GOL announces 1Q16 results

12 May 2016 - 1:47PM

PR Newswire (US)

SAO PAULO, May 11, 2016 /PRNewswire/ -- GOL Linhas Aéreas

Inteligentes S.A. (BM&FBOVESPA: GOLL4 and NYSE: GOL), (S&P:

CC, Fitch: C and Moody's: Caa3), the largest low-cost and

best-fare airline in Latin

America, announces today its consolidated results for the

first quarter of 2016. All information is presented in accordance

with International Financial Reporting Standards (IFRS) and in

Brazilian Reais (R$), and all comparisons are with the first

quarter of 2015 unless otherwise stated.

Quarter highlights

- GOL's offer of ASK in the domestic and international markets

reduced by 4.0% and 18.5%, respectively, resulting in an overall

GOL system decrease of 5.9% in the first quarter of 2016 compared

to the same period in 2015.

- In the same period, demand for the Company's seats in the

domestic market fell by 5.9%, and 12.0% in the international

market. In the overall GOL system, the decrease was 6.6%.

- In 1Q16, GOL's total load factor fell by 0.6 percentage points,

reaching 77.5%. In the domestic market, the reduction was 1.6

percentage points, to 77.3%, and the load factor in the

international market was 78.4%, an increase of 5.8 percentage

points compared to the same period in 2015.

- The Company's net revenue totaled R$2.7

billion in 1Q16, an increase of 8.3% in the annual

comparison. Net revenue for the last twelve months was R$10 billion.

- Ancillary and cargo revenues reached R$274.2 million in 1Q16, down 1.3%, and

representing 10.1% of total net revenue. In the last twelve months,

ancillary and cargo revenues totaled R$1.2

billion.

- With the 36.0% devaluation of the Real against the US Dollar's

average price in the period, year-over-year CASK, excluding fuel

expenses and non-recurring event, registered an increase of 16.9%

in the first quarter.

- Recurring operating results (EBIT) in 1Q16 was R$224.6 million, with a margin of 8.3%. Excluding

the non-recurring event, EBITDAR was R$663.2

million in the quarter, with a margin of 24.4%.

- The non-recurring gain on the return of aircraft under finance

lease contracts and on sale-leaseback transactions generated a

profit of R$212.6 million.

- The appreciation of the Brazilian Real against the US Dollar

and the non-recurring event, were R$653.5

million and R$212.6 million,

respectively. Excluding the exchange rate variations and the

non-recurring event, GOL's net loss, before income taxes, was

R$42.7 million. Net income for the

first quarter of 2016 was R$757.1

million.

- The Company ended the quarter with a cash position of

R$1,815.1 million, down 21.1% versus

December 31, 2015, representing 18.2%

of the last twelve months (LTM) net revenue. Available cash was

R$658.4 million (6.6% of LTM net

revenue), excluding the amount held by Smiles and restricted

cash.

- Financial leverage (adjusted gross debt/EBITDAR) ended the

quarter at 9.4x, compared to 7.3x recorded in the first quarter of

2015 – this indicator was affected by the Real's 10.9% depreciation

in the annual comparison.

- In addition to the reduction in the number of departures

previously announced, between 15% and 18% in the year, GOL launched

a new and more efficient flight network in May 2016. This redesign generated additional

departures from Congonhas to the North and Northeast regions and to

the cities of Maringá, Londrina and Presidente Prudente, as well as

new routes from Northeast capitals to Buenos Aires. Eight destinations operated by

GOL were also suspended.

- The three main credit rating agencies revised GOL's credit

ratings. Fitch changed the rating from 'CCC' to 'C', Moodys from

'Caa1' to 'Caa3' and Standard & Poors from 'CCC-' to 'CC'.

- Early in May 2016, GOL announced

a private exchange offer for up to all outstanding bonds issued by

the Company in international capital markets, continuing the

restructuring plan begun in 2015. Unsecured bonds held by

investors, currently totaling US$781.4

million, may be exchanged for cash plus new secured bonds at

a premium over their current market value.

For further information visit

www.voegol.com.br/ir

CONTACTS

INVESTOR RELATIONS

Phone: +55 (11) 2128-4700

E-mail: ri@voegol.com.br

CORPORATE COMMUNICATIONS

Phone: +55 (11) 2128-4183

E-mail: comcorp@voegol.com.br

To view the original version on PR Newswire,

visit:http://www.prnewswire.com/news-releases/gol-announces-1q16-results-300267466.html

SOURCE GOL Linhas Aereas Inteligentes S.A.

Copyright 2016 PR Newswire

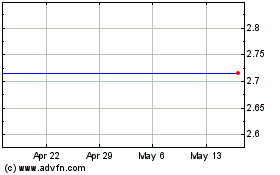

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Oct 2024 to Nov 2024

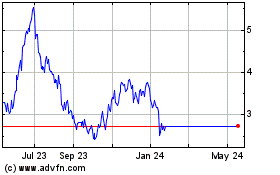

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Nov 2023 to Nov 2024