Eaton Vance Tax-Managed Diversified Equity Income Fund Report of Earnings

04 April 2009 - 7:22AM

PR Newswire (US)

BOSTON, April 3 /PRNewswire-FirstCall/ -- Eaton Vance Tax-Managed

Diversified Equity Income Fund (NYSE:ETY), a closed-end investment

company, today announced the earnings of the Fund for the three

months ended January 31, 2009. The Fund's fiscal year ends on

October 31, 2009. For the three months ended January 31, 2009, the

Fund had net investment income of $5,186,735 ($0.035 per common

share). In comparison, for the three months ended January 31, 2008,

the Fund had net investment income of $16,743,413 ($0.112 per

common share). Net realized and unrealized losses for the three

months ended January 31, 2009 were $115,564,631 ($0.772 per common

share). In comparison, net realized and unrealized losses for the

three months ended January 31, 2008 were $218,420,855 ($1.459 per

common share). On January 31, 2009, net assets applicable to the

common shares of the Fund were $1,758,165,144. The net asset value

per common share on January 31, 2009 was $11.74 based on

149,711,079 common shares outstanding. In comparison, on January

31, 2008, net assets applicable to common shares of the Fund were

$2,662,790,947. The net asset value per common share on January 31,

2008 was $17.79 based on 149,711,079 common shares outstanding. The

Fund is managed by Eaton Vance Management, a subsidiary of Eaton

Vance Corp. (NYSE:EV), based in Boston, one of the oldest

investment management firms in the United States, with a history

dating back to 1924. Eaton Vance and its affiliates managed $121.9

billion in assets as of January 31, 2009, offering individuals and

institutions a broad array of investment products and wealth

management solutions. The Company's long record of providing

exemplary service and attractive returns through a variety of

market conditions has made Eaton Vance the investment manager of

choice for many of today's most discerning investors. For more

information about Eaton Vance, visit http://www.eatonvance.com/.

EATON VANCE TAX-MANAGED DIVERSIFIED EQUITY INCOME FUND SUMMARY OF

RESULTS OF OPERATIONS (in thousands, except per share amounts)

Three Months Ended Three Months Ended January 31 January 31

---------- ---------- 2009 2008 ---- ---- Gross investment income

$10,077 $24,103 Operating expenses (4,890) (7,360) ------ ------

Net investment income $5,187 $16,743 Net realized and unrealized

gains (losses) on investments (115,565) (218,421) ------- -------

Net increase (decrease) in net assets from operations $(110,378)

$(201,678) ======= ======= Earnings per Common Share Outstanding

------------------------------------- Gross investment income

$0.067 $0.161 Operating expenses (0.032) (0.049) ----- ----- Net

investment income $0.035 $0.112 Net realized and unrealized gains

(losses) on investments (0.772) (1.459) ----- ----- Net increase

(decrease) in net assets from operations $(0.737) $(1.347) =====

===== Net Asset Value at January 31 (Common Shares)

--------------------------------------------- Net assets (000)

$1,758,165 $2,662,791 Shares outstanding (000) 149,711 149,711 Net

asset value per share outstanding $11.74 $17.79 Market Value

Summary (Common Shares) ------------------------------------ Market

price on NYSE at January 31 $10.83 $17.05 High market price (period

ended January 31) $11.98 $17.17 Low market price (period ended

January 31) $7.87 $15.48 DATASOURCE: Eaton Vance Management

CONTACT: Investor Relations of Eaton Vance Management,

+1-800-262-1122 Web Site: http://www.eatonvance.com/

Copyright

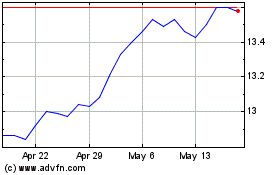

Eaton Vance Tax Managed ... (NYSE:ETY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eaton Vance Tax Managed ... (NYSE:ETY)

Historical Stock Chart

From Jul 2023 to Jul 2024