eaton Vance Tax Managed ... (NYSE:ETY)

Historical Stock Chart

From Jul 2023 to Jul 2024