UPDATE: TPK Seeking Up To US$227.5 Million In Taiwan IPO - Sources

12 October 2010 - 4:56PM

Dow Jones News

TPK Holdings Co. (3673.TW), the main supplier of touch screens

for Apple Inc.'s (AAPL) iPhone and iPad, is seeking to raise up to

NT$7 billion (US$227.5 million) in an initial public offering ahead

of a listing on the Taiwan Stock Exchange on Oct. 29, a person

familiar with the deal said Tuesday.

TPK's IPO is the largest in Taiwan so far this year, and the

deal comes amid Taiwan's economic recovery and flush liquidity on

the island, which has spurred companies to launch IPOs and issue

Taiwan Depositary Receipts.

The Taiwanese touch-screen maker plans to sell 28 million new

shares in an indicative price range of NT$200-NT$250 each, said the

person, who declined to be named. Another person who has direct

knowledge of the deal said the company will announce the indicative

price range on Monday before announcing the final IPO price on Oct.

22.

Both people said sovereign-wealth fund Government of Singapore

Investment Corp. and a HSBC Holdings PLC (HBC) private-equity fund

bought around 6% of TPK's shares from TPK's second-largest

shareholder Balda AG (BAF.XE) last year. The shares will have a

lock-up period, the person familiar with the deal said, without

disclosing a time frame.

The person didn't specify whether GIC and the HSBC

private-equity fund plan to invest in TPK's IPO.

Frankfurt-listed plastic component maker Balda AG's stake in TPK

is around 19% after the sale, said the person, who didn't specify

whether Balda will invest in the IPO.

TPK, whose main production facilities are in Xiamen, China, will

use proceeds from the IPO to fund capacity expansion to meet strong

demand for its touch screens, the person said.

Analysts said Apple accounts for around half of TPK's sales, and

robust demand for Apple's recently launched iPad and iPhone 4

helped boost the Taiwanese company's sales. Apple has sold more

than 3 million iPads since the product's launch in the U.S. in

April, and global demand for the iPhone 4 remains strong four

months after its launch in June.

BNP Paribas analyst Szeho Ng said he expects TPK's earnings per

share to rise 50% to NT$30 in 2011 from NT$20 this year on strong

sales of the iPad and iPhone.

"TPK's share price could easily rise to as much as NT$600 on its

first day of trading as it justifies the valuation of 20 times 2011

EPS. Investors are eager to take a ride on this Apple-theme hot

stock," said Ng.

"Touch panel penetration within the PC market is expected to

grow rapidly, with market estimates that the tablet PC will form

almost a quarter of the global PC market by 2015," said Satish

Lele, an analyst at consulting firm Frost & Sullivan.

Research firm Credit Suisse expects revenue in the touch panel

market to rise 31% to US$6.26 billion this year from US$4.79

billion in 2009.

The person familiar with the deal said TPK's new IPO shares will

account for about 12.5% of the company's enlarged issued capital.

The company has 196 million existing shares, the person said.

Yuanta Securities Ltd. is the sponsor of the deal.

-By Lorraine Luk, Dow Jones Newswires; 8862-25022557;

lorraine.luk@dowjones.com

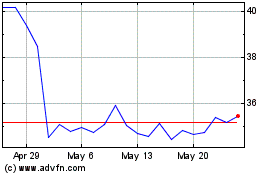

Global Industrial (NYSE:GIC)

Historical Stock Chart

From Jun 2024 to Jul 2024

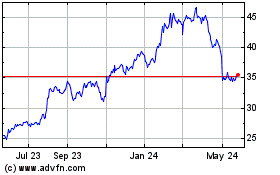

Global Industrial (NYSE:GIC)

Historical Stock Chart

From Jul 2023 to Jul 2024