Gap Projects Disappointing Results as Sales Slide at Banana Republic -- Update

10 November 2015 - 9:27AM

Dow Jones News

By Lauren Pollock

Gap Inc. forecast weaker-than-expected results for its recently

completed quarter as the retailer's sales continued declining in

October, particularly at Banana Republic.

Shares declined 5.4% after hours.

Gap, which has more than 3,700 stores under brands that include

Old Navy, Banana Republic and its namesake division, has been

trying to revamp, following a series of fashion mis-hits. Its

shares have come under pressure as sales in recent months

disappointed and the head of its top-performing Old Navy division

departed to take over Ralph Lauren Corp.

For the quarter ended Nov. 1, Gap projected earnings, excluding

one-time items, of 62 cents to 63 cents a share, short of the 66

cents a share projected by analysts polled by Thomson Reuters.

Sales slid 3% to $3.86 billion but were flat on a

constant-currency basis and missed the $3.93 billion expected on

Wall Street.

Gap said it also expects year-over-year inventory dollars per

store at the end of the quarter to be slightly lower than it

previously guided.

As for October, sales, excluding newly opened and closed

locations, declined 3%, on top of a 3% fall last year. Analysts at

Retail Metrics had guided for a 0.4% decline.

Banana Republic logged a 15% sales drop, while the Gap brand saw

sales fall 4% and Old Navy notched a 2% increase.

Gap is due to report its quarterly results Nov. 19.

Write to Lauren Pollock at lauren.pollock@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 09, 2015 17:12 ET (22:12 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

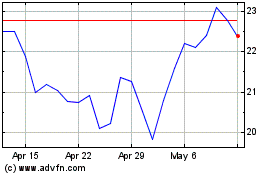

Gap (NYSE:GPS)

Historical Stock Chart

From May 2024 to Jun 2024

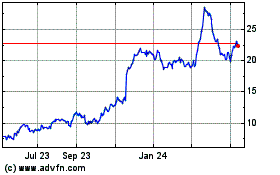

Gap (NYSE:GPS)

Historical Stock Chart

From Jun 2023 to Jun 2024